Last Week's CoreWeave (CRWV) Stock Rally: A Deep Dive Into The Contributing Factors

Table of Contents

Main Points:

2.1. Increased Investor Confidence and Positive Market Sentiment

The recent CRWV stock rally wasn't isolated; it mirrored a broader positive sentiment within the tech sector, particularly in cloud computing and AI infrastructure. This positive market sentiment significantly impacted investor confidence in CoreWeave. Several factors contributed to this upswing:

- Positive analyst ratings and price target increases: Several reputable financial analysts issued positive ratings and increased their price targets for CRWV stock, signaling a bullish outlook for the company's future performance. This boosted investor confidence and fueled buying pressure.

- Growing adoption of cloud computing and AI: The continued and rapid growth of the cloud computing and artificial intelligence sectors provides a fertile ground for companies like CoreWeave to thrive. Increased demand for AI infrastructure directly translates into increased demand for CoreWeave's services.

- Successful partnerships and collaborations: CoreWeave's strategic partnerships with major players in the tech industry have reinforced investor confidence in its long-term growth trajectory. These collaborations expand their market reach and bolster their technological capabilities.

- Strong financial performance (if applicable): If CoreWeave recently announced strong financial results, exceeding expectations in terms of revenue growth and profitability, it would further bolster investor confidence and drive up the CRWV stock price. This positive performance would validate the company's business model and growth strategy. This positive financial news directly influenced the CRWV stock outlook.

This positive confluence of factors significantly improved the CoreWeave investor sentiment, leading to increased demand for CRWV stock and driving up its price. The overall cloud computing investment environment also played a crucial role.

2.2. Strong Performance and Growth Projections in the AI Sector

CoreWeave is uniquely positioned to benefit from the explosive growth of the AI sector. Their specialization in providing AI-optimized infrastructure gives them a competitive edge. The CRWV stock price increase reflects this market reality:

- Emphasis on AI-optimized infrastructure: CoreWeave's focus on providing infrastructure specifically tailored for AI workloads, including high-performance computing and GPU-accelerated services, is a key differentiator.

- Growth potential in the generative AI space: The rapid advancement and adoption of generative AI models significantly increases the demand for powerful computing resources, presenting substantial growth opportunities for CoreWeave.

- Strategic partnerships with AI companies: Collaborations with leading AI companies provide CoreWeave with access to cutting-edge technologies and a larger customer base, further solidifying their position in the market.

- Market share gains in the AI cloud computing sector: As the AI cloud computing market continues to expand, CoreWeave's ability to capture market share contributes to its overall growth potential and subsequently influences the CRWV AI infrastructure valuation.

The strong performance and future growth projections in the generative AI investment space directly translate into increased demand for CoreWeave's services, driving up the CRWV stock price. CoreWeave AI's offerings are central to this growth.

2.3. Strategic Partnerships and Business Developments

Recent strategic partnerships and business developments have significantly contributed to the positive sentiment surrounding CoreWeave. These actions demonstrate the company's commitment to growth and innovation:

- New partnerships with major technology companies: Announcing new alliances with influential technology companies expands CoreWeave's reach and strengthens its position within the industry ecosystem.

- Expansion into new markets or service offerings: Entering new geographic markets or offering new services diversifies CoreWeave's revenue streams and reduces its reliance on any single market.

- Successful product launches or upgrades: The release of new products or significant upgrades to existing offerings demonstrate CoreWeave's ongoing commitment to innovation and improvement, attracting new customers and retaining existing ones.

- Strategic investments in research and development: Investing in R&D showcases CoreWeave's dedication to staying ahead of the curve in the rapidly evolving tech landscape. This enhances their technological capabilities and competitiveness.

These strategic alliances and business developments underscore CoreWeave's dynamic growth strategy and strengthen its position in the market, positively impacting the CRWV stock price. Analyzing CoreWeave partnerships is crucial to understanding its overall growth.

2.4. Short Squeeze and Market Speculation

While fundamental factors played a significant role, the potential for a short squeeze cannot be ignored. A high level of short interest in CRWV stock before the rally created the possibility for a rapid price increase:

- High short interest leading to a squeeze: A substantial number of investors betting against CoreWeave's success could have triggered a short squeeze as the stock price began to rise, forcing them to buy shares to cover their positions, further driving up the price.

- Increased buying pressure from short-covering: As short-sellers covered their positions, this added buying pressure accelerated the upward momentum of the CRWV stock price.

- Market speculation and momentum trading: The rapid price increase attracted momentum traders, further amplifying the rally.

- Potential impact of social media sentiment: Social media discussions and online forums can significantly influence market sentiment and trading activity, potentially contributing to the volatility of the CRWV stock price.

Understanding the dynamics of CRWV short interest and the potential for short squeezes provides a more complete picture of the recent rally. Examining CRWV short squeeze potential is an essential aspect of any thorough analysis.

Conclusion: Analyzing the CoreWeave (CRWV) Stock Rally

Last week's CRWV stock rally was driven by a confluence of factors, including improved investor sentiment, strong performance within the burgeoning AI sector, strategic partnerships, and the potential for a short squeeze. Understanding these factors is crucial for making informed investment decisions regarding CRWV stock price fluctuations. While the outlook for CoreWeave appears positive, it is important to acknowledge potential risks and uncertainties inherent in any investment. The future success of CoreWeave depends on its ability to maintain its innovative edge, navigate the competitive landscape, and effectively execute its business strategy.

Call to action: Stay informed about future developments in CoreWeave (CRWV) stock and the broader cloud computing and AI markets to make informed investment decisions regarding CRWV stock price fluctuations. Continue researching the factors affecting CoreWeave's performance to fully understand the CRWV stock rally and future potential. Keep a close eye on CRWV stock price movements and related news for a complete picture of CoreWeave's future.

Featured Posts

-

The Impact Of Ai Mode On Google Search Functionality

May 22, 2025

The Impact Of Ai Mode On Google Search Functionality

May 22, 2025 -

Vanja I Sime Iz Gospodina Savrsenog Najbolja Kombinacija Pogledajte Fotografije

May 22, 2025

Vanja I Sime Iz Gospodina Savrsenog Najbolja Kombinacija Pogledajte Fotografije

May 22, 2025 -

Decouverte A Velo De La Loire Du Vignoble Et De L Estuaire 5 Propositions

May 22, 2025

Decouverte A Velo De La Loire Du Vignoble Et De L Estuaire 5 Propositions

May 22, 2025 -

Abn Amro Rentedaling En Impact Op Huizenprijzen In Nederland

May 22, 2025

Abn Amro Rentedaling En Impact Op Huizenprijzen In Nederland

May 22, 2025 -

Concert Hellfest Mulhouse Accueille Le Noumatrouff

May 22, 2025

Concert Hellfest Mulhouse Accueille Le Noumatrouff

May 22, 2025

Latest Posts

-

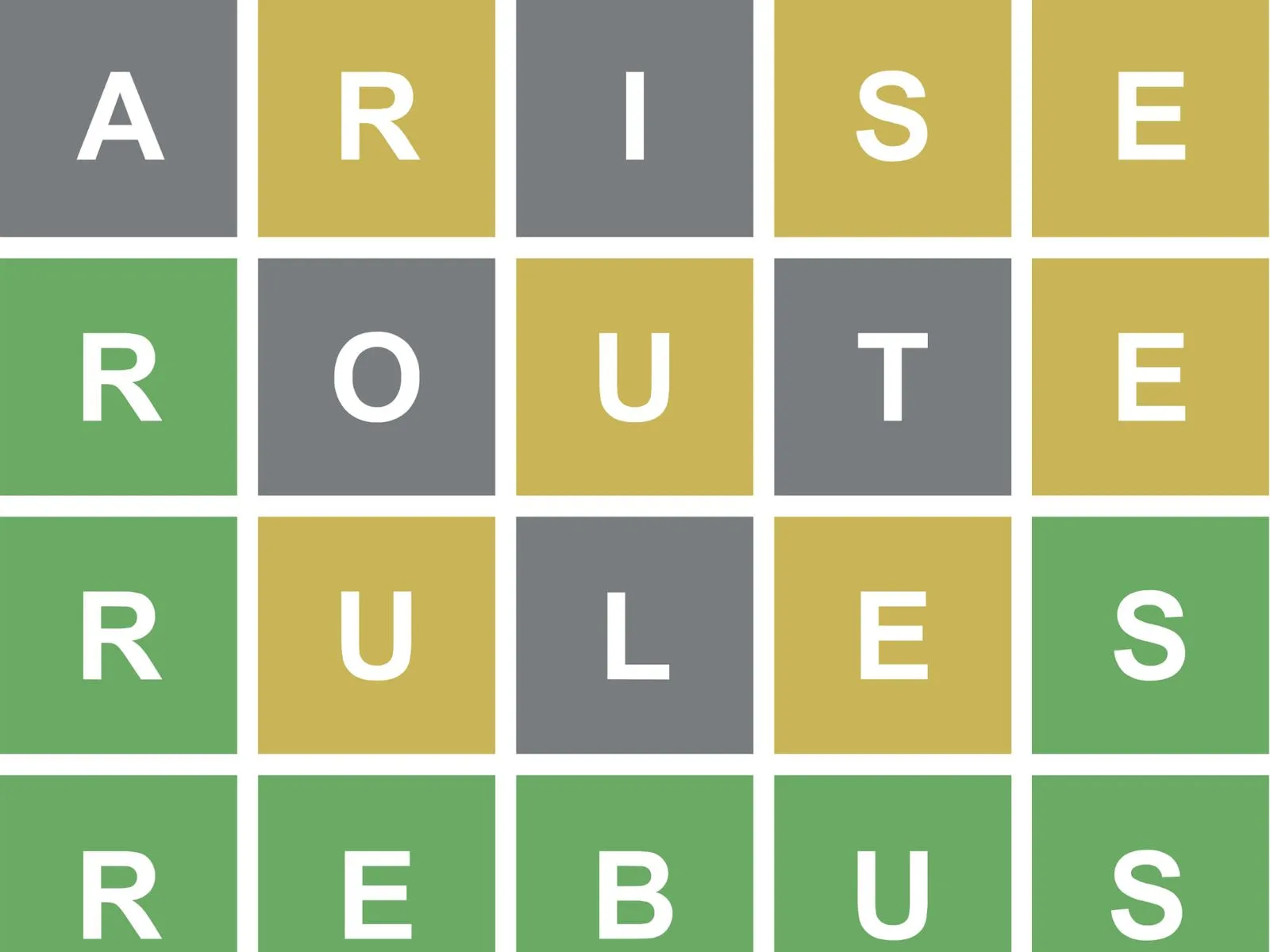

Wordle Hints And Answer March 20th 370

May 22, 2025

Wordle Hints And Answer March 20th 370

May 22, 2025 -

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025 -

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025 -

Conquering Todays Nyt Wordle March 26 A Step By Step Guide

May 22, 2025

Conquering Todays Nyt Wordle March 26 A Step By Step Guide

May 22, 2025 -

Nyt Wordle March 26 Solution And Gameplay Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Gameplay Analysis

May 22, 2025