Marc Fiorentino : Déconstruire La Carte Blanche

Table of Contents

L'approche "Carte Blanche" de Marc Fiorentino : Une rupture avec les méthodes traditionnelles.

Marc Fiorentino's "Carte Blanche" philosophy represents a significant departure from traditional asset management methodologies. Instead of adhering to established benchmarks or passively tracking market indices, his approach prioritizes a deep, fundamental analysis of individual assets, seeking out opportunities that others may overlook. This active, bottom-up strategy prioritizes long-term value creation over short-term gains.

This revolutionary approach is characterized by:

- Focus on identifying undervalued assets: Fiorentino's team meticulously researches companies and assets, focusing on intrinsic value rather than market sentiment. This involves extensive due diligence and a critical evaluation of financial statements.

- Emphasis on fundamental analysis and long-term vision: Unlike many strategies focused on short-term market fluctuations, "Carte Blanche" prioritizes a long-term investment horizon. This allows for a more patient approach to value creation and reduces the impact of short-term market volatility.

- Flexibility and adaptability to changing market conditions: The strategy isn't static; it adapts to evolving economic landscapes and market dynamics. This agility is crucial for navigating unexpected events and capitalizing on emerging opportunities.

- Diversification across various asset classes: "Carte Blanche" employs a diversified portfolio approach, strategically allocating capital across different asset classes to mitigate risk and enhance overall returns. This diversification may include equities, fixed income, and alternative investments.

Déconstruire les biais cognitifs en investissement : Le rôle de l'analyse critique.

A key element of Fiorentino's success lies in his conscious effort to deconstruct common cognitive biases that often plague investors. His approach emphasizes objective analysis and rigorous risk management, mitigating the impact of emotional decision-making and herd behavior.

The strategy actively addresses:

- Identifying and mitigating herd behavior: By avoiding the tendency to follow the crowd, Fiorentino's approach identifies opportunities often missed in the rush to chase popular investments. Independent research is paramount.

- Overcoming emotional decision-making: The strategy employs a disciplined approach to decision-making, prioritizing data-driven analysis over emotional impulses. This reduces the risk of panic selling or impulsive buying.

- The application of rigorous due diligence: A thorough, independent investigation of each investment opportunity is crucial. This involves scrutinizing financial statements, conducting management interviews, and assessing market conditions.

- Importance of independent thinking and research: The "Carte Blanche" philosophy fosters independent thought and encourages challenging conventional market wisdom. This critical approach is essential for identifying undervalued opportunities and mitigating risk.

Stratégie d'investissement "Carte Blanche" : Performance et gestion du risque.

While specific performance data may not be publicly available due to confidentiality agreements with investors, the strategy aims for consistent, long-term growth by focusing on risk-adjusted returns. Transparency in reporting to investors is a priority where permissible.

Key aspects of risk management include:

- Transparency in reporting performance data: To the extent permitted by client agreements, regular and transparent reporting provides investors with a clear understanding of their portfolio's performance.

- Emphasis on downside protection: Strategies are implemented to protect capital from significant losses, ensuring that the portfolio can withstand periods of market volatility.

- Adapting the strategy based on market volatility: The dynamic nature of the strategy allows for adjustments based on market conditions, enhancing resilience during periods of uncertainty.

- Long-term perspective for sustainable growth: The emphasis on long-term value creation facilitates sustained growth, allowing the portfolio to weather short-term market fluctuations.

Accès à la stratégie "Carte Blanche" : Options pour les investisseurs.

Access to Fiorentino's "Carte Blanche" strategy may be subject to certain eligibility criteria and minimum investment requirements. Direct access might be limited to high-net-worth individuals or institutional investors.

Potential options for investors include:

- Potential limitations and eligibility criteria: Specific requirements, such as minimum investment amounts or accreditation status, might apply.

- Information on minimum investment amounts: Details regarding minimum investment thresholds would be determined on a case-by-case basis.

- Alternatives for investors with smaller portfolios: While direct access may be limited, investors with smaller portfolios might explore alternative investment vehicles that utilize similar strategies.

- Resources for further research: More information may be found through researching reputable financial news sources or consulting a qualified financial advisor.

Conclusion:

Marc Fiorentino's "Carte Blanche" represents a significant departure from traditional asset management. By déconstruire la carte blanche of conventional wisdom and employing a rigorous, critical approach, he has developed a strategy focused on identifying undervalued assets and managing risk effectively. His emphasis on fundamental analysis, a long-term perspective, and independent thinking provides a compelling alternative for investors seeking superior performance.

Call to Action: Learn more about Marc Fiorentino's revolutionary "Carte Blanche" approach and discover how this innovative strategy could reshape your investment portfolio. Explore the resources available to understand the principles of déconstruire la carte blanche and make informed investment decisions. Contact a financial advisor to discuss investment strategies aligned with your personal financial goals.

Featured Posts

-

Pazartesi Dizileri 17 Subat Tv Programi

Apr 23, 2025

Pazartesi Dizileri 17 Subat Tv Programi

Apr 23, 2025 -

Winning Formula Revealed How The Yankees Beat The Brewers On Opening Day

Apr 23, 2025

Winning Formula Revealed How The Yankees Beat The Brewers On Opening Day

Apr 23, 2025 -

High Winds Fuel Power Outages Across Lehigh Valley

Apr 23, 2025

High Winds Fuel Power Outages Across Lehigh Valley

Apr 23, 2025 -

Elections Legislatives Allemandes J 6 Tout Ce Qu Il Faut Savoir

Apr 23, 2025

Elections Legislatives Allemandes J 6 Tout Ce Qu Il Faut Savoir

Apr 23, 2025 -

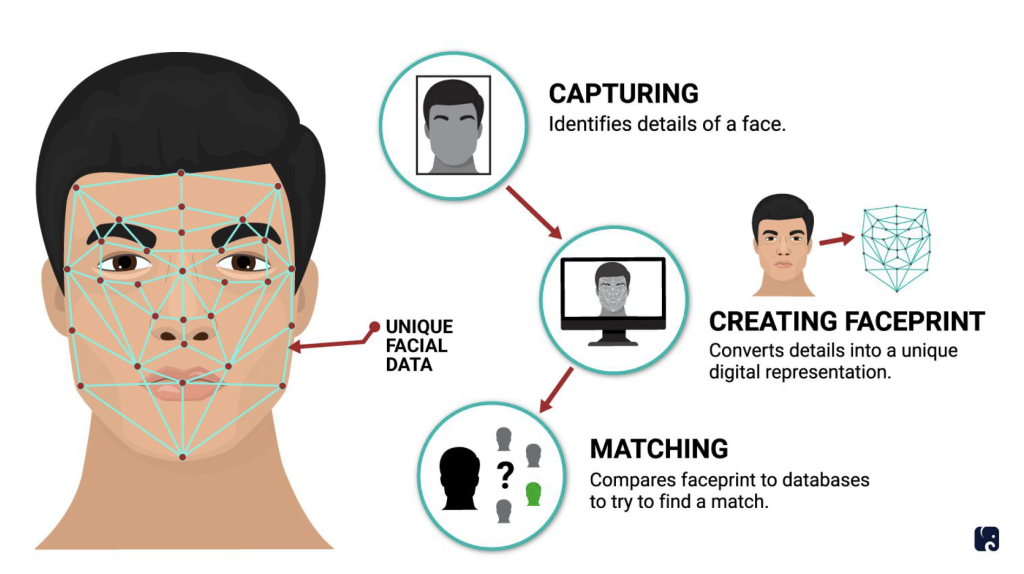

Target Fields Go Ahead Entry System How Facial Recognition Works

Apr 23, 2025

Target Fields Go Ahead Entry System How Facial Recognition Works

Apr 23, 2025

Latest Posts

-

Nyt Crossword Strands April 6th 2025 Hints And Answers

May 10, 2025

Nyt Crossword Strands April 6th 2025 Hints And Answers

May 10, 2025 -

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 10, 2025

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 10, 2025 -

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025 -

February 15th Nyt Strands Answers Game 349

May 10, 2025

February 15th Nyt Strands Answers Game 349

May 10, 2025 -

Nyt Strands Game 349 Hints And Solutions For February 15th

May 10, 2025

Nyt Strands Game 349 Hints And Solutions For February 15th

May 10, 2025