Market Rally Shakes Up Palantir Stock: New Analyst Forecasts

Table of Contents

Recent Market Rally's Impact on Palantir Stock Price

The recent market upswing has had a significant, albeit complex, impact on Palantir stock price (PLTR Stock Price). While the broader market experienced a period of growth, Palantir's performance has been more nuanced, reflecting the specific factors impacting the company. Analyzing Palantir stock performance within the context of this rally requires a deeper look at its volatility compared to other technology stocks and the overall market trends.

-

Percentage Change: During the recent rally, Palantir's stock price saw a [insert percentage increase/decrease here] change. This needs to be updated with current data. This fluctuation reflects the inherent volatility of the technology sector and investor sentiment towards Palantir's future prospects.

-

Benchmark Comparison: Comparing Palantir's performance to industry benchmarks like the Nasdaq Composite reveals [insert comparative data here—e.g., whether it outperformed or underperformed and by how much]. This comparison provides context and helps determine whether Palantir's movement was unique or a reflection of broader market trends.

-

Trading Volume: The trading volume for PLTR during this period [insert data here—e.g., increased, decreased, remained stable]. High trading volume often indicates increased investor interest and activity, suggesting either strong buying or selling pressure depending on the price movement. Charts and graphs would visualize this data effectively. [Insert chart/graph here].

Divergent Analyst Forecasts: Bullish vs. Bearish Predictions

Analyst forecasts for Palantir (PLTR Stock) are currently quite diverse, ranging from bullish to bearish predictions, showcasing significant disagreement regarding the company's future trajectory. Understanding these divergent views is crucial for investors formulating their investment strategies. The Buy Sell Hold Palantir ratings from various firms vary significantly.

-

Prominent Forecasts: [Name financial institution 1] has issued a [Buy/Sell/Hold] rating with a price target of $[price]. Their rationale emphasizes [reasoning, e.g., strong revenue growth potential]. Conversely, [Name financial institution 2] issued a [Buy/Sell/Hold] rating with a target of $[price], highlighting concerns about [reasoning, e.g., intense competition in the data analytics market].

-

Price Target Discrepancy: The range of price targets set by analysts underscores the uncertainty surrounding Palantir's future valuation. This wide range reflects the differing perspectives on the company's ability to execute its strategy and capitalize on market opportunities.

-

Underlying Factors: The disparity in predictions stems from differing assessments of key factors such as Palantir's revenue growth, the success of its government contracts, the intensity of competition, and its ability to penetrate the commercial market effectively.

Factors Influencing Palantir's Stock Performance

Several factors significantly influence Palantir's stock performance (Palantir Stock Performance). Understanding these interwoven elements provides a clearer picture of the company's prospects.

-

Financial Performance: Palantir's recent financial reports reveal [insert key data points from recent reports, e.g., revenue growth, profitability, operating expenses]. This information is vital for assessing the company's financial health and future sustainability.

-

Government Contracts: Government contracts represent a substantial portion of Palantir's revenue. The securing of new contracts, or delays/losses in existing bids, directly impacts investor confidence and the PLTR stock price. Analysis of the pipeline of future government contracts is crucial.

-

Competition in Data Analytics: The data analytics market is highly competitive. Palantir faces competition from established players and emerging startups. The company's ability to differentiate itself through innovation and strategic partnerships is key to its success.

-

Commercial Sales: Palantir's expansion into the commercial sector is pivotal for long-term growth. Its success in attracting and retaining commercial clients will heavily influence its stock valuation.

Long-Term Outlook for Palantir Stock

Considering current analyst forecasts and market trends, the long-term outlook for Palantir stock (Palantir Long Term Investment) is characterized by both significant potential and considerable risk.

-

Growth Prospects: The consensus view suggests [insert summary of long-term growth projections – optimistic, cautious, etc.]. This projection hinges on several factors, including the successful execution of its growth strategy and its ability to maintain its competitive edge.

-

Potential Risks: Significant risks include increased competition from established tech giants, potential economic slowdowns impacting government spending, and the challenges of scaling its operations efficiently.

-

Investment Advice: Investors should carefully evaluate their risk tolerance before investing in Palantir stock. The high volatility associated with the company's stock necessitates a long-term perspective and a thorough understanding of the risks involved. Palantir Stock Forecast 2024 and beyond will largely depend on these risk factors.

Conclusion

The recent market rally has introduced volatility to Palantir stock, with analysts providing diverse forecasts. Understanding the factors influencing Palantir’s performance, both positive and negative, is essential for informed investment decisions. The long-term outlook remains complex and requires a careful assessment of risks and rewards. The Palantir investment potential is considerable, but only for investors comfortable with this inherent uncertainty.

Call to Action: Stay informed about the latest news concerning Palantir stock and the evolving analyst forecasts to navigate the intricacies of this dynamic market. Continue researching Palantir stock and its performance to make well-informed decisions for your investment portfolio.

Featured Posts

-

Nhls Leading Goal Scorer Leon Draisaitl Injured Status Unknown

May 10, 2025

Nhls Leading Goal Scorer Leon Draisaitl Injured Status Unknown

May 10, 2025 -

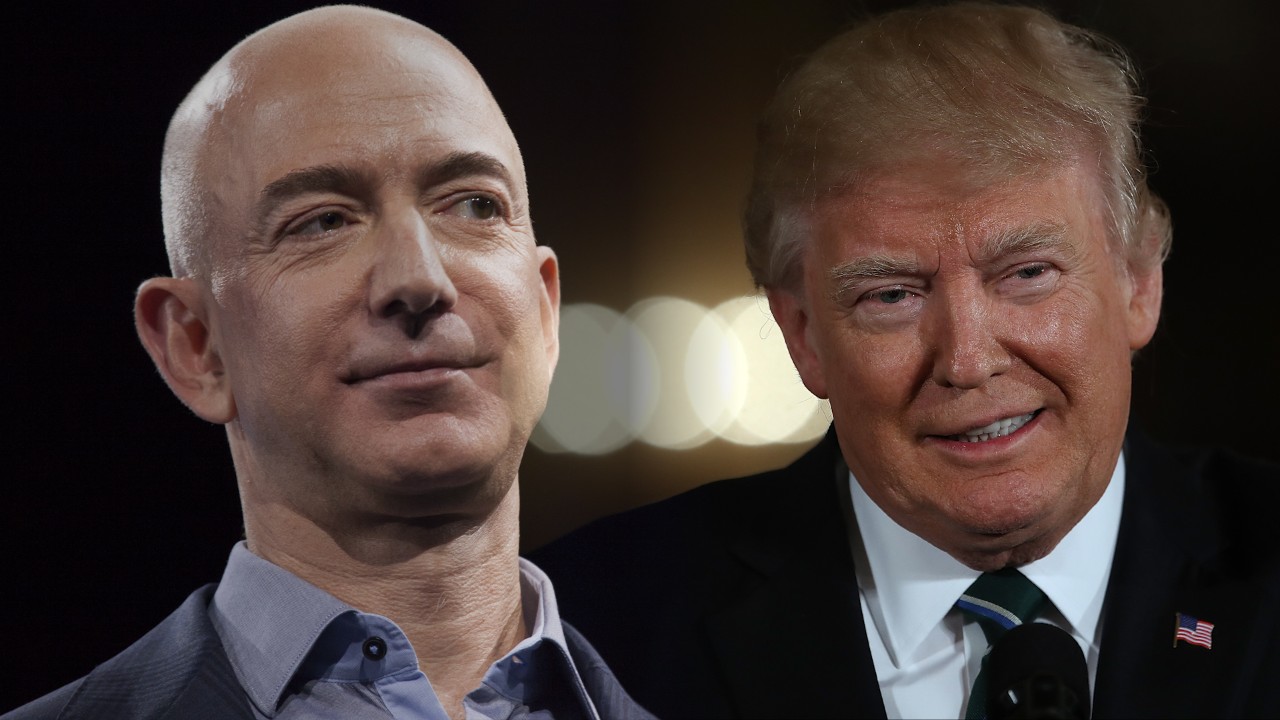

How Trumps Presidency Affected The Fortunes Of Musk Bezos And Zuckerberg

May 10, 2025

How Trumps Presidency Affected The Fortunes Of Musk Bezos And Zuckerberg

May 10, 2025 -

Bert Kreischer And His Wife Navigating The Comedy Of Sex Jokes On Netflix

May 10, 2025

Bert Kreischer And His Wife Navigating The Comedy Of Sex Jokes On Netflix

May 10, 2025 -

Uk Visa Restrictions Report Highlights Potential Nationality Limits

May 10, 2025

Uk Visa Restrictions Report Highlights Potential Nationality Limits

May 10, 2025 -

Uk Citys Caravan Invasion Is It Turning Into A Ghetto

May 10, 2025

Uk Citys Caravan Invasion Is It Turning Into A Ghetto

May 10, 2025