Low Inflation Podcast: A Guide To Smart Spending

Table of Contents

Understanding the Impact of Low Inflation on Spending Habits

Low inflation doesn't automatically translate to cheaper goods and services. While a low inflation rate might seem beneficial, it’s crucial to understand its complex impact on your spending habits.

The Illusion of Low Prices

Low inflation doesn't negate other economic pressures. Factors like supply chain disruptions, increased demand, and corporate profit margins can significantly impact prices, creating an illusion of affordability.

- Analyze examples of seemingly "low-priced" items with hidden costs: Consider shrinkflation, where product sizes decrease while prices remain the same or even increase. A smaller box of cereal at the same price is a classic example. Also, observe the quality of products; lower-quality ingredients or materials might lead to seemingly lower prices but reduced value.

- Explain how to distinguish between real price decreases and perceived price decreases due to inflation: A real price decrease occurs when the actual cost of a good or service goes down. A perceived decrease happens when the inflation rate is lower than the previous period but prices may still be increasing, albeit more slowly. Comparing prices year-over-year, rather than month-to-month, helps reveal the true trend.

Planning for Future Inflation

Proactive budgeting and financial planning are crucial, even during periods of low inflation. Economic conditions are unpredictable; preparing for potential future inflation is essential for long-term financial security.

- Explain the concept of emergency funds and their importance in navigating unpredictable economic changes: Having 3-6 months' worth of living expenses in a readily accessible savings account provides a crucial buffer during job loss, unexpected medical expenses, or other financial emergencies. This minimizes the need to resort to high-interest debt during challenging times.

- Discuss strategies for investing and growing your savings during low inflation periods: While low inflation might not offer high returns on savings accounts, diversifying investments in stocks, bonds, and other assets can help your money grow faster than inflation. Consider consulting a financial advisor to determine the best investment strategy based on your risk tolerance and financial goals.

Practical Strategies for Smart Spending During Low Inflation

Smart spending involves a combination of budgeting, strategic shopping, and curbing unnecessary expenses. These strategies remain critical, regardless of inflation levels.

Budgeting and Tracking Expenses

Creating a detailed budget and diligently tracking your expenses are foundational steps for managing your finances effectively.

- Introduce budgeting apps and methods like the 50/30/20 rule: Apps like Mint, YNAB (You Need A Budget), and Personal Capital offer automated tracking and budgeting features. The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Discuss the importance of categorizing expenses to identify spending patterns: Categorizing expenses (e.g., housing, transportation, food, entertainment) reveals spending habits and pinpoints areas where you can cut back. This detailed analysis enables informed decision-making regarding your finances.

Smart Shopping Techniques

Savvy shoppers can significantly reduce their expenses by implementing smart shopping techniques.

- Recommend websites and apps for comparing prices and finding deals: Websites like Google Shopping, CamelCamelCamel (for Amazon), and browser extensions like Honey can help you compare prices and find coupons.

- Discuss loyalty programs and their benefits: Loyalty programs offer discounts, exclusive offers, and reward points, adding value to your purchases.

Reducing Non-Essential Spending

Identifying and reducing non-essential expenses can free up significant funds for savings and investments.

- Provide examples of common areas where people overspend (e.g., dining out, entertainment): Dining out frequently, impulse purchases, subscriptions you rarely use, and excessive entertainment spending are common areas of overspending.

- Suggest alternative, cost-effective options for entertainment and leisure activities: Explore free or low-cost activities like hiking, visiting parks, attending free community events, borrowing books from the library, and hosting game nights instead of expensive outings.

Leveraging Technology for Smart Spending

Technology plays a crucial role in optimizing spending habits and achieving financial goals.

Budgeting Apps and Tools

Numerous budgeting apps and financial planning tools are available to streamline your financial management.

- Compare the features and benefits of different apps, highlighting their user-friendliness and functionalities: Each app has unique features; some offer automated expense categorization, while others provide detailed financial reports and goal-setting tools. Choosing the right app depends on your individual needs and preferences.

- Discuss how these tools can help users track spending, set budgets, and achieve financial goals: These tools provide a clear overview of your spending, helping you stay on track with your budget and achieve your financial objectives.

Price Comparison Websites and Extensions

Leveraging price comparison tools can help you find the best deals online.

- Provide examples of popular price comparison websites and browser extensions: Google Shopping, PriceGrabber, and Keepa are examples of popular price comparison websites. Browser extensions like Honey and Rakuten automatically search for coupons and cashback offers.

- Explain how these tools can save time and money when shopping online: These tools automate the process of comparing prices across multiple retailers, saving you time and ensuring you secure the best deals.

Conclusion

This Low Inflation Podcast guide offers valuable insights into smart spending strategies. By understanding the nuances of low inflation, implementing effective budgeting techniques, and utilizing helpful technology, you can significantly improve your financial well-being. Remember, even with low inflation, mindful spending habits are crucial for long-term financial success. Listen to our Low Inflation Podcast for more in-depth discussions and expert advice on navigating your finances effectively. Start your journey to smart spending with our Low Inflation Podcast today!

Featured Posts

-

Listeia Se Spiti Sti Xalkidiki Pliris Kalypsi Toy Peristatikoy

May 27, 2025

Listeia Se Spiti Sti Xalkidiki Pliris Kalypsi Toy Peristatikoy

May 27, 2025 -

Us Trade Policy And Its Implications For The Asia Summit

May 27, 2025

Us Trade Policy And Its Implications For The Asia Summit

May 27, 2025 -

Significant V Mware Price Hike Proposed By Broadcom At And Ts Perspective

May 27, 2025

Significant V Mware Price Hike Proposed By Broadcom At And Ts Perspective

May 27, 2025 -

Ghwtshy Fy Flwrnsa Irth Wtarykh Yewdan Llhyat Fy Erd Krwz 2026

May 27, 2025

Ghwtshy Fy Flwrnsa Irth Wtarykh Yewdan Llhyat Fy Erd Krwz 2026

May 27, 2025 -

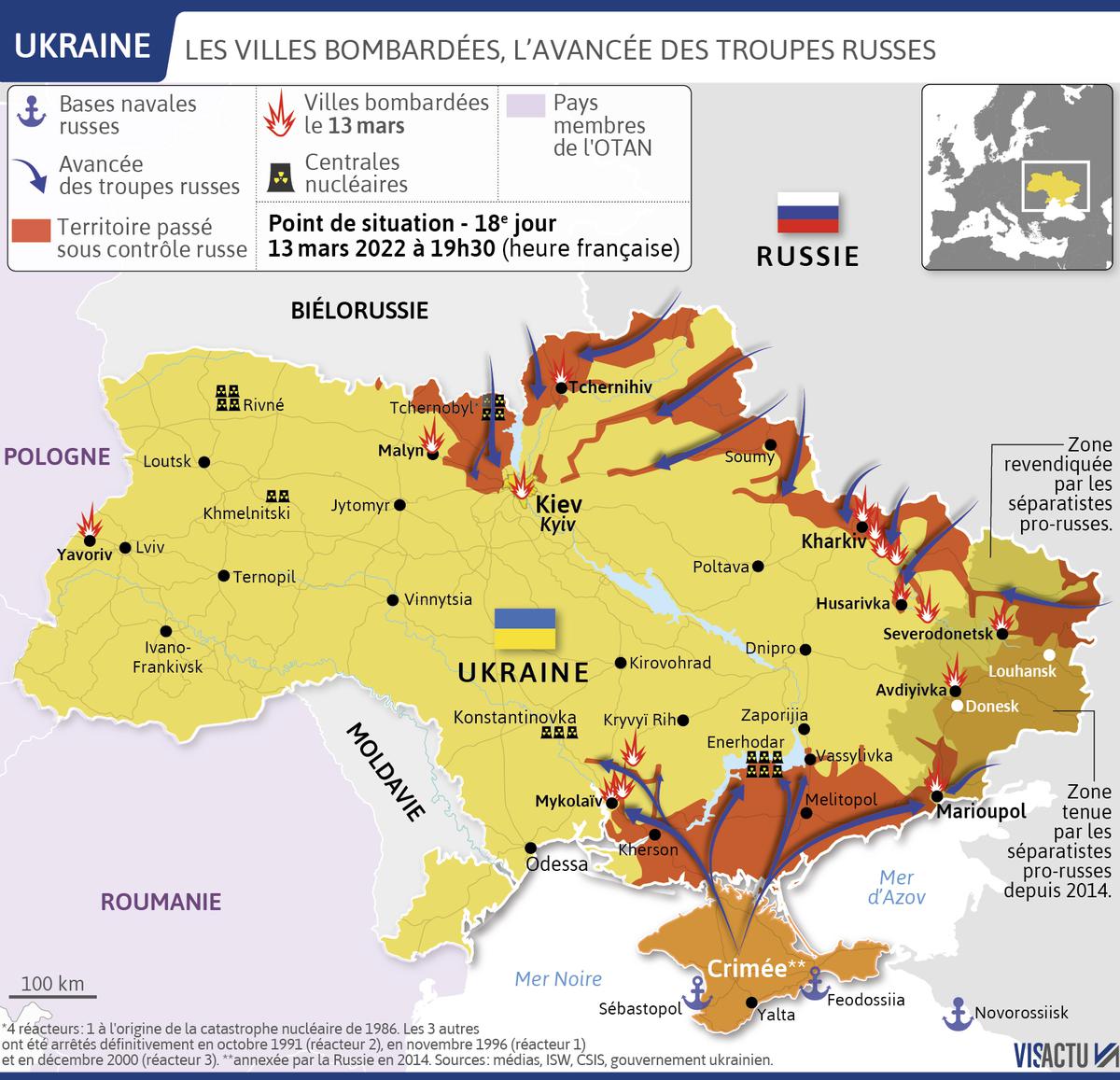

Furnizime Te Reja Te Armeve Per Ukrainen Nga Gjermania Cfare Duhet Te Dime

May 27, 2025

Furnizime Te Reja Te Armeve Per Ukrainen Nga Gjermania Cfare Duhet Te Dime

May 27, 2025

Latest Posts

-

Autoroute A69 Ministres Et Parlementaires Unis Pour Relancer Le Projet

May 30, 2025

Autoroute A69 Ministres Et Parlementaires Unis Pour Relancer Le Projet

May 30, 2025 -

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025 -

Perspectives De Greve Sncf Le Point Sur La Situation Pour La Semaine Du 8 Mai

May 30, 2025

Perspectives De Greve Sncf Le Point Sur La Situation Pour La Semaine Du 8 Mai

May 30, 2025 -

Droits De Douane Votre Guide Pour Une Importation Exportation Sans Accroc

May 30, 2025

Droits De Douane Votre Guide Pour Une Importation Exportation Sans Accroc

May 30, 2025 -

Greve Sncf La Semaine Du 8 Mai Sera T Elle Impactee Analyse De La Situation

May 30, 2025

Greve Sncf La Semaine Du 8 Mai Sera T Elle Impactee Analyse De La Situation

May 30, 2025