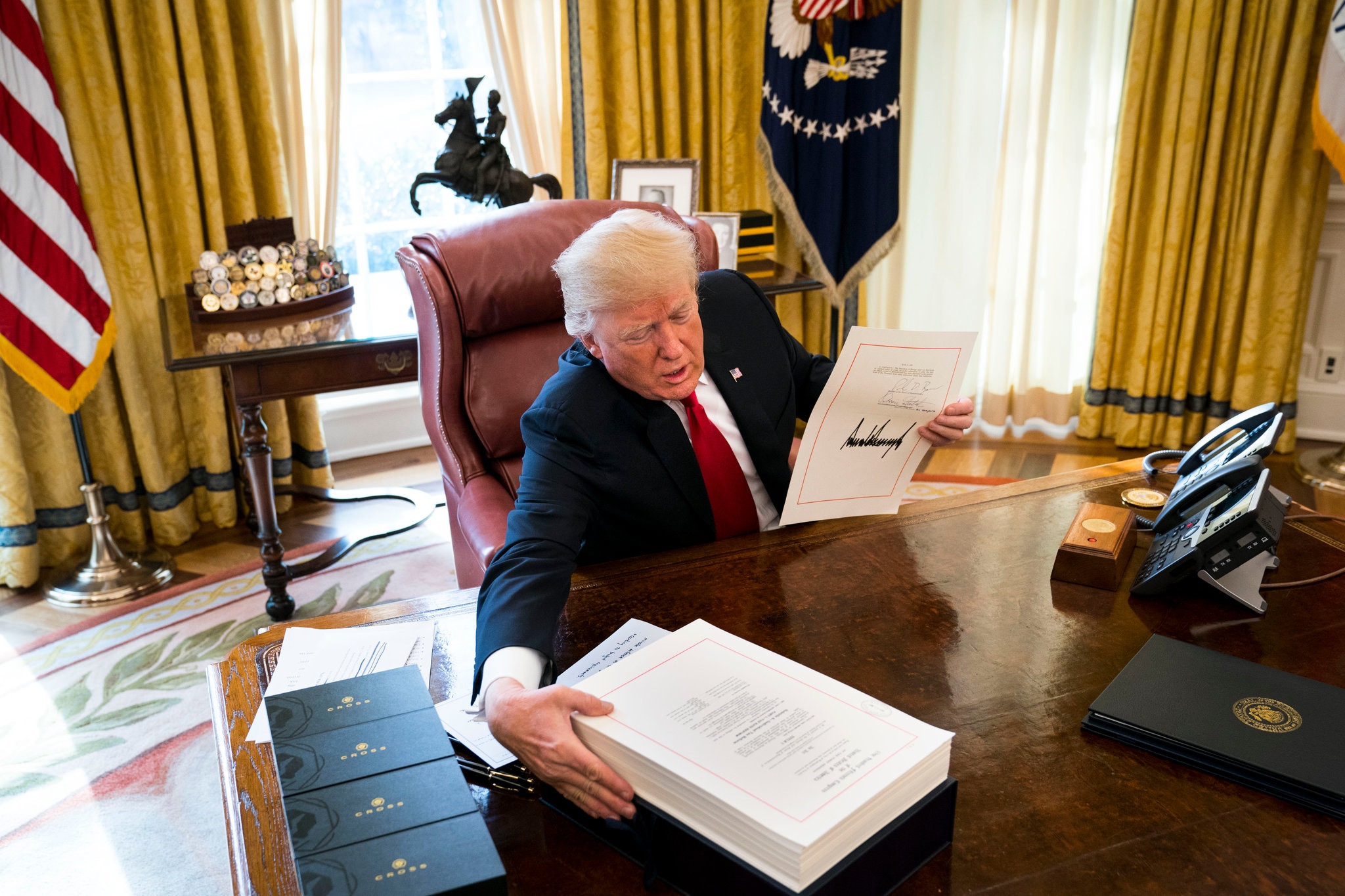

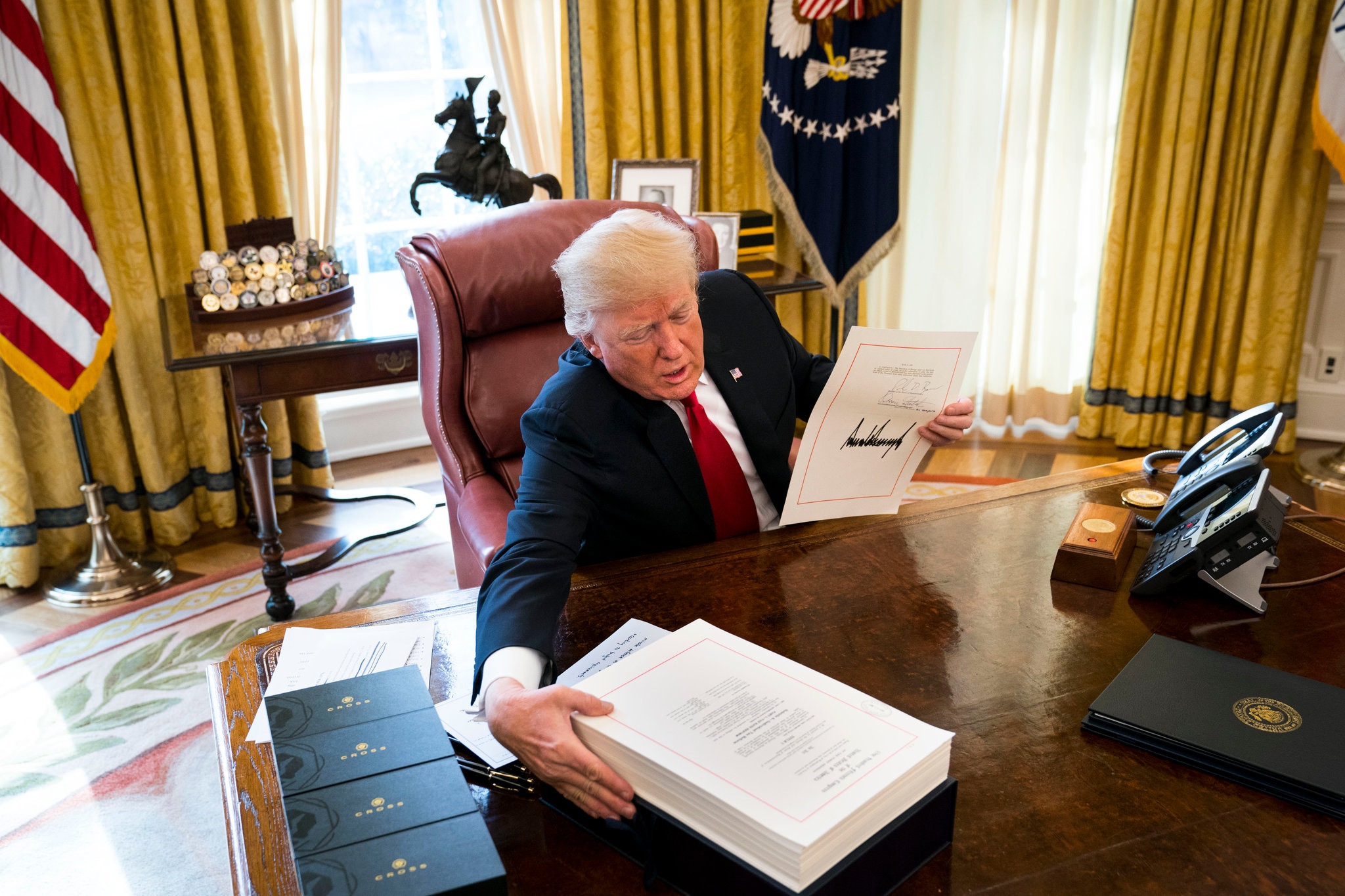

Last-Minute Changes To Trump Tax Bill Before House Vote

Table of Contents

Key Provisions Facing Last-Minute Changes

The Trump Tax Bill, initially a sweeping overhaul of the US tax code, underwent significant changes in its final stages before the House vote. Several core aspects were subject to intense debate and last-minute amendments, reflecting the complex interplay of political interests and economic considerations.

Corporate Tax Rate Adjustments

One of the most significant changes concerned the corporate tax rate. The original proposal included a reduction to 20%, but last-minute negotiations led to adjustments based on lobbying efforts from various industries.

- Reduction from 35% to 21%: The final bill maintained a significant decrease in the corporate tax rate, down from the previous 35%.

- Impact on Small Businesses: This reduction was expected to benefit small businesses significantly, boosting investment and job creation, according to proponents.

- Lobbying Efforts: Powerful industry groups lobbied extensively for specific provisions affecting their sectors, resulting in subtle alterations to the initial rate structure. For example, certain deductions for research and development were modified.

Individual Tax Rate Modifications

The individual income tax brackets also saw last-minute modifications, impacting deductions and credits for many American taxpayers.

- Changes to Standard Deduction: The standard deduction was increased, providing immediate tax relief to lower and middle-income earners.

- Child Tax Credit Modifications: Adjustments to the child tax credit were made, expanding eligibility or increasing the amount for certain families.

- Impact on Income Levels: These changes had a varying impact across different income levels. Some analyses predicted a greater benefit for higher-income families compared to lower-income households.

Changes to Pass-Through Business Taxation

Amendments also targeted the taxation of pass-through entities—businesses such as partnerships and S-corporations where profits and losses are passed directly to the owners.

- Deduction Limit Changes: The bill altered the proposed deduction limitations for pass-through income, sparking debate regarding its effect on small businesses and high-income earners.

- Difference from Original Proposal: The final version differed significantly from the initial proposal in how it treated pass-through business income, reflecting compromises made during negotiations.

- Expert Opinions: Tax experts expressed divergent opinions on the long-term impact of these changes, citing potential unforeseen consequences.

Political Maneuvering and Lobbying Efforts

The last-minute changes to the Trump Tax Bill were a direct result of intense political maneuvering and extensive lobbying by various interest groups.

Impact of Key Congressional Players

Several influential members of Congress played crucial roles in shaping the final legislation.

- House Speaker's Influence: The House Speaker's ability to gather support for specific amendments was pivotal in the final shape of the bill.

- Senate Negotiations: The Senate's involvement and potential amendments further shaped the final version before it reached the House for a vote.

Lobbying Groups and Their Influence

Powerful lobbying groups representing various industries exerted considerable influence on specific provisions.

- Corporate Lobbying: Major corporations lobbied extensively for specific tax breaks and incentives, impacting the final version of the corporate tax rate and deductions.

- Small Business Advocacy: Groups representing small businesses advocated for provisions aimed at promoting growth and easing the tax burden on small enterprises.

Potential Consequences of Last-Minute Changes

The last-minute adjustments to the Trump Tax Bill carry significant short-term and long-term consequences.

Economic Impacts

The altered legislation's economic impacts are complex and subject to ongoing debate.

- GDP Growth Projections: Economists offered varying projections on GDP growth, with some forecasting a modest increase while others remained cautious.

- Job Creation and Inflation: The effects on job creation and inflation remained uncertain and subject to diverse economic models and predictions.

Social Impacts

The social implications are equally significant and require careful consideration.

- Income Inequality: Concerns arose regarding the potential widening of income inequality, with some analyses suggesting that the tax cuts disproportionately benefited higher-income groups.

- Tax Burden Distribution: The changes in tax burden across different demographics remained a key area of discussion and analysis, highlighting the need for further study.

Conclusion

The last-minute changes to the Trump Tax Bill represent a dramatic example of political compromise and lobbying influence shaping significant legislation. These alterations to corporate tax rates, individual tax brackets, and pass-through business taxation had profound implications, influencing the economic and social landscape of the nation. The potential consequences, ranging from GDP growth to income inequality, are subjects of ongoing debate and analysis. Stay updated on the implications of this landmark legislation as the Trump tax bill moves forward. Continue to follow our coverage for in-depth analysis and updates on the lasting effects of these last-minute changes to the Trump tax reform.

Featured Posts

-

Elias Rodriguez Suspect In Israeli Embassy Attack Shouting Free Palestine

May 23, 2025

Elias Rodriguez Suspect In Israeli Embassy Attack Shouting Free Palestine

May 23, 2025 -

Cat Deeleys Cowboy Chic Denim Midi Dress Get The Look

May 23, 2025

Cat Deeleys Cowboy Chic Denim Midi Dress Get The Look

May 23, 2025 -

Analysis Of Big Rig Rock Report 3 12 96 Focus On The Rocket

May 23, 2025

Analysis Of Big Rig Rock Report 3 12 96 Focus On The Rocket

May 23, 2025 -

Triumf Na Shpani A Vo Ln Bolka Za Khrvatska Po Penalite

May 23, 2025

Triumf Na Shpani A Vo Ln Bolka Za Khrvatska Po Penalite

May 23, 2025 -

Tour De France 2027 Grand Depart From Edinburgh Scotland

May 23, 2025

Tour De France 2027 Grand Depart From Edinburgh Scotland

May 23, 2025

Latest Posts

-

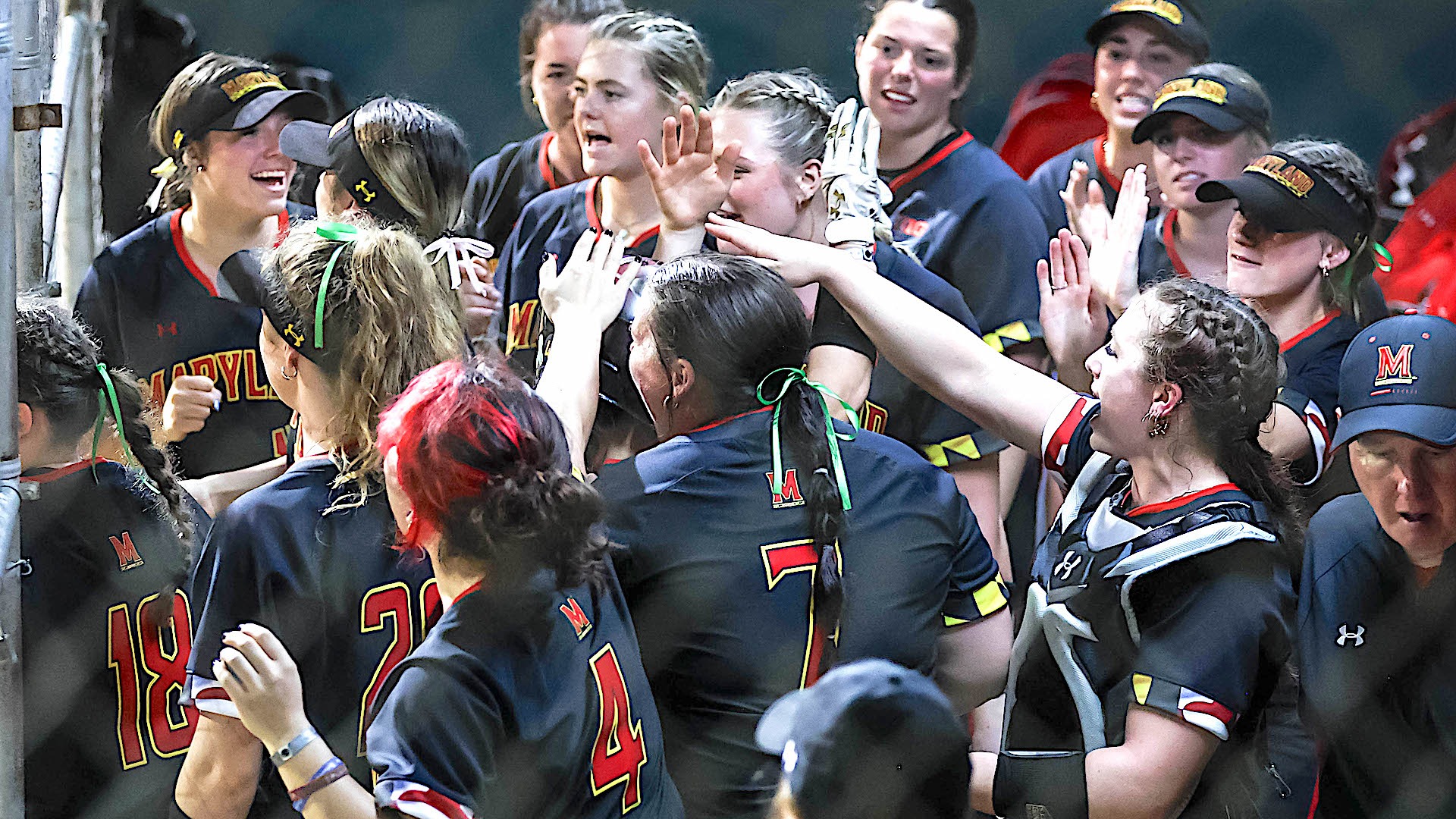

Aubrey Wurst Leads Maryland Softball To 11 1 Victory Over Delaware

May 24, 2025

Aubrey Wurst Leads Maryland Softball To 11 1 Victory Over Delaware

May 24, 2025 -

Pobeditel Evrovideniya 2014 Konchita Vurst Zhizn Karera I Put K Mechte Stat Devushkoy Bonda

May 24, 2025

Pobeditel Evrovideniya 2014 Konchita Vurst Zhizn Karera I Put K Mechte Stat Devushkoy Bonda

May 24, 2025 -

Konchita Vurst Evrovidenie 2014 Coming Out V 13 Let I Ambitsii Stat Devushkoy Bonda

May 24, 2025

Konchita Vurst Evrovidenie 2014 Coming Out V 13 Let I Ambitsii Stat Devushkoy Bonda

May 24, 2025 -

Konchita Vurst Pobeditel Evrovideniya 2014 Gey S 13 Let Mechtaet Stat Devushkoy Bonda

May 24, 2025

Konchita Vurst Pobeditel Evrovideniya 2014 Gey S 13 Let Mechtaet Stat Devushkoy Bonda

May 24, 2025 -

Terrapins Grit Maryland Softball Beats Delaware Despite Early Deficit

May 24, 2025

Terrapins Grit Maryland Softball Beats Delaware Despite Early Deficit

May 24, 2025