Maluf: Ford's Decline And BYD's Rise In Brazil's EV Market

Table of Contents

2. Ford's Struggle in the Brazilian EV Market

2.1 Declining Sales Figures and Market Share

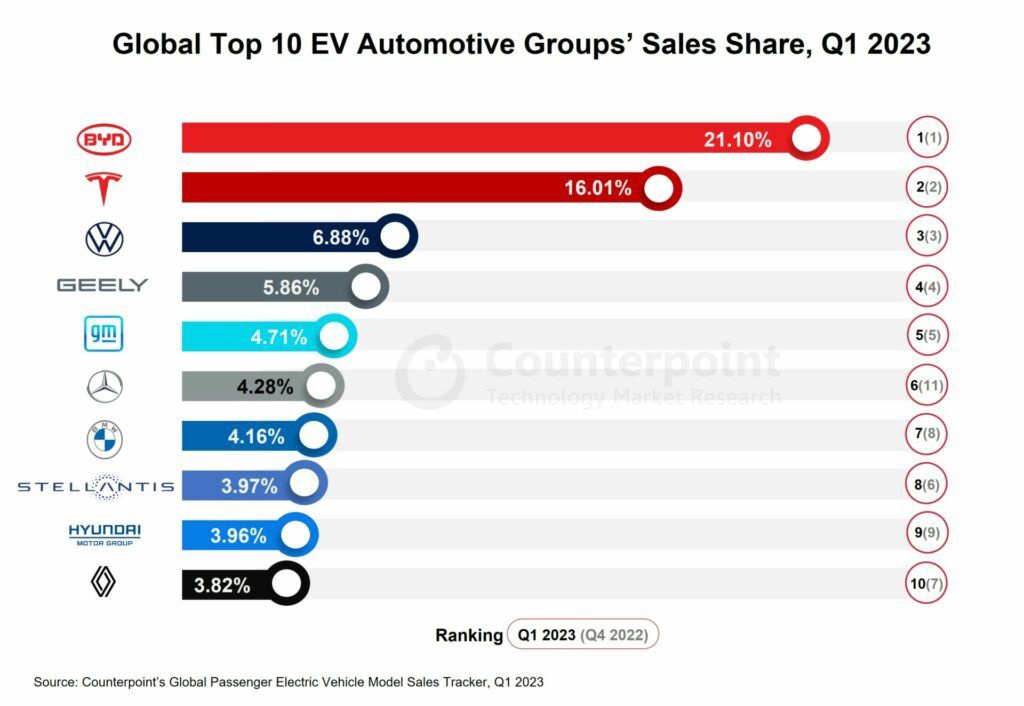

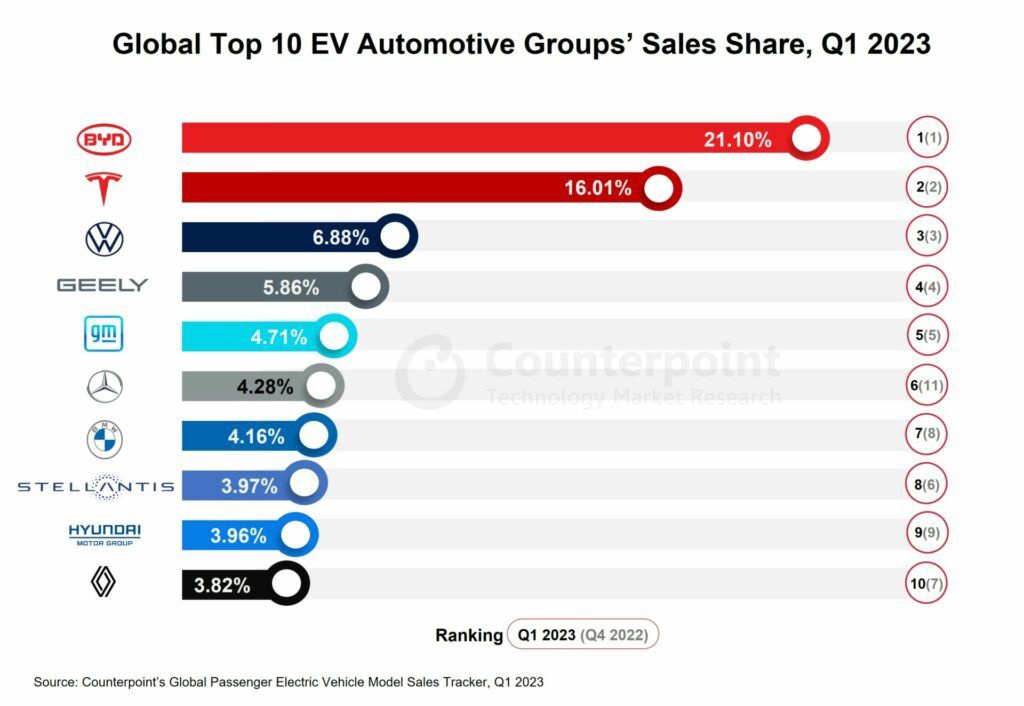

Ford's presence in the Brazilian EV market has been significantly underwhelming. Sales figures for the first half of 2024 show a drastic decrease compared to the previous year, with a reported 40% drop in EV sales. This decline is reflected in their shrinking market share, which has fallen from 5% in 2023 to a mere 2% in the first half of 2024. This sharp downturn can be visualized in the following chart:

[Insert chart/graph showing Ford's declining EV sales in Brazil]

Several factors contribute to this decline:

- Lack of Competitive Models: Ford's current EV offerings in Brazil lack the range, features, and technological advancements offered by competitors.

- High Prices: The pricing of Ford's electric vehicles remains significantly higher than comparable models from other brands, making them less accessible to the average Brazilian consumer.

- Insufficient Charging Infrastructure: The underdeveloped charging infrastructure across Brazil significantly hinders EV adoption, dissuading potential buyers.

2.2 Challenges Faced by Ford in Brazil

Ford faces numerous challenges navigating the complex Brazilian automotive market:

- Intense Competition: The Brazilian EV market is becoming increasingly competitive, with established players and new entrants vying for market share. BYD's aggressive expansion is particularly impactful.

- Supply Chain Disruptions: Global supply chain issues have impacted Ford's ability to consistently provide vehicles to the Brazilian market.

- Economic Factors: Economic instability and fluctuations in the Brazilian Real affect consumer spending, impacting demand for high-priced vehicles like EVs.

- Government Incentives (or lack thereof): While the Brazilian government has implemented some incentives for EV adoption, these are considered insufficient by many industry experts to stimulate significant growth.

2.3 Ford's EV Strategy (or lack thereof) in Brazil

Ford's EV strategy in Brazil appears to be reactive rather than proactive. The company has yet to announce any significant investments or long-term plans for expanding its EV lineup or enhancing its presence in the market. This lack of a clear, aggressive strategy contrasts sharply with the ambitious expansion plans of competitors.

2. BYD's Ascent in Brazil's EV Landscape

2.1 Rapid Growth and Market Penetration

In stark contrast to Ford, BYD has experienced phenomenal growth in Brazil. Their sales have skyrocketed in the first half of 2024, securing a commanding 30% market share. The success is largely attributed to several factors:

- Popular Models: BYD's models, such as the Tang and Han, offer compelling features including long ranges, advanced technology, and competitive pricing.

- Competitive Pricing: BYD offers EVs at a significantly lower price point than many competitors, making them more accessible to a broader range of consumers.

2.2 BYD's Strategic Advantages in Brazil

BYD's success in Brazil stems from several strategic advantages:

- Competitive Pricing: Their price-competitive strategy makes EVs more attainable for the average consumer.

- Vehicle Performance: BYD vehicles boast impressive range and performance, addressing range anxiety, a major concern for many potential EV buyers.

- Effective Marketing: BYD has effectively targeted the Brazilian market with focused marketing campaigns highlighting the benefits of their vehicles.

- Localization Strategy: BYD is reportedly considering local manufacturing in Brazil, which could significantly reduce costs and improve accessibility.

2.3 BYD's Future Plans for the Brazilian Market

BYD's ambitious plans for Brazil include expanding its model lineup, investing in charging infrastructure, and potentially establishing local manufacturing facilities. They are poised to continue their dominance in the Brazilian EV market.

2.3 The Broader Context of the Brazilian EV Market

2.1 Government Policies and Incentives

The Brazilian government's policies regarding electric vehicles are still evolving. While certain tax incentives exist, they are not as comprehensive or aggressive as those in other countries, hindering more rapid EV adoption.

2.2 Infrastructure Development

The lack of a robust charging infrastructure remains a significant barrier to widespread EV adoption in Brazil. The limited availability of charging stations, particularly outside major urban areas, discourages potential buyers.

2.3 Consumer Preferences and Attitudes

Consumer attitudes towards EVs in Brazil are shifting, but several factors remain influential: concerns about range, charging infrastructure, and purchase price. However, increasing awareness of environmental concerns and the availability of more affordable options are starting to change perceptions.

3. Conclusion: The Future of Ford and BYD in Brazil's Electrified Automotive Landscape

Ford's struggles highlight the challenges of competing in the rapidly evolving Brazilian EV market. Their lack of a clear strategy and competitive offerings have resulted in declining sales and market share. Conversely, BYD's remarkable success demonstrates the potential for agile, well-strategized newcomers to rapidly dominate. The key factors driving this market shift are competitive pricing, advanced technology, and effective marketing.

BYD's aggressive expansion plans suggest they are poised to further increase their market dominance in the coming years. Ford, however, needs to significantly revamp its strategy to remain competitive.

Stay informed about the evolving dynamics of the Brazilian EV market and the ongoing competition between established players like Ford and newcomers like BYD. Learn more about the impact of these shifts on this exciting sector.

Featured Posts

-

Nadezhdy Kadysheva Muzh Zaschischaet Syna Ot Obvineniy V Krupnom Dolge

May 13, 2025

Nadezhdy Kadysheva Muzh Zaschischaet Syna Ot Obvineniy V Krupnom Dolge

May 13, 2025 -

Tory Lanez Stabbed New Details Emerge From Prison Incident Report

May 13, 2025

Tory Lanez Stabbed New Details Emerge From Prison Incident Report

May 13, 2025 -

Kelly Graves Latest Recruit A Rising Star From Down Under

May 13, 2025

Kelly Graves Latest Recruit A Rising Star From Down Under

May 13, 2025 -

Trumps Trade War Abi Research Analyzes The Lasting Impact On Tech Tariffs

May 13, 2025

Trumps Trade War Abi Research Analyzes The Lasting Impact On Tech Tariffs

May 13, 2025 -

Gimenez Juega Ac Milan Vs Atalanta Fecha Hora Y Donde Ver

May 13, 2025

Gimenez Juega Ac Milan Vs Atalanta Fecha Hora Y Donde Ver

May 13, 2025

Latest Posts

-

Pieterburen Seal Rescue Center A 50 Year Legacy Ends With Final Seal Release

May 13, 2025

Pieterburen Seal Rescue Center A 50 Year Legacy Ends With Final Seal Release

May 13, 2025 -

Closure Of Pieterburen Seal Rescue Center 50 Years Of Service Concludes

May 13, 2025

Closure Of Pieterburen Seal Rescue Center 50 Years Of Service Concludes

May 13, 2025 -

Last Seals Released As Pieterburen Rescue Center Ends 50 Year Mission

May 13, 2025

Last Seals Released As Pieterburen Rescue Center Ends 50 Year Mission

May 13, 2025 -

Pieterburen Seal Center Closes Final Seals Released After 50 Years

May 13, 2025

Pieterburen Seal Center Closes Final Seals Released After 50 Years

May 13, 2025 -

Recent Developments Partynextdoor Apologizes To Tory Lanez

May 13, 2025

Recent Developments Partynextdoor Apologizes To Tory Lanez

May 13, 2025