Live Stock Market Coverage: Trump's China Tariffs And UK Brexit Trade Deal

Table of Contents

Trump's China Tariffs and their Impact on Live Stock Market Coverage

The Trade War's Initial Shock:

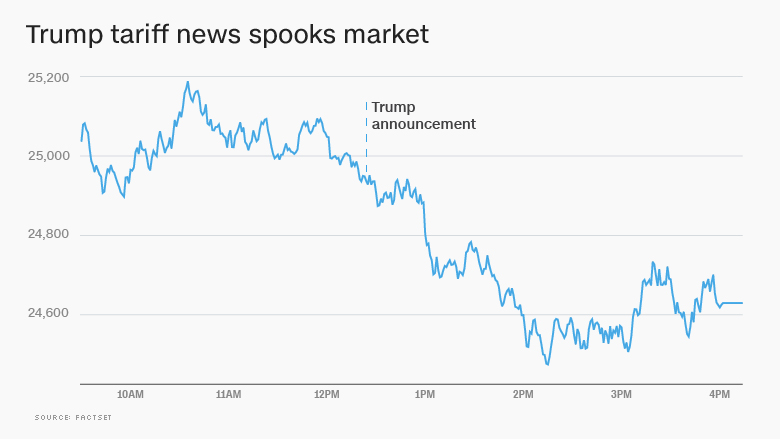

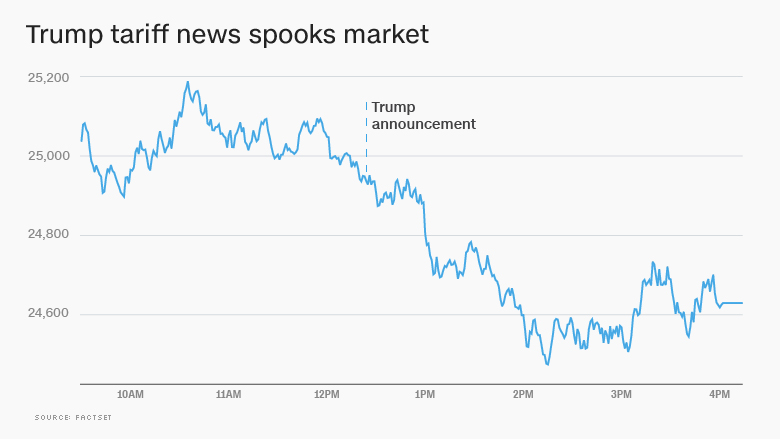

The announcement of Trump's tariffs on Chinese goods sent shockwaves through the live stock market. Investors, already grappling with global economic uncertainty, faced a new layer of complexity. The initial reaction was a period of heightened volatility, with significant price swings in various sectors. Uncertainty reigned supreme, as businesses struggled to predict the long-term consequences of the escalating trade war. Sectors heavily impacted included technology, due to its reliance on global supply chains, and agriculture, as tariffs directly affected the import and export of agricultural products.

- Increased market volatility, leading to significant daily price fluctuations.

- Decreased investor confidence, resulting in a flight to safety and reduced investment in riskier assets.

- Negative impact on specific sectors, particularly those heavily reliant on international trade.

- Global supply chain disruptions, leading to production delays and increased costs.

Long-Term Effects of the Tariffs:

The long-term effects of Trump's tariffs continue to reverberate throughout the global economy and the live stock market. The trade war fundamentally altered trade relations between the US and China, leading to a restructuring of global supply chains. Businesses adapted by diversifying sourcing, relocating production facilities, and exploring alternative markets. This adaptation process, however, came at a cost, increasing production expenses and impacting consumer prices through inflation.

- Restructuring of global supply chains, with companies seeking to diversify their sourcing and reduce reliance on a single market.

- Increased production costs, leading to higher prices for consumers and impacting corporate profitability.

- Changes in consumer purchasing habits, as consumers adjusted to higher prices and sought alternatives.

- Long-term effects on economic growth, with studies suggesting a negative impact on global GDP.

UK Brexit and its Influence on Live Stock Market Coverage

Uncertainty Surrounding Brexit:

The period leading up to the UK's departure from the European Union was marked by significant uncertainty, profoundly impacting the live stock market. Different Brexit scenarios – a hard Brexit, a soft Brexit, or no deal – each presented a unique set of potential consequences, creating considerable volatility. UK-based companies faced uncertainty regarding their future access to the EU market, impacting their valuations and investment attractiveness. The London Stock Exchange, a major global financial center, also felt the effects of this uncertainty.

- Pound Sterling fluctuations, reflecting the shifting market sentiment and expectations regarding the outcome of Brexit negotiations.

- Increased market uncertainty, leading to increased volatility and risk aversion among investors.

- Impact on UK-based businesses, particularly those heavily reliant on trade with the EU.

- Uncertainty about future trade agreements, affecting investment decisions and business planning.

The Post-Brexit Trade Deal and its Consequences:

The final trade agreement between the UK and the EU, while avoiding a no-deal scenario, introduced new trade regulations and barriers. This had immediate and long-term effects on the live stock market. Specific sectors, such as financial services and agriculture, were particularly affected by the new regulations. The impact on the UK economy is still being assessed, with ongoing debates regarding the long-term consequences of Brexit on economic growth.

- Changes in trading relationships, with new customs procedures and potential delays affecting cross-border trade.

- New regulatory hurdles, leading to increased compliance costs and administrative burdens for businesses.

- Impact on specific industries, with varying degrees of impact depending on the sector's reliance on EU trade.

- Long-term effects on UK economic growth, with ongoing assessments and varying projections from economists.

Analyzing the Interconnectedness: Tariffs, Brexit, and Global Market Fluctuations

The interconnectedness of global markets is undeniable. Trump's tariffs and the UK's Brexit were not isolated events; they interacted and influenced each other, impacting investor behavior and investment strategies worldwide. The media played a crucial role in shaping perceptions and influencing market sentiment. Understanding these interconnected dynamics is paramount for successful navigation of the live stock market.

- Global market interconnectedness, with events in one region having ripple effects across the globe.

- Investor sentiment and risk aversion, influencing investment decisions and market behavior.

- The role of media in shaping perceptions, influencing investor confidence and market trends.

- Impact on diversification strategies, with investors reassessing their portfolios to mitigate risks.

Conclusion:

This analysis of live stock market coverage highlights the significant impact of both Trump's China tariffs and the UK's Brexit on global financial markets. Understanding these events and their interconnectedness is crucial for investors seeking to navigate the complexities of the live stock market. By carefully considering the long-term effects and adapting strategies accordingly, investors can better position themselves for success. Staying informed on current live stock market coverage and global events is paramount for making informed investment decisions. Continue to monitor live stock market coverage to understand the evolving landscape and adapt your investment strategy accordingly.

Featured Posts

-

Advisory Councils Advocate For Improved Asylum Shelter Management To Save E1 Billion

May 11, 2025

Advisory Councils Advocate For Improved Asylum Shelter Management To Save E1 Billion

May 11, 2025 -

Singer Jessica Simpson Ends 15 Year Hiatus With Successful Performance

May 11, 2025

Singer Jessica Simpson Ends 15 Year Hiatus With Successful Performance

May 11, 2025 -

Analysis Of Jurickson Profars 80 Game Suspension In Mlb

May 11, 2025

Analysis Of Jurickson Profars 80 Game Suspension In Mlb

May 11, 2025 -

Will Aaron Judge Break Records Again A Yankees Magazine Analysis

May 11, 2025

Will Aaron Judge Break Records Again A Yankees Magazine Analysis

May 11, 2025 -

Hl Yjme Twm Krwz Wana Dy Armas Elaqt Eatfyt

May 11, 2025

Hl Yjme Twm Krwz Wana Dy Armas Elaqt Eatfyt

May 11, 2025