Market Rally: S&P 500 Up More Than 3% After Trade Truce

Table of Contents

Understanding the Trade Truce and its Impact on Market Sentiment

The recent trade truce, while still needing formal ratification, significantly eased tensions between key global players. Details of the agreement included [Insert specific details of the trade truce here, e.g., a temporary suspension of tariffs on certain goods, commitments to further negotiations, etc.]. This alleviation of trade war anxieties had an immediate and positive effect on investor confidence. The prolonged period of uncertainty surrounding tariffs and trade disputes had created considerable market volatility, impacting investment decisions and overall market sentiment. This truce effectively reduced this uncertainty, injecting a much-needed dose of optimism into the market.

- Specific examples of tariff reductions or delays: [List specific examples, e.g., "The 25% tariff on steel imports was temporarily suspended," or "Negotiations are underway to reduce tariffs on agricultural products by X%."]

- Statements from key political figures: [Quote relevant statements from political leaders involved in the agreement, highlighting the positive sentiment expressed.]

- Quantify the reduction in uncertainty: [Provide data or estimates, if available, on the reduction in uncertainty. For example: "Analysts estimate the trade truce reduced uncertainty by approximately 15%, based on [Source]."]

S&P 500 Performance Analysis: Key Sectors Driving the Rally

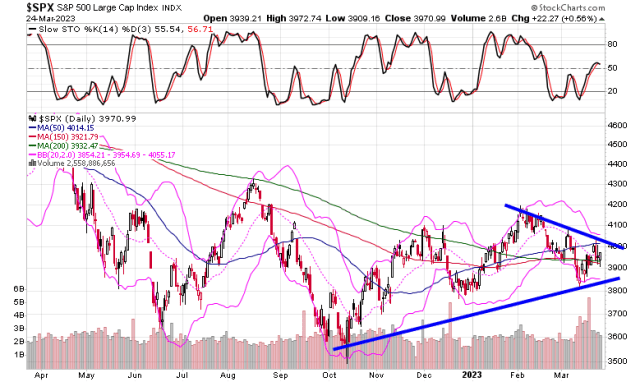

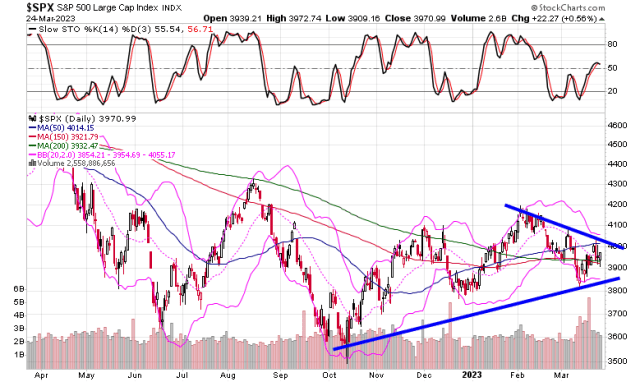

The S&P 500 jumped 3.1% following the announcement of the trade truce, representing a significant market rally. This wasn't a uniform increase across all sectors, however. Certain sectors experienced disproportionately larger gains, reflecting investor confidence in specific areas of the economy. Technology and financial stocks, for example, saw particularly strong performance.

- Percentage increase in key sectors: [Provide specific percentages for key sectors, e.g., "The technology sector saw a 4.2% increase, while the financial sector gained 3.8%."]

- Mention specific companies that saw significant gains: [List examples of companies with significant stock price increases, citing percentages.]

- Charts/graphs showing S&P 500 performance: [Include relevant charts and graphs visually representing the S&P 500's performance during this period. This could be a line graph showing the index's movement or a bar chart comparing sector performance.]

Long-Term Implications and Future Market Outlook After the Rally

While the current market rally is encouraging, its sustainability remains a key question. The positive impact of the trade truce could be short-lived if unforeseen challenges emerge. Geopolitical instability, economic slowdowns in key regions, or unexpected shifts in global trade policy could all impact the market's trajectory.

- Potential threats to the sustained rally: [List potential risks, such as escalating geopolitical tensions, unexpected economic data releases, or renewed trade disputes.]

- Expert opinions and predictions for the future: [Include opinions and forecasts from reputable financial analysts and economists on the future outlook for the S&P 500.]

- Suggestions for investors based on the outlook: [Offer cautious advice for investors, considering the potential risks and rewards.]

Strategies for Navigating the Post-Rally Market

The current market environment requires a thoughtful and strategic approach to investing. Diversification remains crucial in mitigating risk. Investors should consider a balanced portfolio that incorporates a variety of asset classes, including stocks, bonds, and potentially alternative investments. The choice of investment strategy – value investing, growth investing, or a blend of both – depends on individual risk tolerance and financial goals.

- Specific examples of diversification: [Provide concrete examples of diversified portfolios, emphasizing the importance of asset allocation.]

- Tips for managing risk in a volatile market: [Offer practical risk management tips, such as setting stop-loss orders or dollar-cost averaging.]

- Recommendations for different investor profiles: [Tailor recommendations based on investor risk tolerance (e.g., conservative, moderate, aggressive).]

Conclusion: Capitalizing on the Market Rally: S&P 500's Future Potential

The recent market rally, driven by a significant trade truce, has resulted in a substantial increase in the S&P 500 index. While this presents opportunities, it's crucial to acknowledge the inherent risks and uncertainties that remain. Understanding the long-term implications of this market rally requires careful consideration of geopolitical factors and economic indicators. To effectively navigate the post-rally market and make informed investment decisions, consider consulting with financial advisors and staying abreast of market analysis. Understand the nuances of this market rally and plan your investment strategy accordingly. Learn more about navigating market fluctuations and maximizing your returns during times of S&P 500 growth.

Featured Posts

-

Leonardo Di Caprio Nevjerojatna Transformacija Slobodna Dalmacija

May 13, 2025

Leonardo Di Caprio Nevjerojatna Transformacija Slobodna Dalmacija

May 13, 2025 -

Search For Edan Alexander International Efforts And Calls For Release

May 13, 2025

Search For Edan Alexander International Efforts And Calls For Release

May 13, 2025 -

Accord Post Brexit Gibraltar Les Dernieres Nouvelles

May 13, 2025

Accord Post Brexit Gibraltar Les Dernieres Nouvelles

May 13, 2025 -

Mlb Prop Bets Today Focus On Home Runs April 26th Edition

May 13, 2025

Mlb Prop Bets Today Focus On Home Runs April 26th Edition

May 13, 2025 -

Rome Open Sabalenka And Gauff Prevent Upsets Advance To Next Round

May 13, 2025

Rome Open Sabalenka And Gauff Prevent Upsets Advance To Next Round

May 13, 2025

Latest Posts

-

The Ukraine Conflict Examining Trumps Impact On United States And European Policy Towards Russia

May 14, 2025

The Ukraine Conflict Examining Trumps Impact On United States And European Policy Towards Russia

May 14, 2025 -

Shifting Sands Trumps Influence On The Ukraine Conflict And Western Pressure On Russia

May 14, 2025

Shifting Sands Trumps Influence On The Ukraine Conflict And Western Pressure On Russia

May 14, 2025 -

Ukraine Crisis How Trump Altered The Us Europe Response To Russia

May 14, 2025

Ukraine Crisis How Trump Altered The Us Europe Response To Russia

May 14, 2025 -

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

May 14, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

May 14, 2025