Lower UK Inflation Eases BOE Rate Cut Pressure: Pound Sterling's Rise

Table of Contents

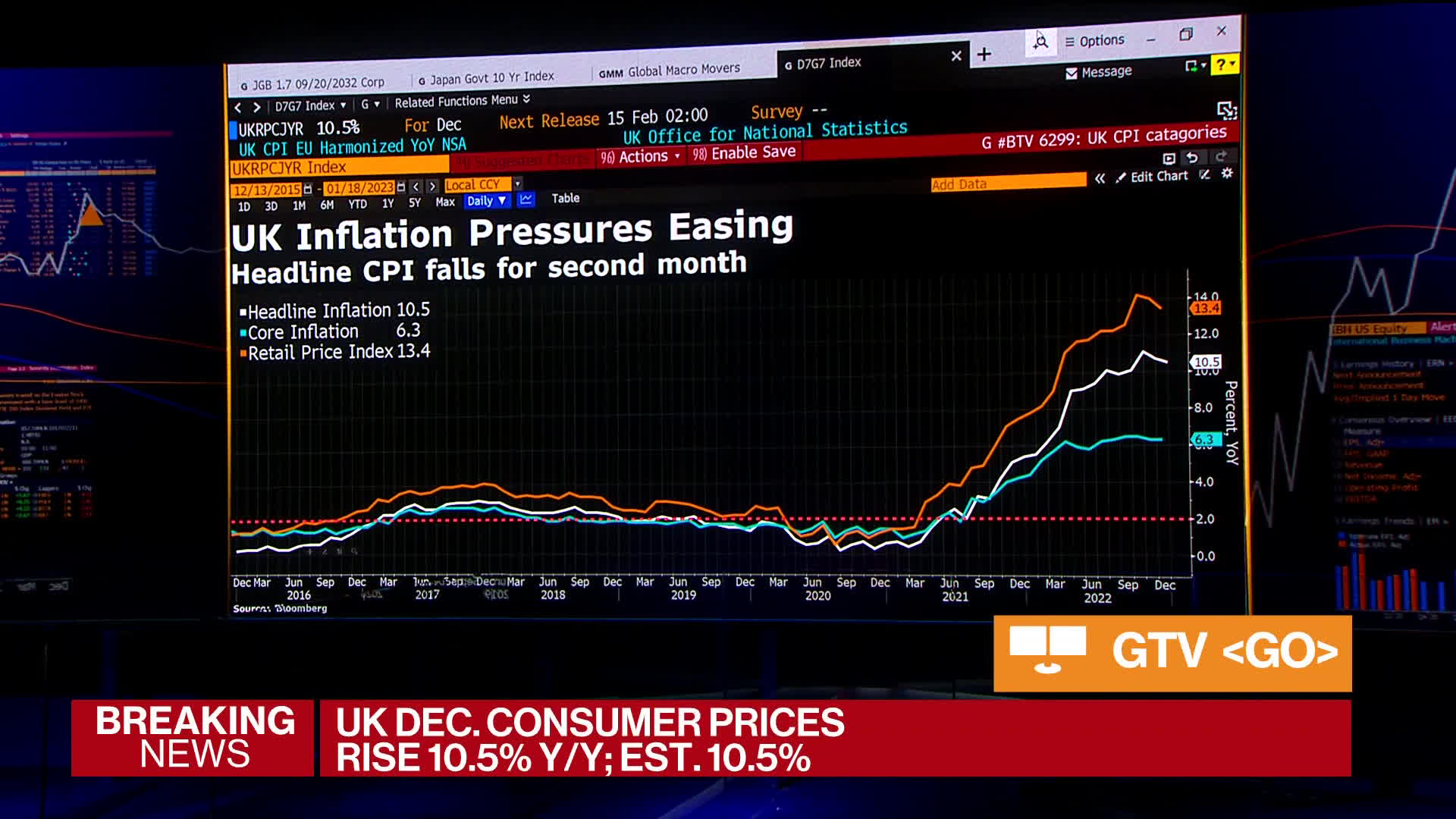

Declining UK Inflation: A Detailed Look

The UK inflation rate, measured by the Consumer Price Index (CPI) and the Retail Price Index (RPI), has shown a welcome decline in recent months. This decrease in UK inflation data is largely attributed to easing energy prices and improvements in global supply chains. While inflation remains above the BOE's target of 2%, the downward trend is significant.

- UK inflation rate: The CPI fell from a peak of X% in [Month, Year] to Y% in [Month, Year], a significant decrease. (Replace X and Y with actual figures).

- Comparison to previous years: This represents a substantial drop compared to the Z% inflation rate observed in [Month, Year] (Replace Z with the relevant figure).

- Contributing factors:

- Easing energy prices: A reduction in global energy costs has directly impacted household bills, contributing significantly to the lower inflation rate. Data from [Source] shows a W% decrease in energy prices since [Date]. (Replace W with actual figure and source with a reputable source)

- Supply chain improvements: The easing of global supply chain bottlenecks has led to a more stable supply of goods, reducing inflationary pressures. Reports indicate a significant improvement in delivery times for key goods.

This positive trend in UK inflation rate provides crucial context for understanding the BOE’s current strategy and the Pound's performance.

The Bank of England's Response to Lower Inflation

The Bank of England's monetary policy directly responds to inflation levels. With lower UK inflation, the pressure on the BOE to implement further interest rate cuts has diminished considerably. The Monetary Policy Committee (MPC) now has more flexibility in its decision-making, potentially allowing for a pause or even a future increase in interest rates.

- Recent BOE announcements: The BOE has recently indicated [summarize recent announcements regarding interest rates and monetary policy].

- Potential for future rate hikes/holds: The market anticipates [insert market predictions and analysis of potential future BOE actions]. The reduced inflationary pressure makes a rate hike more likely in the coming months.

- Analysis of market expectations: Analysts are closely monitoring the inflation data and the BOE's response. The current consensus suggests [summarize market expectations].

The BOE's cautious approach, reflecting the lower UK inflation, is a key factor in the Pound Sterling's recent appreciation.

Pound Sterling's Appreciation: Causes and Consequences

The interplay between lower UK inflation, reduced BOE rate cut pressure, and a stronger Pound Sterling is clearly evident. The reduced risk of further rate cuts makes the UK a more attractive investment destination, boosting demand for the Pound.

- GBP exchange rate against major currencies: The Pound Sterling has strengthened against the Euro and the US dollar recently. [Insert specific exchange rate data].

- Impact on UK import and export prices: A stronger Pound makes imports cheaper for UK consumers but can make UK exports more expensive in international markets, potentially impacting businesses involved in international trade.

- Effects on UK businesses and consumers: For businesses, this could lead to increased competition from cheaper imports, whilst consumers benefit from lower import costs.

Conclusion: Lower UK Inflation and the Future of the Pound

In summary, the decrease in lower UK inflation has significantly eased the pressure on the BOE to cut interest rates, resulting in a strengthening of the Pound Sterling. These three elements are inextricably linked, and understanding their dynamic interplay is vital for navigating the UK's current economic climate.

Looking forward, the future trajectory of UK inflation, BOE policy, and the Pound Sterling's value will depend on several factors, including global economic conditions and domestic economic data. Stay informed about lower UK inflation and its impact on the Pound and the broader UK economy. Subscribe to our newsletter for regular updates and in-depth analyses of BOE policy and market forecasts. We will be publishing further articles exploring specific market predictions and detailed analyses of BOE monetary policy in the coming weeks.

Featured Posts

-

Tour Of Flanders Pogacars Stunning Solo Victory

May 26, 2025

Tour Of Flanders Pogacars Stunning Solo Victory

May 26, 2025 -

Relay Race Sweep Earns T Bird Girls Home Invite Win

May 26, 2025

Relay Race Sweep Earns T Bird Girls Home Invite Win

May 26, 2025 -

Coheres Legal Fight Addressing Copyright Infringement Allegations

May 26, 2025

Coheres Legal Fight Addressing Copyright Infringement Allegations

May 26, 2025 -

The Latest On Elon Musk And His Dogecoin Investments

May 26, 2025

The Latest On Elon Musk And His Dogecoin Investments

May 26, 2025 -

Live Streaming Moto Gp Inggris 2025 Trans7 And Spotv Jadwal And Update Klasemen

May 26, 2025

Live Streaming Moto Gp Inggris 2025 Trans7 And Spotv Jadwal And Update Klasemen

May 26, 2025

Latest Posts

-

Gisele Pelicots Memoir Hbo Adaptation In The Works

May 30, 2025

Gisele Pelicots Memoir Hbo Adaptation In The Works

May 30, 2025 -

Reecouter L Integrale D Europe 1 Soir Du 19 Mars 2025

May 30, 2025

Reecouter L Integrale D Europe 1 Soir Du 19 Mars 2025

May 30, 2025 -

Hbo To Adapt Gisele Pelicots Book A French Rape Victims Story

May 30, 2025

Hbo To Adapt Gisele Pelicots Book A French Rape Victims Story

May 30, 2025 -

Europe 1 Soir Du 19 03 2025 L Integrale De L Emission

May 30, 2025

Europe 1 Soir Du 19 03 2025 L Integrale De L Emission

May 30, 2025 -

Emission Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025

Emission Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025