Live Now, Pay Later: Your Guide To Smart Spending

Table of Contents

Understanding Live Now, Pay Later (BNPL) Services

How BNPL Works

BNPL services allow you to purchase goods and services now and pay for them in installments over a predetermined period. Several popular providers, such as Klarna, Afterpay, and Affirm, offer various BNPL options. These typically range from point-of-sale financing, where you choose BNPL at the checkout, to installment loans for larger purchases. However, it's vital to understand the mechanics. Interest rates and fees vary widely across providers. Some offer interest-free periods, while others charge interest if payments are late or missed. Repayment schedules usually span several weeks or months, and missing payments can severely damage your credit score.

- Types of BNPL services: Point-of-sale financing (integrated at checkout), installment loans (for larger purchases).

- Comparison of interest rates and fees: Research thoroughly before selecting a provider. Compare APRs (Annual Percentage Rates) and any late payment fees.

- Typical repayment terms: Understand the repayment schedule and ensure it aligns with your budget. Late payments can result in hefty fees and negatively impact your credit report.

- The impact on your credit score: While some BNPL providers report payments to credit bureaus, which can potentially improve your score if used responsibly, late or missed payments can significantly harm your credit rating.

Responsible Use of Buy Now Pay Later Schemes

Budgeting and Financial Planning

Before even considering using BNPL, meticulous budgeting and financial planning are essential. This involves creating a realistic budget that accounts for all your income and expenses. Track your spending meticulously, identifying essential versus non-essential purchases. Prioritize needs over wants to ensure you can comfortably manage your BNPL payments without compromising other financial obligations.

- Steps to create a detailed budget: Use budgeting apps (Mint, YNAB), spreadsheets, or even a simple notebook to track income and expenses.

- Tracking expenses: Categorize your expenses to understand where your money is going.

- Identifying essential vs. non-essential purchases: Distinguish between needs (rent, food) and wants (new clothes, entertainment) to prioritize spending.

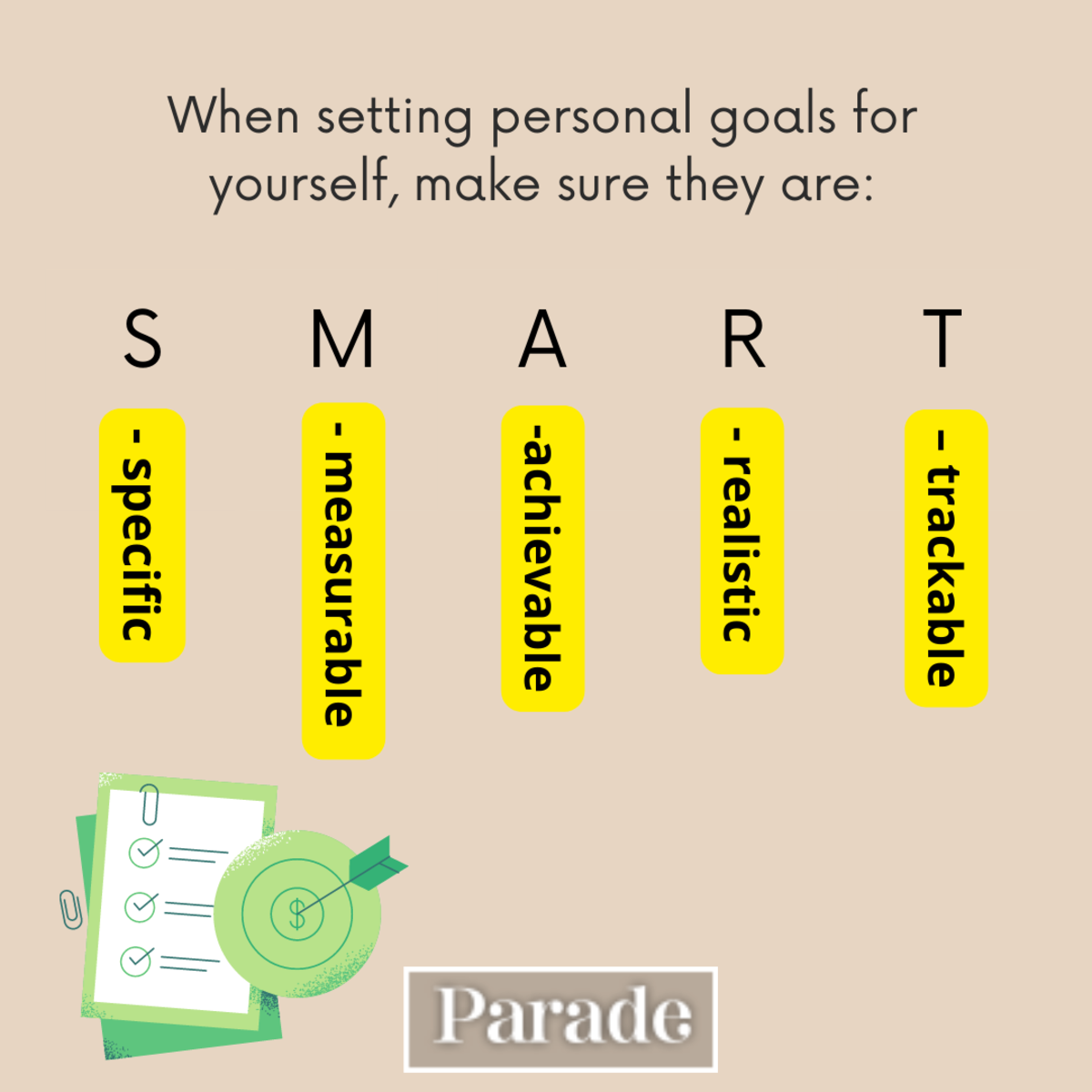

- Setting financial goals: Define short-term and long-term financial goals to guide your spending decisions.

Avoiding BNPL Debt Traps

The convenience of BNPL can easily lead to overspending and accumulating debt. It's crucial to set spending limits and stick to them religiously. Avoid accumulating multiple BNPL loans simultaneously, as managing several repayment schedules can become overwhelming. Late payments attract hefty fees and negatively impact your credit score. If you find yourself struggling with debt, seek professional help from a financial advisor or credit counselor.

- Setting spending limits: Decide beforehand how much you can comfortably afford to spend using BNPL each month.

- Prioritizing debt repayment: Prioritize paying off your BNPL debt before taking on new ones.

- Understanding the consequences of late payments: Late payments can significantly increase the overall cost and negatively impact your creditworthiness.

- Seeking help from financial advisors: If you're struggling to manage your BNPL debt, seek professional financial guidance.

Alternatives to Live Now, Pay Later

Exploring other payment options

While BNPL offers convenience, alternatives exist. Traditional credit cards, used responsibly, can offer rewards and build credit history. However, high interest rates can be detrimental if not managed carefully. Saving up for purchases before buying eliminates the need for BNPL altogether. Store credit cards can offer discounts but carry high interest rates if balances aren't paid promptly. Carefully weigh the pros and cons of each option.

- Comparison of BNPL vs. credit cards: Consider interest rates, fees, and the impact on your credit score.

- Strategies for saving money: Create a dedicated savings account and automate regular transfers to build funds for larger purchases.

- The benefits and drawbacks of store credit cards: Assess the potential discounts against the risk of high interest rates.

Conclusion

Mastering the art of smart spending with "live now, pay later" requires responsible financial planning. Budgeting, understanding BNPL terms, and setting realistic spending limits are crucial to avoid falling into debt traps. While BNPL services offer convenience, they should be used judiciously. Remember to explore alternative payment methods like saving up or using credit cards responsibly. Understanding the potential risks and benefits is key to successfully using buy now pay later options. Download a budgeting app today, and if you need personalized guidance, consult a financial advisor. Take control of your finances and use "live now, pay later" wisely.

Featured Posts

-

Quebec Marketing Firm Receives 330 K From Via Rail For High Speed Rail

May 30, 2025

Quebec Marketing Firm Receives 330 K From Via Rail For High Speed Rail

May 30, 2025 -

Greece Travel Warning Urgent Advice For British Tourists

May 30, 2025

Greece Travel Warning Urgent Advice For British Tourists

May 30, 2025 -

Ti Tha Deite Stin Tileorasi M Savvatoy 19 4

May 30, 2025

Ti Tha Deite Stin Tileorasi M Savvatoy 19 4

May 30, 2025 -

Kein Volek Mehr Bei Den Augsburger Panthern Die Folgen

May 30, 2025

Kein Volek Mehr Bei Den Augsburger Panthern Die Folgen

May 30, 2025 -

Ticketmaster Y Setlist Fm La Guia Definitiva Para La Experiencia Del Concierto Perfecto

May 30, 2025

Ticketmaster Y Setlist Fm La Guia Definitiva Para La Experiencia Del Concierto Perfecto

May 30, 2025

Latest Posts

-

What Is The Good Life Exploring Meaning And Purpose

May 31, 2025

What Is The Good Life Exploring Meaning And Purpose

May 31, 2025 -

Building A Good Life Strategies For Sustainable Wellbeing

May 31, 2025

Building A Good Life Strategies For Sustainable Wellbeing

May 31, 2025 -

The Good Life Defining And Achieving Your Personal Best

May 31, 2025

The Good Life Defining And Achieving Your Personal Best

May 31, 2025 -

Creating Your Good Life Personal Growth And Meaning

May 31, 2025

Creating Your Good Life Personal Growth And Meaning

May 31, 2025 -

Finding Your Good Life A Journey Of Self Discovery And Purpose

May 31, 2025

Finding Your Good Life A Journey Of Self Discovery And Purpose

May 31, 2025