May 26 Stock Market Report: Dow, S&P 500, And Nasdaq

Table of Contents

2.1 Dow Jones Industrial Average (DJIA) Performance on May 26th

Dow Jones Performance: Gains, Losses, and Key Influencers

The Dow Jones Industrial Average (DJIA) experienced a volatile day on May 26th. Opening at 33,800, it saw intraday highs and lows before closing at 33,900, representing a 0.3% gain. This relatively modest increase, however, masked significant sector-specific movements.

- Top Performers: Companies in the energy sector, boosted by rising oil prices, led the gains. Specific examples include [Insert Example Company 1] and [Insert Example Company 2], which saw significant percentage increases.

- Worst Performers: Conversely, some technology companies experienced setbacks, reflecting concerns about [mention specific concerns, e.g., rising interest rates or regulatory scrutiny]. [Insert Example Company 3] and [Insert Example Company 4] saw notable declines.

- Economic News Influence: The positive economic data release, specifically [mention the specific data, e.g., stronger-than-expected GDP growth], contributed to the overall positive sentiment, although its impact was uneven across sectors.

[Insert a relevant chart or image visualizing the Dow's performance on May 26th here.]

2.2 S&P 500 Index Performance on May 26th

S&P 500 Market Report: A Broad Market Overview for May 26

Mirroring the Dow's performance, the S&P 500 index also displayed a mixed bag on May 26th. It opened at 4,100, fluctuated throughout the day, and closed at 4,115, registering a 0.4% increase. This broader market index offered a more nuanced picture of the day's trading activity.

- Sector-Specific Changes: While energy stocks performed well, mirroring the Dow's trend, the consumer discretionary sector saw some weakness, potentially reflecting concerns about [mention specific concerns, e.g., inflation impacting consumer spending].

- Investor Sentiment and Volatility: The market experienced moderate volatility throughout the day, reflecting the uncertainty surrounding the economic data and its longer-term implications. Investor sentiment seemed cautiously optimistic, though this wasn't uniformly reflected across all sectors.

[Insert a relevant chart or image visualizing the S&P 500's performance on May 26th here.]

2.3 Nasdaq Composite Performance on May 26th

Nasdaq Report: Tech Sector Trends and May 26th Market Activity

The Nasdaq Composite, heavily weighted toward technology stocks, showed a more subdued response to the day's events. Opening at 12,000, it closed at 12,050, a 0.4% increase. The tech sector’s performance played a crucial role in shaping the Nasdaq’s trajectory.

- Major Tech Company Performance: While some major tech companies saw modest gains, others experienced minor declines, reflecting the sector's sensitivity to economic shifts and interest rate changes. [Insert Example Tech Company 1] and [Insert Example Tech Company 2] provide examples of these diverging performances.

- Tech-Related News: The absence of any major tech-related news on May 26th contributed to the relatively calm performance of the Nasdaq compared to the more pronounced sector-specific movements in the Dow and S&P 500.

[Insert a relevant chart or image visualizing the Nasdaq's performance on May 26th here.]

2.4 Overall Market Sentiment and Outlook for May 26th

May 26 Stock Market Summary: A Comprehensive Analysis of Market Sentiment

The May 26th stock market presented a complex picture. While the Dow and S&P 500 showed modest gains, largely driven by positive economic data, the Nasdaq’s performance was more muted. The overall market sentiment seemed cautiously optimistic, reflecting a balance between positive economic news and lingering concerns about [mention lingering concerns, e.g., inflation or geopolitical instability].

- Broader Market Trends: Sector-specific trends were noticeable, highlighting the uneven distribution of economic impacts across different industry segments.

- Potential Market Movements: The outlook for the following days remained uncertain, with potential further volatility depending on future economic releases and news events.

3. Conclusion: Recap and Call to Action for Continued Market Monitoring

In summary, the May 26th stock market demonstrated a mixed performance, with the Dow and S&P 500 exhibiting modest gains driven by positive economic data, while the Nasdaq showed more subdued growth. The day’s events highlighted the importance of monitoring sector-specific trends and understanding the interplay between economic indicators and investor sentiment.

To stay informed about daily market fluctuations and receive comprehensive reports like this "May 26 Stock Market Report: Dow, S&P 500, and Nasdaq," subscribe to our daily market updates. Stay ahead of the curve with continuous market insights and analysis. Don't miss out on future daily stock market reports and analyses!

Featured Posts

-

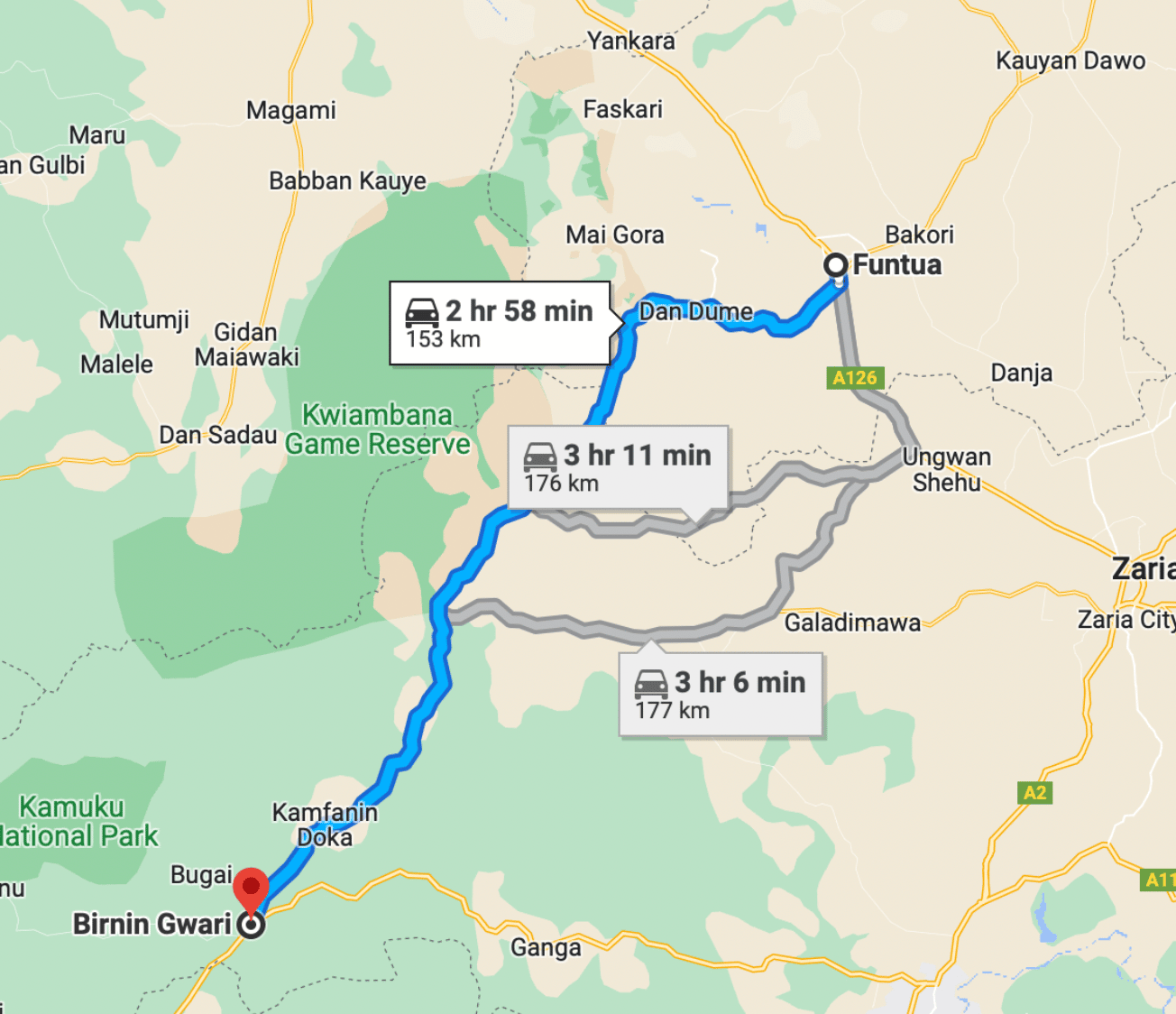

Urgent Action Needed Katsina Bandits Block Major Road Kidnap Entire Vehicle

May 27, 2025

Urgent Action Needed Katsina Bandits Block Major Road Kidnap Entire Vehicle

May 27, 2025 -

The Carrie Underwood Taylor Swift Rift What Really Happened

May 27, 2025

The Carrie Underwood Taylor Swift Rift What Really Happened

May 27, 2025 -

Fdyht Srqt Hqayb Bmtar Aljzayr Kamyrat Almraqbt Tkshf Alhqyqt

May 27, 2025

Fdyht Srqt Hqayb Bmtar Aljzayr Kamyrat Almraqbt Tkshf Alhqyqt

May 27, 2025 -

8 Marzo Almanacco Della Giornata Compleanni Santo Del Giorno E Proverbio

May 27, 2025

8 Marzo Almanacco Della Giornata Compleanni Santo Del Giorno E Proverbio

May 27, 2025 -

Zelenskiy O Reaktsii Ukrainy Na Konflikt Trampa I Putina

May 27, 2025

Zelenskiy O Reaktsii Ukrainy Na Konflikt Trampa I Putina

May 27, 2025

Latest Posts

-

Did Elon Musk Father Amber Heards Twins Years After Embryo Dispute

May 30, 2025

Did Elon Musk Father Amber Heards Twins Years After Embryo Dispute

May 30, 2025 -

Holder Vejret Analyser Og Forudsigelser Om Hans Afvisning Af Danmark

May 30, 2025

Holder Vejret Analyser Og Forudsigelser Om Hans Afvisning Af Danmark

May 30, 2025 -

Elon Musks Alleged Paternity Of Amber Heards Twins

May 30, 2025

Elon Musks Alleged Paternity Of Amber Heards Twins

May 30, 2025 -

Holder Vejret Danmarks Fremtid Afhaenger Af Hans Beslutning

May 30, 2025

Holder Vejret Danmarks Fremtid Afhaenger Af Hans Beslutning

May 30, 2025 -

Danmark Portugal En Dybdegaende Kampanalyse

May 30, 2025

Danmark Portugal En Dybdegaende Kampanalyse

May 30, 2025