Liberals Decide Against New Rules To Remove Mark Carney As Leader

Table of Contents

The Rationale Behind the Proposed Rules

The initial push for changes to the process governing the Governor's removal stemmed from concerns about Governor accountability and the perceived need for greater political influence over the Bank of Canada. Some within the Liberal Party argued that the existing framework lacked sufficient mechanisms to address potential shortcomings in leadership.

- Criticisms of Mark Carney's Leadership (if any): While publicly stated criticisms of Mark Carney's leadership were limited, some within the party may have privately voiced concerns about specific policy decisions or the perceived communication style of the Governor. These concerns, however, remained largely unsubstantiated and did not translate into a widespread public call for his removal.

- Political Influence and Central Bank Independence: Proponents of the rule changes argued for a stronger mechanism to ensure alignment between the Bank of Canada's monetary policy and the government's overall economic objectives. However, this argument raised concerns about potentially undermining the central bank's independence, a cornerstone of economic stability. The risk of political interference, influencing interest rate decisions or other crucial monetary policy choices, was a significant counterpoint.

The Opposition to the Proposed Changes

The proposed changes faced strong opposition from various quarters, primarily centered on the crucial issue of preserving central bank independence. Opponents argued that altering the removal process would jeopardize the Bank of Canada's autonomy and its ability to make objective, data-driven decisions free from partisan political pressures.

- Economic Stability and Political Interference: Experts warned that any perceived political interference could severely damage the credibility of the Bank of Canada, leading to increased market volatility and potentially higher inflation. The independence of the central bank is viewed as paramount to maintaining investor confidence and ensuring long-term economic stability.

- Expert Opinions: Leading economists and political scientists issued statements emphasizing the importance of maintaining the existing framework. They stressed that the Bank of Canada’s independence is a crucial safeguard against short-sighted political decisions that could negatively impact the Canadian economy.

- Public Backlash and Internal Opposition: Beyond expert opinions, a significant public backlash emerged against the proposed changes. Many Canadians expressed concerns about the potential for political interference in monetary policy. This public pressure, coupled with internal opposition within the Liberal Party itself, ultimately contributed to the decision to halt the proposed rule changes.

The Liberal Party's Final Decision and its Implications

The Liberal Party ultimately decided against proceeding with the new rules, opting to maintain the existing framework for removing the Bank of Canada Governor. This decision reflects a careful balancing act between political considerations and the overriding need to uphold the institution's independence.

- Political Strategy and Public Opinion: The potential negative political fallout from enacting the controversial changes likely played a significant role in the final decision. The strong public and expert opposition made the proposed changes politically untenable.

- Mark Carney's Tenure: The decision ensures the continuation of Mark Carney's leadership, at least for the foreseeable future. This provides much-needed continuity and stability in the face of ongoing economic uncertainty.

- Short-Term and Long-Term Effects on the Canadian Economy: Maintaining the status quo is likely to bolster investor confidence and contribute to macroeconomic stability. In the long term, preserving the Bank of Canada's independence strengthens its ability to effectively manage the Canadian economy. This includes navigating future challenges, such as inflation and potential economic downturns.

Conclusion

This article examined the recent political maneuvering surrounding potential changes to the removal process for Bank of Canada Governor Mark Carney. While initial proposals aimed at altering the existing rules were met with significant opposition, the Liberal Party ultimately chose to maintain the status quo. This decision underscores the paramount importance of preserving central bank independence and its vital role in ensuring economic stability for Canada. The debate highlights the delicate balance between political accountability and the need for an autonomous central bank free from partisan influence. Understanding the implications of this decision is vital for every Canadian citizen.

Call to Action: Stay informed about the ongoing developments in Canadian politics and monetary policy. Regularly check back for updates on the Bank of Canada and Mark Carney's leadership. Understanding the nuances of this debate surrounding the potential removal of Mark Carney is crucial for every Canadian.

Featured Posts

-

Gwen Stefani Confirms A Third Partys Role In Her Past Relationship With Blake Shelton

May 27, 2025

Gwen Stefani Confirms A Third Partys Role In Her Past Relationship With Blake Shelton

May 27, 2025 -

1923 Season 2 Finale Where To Watch Episode 7 Online

May 27, 2025

1923 Season 2 Finale Where To Watch Episode 7 Online

May 27, 2025 -

Mob Land Season 1 Episode 6 Everything You Need To Know

May 27, 2025

Mob Land Season 1 Episode 6 Everything You Need To Know

May 27, 2025 -

Guccis Shanghai Exhibition A Deep Dive Into The Houses Legacy

May 27, 2025

Guccis Shanghai Exhibition A Deep Dive Into The Houses Legacy

May 27, 2025 -

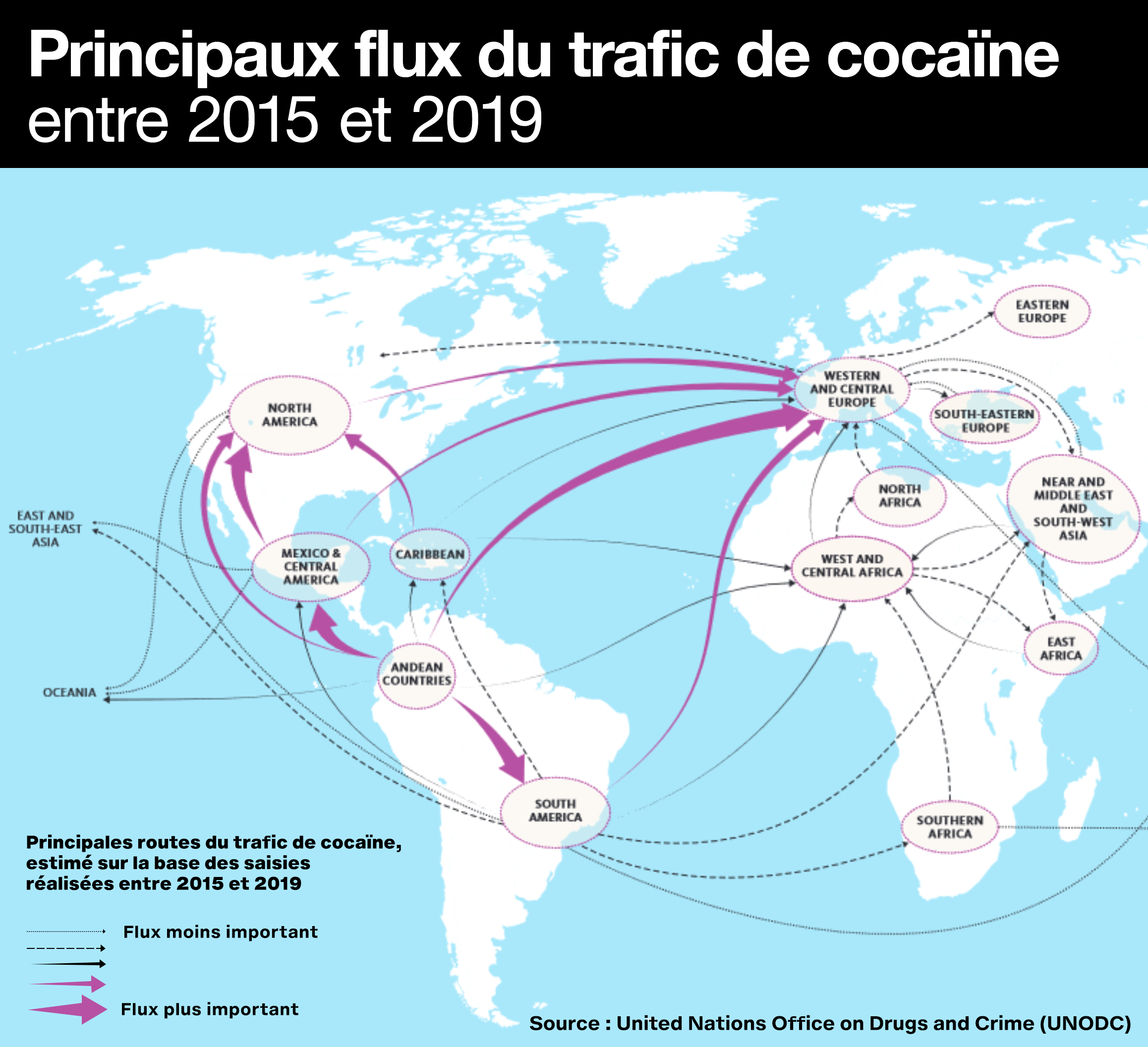

Saint Ouen L Ecole Maternelle Et Le Trafic De Drogue Un Transfert Au Printemps

May 27, 2025

Saint Ouen L Ecole Maternelle Et Le Trafic De Drogue Un Transfert Au Printemps

May 27, 2025

Latest Posts

-

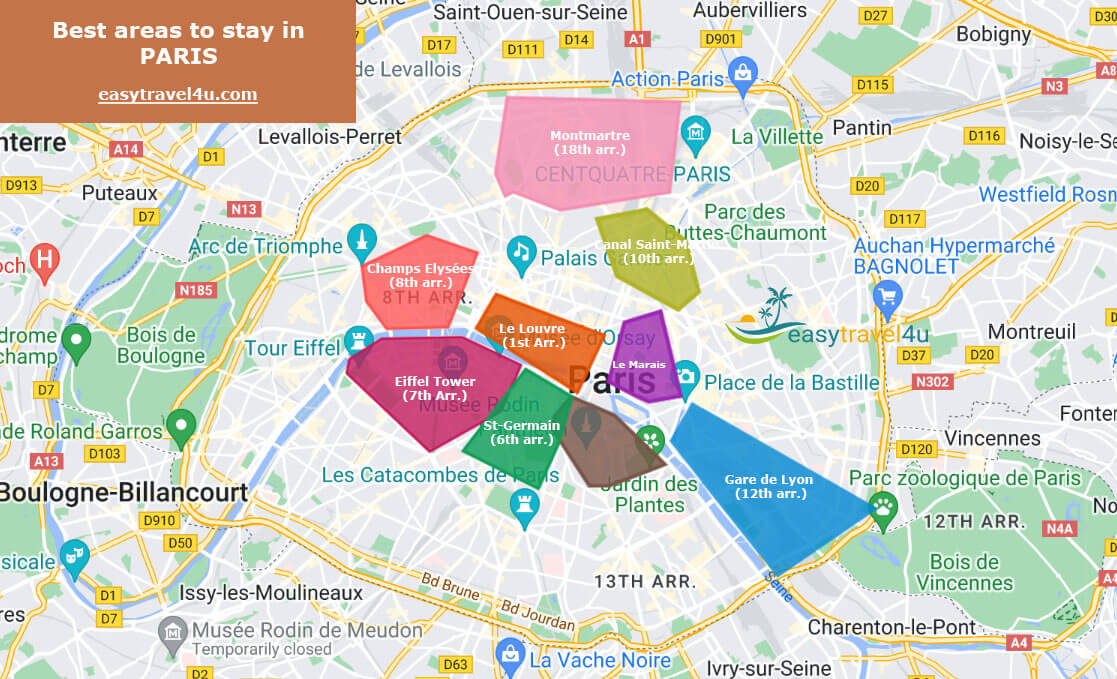

Where To Stay In Paris A Guide To The Citys Best Neighborhoods

May 30, 2025

Where To Stay In Paris A Guide To The Citys Best Neighborhoods

May 30, 2025 -

Paris Hidden Gems A Guide To The Best Neighborhoods

May 30, 2025

Paris Hidden Gems A Guide To The Best Neighborhoods

May 30, 2025 -

Discover The Best Areas To Stay In Paris A Neighborhood Guide

May 30, 2025

Discover The Best Areas To Stay In Paris A Neighborhood Guide

May 30, 2025 -

Paris Neighborhood Guide Top Areas To Explore

May 30, 2025

Paris Neighborhood Guide Top Areas To Explore

May 30, 2025 -

Autoroute A69 Une Decision Gouvernementale Contre L Avis De La Justice

May 30, 2025

Autoroute A69 Une Decision Gouvernementale Contre L Avis De La Justice

May 30, 2025