Market Volatility And The Freeze On IPOs: Analyzing The Effects Of Tariffs

Table of Contents

Understanding the Link Between Tariffs and Market Volatility

Tariffs, essentially taxes on imported goods, significantly impact businesses, consumer confidence, and investor sentiment, leading to market volatility. The mechanism is relatively straightforward: tariffs increase the cost of imported goods, leading to higher prices for consumers. This inflation, coupled with the uncertainty surrounding future trade policies, erodes consumer spending. Businesses, facing increased production costs and reduced demand, see their earnings forecasts negatively impacted. This uncertainty fuels investor apprehension, resulting in market fluctuations and increased volatility.

-

Increased production costs due to tariffs leading to higher prices: Businesses relying on imported components or raw materials see their operating costs rise dramatically, forcing them to either absorb the increased costs or pass them onto consumers through higher prices.

-

Reduced consumer spending due to inflation and uncertainty: Higher prices on everyday goods and services decrease consumer purchasing power and create uncertainty about future economic prospects, prompting consumers to delay purchases.

-

Negative impact on corporate earnings forecasts: Reduced consumer spending and increased production costs directly affect corporate profits, leading to downward revisions in earnings forecasts and impacting stock prices.

-

Heightened uncertainty causing investor apprehension and market fluctuations: The unpredictable nature of tariff policies creates a climate of uncertainty, making investors hesitant to commit capital, leading to increased market volatility.

-

Examples of specific industries heavily impacted (e.g., technology, manufacturing): The technology sector, heavily reliant on global supply chains, and the manufacturing sector, facing direct tariff impacts on imported materials, have been particularly hard hit.

The Chilling Effect of Tariffs on IPOs

Market volatility significantly discourages companies from going public through an initial public offering (IPO). The unpredictable market conditions make it exceedingly difficult to accurately price an IPO, increasing the risk for both the company and investors. This increased risk aversion is a major factor contributing to the IPO freeze.

-

Increased risk aversion among investors during volatile markets: Investors are less likely to invest in new, less established companies during periods of market uncertainty.

-

Difficulty in accurately pricing IPOs in unpredictable market conditions: Accurately valuing a company’s stock is challenging when the overall market is volatile and unpredictable. This uncertainty makes it difficult to set an appropriate IPO price.

-

Reduced investor appetite for riskier, less established companies: IPOs, by their nature, involve a higher degree of risk than investing in established companies. During times of market volatility, this risk becomes even more pronounced.

-

Companies postponing IPOs to wait for more favorable market conditions: Companies are delaying their IPOs, hoping for improved market conditions that will provide a better valuation and a more receptive investor audience.

-

Examples of IPOs delayed or cancelled due to market volatility: Several high-profile IPOs have been delayed or canceled in recent years due to heightened market uncertainty stemming from trade tensions and tariff increases.

Impact on Specific Sectors

The impact of tariffs and subsequent market volatility is not uniform across all sectors. Some industries are disproportionately affected, while others may experience unexpected opportunities.

-

Technology sector's dependence on global supply chains: The tech sector is particularly vulnerable due to its globalized supply chains and reliance on imported components. Tariffs disrupt these chains, increasing costs and delaying product launches.

-

Manufacturing's vulnerability to tariff-related cost increases: Manufacturing companies, particularly those reliant on imported raw materials, face significant cost increases, affecting their profitability and competitiveness.

-

Impact on consumer goods due to price increases: Higher prices on imported consumer goods lead to reduced consumer spending and overall economic slowdown.

-

Potential for increased domestic production and reshoring: Tariffs can incentivize companies to shift production to domestic facilities, leading to reshoring and the potential creation of jobs within the country.

Long-Term Implications and Potential Outcomes

Sustained market volatility, driven by tariffs and trade uncertainties, has significant long-term economic implications. The potential consequences include slower economic growth, impacting job creation and investment decisions.

-

Potential for slower economic growth: Reduced consumer spending, business investment, and overall uncertainty can contribute to a significant slowdown in economic growth.

-

Impact on job creation and investment: Companies may postpone expansion plans and hiring, leading to reduced job creation and decreased investment.

-

Changes in corporate strategies and investment decisions: Businesses will adapt their strategies to navigate this new climate, potentially leading to changes in supply chains, production methods, and investment priorities.

-

The potential for government intervention to mitigate the effects: Governments may implement policies to mitigate the negative impacts of market volatility, such as financial stimulus packages or tax breaks for businesses.

Conclusion

The significant impact of tariffs on market volatility and the subsequent freeze on IPOs is undeniable. The interconnectedness of these factors and their broader economic implications are crucial for investors and businesses to understand. The uncertainty surrounding global trade policies creates a challenging environment for economic growth and investment.

Understanding the complex interplay between tariffs, market volatility, and the IPO market is crucial for investors and businesses alike. Stay informed about the latest developments in global trade and market conditions to make informed decisions regarding investments and business strategies. Continue researching the effects of tariffs on market volatility and their impact on the IPO market. Learn more about mitigating risks associated with market volatility and tariff-related uncertainty.

Featured Posts

-

Could There Be A Tommy Boy Sequel With David Spade

May 14, 2025

Could There Be A Tommy Boy Sequel With David Spade

May 14, 2025 -

Saechsische Schweiz Nationalpark Fuenf Neue Partner Erweitern Das Netzwerk

May 14, 2025

Saechsische Schweiz Nationalpark Fuenf Neue Partner Erweitern Das Netzwerk

May 14, 2025 -

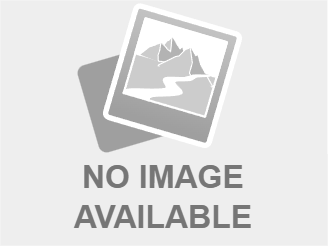

Wahlergebnisse Dresden Deutliche Ablehnung Von Cdu Und Spd 80 Waehlen Anders

May 14, 2025

Wahlergebnisse Dresden Deutliche Ablehnung Von Cdu Und Spd 80 Waehlen Anders

May 14, 2025 -

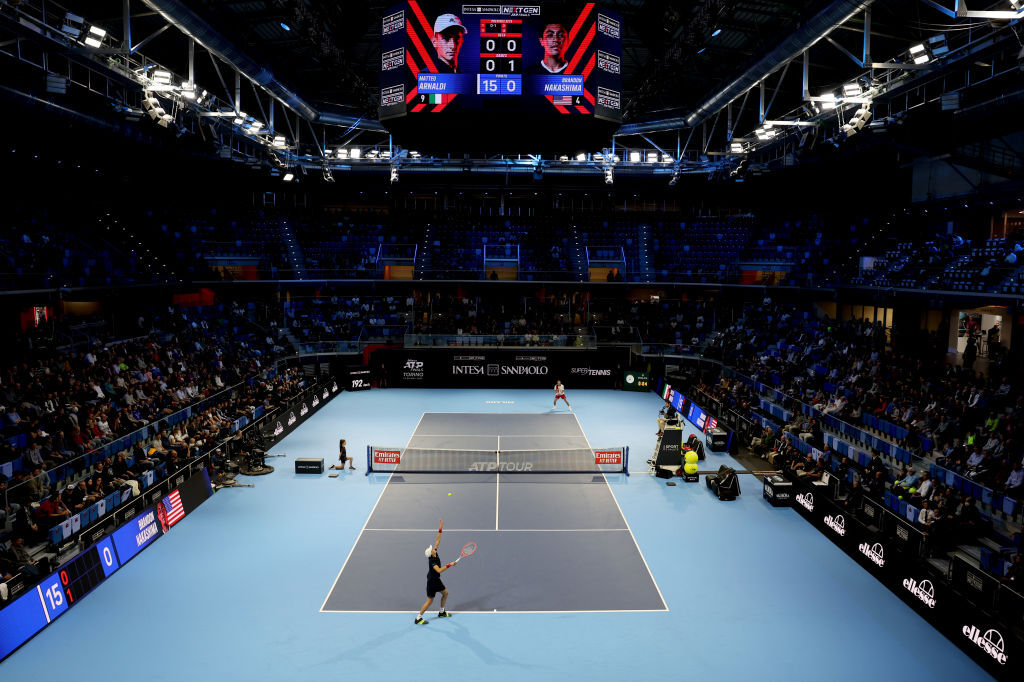

Wta Roundup No 3 Seed Stearns Falls In Austin

May 14, 2025

Wta Roundup No 3 Seed Stearns Falls In Austin

May 14, 2025 -

Captain America Brave New World Digital Release Date Where To Watch And Physical Media Availability

May 14, 2025

Captain America Brave New World Digital Release Date Where To Watch And Physical Media Availability

May 14, 2025

Latest Posts

-

Gde Kupiti Novakove Patike Od 1 500 Evra

May 14, 2025

Gde Kupiti Novakove Patike Od 1 500 Evra

May 14, 2025 -

Luksuzne Patike Novaka Okovi A Da Li Vrede 1 500 Evra

May 14, 2025

Luksuzne Patike Novaka Okovi A Da Li Vrede 1 500 Evra

May 14, 2025 -

Patike Novaka Okovi A 1 500 Evra Tsena Diza N I Karakteristike

May 14, 2025

Patike Novaka Okovi A 1 500 Evra Tsena Diza N I Karakteristike

May 14, 2025 -

Novakove Patike Tsena Od 1 500 Evra I Vrednost Za Novats

May 14, 2025

Novakove Patike Tsena Od 1 500 Evra I Vrednost Za Novats

May 14, 2025 -

Novakove Patike Od 1 500 Evra Luksuzni Modeli I Gde Ikh Kupiti

May 14, 2025

Novakove Patike Od 1 500 Evra Luksuzni Modeli I Gde Ikh Kupiti

May 14, 2025