Luxury Watch Ownership: Is It Worth The Investment?

Table of Contents

The Financial Aspects of Luxury Watch Ownership

Owning a luxury timepiece is a significant financial undertaking. Understanding the financial implications is crucial before diving into the world of high-end horology.

Appreciation and Depreciation

The value of luxury watches can fluctuate significantly. Some models appreciate over time, becoming highly sought-after collector's items, while others depreciate more rapidly. Several factors influence a watch's value:

- Examples of watches that appreciate: Rolex Daytona Cosmograph, Patek Philippe Nautilus, Audemars Piguet Royal Oak. These models are known for their strong resale value and consistent demand.

- Examples of watches that depreciate more rapidly: Certain limited-edition pieces from less established brands may depreciate quicker, particularly if the brand's popularity wanes.

- Factors affecting resale value: Condition (scratches, dents), original box and papers (certificate of authenticity), current market trends, and overall desirability all play a crucial role. A well-maintained watch with complete documentation will command a higher price.

Luxury Watches as an Alternative Investment

Luxury watches are often considered an alternative investment asset, similar to gold, art, or real estate. However, it’s crucial to understand both the potential benefits and significant risks.

-

Advantages:

- Tangible asset: Unlike stocks or bonds, you physically possess the watch.

- Potential for appreciation: Certain luxury watches can significantly appreciate in value over time.

- Diversification: Adding luxury watches to a diversified investment portfolio can provide a unique asset class.

-

Disadvantages:

- Illiquidity: Selling a luxury watch quickly can be difficult, and you may not receive the full market value.

- Market volatility: The luxury watch market is susceptible to economic downturns and shifts in fashion trends.

- Storage and insurance costs: Proper storage and insurance are essential to protect your investment, adding to the overall cost of ownership.

The Cost of Ownership

The initial purchase price is just the beginning. Owning a luxury watch involves ongoing expenses:

- Servicing and maintenance costs: Luxury watches require regular servicing by authorized technicians, which can be expensive. Over time, these costs can add up considerably.

- Insurance premiums: Insuring a high-value watch is essential to protect against loss, theft, or damage. Premiums for luxury watches can be substantial.

The Emotional and Lifestyle Aspects of Luxury Watch Ownership

Beyond the financial considerations, luxury watch ownership offers several intangible benefits that contribute to its appeal.

Status Symbol and Social Signaling

Luxury watches often serve as status symbols, communicating wealth, success, and refined taste. The brand and model choice can significantly impact the social perception of the wearer.

- Luxury brands and their associated prestige: Brands like Rolex, Patek Philippe, and Audemars Piguet carry significant prestige, instantly conveying a certain image.

- The psychology of luxury goods and consumer behavior: Luxury goods often fulfill psychological needs beyond their functional value, satisfying desires for self-expression and social status.

A Passion for Horology and Craftsmanship

For many enthusiasts, the appeal extends beyond mere status. A luxury watch represents a passion for horology – the art and science of timekeeping.

- The history and heritage of specific brands: Many luxury watch brands have a rich history and legacy, adding to the allure of their timepieces.

- The intricate mechanisms and design elements: The meticulous craftsmanship and complex mechanisms of luxury watches are works of art and engineering.

Personal Connection and Legacy

Luxury watches can become cherished personal items, holding significant sentimental value. They can also serve as family heirlooms, passed down through generations.

- The emotional significance of owning a cherished family timepiece: A watch inherited from a loved one holds immense emotional value, representing a connection to the past.

- The legacy aspect of luxury watch ownership: Owning a timepiece with enduring value allows one to leave a legacy for future generations.

Conclusion

Luxury watch ownership is a complex decision with significant financial and emotional implications. While some luxury watches appreciate in value, others depreciate, and ongoing maintenance costs are substantial. However, the intangible benefits – the status, the craftsmanship, the personal connection – are also important factors to consider. Before you consider luxury watch ownership, carefully weigh the pros and cons, aligning your decision with your financial goals and personal preferences. Make an informed decision about luxury watch ownership, understanding the potential risks and rewards involved. Learn more about luxury watch ownership and explore different brands and models to find the perfect timepiece for you.

Featured Posts

-

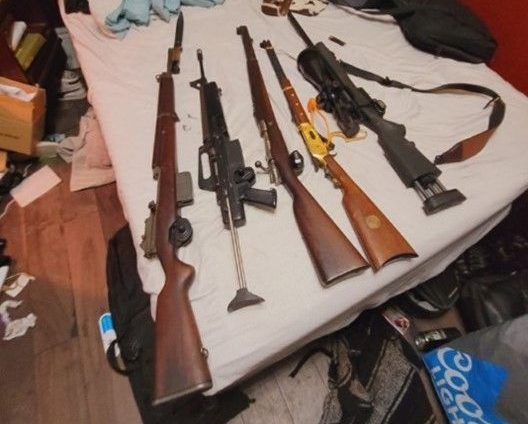

Police Apprehend Five In Connection With Drugs And Weapons

May 27, 2025

Police Apprehend Five In Connection With Drugs And Weapons

May 27, 2025 -

Ujabb Targyalasok Trump Kueloenmegbizottja Ismet Talalkozott Putyinnal

May 27, 2025

Ujabb Targyalasok Trump Kueloenmegbizottja Ismet Talalkozott Putyinnal

May 27, 2025 -

Analyzing Taylor Swifts Reputation Taylors Version Teaser Clues And Hints

May 27, 2025

Analyzing Taylor Swifts Reputation Taylors Version Teaser Clues And Hints

May 27, 2025 -

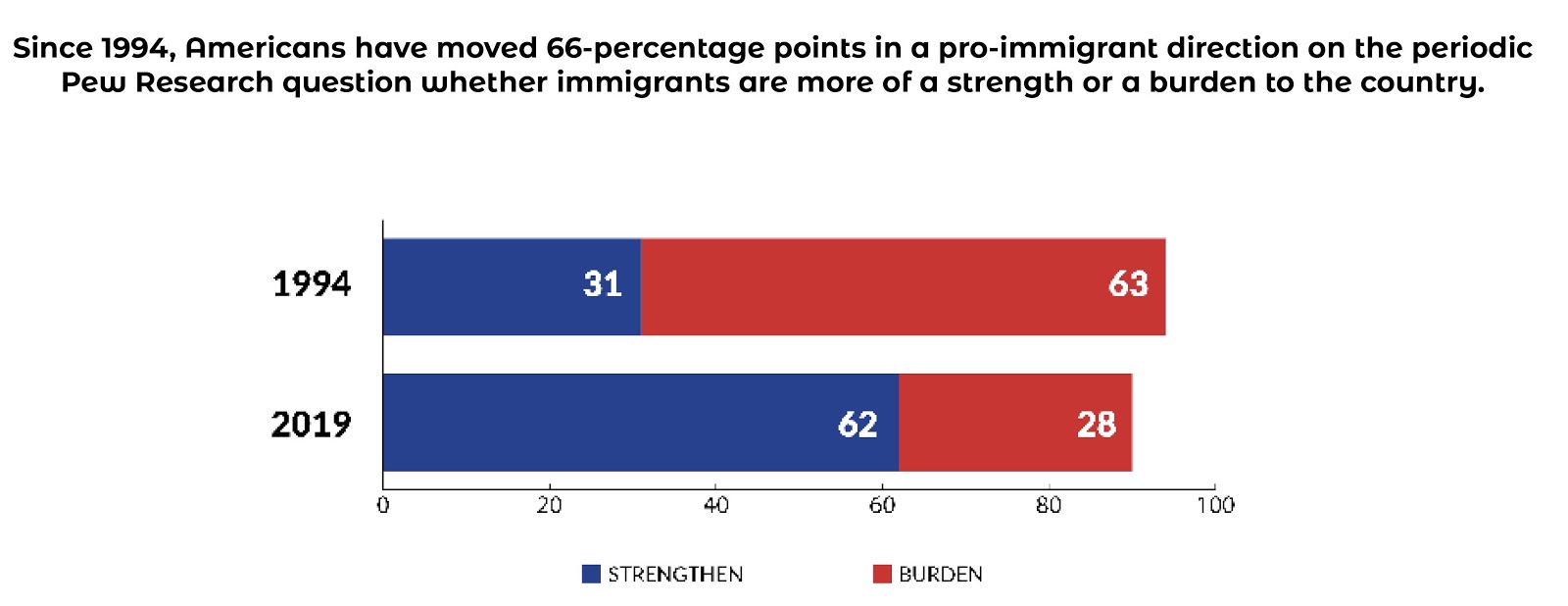

A Demographic Deep Dive How Immigration Impacts Californias Population

May 27, 2025

A Demographic Deep Dive How Immigration Impacts Californias Population

May 27, 2025 -

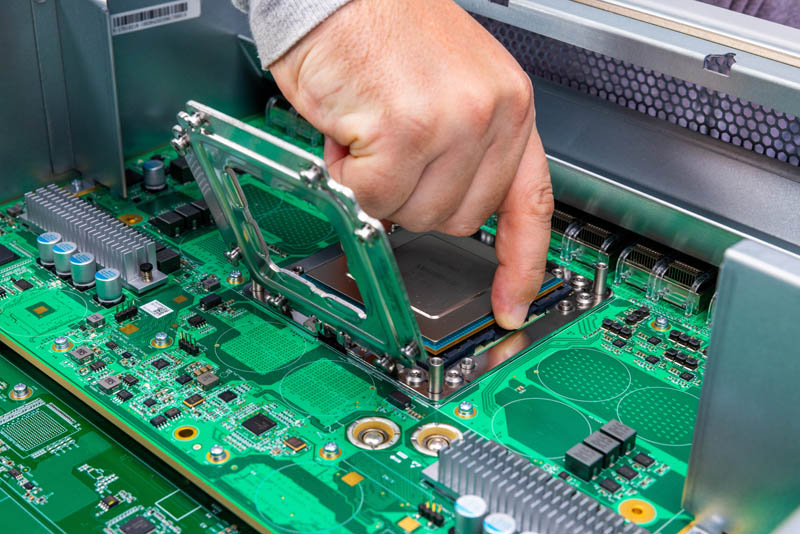

Broadcoms V Mware Acquisition At And T Reports A 1 050 Price Increase

May 27, 2025

Broadcoms V Mware Acquisition At And T Reports A 1 050 Price Increase

May 27, 2025

Latest Posts

-

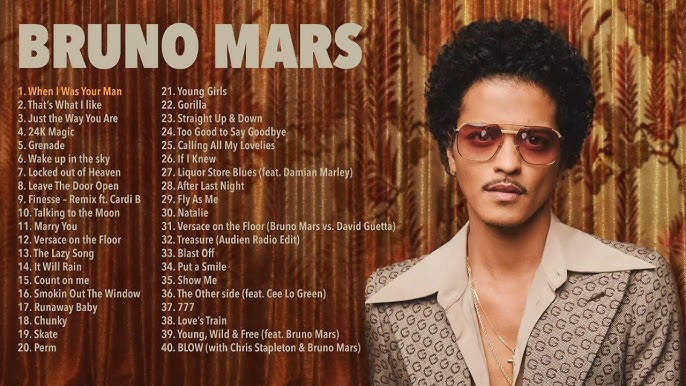

Is Miley Cyrus Hit Een Plagiaat Van Bruno Mars Rechtszaak Wordt Voortgezet

May 31, 2025

Is Miley Cyrus Hit Een Plagiaat Van Bruno Mars Rechtszaak Wordt Voortgezet

May 31, 2025 -

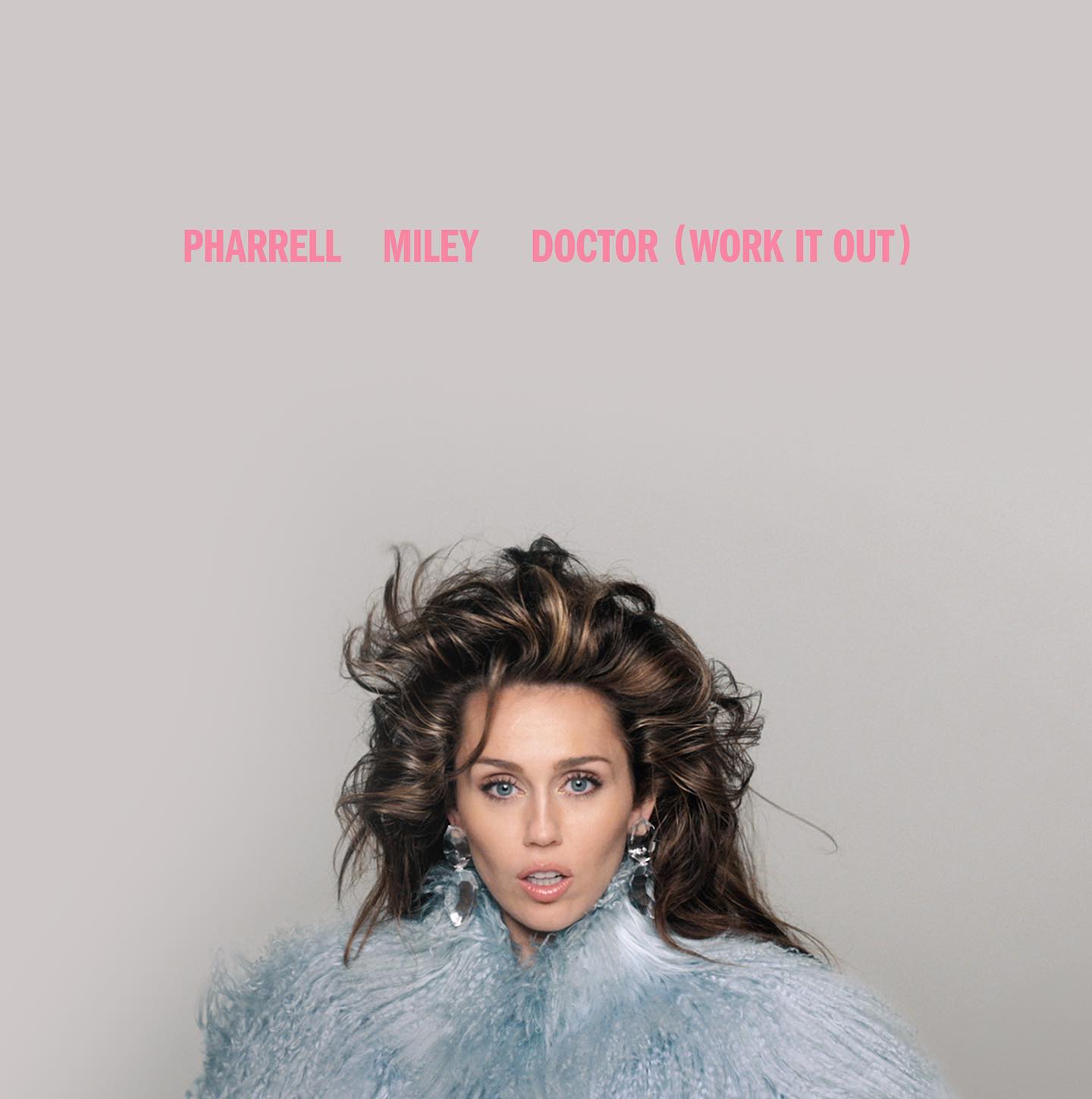

Analisis Lirik Dan Musik Video Single Baru Miley Cyrus End Of The World

May 31, 2025

Analisis Lirik Dan Musik Video Single Baru Miley Cyrus End Of The World

May 31, 2025 -

Resmi Miley Cyrus Rilis Singel Baru End Of The World

May 31, 2025

Resmi Miley Cyrus Rilis Singel Baru End Of The World

May 31, 2025 -

Donderdag Miley Cyrus Onthult Eerste Single Van Nieuw Album

May 31, 2025

Donderdag Miley Cyrus Onthult Eerste Single Van Nieuw Album

May 31, 2025 -

Miley Cyrus Plagiaatzaak Voortgezet Hit Veroordeeld Tot Gelijkend Op Bruno Mars Nummer

May 31, 2025

Miley Cyrus Plagiaatzaak Voortgezet Hit Veroordeeld Tot Gelijkend Op Bruno Mars Nummer

May 31, 2025