Long-Term Investing Strategies: Navigating The Buy-and-Hold Reality

Table of Contents

Understanding the Buy-and-Hold Investment Philosophy

The Core Principles of Buy-and-Hold

Buy-and-hold, at its core, is a long-term investment strategy characterized by patience, discipline, and a long-term vision. Instead of frequently buying and selling assets based on short-term market fluctuations, buy-and-hold investors acquire assets and hold them for an extended period, often years or even decades.

- Minimizing trading fees: Frequent trading incurs transaction costs that can significantly erode returns over time. Buy-and-hold minimizes these fees.

- Ignoring short-term market fluctuations: Market volatility is inevitable. Buy-and-hold investors understand that short-term dips are normal and don't panic sell.

- Focusing on fundamental analysis: Instead of reacting to daily price movements, buy-and-hold investors focus on the underlying value and long-term prospects of the assets they invest in.

Buy-and-Hold vs. Active Trading

Buy-and-hold differs significantly from active trading. Active trading involves frequent buying and selling of assets to capitalize on short-term market movements.

- Risk Tolerance: Buy-and-hold generally suits investors with a higher risk tolerance willing to weather short-term market downturns. Active trading requires a higher risk tolerance and more time commitment.

- Time Commitment: Buy-and-hold requires less time commitment than active trading, which demands constant monitoring of the market.

- Potential Returns: While both strategies can generate significant returns, active trading aims for higher short-term gains, while buy-and-hold focuses on long-term capital appreciation and compounding.

- Tax Implications: Frequent trading in active strategies can lead to higher capital gains taxes compared to the buy-and-hold approach.

Selecting the Right Assets for Buy-and-Hold

Choosing the right assets is crucial for successful long-term buy-and-hold investing. Diversification is key.

- Diversification strategies: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) reduces risk.

- Risk assessment: Understanding your risk tolerance helps determine the appropriate asset allocation.

- Aligning investments with long-term financial goals: Your investment strategy should be aligned with your retirement plans, education savings, or other long-term financial objectives. Index funds and ETFs are popular choices for diversification.

Mitigating Risks in Long-Term Investing

Diversification: Your Shield Against Market Volatility

Diversification is a cornerstone of mitigating risk in long-term investing. By spreading investments across different asset classes, investors can reduce the impact of poor performance in any single asset.

- Examples of diversified portfolios: A balanced portfolio might include a mix of stocks, bonds, and real estate.

- Asset allocation strategies: Determining the ideal percentage of your portfolio allocated to each asset class depends on your risk tolerance and investment goals.

- Rebalancing portfolios: Periodically rebalancing your portfolio to maintain your desired asset allocation ensures you don't become overly concentrated in any one area.

Dollar-Cost Averaging (DCA): A Strategy for Steady Growth

Dollar-cost averaging (DCA) is a risk management technique that involves investing a fixed amount of money at regular intervals, regardless of market fluctuations.

- How DCA works: Instead of investing a lump sum, you invest smaller amounts periodically.

- Benefits of DCA: DCA reduces the risk of investing a large sum at a market peak.

- When DCA is most effective: DCA can be particularly effective during periods of market volatility.

Emotional Discipline: Overcoming Market Fear and Greed

Long-term investing requires emotional discipline. Market fluctuations can trigger fear and greed, leading to impulsive decisions.

- Developing a long-term investment plan: A well-defined plan helps you stick to your strategy even during market downturns.

- Sticking to the plan despite market fluctuations: Avoid emotional reactions to short-term market noise.

- Seeking professional advice when needed: A financial advisor can provide guidance and support during challenging times.

Long-Term Investing Strategies Beyond Buy-and-Hold

While buy-and-hold is a powerful strategy, other approaches can complement a long-term investment plan.

Value Investing

Value investing focuses on identifying undervalued companies with strong fundamentals. This approach aligns with long-term strategies by seeking companies poised for future growth.

Growth Investing

Growth investing targets companies with high growth potential, often in emerging sectors. While riskier, it can yield substantial long-term returns.

Index Fund Investing

Index funds offer broad market exposure at low cost, making them an ideal component of a buy-and-hold strategy. They provide diversification and passively track a specific market index.

Conclusion

Successful long-term investing hinges on employing sound strategies and maintaining discipline. The buy-and-hold approach, coupled with diversification, dollar-cost averaging, and emotional discipline, forms a robust foundation. Understanding the nuances of different investment philosophies, like value and growth investing, and leveraging the benefits of index funds can further enhance your long-term investment success. Remember, consistent investing over the long term, even through market volatility, is key to achieving your financial goals. Start your long-term investing journey today and develop your own successful buy-and-hold strategy! Learn more about effective long-term investment strategies and explore the resources available to help you succeed.

Featured Posts

-

Hands On With The Fujifilm X Half Whimsical Design And User Experience

May 25, 2025

Hands On With The Fujifilm X Half Whimsical Design And User Experience

May 25, 2025 -

Ecb Nin Faiz Karari Avrupa Borsalari Icin Yeni Bir Doenem

May 25, 2025

Ecb Nin Faiz Karari Avrupa Borsalari Icin Yeni Bir Doenem

May 25, 2025 -

The Michael Schumacher Legacy Examining His Relationships With Other Drivers

May 25, 2025

The Michael Schumacher Legacy Examining His Relationships With Other Drivers

May 25, 2025 -

Kazuo Ishiguro An Exploration Of Memory And Forgetting

May 25, 2025

Kazuo Ishiguro An Exploration Of Memory And Forgetting

May 25, 2025 -

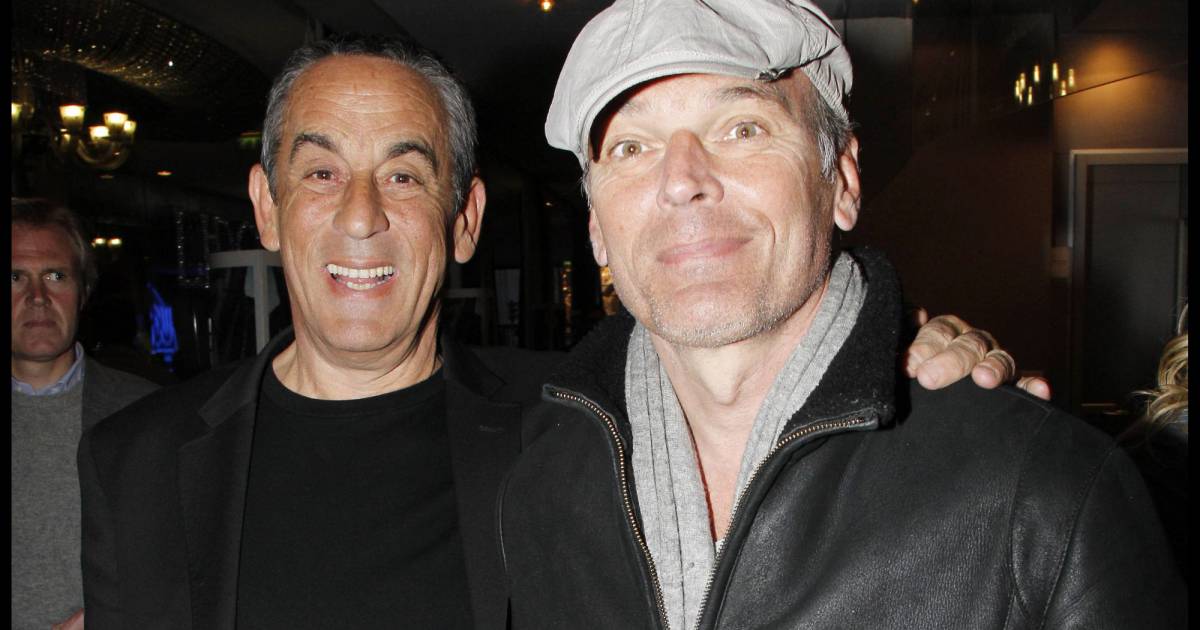

Thierry Ardisson Et Laurent Baffie Cons Et Machos L Animateur Tacle Son Ancien Sniper

May 25, 2025

Thierry Ardisson Et Laurent Baffie Cons Et Machos L Animateur Tacle Son Ancien Sniper

May 25, 2025