Market Update: Shopify Stock's Reaction To Nasdaq 100 Listing

Table of Contents

Pre-Listing Sentiment and Expectations

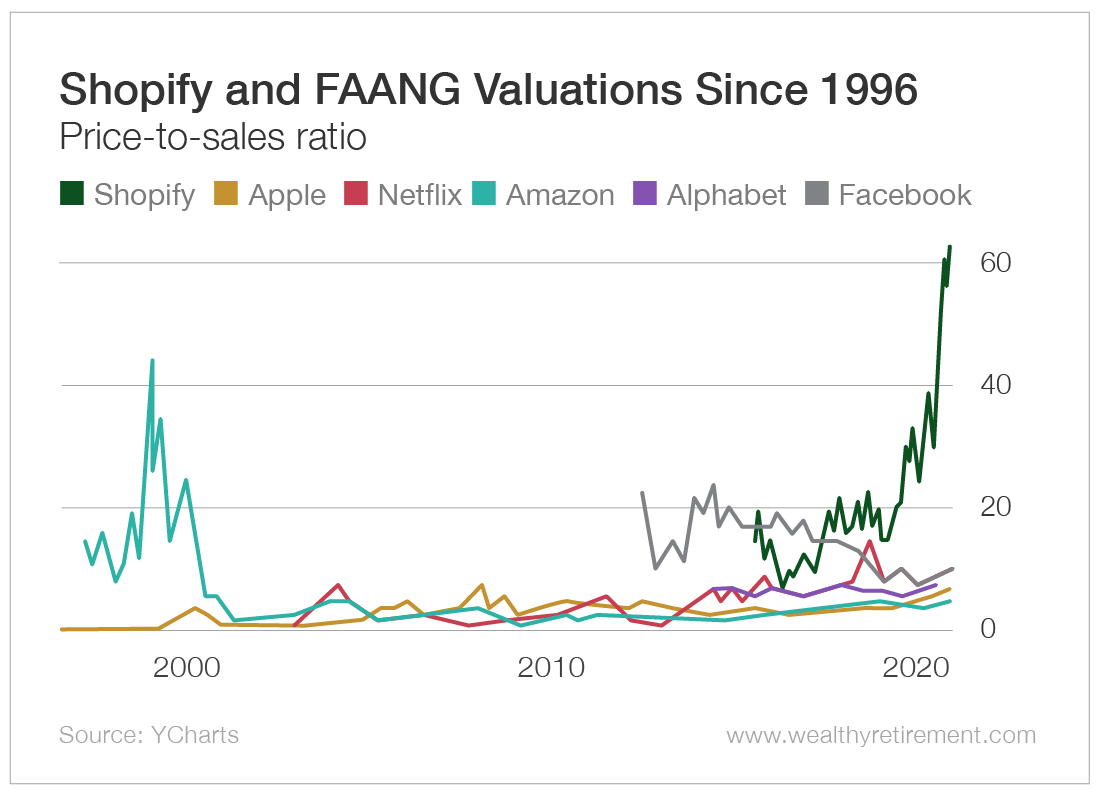

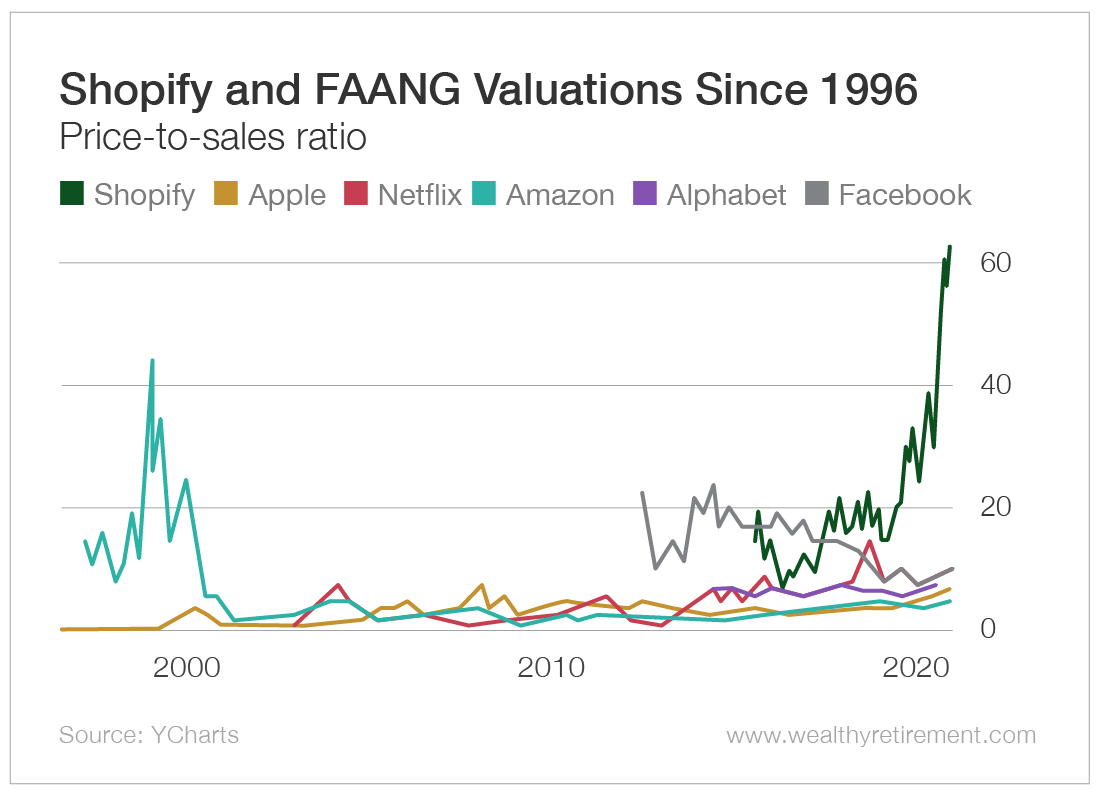

Before its inclusion in the Nasdaq 100, investor sentiment towards Shopify was generally positive, although tempered by broader market uncertainties. Analysts had varying price targets, reflecting differing opinions on Shopify's growth trajectory and the potential impact of increased competition. The overall expectation, however, leaned towards a positive reaction to the Nasdaq 100 listing, considering the index's prestige and the increased exposure it offers.

- Significant News: Prior to the listing, Shopify released strong quarterly earnings reports demonstrating robust revenue growth, despite some headwinds in the broader economy. This positive financial performance significantly influenced investor sentiment.

- Key Financial Indicators: Consistent revenue growth, improving margins, and a strong expansion into new markets all contributed to a positive outlook for Shopify before its Nasdaq 100 inclusion.

- Market Outlook: The e-commerce sector remained a significant area of growth, reinforcing the belief in Shopify's long-term potential. The company's strong market position, innovative platform, and expanding merchant base further solidified investor confidence.

Immediate Market Reaction to the Nasdaq 100 Listing

The announcement of Shopify's inclusion in the Nasdaq 100 was met with an immediate positive market reaction. The stock price experienced a noticeable jump in the hours following the announcement, showcasing the market's confidence in the company. Trading volume also surged, reflecting increased investor activity.

- Specific Data Points: While precise figures vary depending on the exact timing and data source, many reports indicated a percentage increase in Shopify's stock price on the day of the announcement, with trading volume significantly exceeding the average daily volume.

- Unusual Trading Patterns: No unusual trading patterns were widely reported, suggesting a largely organic market response driven by the positive news.

- Shopify Statements: Shopify's official statements regarding the Nasdaq 100 listing were positive and reinforced the company's commitment to long-term growth.

Short-Term Price Fluctuations (Post-Listing)

In the days and weeks after the Nasdaq 100 listing, Shopify's stock price experienced some short-term volatility, typical of the market’s dynamic nature. These fluctuations were influenced by a combination of factors, including overall market trends and specific news related to Shopify and the broader e-commerce landscape.

- Price Trends: (Insert a chart here showing Shopify's stock price performance over a period of, say, one month after the Nasdaq 100 listing. Clearly label the chart and axes.)

- Significant News Events: Any major news impacting Shopify or the e-commerce sector during this period (e.g., changes in interest rates, competitor actions, regulatory updates) would have affected the price fluctuations.

- Correlation with Nasdaq 100: Analyzing the correlation between Shopify’s stock price movement and the overall performance of the Nasdaq 100 index is essential to understanding the impact of the listing.

Long-Term Implications for Shopify Stock

The long-term implications of Shopify's inclusion in the Nasdaq 100 are significant. The increased visibility and access to a broader range of investors are expected to boost trading volume and liquidity. This may, in turn, lead to a more efficient and stable price discovery mechanism. Furthermore, the inclusion reinforces Shopify's brand image and enhances its reputation within the financial community.

- Increased Trading Volume and Liquidity: Being part of the Nasdaq 100 is expected to attract more institutional investors, leading to higher trading volume and greater liquidity.

- Impact on Visibility and Brand Perception: Inclusion in the Nasdaq 100 significantly improves Shopify's profile, attracting the attention of a wider investor base and strengthening its brand perception.

- Long-Term Growth Prospects: The long-term growth prospects for Shopify are enhanced by its presence in the Nasdaq 100, providing access to capital and fostering investor confidence.

Conclusion: Understanding Shopify Stock's Future After the Nasdaq 100 Listing

The Nasdaq 100 listing had a demonstrably positive initial impact on Shopify's stock price, driven by increased investor interest and confidence in the company's future. While short-term fluctuations are expected, the long-term implications suggest a generally favorable outlook. The increased visibility, trading volume, and investor confidence stemming from this inclusion are likely to contribute to Shopify's continued growth.

To stay informed, continue following market updates on Shopify stock's reaction to Nasdaq 100 listing. Consider incorporating Shopify into your investment strategy based on your individual risk tolerance and financial goals. For more detailed analysis and investment recommendations, consult with a qualified financial advisor.

Featured Posts

-

Captain America Brave New World Streaming Guide Where To Watch Online

May 14, 2025

Captain America Brave New World Streaming Guide Where To Watch Online

May 14, 2025 -

Seven Players Amorim Wants Man United To Sign This Summer

May 14, 2025

Seven Players Amorim Wants Man United To Sign This Summer

May 14, 2025 -

Captain America Brave New World Digital And Physical Release Dates And Prices

May 14, 2025

Captain America Brave New World Digital And Physical Release Dates And Prices

May 14, 2025 -

Shark Ninja Pressure Cooker Recall What You Need To Know About Burn Injuries

May 14, 2025

Shark Ninja Pressure Cooker Recall What You Need To Know About Burn Injuries

May 14, 2025 -

Baby Product Recall Walmart Issues Nationwide Warning On Dressers

May 14, 2025

Baby Product Recall Walmart Issues Nationwide Warning On Dressers

May 14, 2025

Latest Posts

-

Revealed Amorims Seven Player Transfer Wish List For Man United

May 14, 2025

Revealed Amorims Seven Player Transfer Wish List For Man United

May 14, 2025 -

Seven Players On Amorims Man United Transfer Wishlist

May 14, 2025

Seven Players On Amorims Man United Transfer Wishlist

May 14, 2025 -

Man United Transfer Targets Amorims Seven Player List Revealed

May 14, 2025

Man United Transfer Targets Amorims Seven Player List Revealed

May 14, 2025 -

The Bonds Ohtani Feud Is It Just Old School Vs New School

May 14, 2025

The Bonds Ohtani Feud Is It Just Old School Vs New School

May 14, 2025 -

Seven Players Amorim Wants Man United To Sign This Summer

May 14, 2025

Seven Players Amorim Wants Man United To Sign This Summer

May 14, 2025