Lutnick-Built FMX Challenges CME: Treasury Futures Trading Begins

Table of Contents

FMX's Entry into the Treasury Futures Market

Howard Lutnick's Strategic Play

Howard Lutnick, the CEO of Cantor Fitzgerald, a firm with a rich history navigating the complexities of the financial markets, has made a significant strategic move with the launch of FMX. This platform represents a direct challenge to the CME Group's established dominance in Treasury futures trading. Lutnick's vision is to provide a more technologically advanced and efficient platform for trading these crucial instruments. Cantor Fitzgerald's history, marked by resilience and innovation, positions them well to disrupt the established order.

- Cantor Fitzgerald's history: A long-standing player in the financial markets, known for its expertise in fixed income and derivatives.

- Lutnick's vision for FMX: To offer a superior trading experience through advanced technology and streamlined processes.

- Potential advantages of a new platform: Opportunities to innovate and provide features not currently available on established platforms.

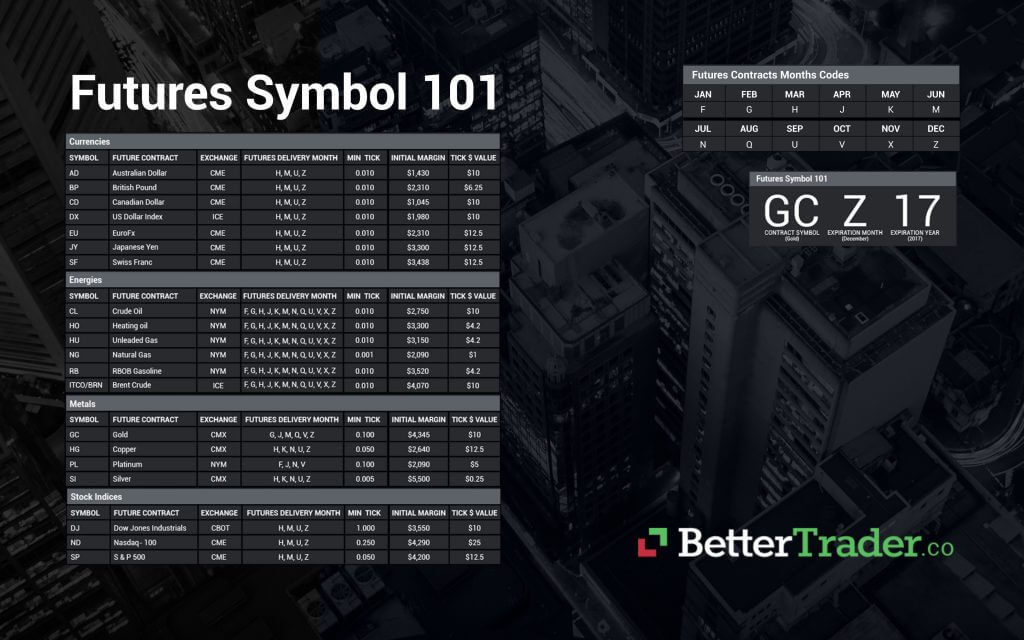

FMX's Technological Advantages

FMX boasts a cutting-edge technological infrastructure designed to compete directly with the CME. A key focus is on speed, efficiency, and an intuitive user experience. This includes reduced latency, enabling faster trade execution, and sophisticated trading tools designed to improve decision-making.

- Specific technological features: High-frequency trading capabilities, advanced order routing systems, and real-time market data feeds.

- Potential for reduced latency: Faster trade execution leading to improved profitability for high-frequency traders.

- Innovative trading tools: Advanced charting, analytics, and risk management tools to enhance the trading experience.

Initial Market Reaction and Trading Volumes

Early reactions to FMX's entry into the Treasury futures market have been mixed. Initial trading volumes are encouraging, though still significantly lower than the CME's established market share. Analyst commentary suggests that the long-term success of FMX will depend on its ability to attract a significant portion of the trading volume currently handled by the CME. Investor sentiment is cautiously optimistic, with many waiting to see how the platform performs over the long term.

- Early trading data: Preliminary volume figures and price comparisons to the CME are crucial indicators of early success.

- Analyst commentary: Experts are analyzing the platform's strengths and weaknesses, assessing its potential for long-term growth.

- Investor sentiment: Gauging investor confidence is essential in understanding the platform's potential for success.

CME's Response and Market Dynamics

CME's Market Dominance and Strategies

The CME Group holds a dominant position in the Treasury futures market, built over decades of operation and strong brand recognition. Their response to FMX’s entry will be crucial in shaping the future of the market. They are likely to employ several strategies, including competitive pricing, further technological upgrades to their platform, and enhanced marketing initiatives.

- CME's market share: The CME currently holds a significant portion of the Treasury futures trading volume.

- Potential counter-strategies: Price adjustments, technological improvements to their platform, and strategic marketing campaigns.

Impact on Market Liquidity and Price Discovery

The entry of FMX could significantly impact market liquidity and the efficiency of price discovery for Treasury futures. Increased competition may lead to tighter spreads, meaning smaller differences between bid and ask prices, benefiting traders. Conversely, it could also increase price volatility in the short term as the market adjusts to the new competitor.

- Potential increased competition leading to tighter spreads: This benefits traders by reducing transaction costs.

- Effects on price volatility: Increased competition could initially increase volatility but may lead to greater price stability over time.

- Increased market depth analysis: The presence of a new exchange can provide a more comprehensive picture of market demand and supply.

Regulatory Considerations

Both FMX and CME operate within a heavily regulated environment. Compliance with all relevant regulations is critical for both platforms. Regulatory scrutiny will likely increase as the competition intensifies, potentially leading to increased oversight and stricter compliance requirements.

- Regulatory oversight: Both exchanges are subject to extensive regulatory oversight to ensure fair and transparent markets.

- Compliance requirements: Meeting strict regulatory standards is paramount for the continued operation of both platforms.

- Potential for regulatory scrutiny: Increased scrutiny is expected as competition intensifies and market share shifts.

The Future of Treasury Futures Trading

Long-Term Implications for Traders and Investors

The increased competition between FMX and CME offers several potential benefits for traders and investors. More choices in trading platforms could lead to better pricing and enhanced technological features. Diversification across multiple platforms can help mitigate risk.

- Increased competition leading to better pricing: Traders may benefit from tighter spreads and more competitive pricing.

- Improved technology and tools: Competition encourages innovation, leading to more advanced trading tools and platforms.

- Benefits of diversification for traders: Trading on multiple platforms can reduce dependence on a single exchange.

Potential for Market Fragmentation or Consolidation

The long-term outcome of this competition is uncertain. The market could experience fragmentation, with both FMX and CME maintaining significant market share, or consolidation, with one platform ultimately dominating. Several factors will determine the final outcome, including the adoption rate of FMX, the effectiveness of CME’s response, and broader market conditions.

- Arguments for and against market fragmentation: Analysis of the potential benefits and drawbacks of a fragmented vs. consolidated market.

- Predictions for future market share: Estimating the long-term market share of each platform is a key element of future market analysis.

Conclusion

The launch of Treasury futures trading on FMX marks a significant turning point in the financial markets, challenging the established dominance of the CME. Howard Lutnick's strategic move introduces a new competitor with potential advantages in technology and market approach. The long-term impact on market dynamics, liquidity, and price discovery remains to be seen, but the increased competition is likely to benefit traders and investors. Stay informed about developments in Treasury futures trading to capitalize on opportunities presented by this exciting market shift. Further analysis of Treasury futures trading will be crucial in understanding the evolving landscape of financial markets.

Featured Posts

-

Spring Breakout 2025 A Comprehensive Look At The Rosters

May 18, 2025

Spring Breakout 2025 A Comprehensive Look At The Rosters

May 18, 2025 -

Barricaded Person Incident Prompts Significant Police Response In Las Vegas Arts District

May 18, 2025

Barricaded Person Incident Prompts Significant Police Response In Las Vegas Arts District

May 18, 2025 -

Canada Post Mail Delivery Commission Report And Proposed Changes

May 18, 2025

Canada Post Mail Delivery Commission Report And Proposed Changes

May 18, 2025 -

2025 The Year Of Pedro Pascal Begins Next Week

May 18, 2025

2025 The Year Of Pedro Pascal Begins Next Week

May 18, 2025 -

Film No Other Land Kemenangan Oscar Dan Refleksi Konflik Palestina Israel

May 18, 2025

Film No Other Land Kemenangan Oscar Dan Refleksi Konflik Palestina Israel

May 18, 2025