Leveraged Semiconductor ETFs: Why Investors Pulled Out Before The Rally

Table of Contents

The High-Risk, High-Reward Nature of Leveraged ETFs

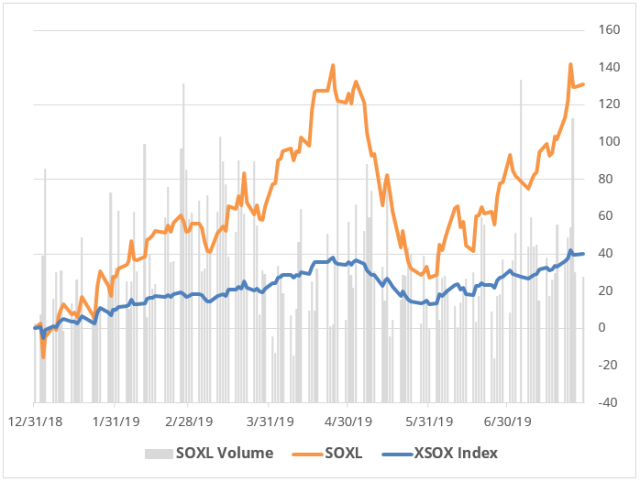

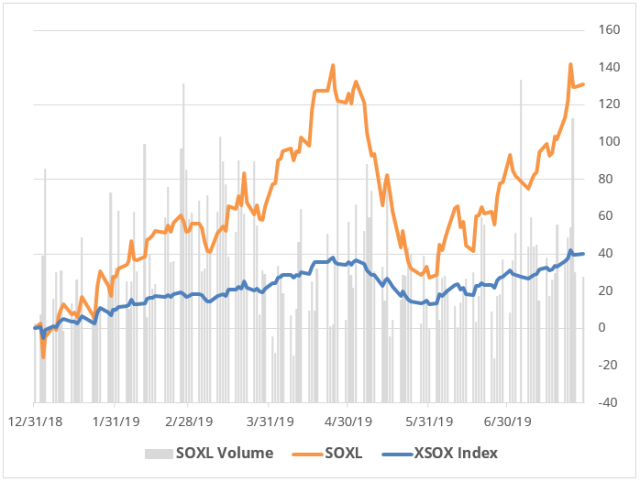

Leveraged ETFs aim to deliver amplified returns – both positive and negative – compared to the underlying index they track. They achieve this through the use of derivatives and leverage. However, this amplification comes with significant risks that many investors may not fully appreciate.

-

Daily Resetting: A crucial aspect of leveraged ETFs is their daily resetting. This means the ETF's leverage is rebalanced daily, leading to compounding effects. Even if the underlying semiconductor index experiences a slight upward trend over a longer period, daily losses can accumulate, significantly eroding the overall returns. For instance, three consecutive days of a 1% decline in the underlying index could translate to a much larger loss in a 3x leveraged ETF.

-

Volatility Drag: Leveraged ETFs are highly sensitive to volatility. Significant price swings, even if ultimately resulting in positive returns for the underlying index, can severely hamper the performance of a leveraged ETF due to the daily resetting mechanism. In highly volatile markets like the semiconductor industry, this volatility drag can be substantial.

-

Expense Ratio: Leveraged ETFs typically have higher expense ratios than traditional ETFs. These higher fees further eat into returns, especially over longer periods, making them even less attractive for long-term investors.

Market Sentiment and Negative News Preceding the Rally

Before the recent rally in semiconductor stocks, market sentiment was significantly negative. Several factors contributed to this pessimism and influenced the exodus from leveraged semiconductor ETFs.

-

Oversaturation Concerns: Fears of oversupply and inventory build-up in the semiconductor market weighed heavily on investor sentiment. Concerns about slowing demand and potential price wars contributed to a bearish outlook.

-

Geopolitical Risks: The ongoing US-China trade tensions and geopolitical uncertainties created considerable uncertainty for the semiconductor industry. Supply chain disruptions and potential trade restrictions further dampened investor enthusiasm.

-

Interest Rate Hikes: Rising interest rates increase borrowing costs and reduce the attractiveness of growth stocks, like those in the semiconductor sector, which are often valued based on future earnings projections. This shift in investor risk appetite played a significant role in the sell-off.

Specific Risks Associated with Semiconductor Investments

Beyond the inherent risks of leveraged ETFs, the semiconductor sector itself presents unique challenges that impact leveraged ETF performance.

-

Technological Disruptions: The semiconductor industry is characterized by rapid technological advancements. New technologies can quickly render existing products obsolete, creating significant uncertainty for investors.

-

Competition: The semiconductor industry is intensely competitive, with many players vying for market share. This competition can lead to price wars and pressure on profit margins, affecting the overall performance of semiconductor stocks.

-

Regulatory Changes: Government regulations and policies can have a major impact on the semiconductor industry. Changes in export controls, trade policies, or environmental regulations can significantly influence the profitability of semiconductor companies.

The Role of Investor Psychology and Behavioral Finance

The investor exodus from leveraged semiconductor ETFs before the rally can also be explained through the lens of behavioral finance. Fear, panic selling, and herd behavior played a significant role in investor decisions.

Negative news is often disproportionately emphasized, leading to a pessimistic outlook. This effect is amplified in volatile markets, encouraging investors to follow the crowd rather than conducting independent analysis.

Conclusion

The investor exodus from leveraged semiconductor ETFs before the recent rally was a confluence of factors: the inherent risks of leveraged products, negative market sentiment driven by oversaturation concerns, geopolitical risks, and interest rate hikes, sector-specific risks such as technological disruption and intense competition, and the influence of investor psychology and herd behavior. Understanding the complexities of leveraged semiconductor ETFs is crucial for making informed investment decisions. Before investing in leveraged semiconductor ETFs, conduct thorough research and consider your risk tolerance. Careful analysis of market trends and a clear understanding of the inherent risks associated with leveraged semiconductor ETFs are essential for successful investing.

Featured Posts

-

Raziskovanje Romske Glasbe V Prekmurju Muzikanti In Njihove Pesmi

May 13, 2025

Raziskovanje Romske Glasbe V Prekmurju Muzikanti In Njihove Pesmi

May 13, 2025 -

Columbus Crew Defeat San Jose Earthquakes 2 1 After First Loss

May 13, 2025

Columbus Crew Defeat San Jose Earthquakes 2 1 After First Loss

May 13, 2025 -

Understanding The Nba Draft Lottery Rules And Odds

May 13, 2025

Understanding The Nba Draft Lottery Rules And Odds

May 13, 2025 -

Doom The Dark Ages Review And File Size Details Revealed

May 13, 2025

Doom The Dark Ages Review And File Size Details Revealed

May 13, 2025 -

Nba Tankathon A Miami Heat Fans Off Season Obsession

May 13, 2025

Nba Tankathon A Miami Heat Fans Off Season Obsession

May 13, 2025

Latest Posts

-

The Traitors Zdrajcy Sezon 2 Odcinek 1 Analiza Konfliktow I Materialy Za Kulisy

May 14, 2025

The Traitors Zdrajcy Sezon 2 Odcinek 1 Analiza Konfliktow I Materialy Za Kulisy

May 14, 2025 -

Zdrajcy 2 Odcinek 1 Spory Graczy Po Pierwszym Wyzwaniu I Materialy Dodatkowe

May 14, 2025

Zdrajcy 2 Odcinek 1 Spory Graczy Po Pierwszym Wyzwaniu I Materialy Dodatkowe

May 14, 2025 -

The Traitors Sezon 2 Odcinek 1 Analiza Konfliktow Po Pierwszym Wyzwaniu

May 14, 2025

The Traitors Sezon 2 Odcinek 1 Analiza Konfliktow Po Pierwszym Wyzwaniu

May 14, 2025 -

Zdrada 2 Odcinek 1 Konflikty Graczy Po Pierwszym Zadaniu Materialy Dodatkowe

May 14, 2025

Zdrada 2 Odcinek 1 Konflikty Graczy Po Pierwszym Zadaniu Materialy Dodatkowe

May 14, 2025 -

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025