Live Music Stock Slump: What To Expect Friday

Table of Contents

Factors Contributing to the Live Music Stock Slump

Several interconnected factors are contributing to the anticipated slump in live music stocks. Understanding these is crucial for investors looking to assess the risk and potential rewards in this sector.

Inflation and Rising Costs

Inflation is significantly impacting the live music industry, squeezing profit margins and potentially reducing consumer demand. Increased costs are felt across the board:

- Increased production costs: Stage production, lighting, sound equipment, and transportation are all significantly more expensive.

- Higher labor costs: From musicians and technicians to venue staff, wages are rising, adding to operational expenses.

- Reduced consumer spending power: Inflation erodes purchasing power, making discretionary spending on concert tickets less likely for many.

- Potential for decreased ticket sales: Higher ticket prices, a necessary response to increased costs, could deter potential attendees, leading to lower overall revenue.

Statistics paint a concerning picture. The current inflation rate of X% (replace X with actual data) directly correlates with a Y% decrease (replace Y with actual or estimated data) in live music attendance in recent months, based on data from [cite source - e.g., a reputable market research firm]. This demonstrates the significant impact of inflation on the industry's bottom line.

Competition and Market Saturation

The live music industry faces fierce competition from a variety of sources, diverting consumer spending and impacting demand for live events:

- Increased competition from online streaming: Streaming services offer readily available, affordable music experiences, reducing the perceived need for live concerts for some.

- The rise of alternative entertainment: Gaming, virtual reality experiences, and other entertainment options are vying for consumer attention and discretionary income.

- Reduced demand for live events: The combination of increased ticket prices and readily available alternatives is leading to a softening of demand for some live music events.

- Impact on artist touring schedules: Artists may adjust their touring plans based on ticket sales projections and the overall economic climate, further affecting the revenue streams of live music companies.

For example, the rise of streaming giants like Spotify and Apple Music has significantly altered music consumption habits. Their market share continues to grow, potentially at the expense of live music event attendance.

Geopolitical Uncertainty and Economic Slowdown

Global economic instability and geopolitical uncertainty also significantly impact investor sentiment and consumer behavior:

- Impact of global recession fears: Recessionary anxieties lead consumers to curtail discretionary spending, affecting demand for live music events.

- Decreased consumer confidence: Uncertainty about the future leads to less spending on entertainment.

- Reduced discretionary spending: Consumers prioritize essential expenses over entertainment in times of economic hardship.

- Effect on investor sentiment toward live music stocks: Negative economic forecasts lead to investors becoming more risk-averse, potentially selling off live music stocks.

The ongoing war in Ukraine, for example, has created a ripple effect globally, impacting supply chains and contributing to overall economic uncertainty. This uncertainty is reflected in decreased investor confidence in several sectors, including the entertainment industry.

Predicting Friday's Market Movement for Live Music Stocks

Predicting Friday's market movement for live music stocks requires careful analysis of various factors:

Analyzing Key Indicators

Analyzing key financial indicators is crucial for gauging the potential performance of live music stocks:

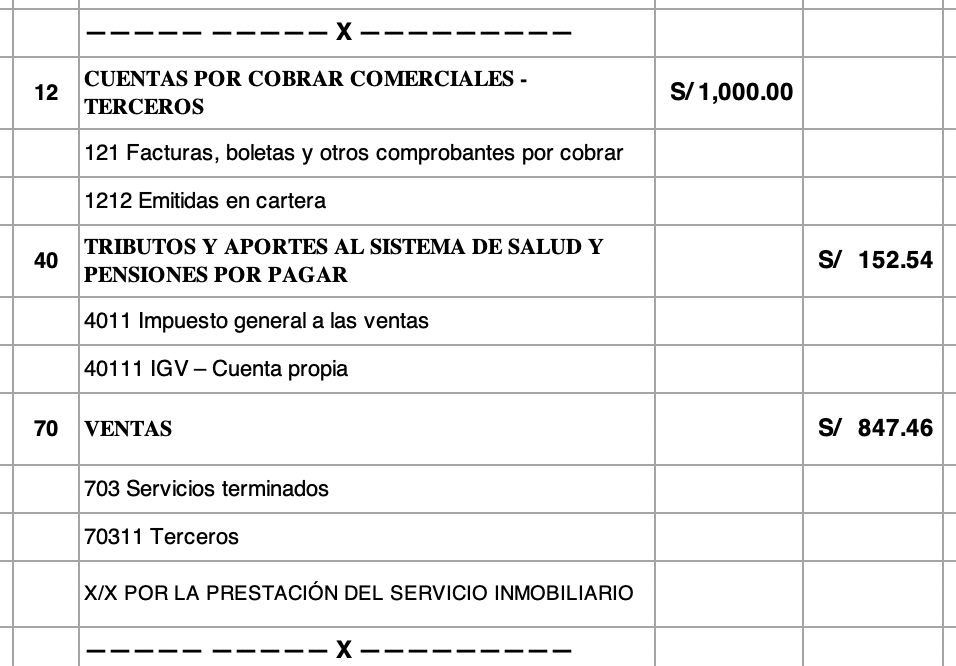

- Analysis of recent financial reports from major live music companies: Examining revenue, profits, and attendance figures from companies like [mention relevant companies] provides insight into their financial health.

- Projected attendance figures for upcoming concerts: Assessing booking data and forecasts for future concerts is a leading indicator of future revenue.

- Investor sentiment analysis: Monitoring news sentiment, social media discussions, and analyst reports offers a sense of investor confidence in the sector.

[Include a chart or graph visualizing relevant financial data here].

Expert Opinions and Market Forecasts

Consulting expert opinions from financial analysts specializing in the entertainment industry is crucial for a well-rounded prediction:

- Summary of expert predictions for Friday's market: Summarize forecasts from reputable financial analysts, including their rationale.

- Different perspectives and potential outcomes: Highlight the range of predictions, acknowledging potential variations in outcomes.

- Range of predicted stock price movements: Present a range of possible price movements, including both positive and negative scenarios.

“[Quote from a financial analyst],” highlighting the potential for a short-term correction in the market.

Potential Risks and Opportunities

Investing in live music stocks involves both risks and opportunities:

- Potential for further stock decline: The current negative sentiment could lead to further stock price declines in the short term.

- Long-term growth potential of the live music industry: Despite the current challenges, the long-term prospects for the live music industry remain positive.

- Strategies for mitigating risk: Diversification, dollar-cost averaging, and a long-term investment horizon can mitigate risk.

Investors should carefully weigh these factors before making investment decisions. Risk management strategies are essential.

Conclusion

The anticipated live music stock slump on Friday is driven by a confluence of factors: inflation, increased competition, and global economic uncertainty. While short-term challenges exist, the long-term potential of the live music industry remains promising. The predictions vary, with experts offering a range of potential outcomes.

Call to Action: Stay informed about the live music stock market and its fluctuations. Monitor financial news, expert opinions, and key indicators to make informed investment decisions concerning live music stocks. Follow our website for updates on Friday's market performance and further analysis of the live music stock situation. Understanding the nuances of the live music market is critical for success in this dynamic sector.

Featured Posts

-

Role Models The Longest Goodbye Tour New Paris And London Shows Added

May 30, 2025

Role Models The Longest Goodbye Tour New Paris And London Shows Added

May 30, 2025 -

Ticketmaster Prueba La Vista Desde Tu Asiento Con El Venue Virtual

May 30, 2025

Ticketmaster Prueba La Vista Desde Tu Asiento Con El Venue Virtual

May 30, 2025 -

Us Imposes Steep Tariffs On Southeast Asian Solar Imports Up To 3 521 Duties

May 30, 2025

Us Imposes Steep Tariffs On Southeast Asian Solar Imports Up To 3 521 Duties

May 30, 2025 -

The Allure Of Victory Honda Motorcycles And Top Riders

May 30, 2025

The Allure Of Victory Honda Motorcycles And Top Riders

May 30, 2025 -

Californias Coastal Crisis The Impact Of Toxic Algae Blooms

May 30, 2025

Californias Coastal Crisis The Impact Of Toxic Algae Blooms

May 30, 2025