Legal Protection After A Self-Defense Shooting: Insurance Options Explained

Table of Contents

Understanding the Legal Ramifications of a Self-Defense Shooting

The legal complexities involved in self-defense claims are significant. Successfully arguing self-defense requires proving you acted reasonably and proportionally to an immediate threat. This means demonstrating that you believed your life or the life of another was in imminent danger, and the force used was necessary to prevent that harm. The burden of proof rests heavily on the individual claiming self-defense.

- Potential for Civil Lawsuits: Even if criminal charges are not filed, you may still face a civil lawsuit from the injured party or their family. These lawsuits can be costly and emotionally draining.

- Immediate Legal Counsel is Essential: Contacting a qualified attorney immediately after a self-defense incident is paramount. They can advise you on your rights, help you gather evidence, and represent you in any legal proceedings.

- Criminal vs. Civil Liability: Criminal liability involves facing charges from the state (e.g., assault, battery), while civil liability involves a lawsuit from an individual seeking monetary compensation for damages. You could face both simultaneously.

- High Legal Fees: Defending yourself against criminal charges and/or civil lawsuits can incur substantial legal fees, including attorney fees, expert witness fees, and court costs. These costs can quickly accumulate, even with a successful defense.

Types of Insurance that Offer Legal Protection After a Self-Defense Shooting

Several types of insurance can offer some level of protection following a self-defense shooting, although coverage can vary greatly. Understanding the limitations and benefits of each is essential.

Homeowner's or Renter's Insurance

Homeowner's and renter's insurance policies typically include liability coverage, which can help cover legal costs and settlements associated with injuries or damages you cause. However, coverage for self-defense incidents is often limited and may have significant exclusions.

- Limited Coverage: Standard policies may not fully cover the legal fees associated with defending a self-defense claim, particularly if the incident involves the use of a firearm.

- Exclusions and Limitations: Many policies exclude coverage for intentional acts, even if those acts were in self-defense. Carefully review your policy's exclusions.

- Premium Increases: Filing a claim, even a successful one, can lead to higher premiums in the future.

Umbrella Liability Insurance

Umbrella liability insurance provides an additional layer of liability coverage above your existing homeowner's or renter's insurance. This can be crucial after a self-defense shooting, as legal costs can quickly exceed the limits of a standard policy.

- Higher Coverage Limits: Umbrella policies offer significantly higher coverage limits, providing greater financial protection in the event of a large lawsuit.

- Cost-Effectiveness: While umbrella policies have an additional premium, the increased coverage can be cost-effective compared to the potential costs of a large lawsuit.

- Coverage for Legal Fees and Settlements: This type of insurance specifically covers legal fees, settlements, and judgments resulting from a liability claim, including those stemming from a self-defense incident.

Self-Defense Insurance Policies (Specific Policies)

Specialized self-defense insurance policies are explicitly designed to cover legal costs and expenses associated with self-defense incidents, often providing more comprehensive coverage than general liability policies.

- Comprehensive Coverage: These policies often cover legal representation, bail bonds, expert witness fees, and other expenses associated with defending a self-defense claim.

- Proactive Planning: Purchasing this type of insurance proactively is highly beneficial, as it provides peace of mind and ensures you have the necessary coverage if an incident occurs.

- Cost Comparison: While the cost may be higher than standard liability coverage, compare it to the potential cost of defending yourself without adequate insurance.

CCW Insurance (Concealed Carry Weapon Insurance)

For individuals with a Concealed Carry Weapon (CCW) permit, specialized CCW insurance offers specific protection related to the legal ramifications of using a firearm in self-defense.

- Importance for Permit Holders: This insurance is highly recommended for anyone carrying a concealed firearm, providing crucial legal protection in the event of a self-defense shooting.

- Legal Defense Coverage: CCW insurance policies typically cover legal fees, bail bonds, and other legal expenses associated with the use of a firearm in self-defense.

- Policy Variations: Coverage and policy details vary significantly across different providers, so carefully compare options before purchasing.

Choosing the Right Self-Defense Shooting Insurance

Selecting the appropriate self-defense shooting insurance requires careful consideration of various factors.

Factors to Consider:

- Individual Risk Profile: Assess your personal risk based on your lifestyle, location, and other factors that might increase your likelihood of being involved in a self-defense situation.

- Cost and Coverage Comparison: Compare policy costs and coverage limits offered by different insurers. Don't just look at the price; examine the extent of coverage.

- Policy Terms and Conditions: Carefully read the policy's terms and conditions, paying close attention to exclusions and limitations.

- Insurance Professional Advice: Consult with an independent insurance agent who can help you assess your needs and compare different policy options.

- Insurer Reputation and Stability: Choose a reputable insurance company with a strong financial standing to ensure the insurer can fulfill its obligations if you need to file a claim.

Conclusion

Facing a self-defense shooting is a traumatic experience, and navigating the legal aftermath can be daunting. Securing appropriate legal protection through comprehensive insurance is crucial. Understanding the different options available – from homeowner's insurance to specialized self-defense policies – allows you to make informed decisions to protect your future. Don't wait until after an incident; proactively secure the right self-defense shooting insurance today. Contact a qualified insurance agent to discuss your specific needs and find the best coverage for your situation. (Call to action using keyword variations: Self-defense shooting insurance, legal protection insurance)

Featured Posts

-

Pochemu Skarlett Yokhansson Ne Delaet Selfi S Fanatami

May 13, 2025

Pochemu Skarlett Yokhansson Ne Delaet Selfi S Fanatami

May 13, 2025 -

Bar Roma Toronto A Blog To Review And Guide

May 13, 2025

Bar Roma Toronto A Blog To Review And Guide

May 13, 2025 -

The Struggle For Market Share Examining The Challenges Faced By Bmw Porsche And Competitors In China

May 13, 2025

The Struggle For Market Share Examining The Challenges Faced By Bmw Porsche And Competitors In China

May 13, 2025 -

Exploring Dan Browns The Da Vinci Code A Literary Analysis

May 13, 2025

Exploring Dan Browns The Da Vinci Code A Literary Analysis

May 13, 2025 -

Lucid Software Acquires Airfocus A Strategic Move For Visual Collaboration

May 13, 2025

Lucid Software Acquires Airfocus A Strategic Move For Visual Collaboration

May 13, 2025

Latest Posts

-

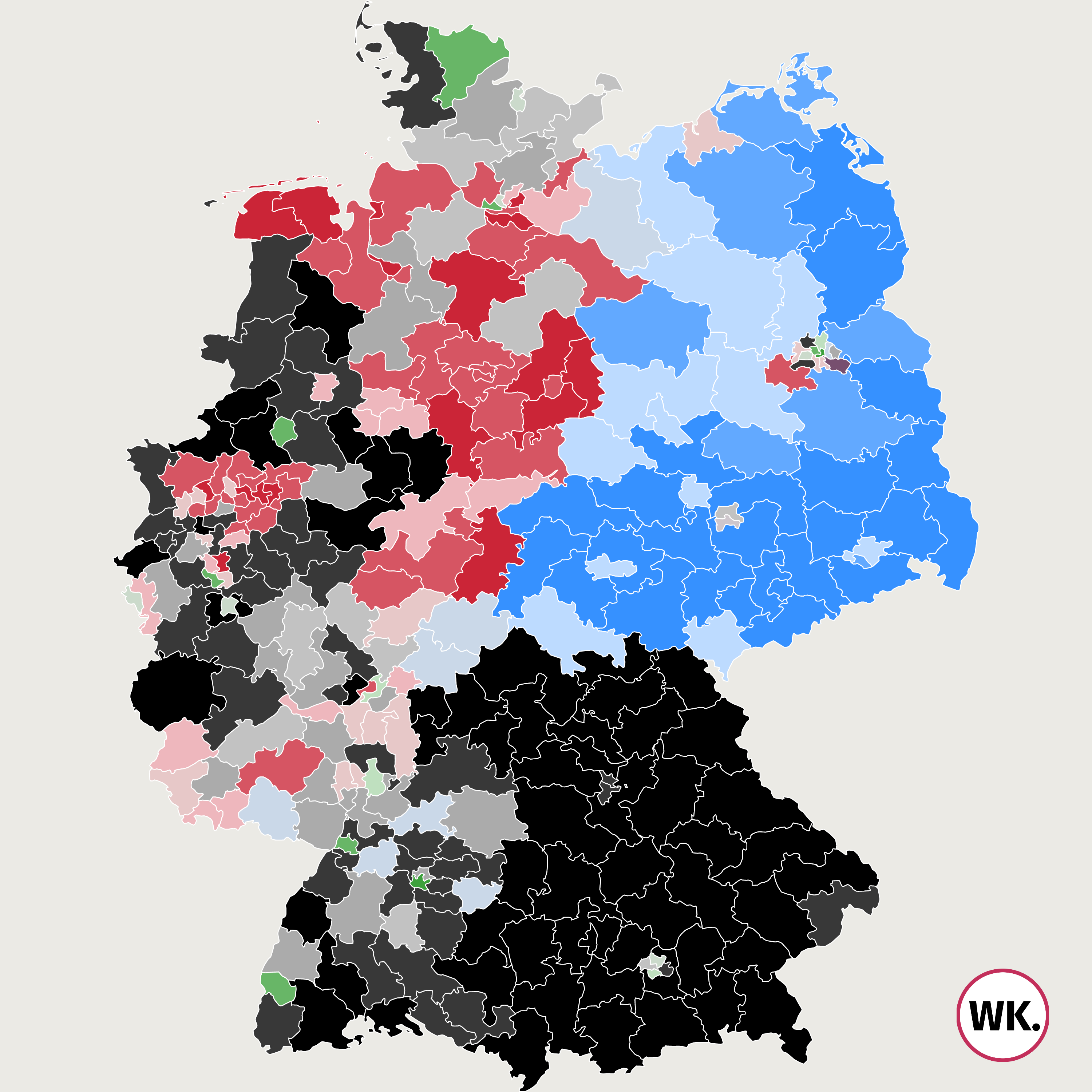

Wahlergebnisse Dresden Deutliche Ablehnung Von Cdu Und Spd 80 Waehlen Anders

May 14, 2025

Wahlergebnisse Dresden Deutliche Ablehnung Von Cdu Und Spd 80 Waehlen Anders

May 14, 2025 -

Naturschutzprojekt Saechsische Schweiz 190 000 Neu Gepflanzte Baeume Staerken Das Oekosystem

May 14, 2025

Naturschutzprojekt Saechsische Schweiz 190 000 Neu Gepflanzte Baeume Staerken Das Oekosystem

May 14, 2025 -

Fuenf Neue Partner Unterstuetzen Den Nationalpark Saechsische Schweiz

May 14, 2025

Fuenf Neue Partner Unterstuetzen Den Nationalpark Saechsische Schweiz

May 14, 2025 -

Saechsische Schweiz Sachsenforst Testet Neue Sensoren Zur Waldbrandfrueherkennung

May 14, 2025

Saechsische Schweiz Sachsenforst Testet Neue Sensoren Zur Waldbrandfrueherkennung

May 14, 2025 -

Moderne Technik Zur Waldbrandfrueherkennung Im Nationalpark Ein Umfassender Ueberblick

May 14, 2025

Moderne Technik Zur Waldbrandfrueherkennung Im Nationalpark Ein Umfassender Ueberblick

May 14, 2025