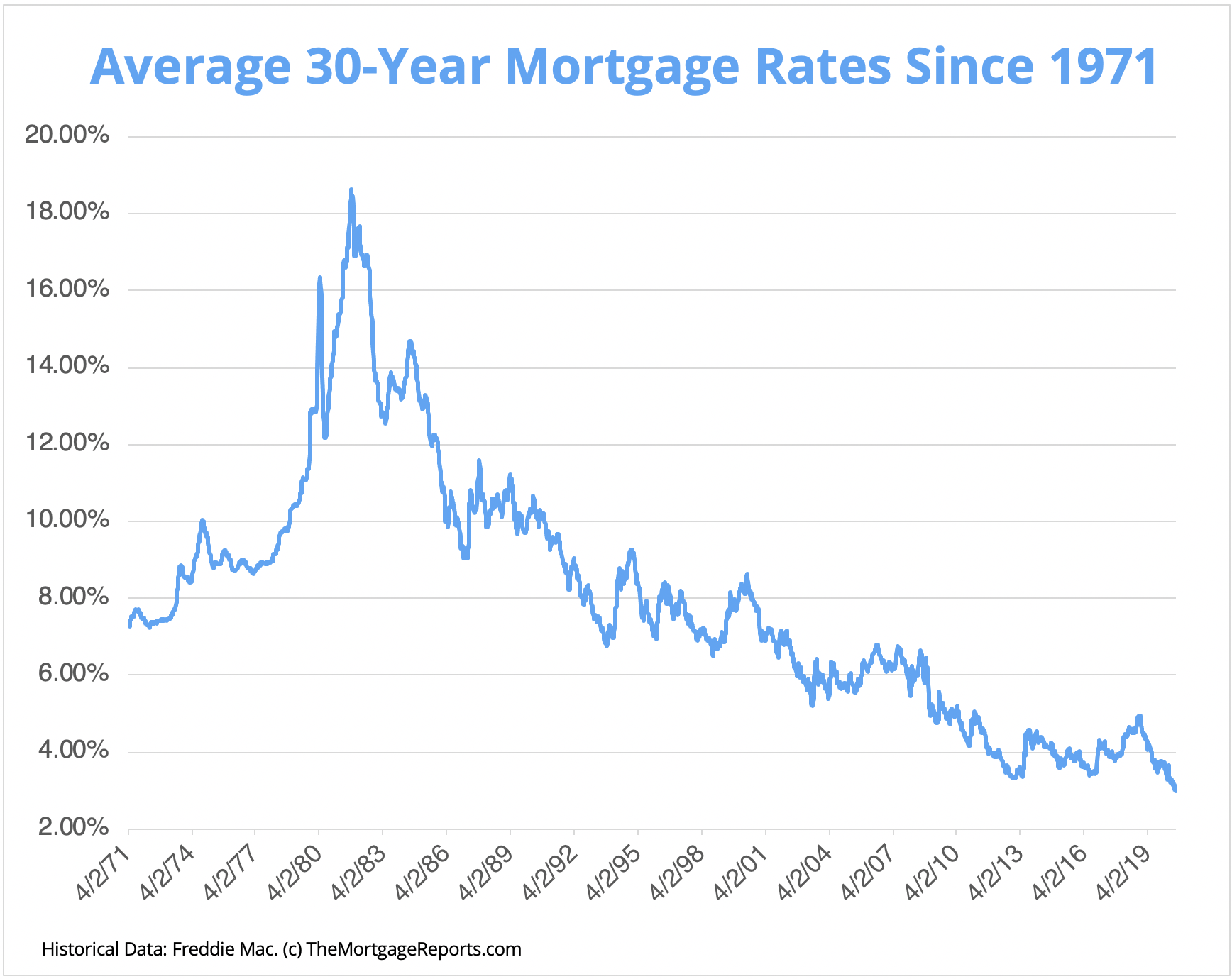

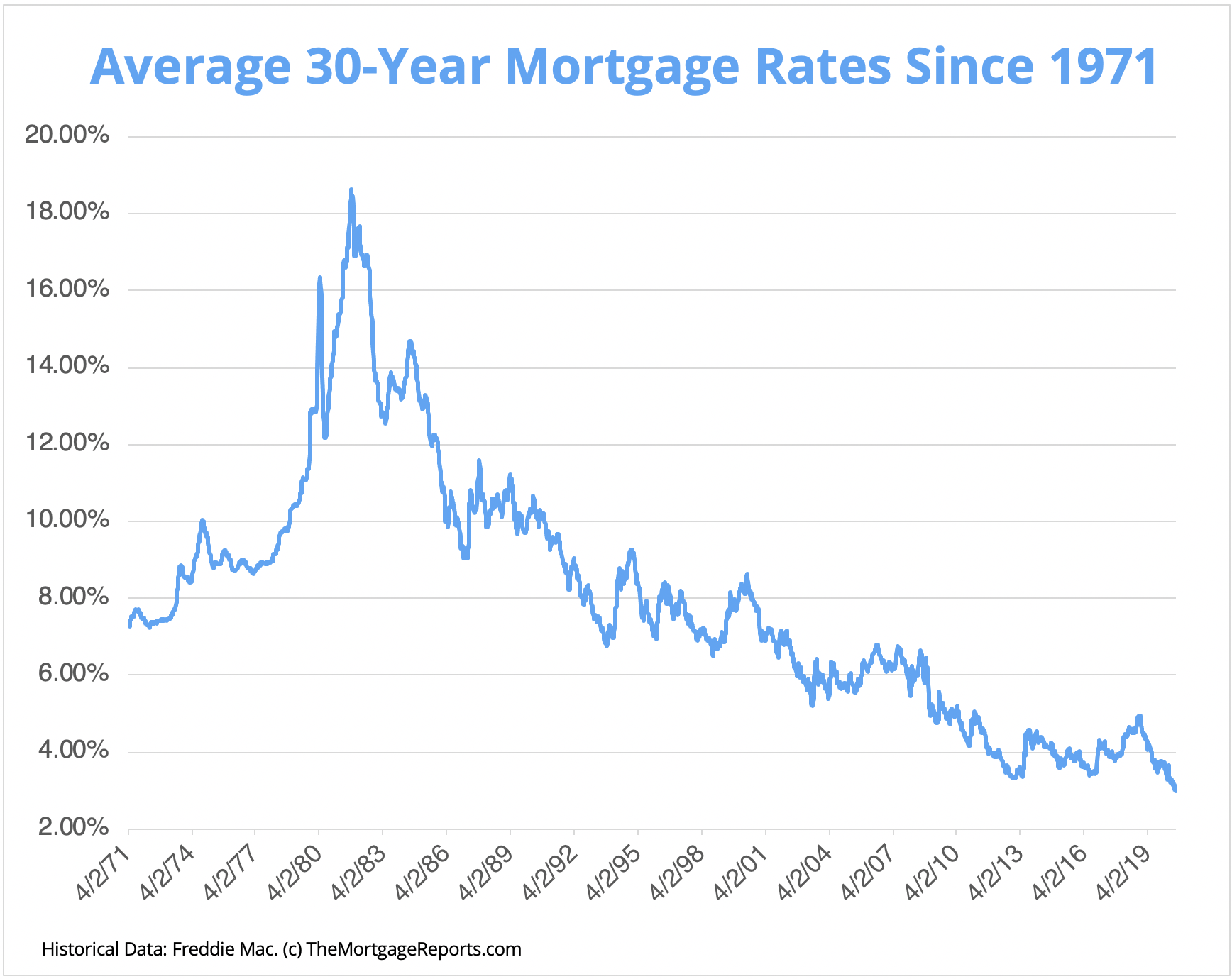

Low Mortgage Rates: A Catalyst For Canada's Housing Market?

Table of Contents

The Impact of Low Mortgage Rates on Affordability

Lower interest rates directly translate to lower monthly mortgage payments, making homeownership more accessible for many Canadians, particularly first-time home buyers. This increased affordability, driven by low mortgage rates Canada, can lead to increased demand and a more competitive market.

- Reduced monthly payments increase purchasing power: Lower payments mean buyers can afford more expensive properties or allocate more funds towards a down payment.

- More Canadians can qualify for larger mortgages: Lenders may approve larger loan amounts due to lower interest payments, expanding the pool of potential homebuyers.

- Stimulates demand, potentially driving up prices in competitive markets: Increased demand, fueled by low mortgage rates, can lead to bidding wars and escalated prices, especially in already competitive markets.

- Increased competition among buyers: The combination of increased affordability and limited inventory creates a highly competitive environment for homebuyers.

The Relationship Between Low Rates and Housing Price Inflation

While low mortgage rates make homes more affordable on a monthly basis, they can also fuel housing price inflation. Increased demand coupled with limited supply pushes prices higher, creating a cyclical effect. This scenario can potentially lead to a housing bubble in the Canadian real estate market.

- Increased buyer demand leads to bidding wars and higher sale prices: More buyers competing for fewer homes inevitably results in higher sale prices than would be seen in a balanced market.

- Low rates incentivize investors to enter the market, further increasing demand: Low mortgage rates make real estate investment more attractive, leading to increased competition from investors driving up prices.

- Potential for unsustainable price growth: Rapid price increases driven by low mortgage rates may not reflect the true underlying value of the properties, creating an unsustainable market.

- Risk of a market correction if rates rise suddenly: If interest rates increase sharply, borrowers with larger mortgages might struggle to make payments, potentially leading to a market correction.

The Role of Government Policies and Regulations

Government policies and regulations play a crucial role in mitigating the risks associated with low mortgage rates. Stress tests and other measures aim to ensure borrowers can manage their mortgages even if rates increase. The Canada Mortgage and Housing Corporation (CMHC) also plays a significant role.

- Stress tests help prevent over-leveraging by borrowers: These tests ensure borrowers can handle higher interest rates before approving a mortgage, reducing the risk of defaults.

- Government initiatives to increase housing supply: Government programs aimed at increasing the supply of housing can help cool down overheated markets.

- Regulations aimed at curbing speculation in the housing market: Regulations such as foreign buyer taxes are designed to mitigate speculation and stabilize the market.

- Impact of CMHC (Canada Mortgage and Housing Corporation) insurance: CMHC insurance influences lending practices and the overall risk profile of the mortgage market.

Regional Variations in Market Response

The impact of low mortgage rates is not uniform across Canada. Different regions experience varying levels of demand, supply, and price sensitivity. Analyzing regional trends offers a nuanced understanding of the overall market impact. For example, the Toronto real estate market might react differently to low mortgage rates than the Montreal real estate market.

- Differences in supply and demand across major cities: Major urban centers like Toronto and Vancouver often face greater competition than smaller cities.

- Varying levels of affordability in different regions: Affordability varies significantly across provinces and even within cities.

- Impact of local economic factors on housing markets: Local economic conditions influence demand and pricing dynamics, creating regional variations in market response to low mortgage rates.

Conclusion

Low mortgage rates have undoubtedly played a significant role in shaping Canada's housing market. While they have increased affordability for some and stimulated demand, they also pose risks, including increased price inflation and potential market instability. Government policies and regional variations further complicate the picture. Understanding the complex interplay of these factors is crucial for navigating the Canadian housing market. Staying informed about current low mortgage rates and their potential impact on your financial decisions is key. Consult with a financial advisor to discuss how current low mortgage rates might influence your personal home-buying strategies and your overall financial health. Making informed decisions about mortgages in Canada requires careful consideration of the current climate of low mortgage rates.

Featured Posts

-

Your Source For Efl Highlights Videos And Analysis

May 13, 2025

Your Source For Efl Highlights Videos And Analysis

May 13, 2025 -

School Stabbing Victims Funeral A Community Grieves

May 13, 2025

School Stabbing Victims Funeral A Community Grieves

May 13, 2025 -

Mosque Under Scrutiny Police Raid Linked To Controversial Muslim Mega City Project

May 13, 2025

Mosque Under Scrutiny Police Raid Linked To Controversial Muslim Mega City Project

May 13, 2025 -

La And Orange Counties Sizzle Under Record Breaking Heat Extreme Temperatures And Safety Measures

May 13, 2025

La And Orange Counties Sizzle Under Record Breaking Heat Extreme Temperatures And Safety Measures

May 13, 2025 -

Prekmurski Romi Muzikanti Glasba In Identiteta

May 13, 2025

Prekmurski Romi Muzikanti Glasba In Identiteta

May 13, 2025

Latest Posts

-

Rossiysko Myanmanskiy Delovoy Forum V Moskve Daty Uchastniki I Povestka Dnya

May 13, 2025

Rossiysko Myanmanskiy Delovoy Forum V Moskve Daty Uchastniki I Povestka Dnya

May 13, 2025 -

Pengalaman Sby Pendekatan Diplomasi Dalam Konflik Myanmar

May 13, 2025

Pengalaman Sby Pendekatan Diplomasi Dalam Konflik Myanmar

May 13, 2025 -

V Moskve Sostoitsya Krupniy Rossiysko Myanmanskiy Delovoy Forum

May 13, 2025

V Moskve Sostoitsya Krupniy Rossiysko Myanmanskiy Delovoy Forum

May 13, 2025 -

Wawasan Sby Mengatasi Konflik Myanmar Dengan Bijak

May 13, 2025

Wawasan Sby Mengatasi Konflik Myanmar Dengan Bijak

May 13, 2025 -

Sby Dan Konflik Myanmar Strategi Resolusi Tanpa Intervensi

May 13, 2025

Sby Dan Konflik Myanmar Strategi Resolusi Tanpa Intervensi

May 13, 2025