Meta Monopoly Trial: FTC Defense Takes Center Stage

Table of Contents

The FTC's Core Arguments Against Meta's Monopoly Power

The FTC's case against Meta rests on two central pillars: allegations of anti-competitive acquisitions and the leveraging of market dominance to stifle competition.

Anti-Competitive Acquisitions

The FTC argues that Meta's acquisitions of Instagram in 2012 and WhatsApp in 2014 were anti-competitive, designed to eliminate potential rivals and stifle innovation.

- Details on the acquisitions: Instagram was acquired for approximately $1 billion, while WhatsApp's acquisition cost Meta around $19 billion. These were significant acquisitions at the time, raising concerns about Meta's growing market power.

- Stifling competition: The FTC contends that these acquisitions prevented Instagram and WhatsApp from becoming major competitors to Facebook, thereby reducing consumer choice and innovation in the social media market. The argument is that had these companies remained independent, they could have posed a significant challenge to Facebook's dominance.

- Eliminated competitors: The FTC suggests that by acquiring these companies, Meta prevented the emergence of alternative social media platforms, limiting consumer options and potentially leading to higher prices or reduced quality of services. Other potential competitors, the FTC argues, were effectively sidelined by Meta's actions.

Leveraging Market Dominance

The FTC claims Meta leverages its dominant position in social networking to unfairly favor its own products and services, disadvantaging competitors.

- Anti-competitive practices: The FTC points to Meta's alleged practices of prioritizing its own products in search results, algorithms, and data sharing, giving its services an unfair advantage over rivals.

- Harm to consumers and competitors: This alleged behavior, the FTC argues, harms consumers by limiting choices and innovation, while simultaneously stifling competitors who cannot compete with Meta's resources and market influence.

- Data privacy and market transparency: The FTC also argues that Meta's dominance negatively impacts data privacy and market transparency. The scale of Meta's data collection and its use of this data to enhance its own products and services raises significant concerns about fair competition.

Meta's Defense Strategy and Key Counterarguments

Meta vigorously defends its actions, employing several key counterarguments to the FTC's claims.

Denying Anti-Competitive Intent

Meta argues that its acquisitions were pro-competitive and ultimately beneficial to users, fostering innovation and integration.

- Benefits of integration: Meta claims the integration of Instagram and WhatsApp into its ecosystem has enhanced user experience, offering seamless communication and access to a wider range of services.

- Evidence presented by Meta: Meta has presented evidence suggesting that the acquisitions resulted in increased innovation and improved user functionalities. This evidence includes data on user growth, engagement, and the introduction of new features.

- Expert testimony: Meta has relied on expert testimony from economists and industry analysts to support its claims that the acquisitions were not anti-competitive and, in fact, beneficial to the market.

Challenging the Definition of the Relevant Market

Meta contests the FTC's definition of the relevant market, arguing that it’s broader than just social networking and encompasses other forms of online communication.

- Meta's arguments on market definition: Meta argues its competitors aren't just other social media platforms, but include various communication channels, like email, messaging apps, and video conferencing platforms.

- Implications of the market definition debate: The definition of the relevant market is crucial, as it dictates the scope of Meta's market share and the degree of its alleged dominance.

- Expert testimony on the relevant market: Meta uses expert testimony to argue that its market share, even within the social media sector, is not as dominant as the FTC claims when considering the broader landscape of online communication.

Potential Implications and Outcomes of the Meta Monopoly Trial

The Meta Monopoly Trial has significant implications across multiple sectors.

Impact on Future Acquisitions

The outcome could significantly change how tech companies approach future mergers and acquisitions.

- Stricter antitrust enforcement: A ruling against Meta could lead to more stringent antitrust enforcement and a greater reluctance by tech giants to make large acquisitions.

- Long-term implications for the tech industry: The case could reshape the landscape of mergers and acquisitions, potentially slowing down consolidation in the tech industry.

Changes to Antitrust Law

The trial could lead to a re-evaluation and potential overhaul of existing antitrust laws and regulations.

- Legislative changes: The trial's outcome could prompt lawmakers to reconsider and possibly update antitrust legislation to better address the challenges posed by large technology companies.

- Implications for future antitrust cases: The precedent set by this case will significantly impact future antitrust litigation involving tech companies.

Impact on Consumers

The trial's outcome will profoundly influence how consumers engage with social media and online services.

- Changes to user experience: Depending on the ruling, users could experience changes in data privacy, algorithm transparency, and the availability of competing platforms.

- Long-term impact on consumer choice and competition: The case's resolution directly impacts the level of competition, innovation, and consumer choice in the digital marketplace.

Conclusion

The Meta Monopoly Trial is a pivotal moment for the tech industry and antitrust law. The FTC’s defense and Meta's counterarguments highlight crucial questions about market dominance, competition, and the future of social media. The outcome will have far-reaching consequences, impacting future acquisitions, antitrust enforcement, and the daily experiences of billions of users. Stay informed about the ongoing developments in the Meta Monopoly Trial and its implications for the digital landscape. Follow the latest updates and analysis to understand how this case will shape the future of tech and the ongoing debate surrounding tech monopolies.

Featured Posts

-

Amanda Bynes Only Fans Launch Photos And Fan Reactions

May 18, 2025

Amanda Bynes Only Fans Launch Photos And Fan Reactions

May 18, 2025 -

Daily Lotto Results For Thursday May 1st 2025

May 18, 2025

Daily Lotto Results For Thursday May 1st 2025

May 18, 2025 -

Bowen Yang Snl Should Air Uncensored

May 18, 2025

Bowen Yang Snl Should Air Uncensored

May 18, 2025 -

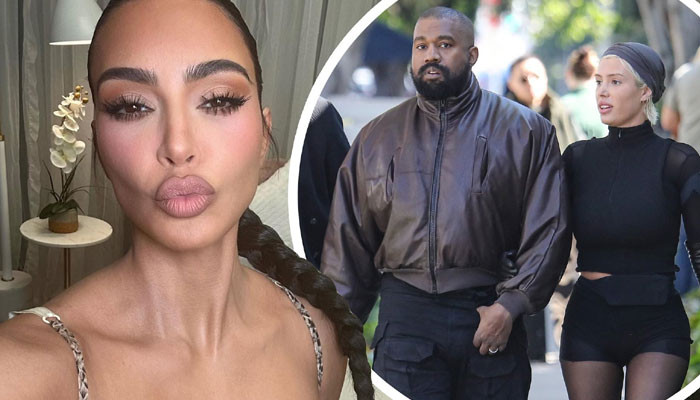

The Kanye West Kim Kardashian Bianca Censori Triangle

May 18, 2025

The Kanye West Kim Kardashian Bianca Censori Triangle

May 18, 2025 -

Hamas Atau Israel Siapa Yang Benar Benar Ingin Perdamaian

May 18, 2025

Hamas Atau Israel Siapa Yang Benar Benar Ingin Perdamaian

May 18, 2025