Market Analysis: Unraveling The Reasons For D-Wave Quantum (QBTS)'s Monday Crash

Table of Contents

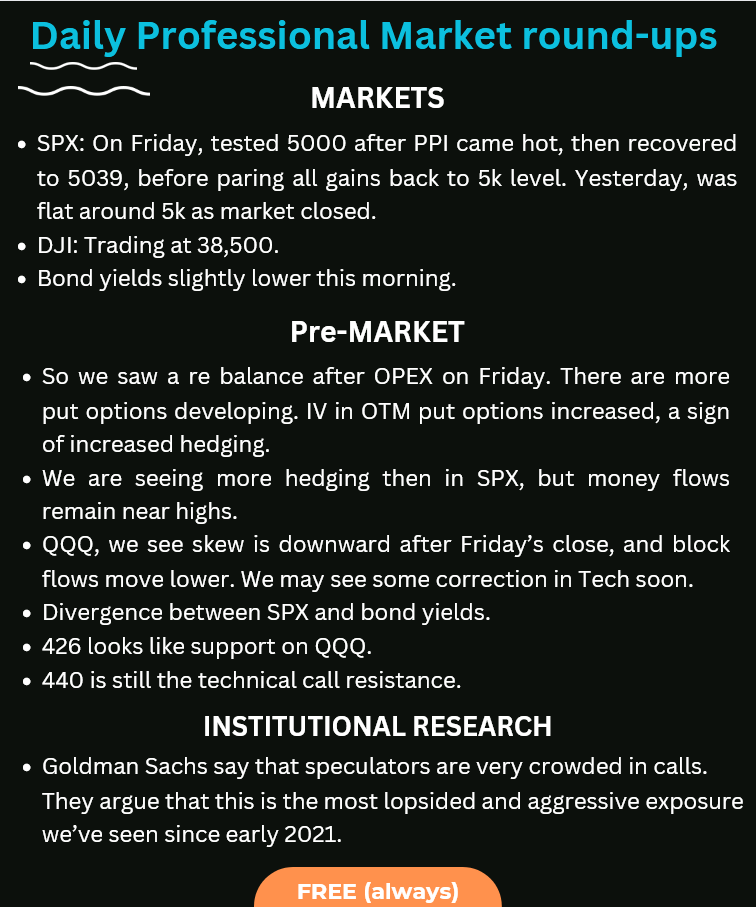

Broader Market Downturn and Tech Sector Weakness

The Monday crash in QBTS wasn't an isolated event; it occurred within the context of a broader market downturn and weakness in the technology sector. Understanding this macroeconomic context is crucial to fully analyzing the D-Wave Quantum stock price drop.

Overall Market Sentiment

The overall market sentiment on Monday was decidedly negative. Several factors contributed to this pessimism.

- Major Market Indices Decline: The NASDAQ Composite and the S&P 500, key indicators of overall market health, experienced significant declines on Monday, reflecting a widespread sell-off across various sectors. This general negative trend undoubtedly impacted QBTS, a company operating within the volatile technology sector.

- Tech Sector Headwinds: Negative news affecting the broader technology sector, such as concerns about rising interest rates, potential regulatory changes, or disappointing earnings reports from other tech giants, created a ripple effect, impacting investor confidence across the board, including in quantum computing stocks like QBTS.

Investor Risk Aversion

Amidst market uncertainty, investors often become more risk-averse. This shift in sentiment can lead to selling even relatively stable stocks.

- Increased Volatility: The increased volatility in the market on Monday encouraged many investors to reduce their exposure to riskier assets, contributing to the sell-off in QBTS.

- Flight to Safety: Investors often seek safer investments during periods of uncertainty. This "flight to safety" often involves moving funds into less volatile assets like government bonds, further increasing selling pressure on stocks like QBTS.

Specific Factors Impacting D-Wave Quantum (QBTS)

While the broader market certainly played a role, several factors specific to D-Wave Quantum likely exacerbated the stock price decline.

Lack of Recent Positive News or Catalysts

The absence of positive news or significant catalysts for D-Wave Quantum could have contributed to the sell-off.

- Missed Earnings Expectations: Any potential shortfall in meeting earnings expectations or slower-than-anticipated revenue growth could have disappointed investors, triggering selling pressure.

- Project Delays & Partnership Absence: Delays in project timelines or a lack of major partnerships and contract wins could have fueled negative sentiment among investors already wary of the broader market conditions. The absence of compelling positive news amplified the negative impact of the overall market downturn.

Competition within the Quantum Computing Industry

The quantum computing industry is highly competitive, and advancements by competitors can impact D-Wave's market position and investor sentiment.

- Competitor Advancements: Significant breakthroughs or announcements from competing quantum computing companies could have shifted investor focus and capital away from D-Wave Quantum, contributing to the stock price decline.

- Disruptive Technologies: The emergence of disruptive technologies from competitors poses a real threat to D-Wave's market share, creating uncertainty and potentially influencing investor decisions.

Analyst Ratings and Price Target Adjustments

Changes in analyst ratings and price targets can significantly impact a company's stock valuation and trading volume.

- Downgrades and Price Target Reductions: Any downgrades from influential financial analyst firms or reductions in price targets could have triggered a wave of selling by investors following the analysts' recommendations.

- Negative Sentiment Amplification: Negative analyst reports can amplify existing market concerns, leading to increased selling pressure and further downward pressure on the stock price.

Technical Analysis of QBTS Stock Chart

A technical analysis of the QBTS stock chart on Monday provides further insights into the magnitude and nature of the sell-off.

Trading Volume and Price Action

Analyzing the trading volume on Monday compared to previous days reveals the intensity of the sell-off.

- High Trading Volume: A significantly higher trading volume on Monday compared to previous days indicates a large number of investors actively selling their QBTS shares, contributing to the sharp price drop.

- Technical Indicators: Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) could indicate oversold conditions, suggesting a potential bounce-back, but also confirming the significant downward pressure. A break below a key support level could also be observed on the chart.

Potential for Short-Selling or Programmatic Trading

The involvement of short-selling and algorithmic trading could have amplified the downward pressure on QBTS.

- Short-Selling Impact: Short-selling, where investors bet against a stock's price, can exacerbate downward pressure, especially during periods of heightened volatility.

- Algorithmic Trading Influence: Algorithmic trading, using computer programs to execute trades, can amplify market fluctuations and contribute to rapid price movements, potentially magnifying the impact of negative news.

Conclusion

The Monday crash in D-Wave Quantum (QBTS) stock price was a multifaceted event. While the broader market downturn and tech sector weakness created a negative backdrop, specific factors related to D-Wave Quantum, including the lack of positive news, intense competition, and potentially negative analyst sentiment, significantly contributed to the sell-off. Further investigation is needed to determine the precise weight of each contributing factor. For investors interested in the quantum computing market and D-Wave Quantum (QBTS), careful monitoring of these factors and the broader market conditions is crucial for making informed investment decisions. Continue to monitor the D-Wave Quantum (QBTS) situation and the broader quantum computing market for further insights into future price movements and investment opportunities.

Featured Posts

-

Gaite Lyrique Evacuation Des Salaries Et Demande D Intervention De La Mairie De Paris

May 20, 2025

Gaite Lyrique Evacuation Des Salaries Et Demande D Intervention De La Mairie De Paris

May 20, 2025 -

Tragedy On Railroad Bridge Two Adults Killed Children Affected

May 20, 2025

Tragedy On Railroad Bridge Two Adults Killed Children Affected

May 20, 2025 -

Le Msc Diletta Un Geant Maritime Ancre Au Port D Abidjan Cote D Ivoire

May 20, 2025

Le Msc Diletta Un Geant Maritime Ancre Au Port D Abidjan Cote D Ivoire

May 20, 2025 -

Zvezda Golodnykh Igr Dzhennifer Lourens Podtverzhdena Informatsiya O Rozhdenii Vtorogo Rebenka

May 20, 2025

Zvezda Golodnykh Igr Dzhennifer Lourens Podtverzhdena Informatsiya O Rozhdenii Vtorogo Rebenka

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Surge On Friday Reasons Behind The Rise

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge On Friday Reasons Behind The Rise

May 20, 2025

Latest Posts

-

Jalkapalloilijat Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025

Jalkapalloilijat Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025 -

Kaellman Ja Hoskonen Puolalainen Seuran Vaihtuu

May 20, 2025

Kaellman Ja Hoskonen Puolalainen Seuran Vaihtuu

May 20, 2025 -

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025 -

Kaellmanin Ja Hoskosen Puola Seuraura Paeaettyi

May 20, 2025

Kaellmanin Ja Hoskosen Puola Seuraura Paeaettyi

May 20, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotiin

May 20, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotiin

May 20, 2025