Low Personal Loan Interest Rates: Your Guide To Finding The Best Deals Today

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into the hunt for the best personal loan rates, it's crucial to understand the basics of interest rates. The Annual Percentage Rate (APR) is the annual cost of borrowing money, expressed as a percentage. It includes not only the interest but also any fees associated with the loan. A lower APR means a lower total cost over the loan's lifespan.

You'll typically encounter two types of interest rates:

- Fixed Interest Rates: These rates remain constant throughout the loan term. This offers predictability and allows you to accurately budget your monthly payments.

- Variable Interest Rates: These rates fluctuate based on market conditions. While you might start with a lower rate, it could increase over time, leading to higher monthly payments.

Several factors significantly influence the interest rate you'll receive:

-

Credit Score: This is the most significant factor. A higher credit score generally translates to lower interest rates. Lenders view borrowers with good credit as less risky.

-

Loan Amount: Larger loan amounts might come with slightly higher interest rates, as they represent a greater risk for the lender.

-

Loan Term: Shorter loan terms typically result in lower interest rates but higher monthly payments. Longer terms mean lower monthly payments but higher overall interest paid.

-

Higher credit scores generally result in lower interest rates.

-

Shorter loan terms usually mean lower interest rates but higher monthly payments.

-

Larger loan amounts may come with slightly higher interest rates.

How to Find the Best Low Personal Loan Interest Rates

Finding the best low personal loan interest rates requires diligent research and comparison. Here's how to do it:

-

Compare Rates from Multiple Lenders: Don't settle for the first offer you receive. Compare rates from various lenders, including banks, credit unions, and online lenders. Each institution has its own lending criteria and interest rate structures.

-

Utilize Online Comparison Tools: Several websites allow you to compare personal loan rates from multiple lenders simultaneously, streamlining your search for cheap personal loans and best personal loan rates. These tools can save you considerable time and effort.

-

Pre-qualify for Loans: Many lenders offer pre-qualification options that allow you to see potential interest rates without impacting your credit score. This gives you a good idea of what you might qualify for before applying officially.

-

Negotiate Interest Rates: Once you've found a lender you like, don't be afraid to negotiate. A slightly better interest rate can save you a substantial amount over the loan term. Highlight your good credit score and any other positive financial factors.

-

Check lender reviews and ratings before applying.

-

Understand all fees associated with the loan (origination fees, prepayment penalties).

-

Read the loan agreement carefully before signing.

Improving Your Chances of Securing Low Personal Loan Interest Rates

Your credit score plays a pivotal role in determining the interest rate you'll receive. A higher credit score significantly improves your chances of securing low personal loan interest rates.

-

Importance of a Good Credit Score: Lenders use credit scores to assess your creditworthiness. A higher score indicates a lower risk to the lender, resulting in lower interest rates.

-

Strategies to Improve Your Credit Score: Focus on paying your bills on time, consistently, and keeping your credit utilization low (the amount of credit you're using compared to your total available credit). Aim for below 30%.

-

Building a Strong Credit History: Over time, responsible credit management will build a strong credit history, leading to better interest rates in the future.

-

Check your credit report regularly for errors.

-

Pay down existing debt to improve your credit utilization ratio.

-

Avoid applying for multiple loans in a short period.

Different Types of Personal Loans and Their Interest Rates

Personal loans come in various forms, each with its own set of interest rates and terms.

-

Secured vs. Unsecured Loans: Secured loans, such as those backed by collateral (like a car or home), typically have lower interest rates because the lender has less risk. Unsecured loans, like credit card cash advances, carry higher interest rates due to the increased risk for the lender.

-

Pros and Cons: Consider the pros and cons of each type, weighing the potential benefits of lower interest rates against the risks of losing collateral in a secured loan.

-

Specific Examples and Interest Rate Ranges: The interest rates for secured personal loans generally range from 6% to 18%, while unsecured personal loans often fall between 10% and 25% or even higher, depending on your creditworthiness and the lender. Always clarify APR details with your lender.

-

Secured loans (e.g., loans secured by a car or home) usually have lower interest rates.

-

Unsecured loans (e.g., credit card cash advances) tend to have higher interest rates.

Conclusion: Securing the Best Low Personal Loan Interest Rates

Securing low personal loan interest rates involves a combination of strategies. Improving your credit score, comparing rates from multiple lenders, and negotiating are key steps to achieving your goal. Remember to always carefully compare rates and thoroughly understand the terms of any loan before signing the agreement. Don't let high interest rates drain your finances!

Don't delay your savings! Start your search for low personal loan interest rates now and find the perfect loan for your needs. Use the tips and resources in this article to secure the best possible deal on your next personal loan.

Featured Posts

-

The China Factor Analyzing The Difficulties Faced By Luxury Car Brands

May 28, 2025

The China Factor Analyzing The Difficulties Faced By Luxury Car Brands

May 28, 2025 -

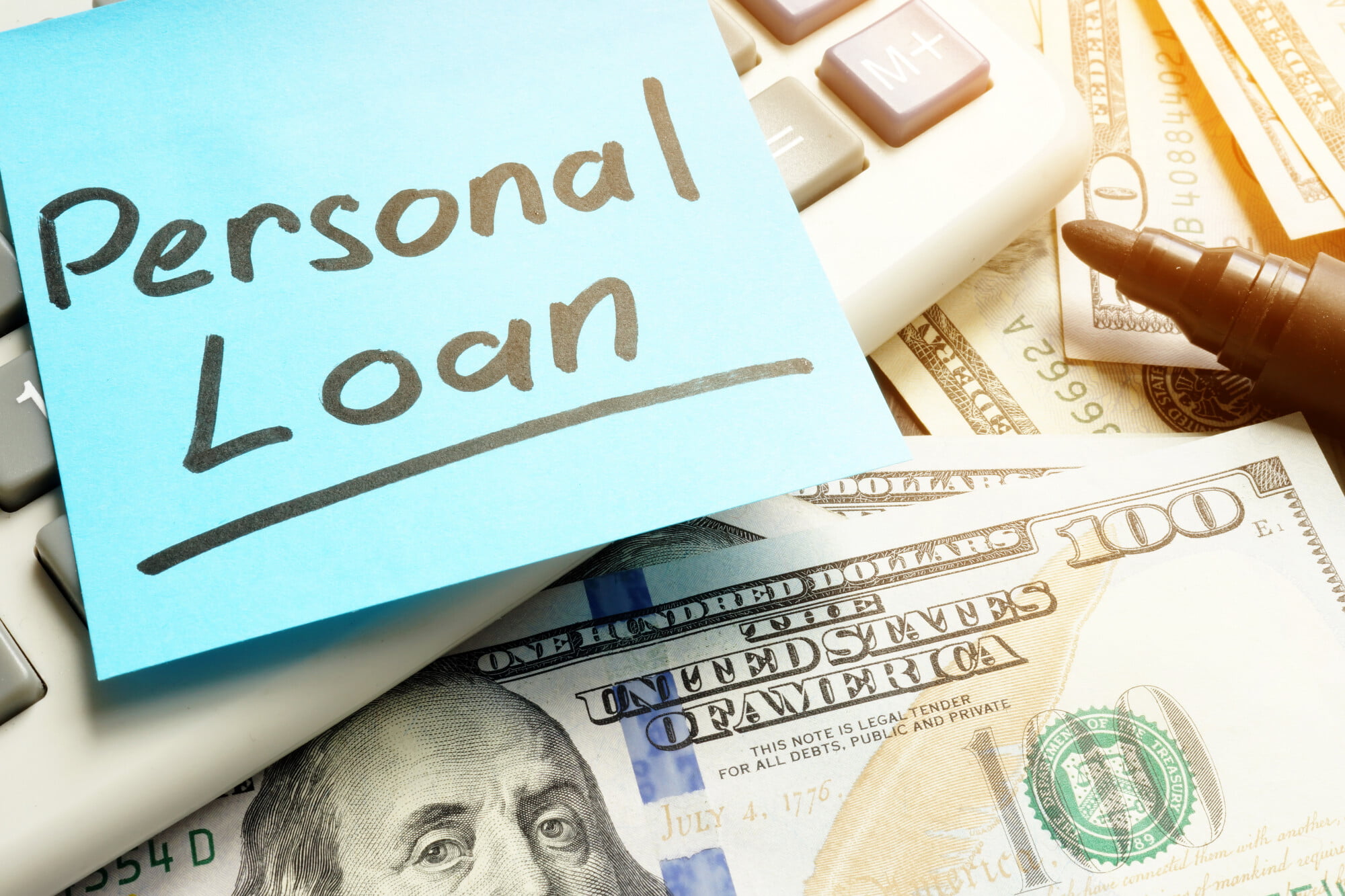

Wrexham History Football And Hidden Gems

May 28, 2025

Wrexham History Football And Hidden Gems

May 28, 2025 -

Psv Juara Liga Belanda Setelah Taklukkan Sparta Rotterdam

May 28, 2025

Psv Juara Liga Belanda Setelah Taklukkan Sparta Rotterdam

May 28, 2025 -

Foinikiko Sxedio I Nea Tainia Toy Goyes Anterson Stis Aithoyses

May 28, 2025

Foinikiko Sxedio I Nea Tainia Toy Goyes Anterson Stis Aithoyses

May 28, 2025 -

Taylor Swift And Beyonce Lead 2025 American Music Award Nominations

May 28, 2025

Taylor Swift And Beyonce Lead 2025 American Music Award Nominations

May 28, 2025

Latest Posts

-

Is Miley Cyrus Hit Een Plagiaat Van Bruno Mars Rechtszaak Wordt Voortgezet

May 31, 2025

Is Miley Cyrus Hit Een Plagiaat Van Bruno Mars Rechtszaak Wordt Voortgezet

May 31, 2025 -

Analisis Lirik Dan Musik Video Single Baru Miley Cyrus End Of The World

May 31, 2025

Analisis Lirik Dan Musik Video Single Baru Miley Cyrus End Of The World

May 31, 2025 -

Resmi Miley Cyrus Rilis Singel Baru End Of The World

May 31, 2025

Resmi Miley Cyrus Rilis Singel Baru End Of The World

May 31, 2025 -

Donderdag Miley Cyrus Onthult Eerste Single Van Nieuw Album

May 31, 2025

Donderdag Miley Cyrus Onthult Eerste Single Van Nieuw Album

May 31, 2025 -

Miley Cyrus Plagiaatzaak Voortgezet Hit Veroordeeld Tot Gelijkend Op Bruno Mars Nummer

May 31, 2025

Miley Cyrus Plagiaatzaak Voortgezet Hit Veroordeeld Tot Gelijkend Op Bruno Mars Nummer

May 31, 2025