Live Now, Pay Later: A Comprehensive Overview Of Buy Now, Pay Later Services

Table of Contents

How Buy Now, Pay Later Services Work

Buy Now, Pay Later (BNPL) services allow you to purchase goods or services and pay for them in installments over a short period, typically a few weeks. This "live now, pay later" approach is appealing to many, but it's crucial to understand the mechanics.

The Application Process

The application process for most BNPL services is remarkably straightforward. It usually involves a soft credit check, meaning it won't affect your credit score in the same way a traditional loan application would. However, factors such as your credit history, income, and spending habits will influence your approval.

- Quick online application: Most applications can be completed in minutes.

- Instant approval (often): Many BNPL providers offer instant approval decisions.

- Linking to bank accounts or credit cards: You'll typically need to link your bank account or credit card for payment.

- Verification of identity and income (sometimes): Some providers may require additional verification steps.

Payment Schedules and Fees

Common payment plans involve splitting the purchase price into four installments over several weeks. However, the specifics vary between providers. Failing to make payments on time can result in significant consequences.

- Typical repayment periods (e.g., 4 weeks): Most BNPL services offer short repayment periods.

- Interest rates and late payment fees (mention variations between providers): While some BNPL services offer interest-free periods, late payment fees can be substantial, and some providers charge interest after the initial grace period.

- Potential for additional charges (e.g., cash advance fees): Be aware of any potential additional fees. Always read the terms and conditions carefully before using a BNPL service.

Popular Buy Now, Pay Later Providers

Several major players dominate the Buy Now, Pay Later market, each with its own strengths and weaknesses.

Comparing Different BNPL Options

Choosing the right BNPL provider requires careful consideration. Here's a brief comparison of some popular options:

- Afterpay: Known for its widespread merchant acceptance and straightforward four-payment plan.

- Klarna: Offers a variety of payment options, including installment plans and pay-in-30-days options.

- Affirm: Provides longer-term payment plans, often with interest, making it suitable for larger purchases.

Each provider has unique features, eligibility criteria, and merchant partnerships. Compare fees, interest rates, and repayment terms before making a decision.

The Benefits and Drawbacks of Using Buy Now, Pay Later

Like any financial tool, Buy Now, Pay Later services have both advantages and disadvantages.

Advantages of BNPL

The convenience of BNPL is undeniable. It offers several benefits:

- Increased purchasing power: Allows you to buy items you might otherwise postpone.

- Spread the cost of purchases: Makes large purchases more manageable.

- Improved cash flow management (potentially): Can help manage cash flow by spreading payments.

Potential Risks and Disadvantages of BNPL

However, the risks associated with BNPL should not be overlooked:

- Risk of debt accumulation: Easy access to credit can lead to overspending and debt accumulation.

- High interest charges for late payments: Missed payments can result in substantial fees and negatively impact your credit score.

- Negative impact on credit score if payments are missed: Late or missed payments can damage your creditworthiness.

- Potential for compulsive spending: The ease of use can encourage impulsive purchases.

Responsible Use of Buy Now, Pay Later Services

To avoid the pitfalls of BNPL, responsible use is paramount.

Tips for Avoiding Debt Traps

Consider these tips for safe and effective BNPL usage:

- Create a budget and stick to it: Only use BNPL for purchases you can comfortably afford to repay.

- Only use BNPL for essential purchases: Avoid using it for non-essential items.

- Set up automatic payments to avoid late fees: Automate payments to ensure timely repayments.

- Monitor your credit report regularly: Check your credit report to track your BNPL activity.

Conclusion:

Buy Now, Pay Later services offer a convenient way to spread the cost of purchases, providing a "live now, pay later" solution. However, the ease of access to credit comes with significant risks. Understanding how BNPL works, comparing providers, and using it responsibly are crucial to avoiding debt and protecting your credit score. Before you choose a Buy Now, Pay Later option, thoroughly research to find the best live now, pay later solution for your budget. Remember, responsible financial planning is key to maximizing the benefits and minimizing the risks of using BNPL services.

Featured Posts

-

Bruno Fernandes To Al Hilal Transfer Talks Confirmed

May 30, 2025

Bruno Fernandes To Al Hilal Transfer Talks Confirmed

May 30, 2025 -

A69 L Etat Saisit La Justice Pour Relancer Le Chantier

May 30, 2025

A69 L Etat Saisit La Justice Pour Relancer Le Chantier

May 30, 2025 -

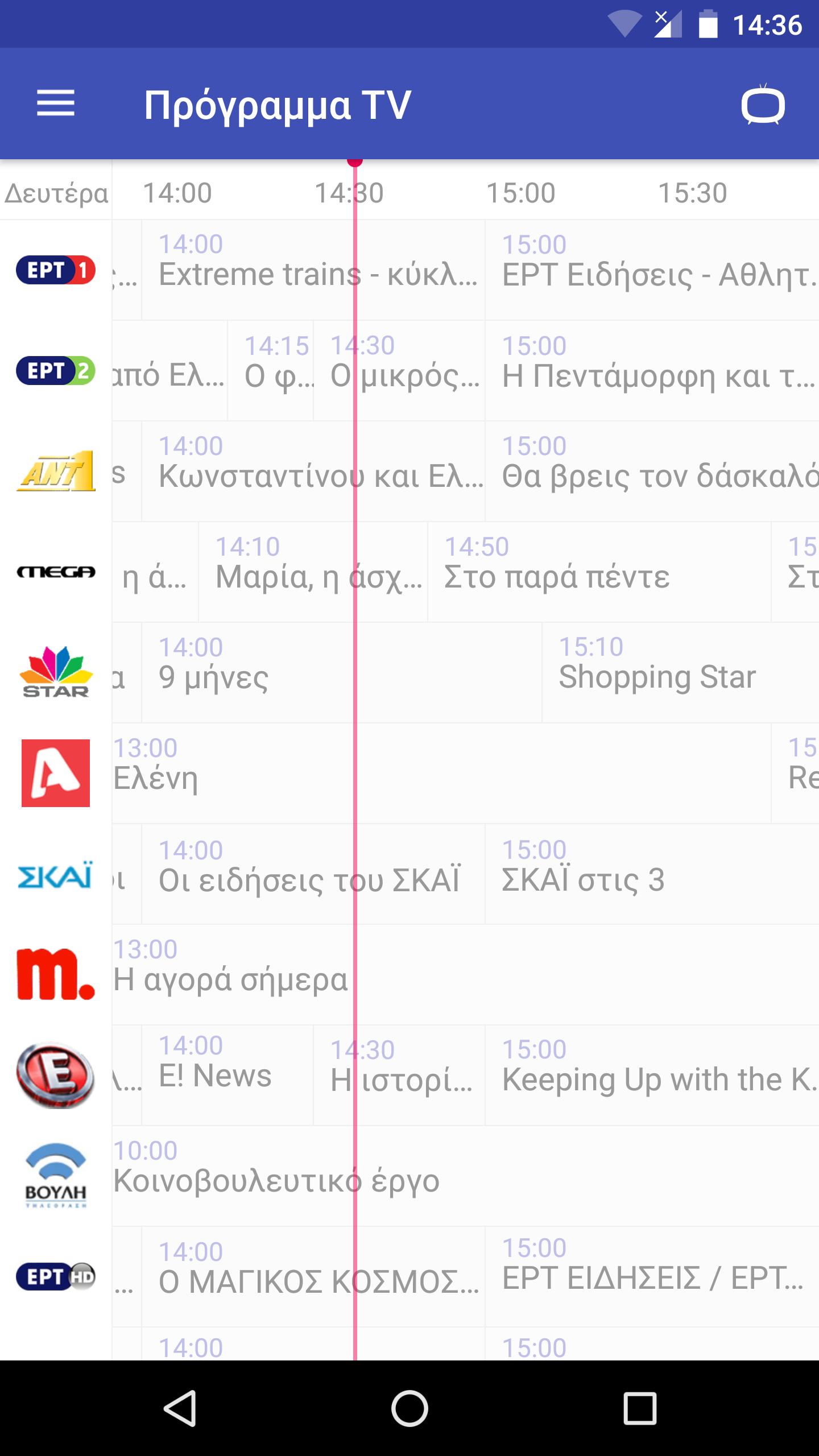

Programma Tileoptikon Metadoseon Savvatoy 12 4

May 30, 2025

Programma Tileoptikon Metadoseon Savvatoy 12 4

May 30, 2025 -

Barry Dillers Revelation Drug Use On The Set Of Popeye With Robin Williams

May 30, 2025

Barry Dillers Revelation Drug Use On The Set Of Popeye With Robin Williams

May 30, 2025 -

Wybory Prezydenckie 2025 Czy Mentzen Zaskoczy Wyborcow

May 30, 2025

Wybory Prezydenckie 2025 Czy Mentzen Zaskoczy Wyborcow

May 30, 2025

Latest Posts

-

Receta Aragonesa De 3 Ingredientes Un Sabor Del Pasado

May 31, 2025

Receta Aragonesa De 3 Ingredientes Un Sabor Del Pasado

May 31, 2025 -

3 Ingredientes Una Historia Receta Aragonesa Del Siglo Xix

May 31, 2025

3 Ingredientes Una Historia Receta Aragonesa Del Siglo Xix

May 31, 2025 -

Receta Facil De Aragon 3 Ingredientes Para Transportarte Al 1800

May 31, 2025

Receta Facil De Aragon 3 Ingredientes Para Transportarte Al 1800

May 31, 2025 -

4 Recetas Para Apagones Comida Rica Y Preparada Sin Electricidad Ni Gas

May 31, 2025

4 Recetas Para Apagones Comida Rica Y Preparada Sin Electricidad Ni Gas

May 31, 2025 -

Supera Un Apagon Con Estilo 4 Recetas Faciles Y Sabrosas

May 31, 2025

Supera Un Apagon Con Estilo 4 Recetas Faciles Y Sabrosas

May 31, 2025