MicroStrategy Vs Bitcoin Investment: A Comparative Outlook For 2025

Table of Contents

MicroStrategy's Bitcoin Strategy: A Deep Dive

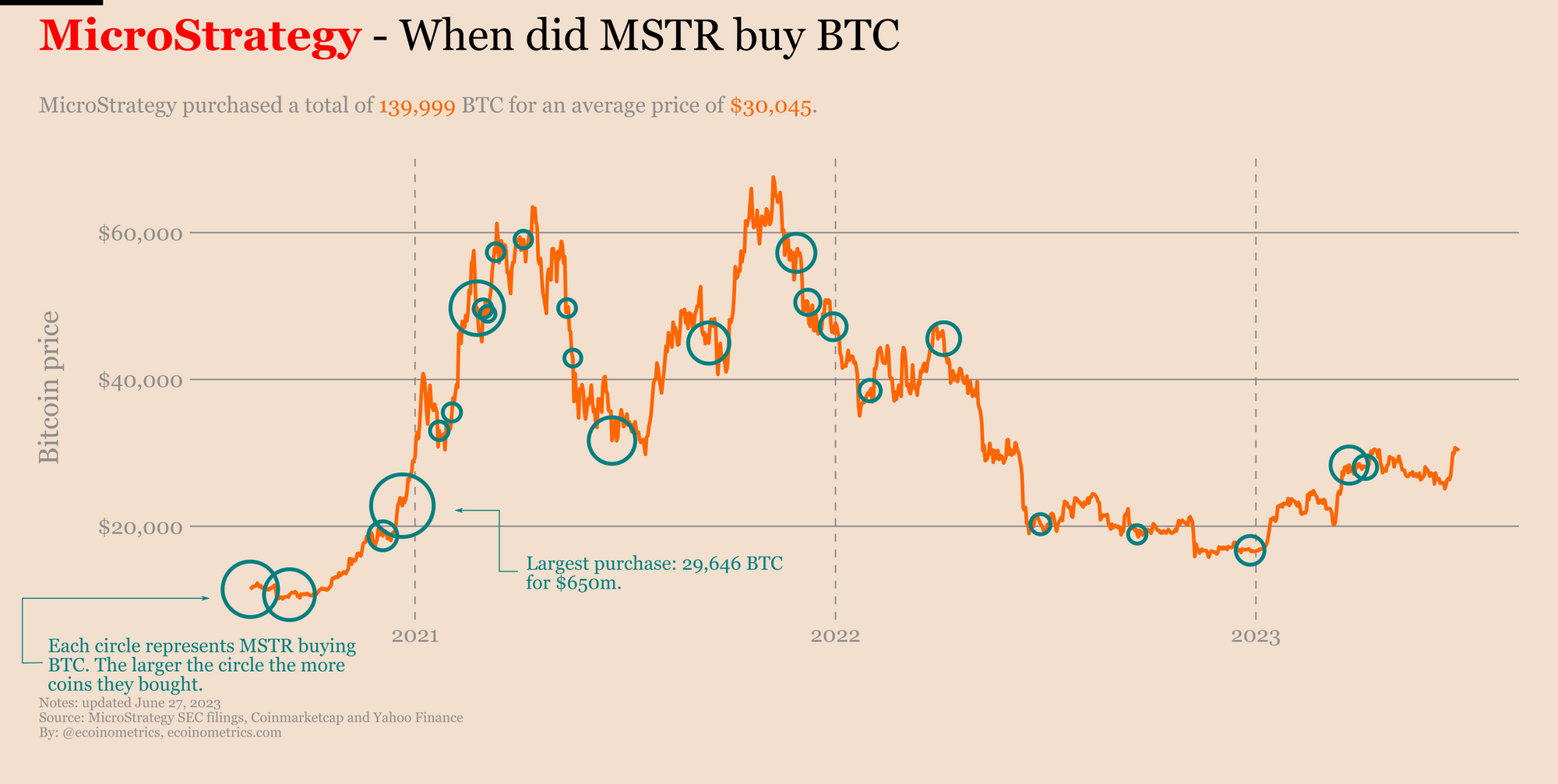

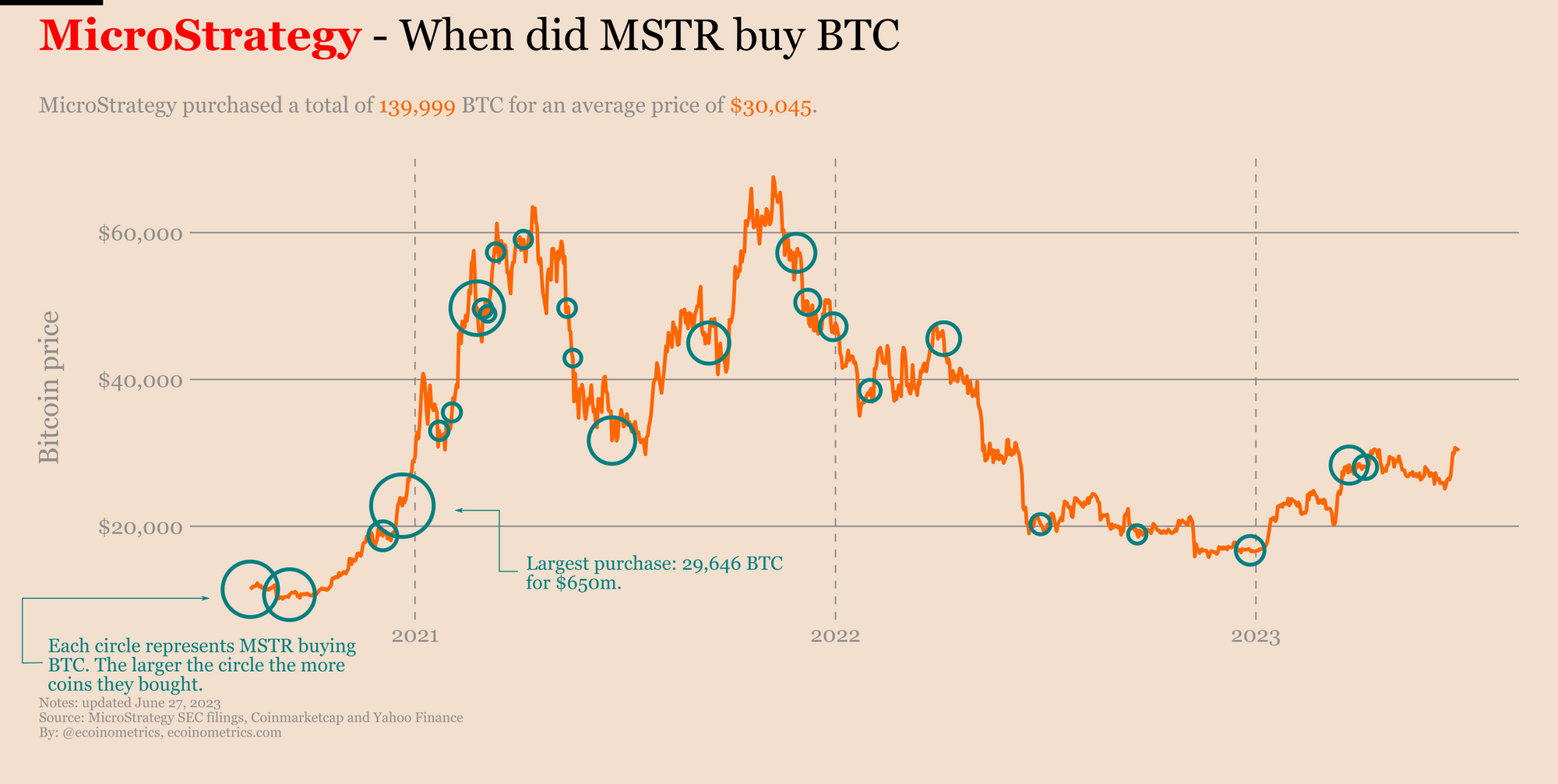

MicroStrategy, a business intelligence company, has made a significant bet on Bitcoin, accumulating a substantial holding. Understanding their strategy is crucial for assessing the viability of investing in their stock.

MicroStrategy's Business Model and Bitcoin Holdings:

MicroStrategy's core business revolves around providing enterprise analytics, mobility, and cloud-based services. However, its most striking feature is its massive Bitcoin accumulation, making it one of the largest corporate holders of the cryptocurrency. This strategy, spearheaded by CEO Michael Saylor, is predicated on the belief in Bitcoin's long-term value as a store of value and a hedge against inflation.

- Market Capitalization: MicroStrategy's market capitalization is significantly influenced by the price of Bitcoin.

- Stock Performance Tied to Bitcoin Price: MicroStrategy's stock price demonstrates a strong correlation with Bitcoin's price movements.

- CEO Michael Saylor's Influence: Michael Saylor's unwavering advocacy for Bitcoin has been instrumental in shaping the company's strategy.

Risks and Rewards of MicroStrategy's Approach:

While MicroStrategy's Bitcoin strategy offers potential rewards, it's not without risks.

- Correlation between MicroStrategy stock and Bitcoin: Investors should be aware of the high correlation between MicroStrategy's stock price and Bitcoin's price, meaning significant volatility.

- Potential for future acquisitions: MicroStrategy might continue its Bitcoin accumulation, potentially boosting the value of its holdings and its stock.

- Impact of regulatory uncertainty: Changes in the regulatory landscape surrounding Bitcoin could significantly impact MicroStrategy's investment and its stock price. Understanding the Bitcoin regulatory landscape is crucial.

MicroStrategy's Future Outlook in 2025:

Predicting MicroStrategy's position in 2025 requires considering several factors.

- Predictions on Bitcoin price: Various forecasts exist regarding Bitcoin's price in 2025; these projections directly impact MicroStrategy's valuation.

- Potential for further Bitcoin accumulation: MicroStrategy may continue to acquire more Bitcoin, further solidifying its position in the market.

- Impact of competition: The emergence of other corporate Bitcoin holders could affect MicroStrategy's market dominance and stock price. Analyzing the competitive landscape within the MicroStrategy Bitcoin holdings sector is therefore important.

Direct Bitcoin Investment: Advantages and Disadvantages

Investing directly in Bitcoin offers a different set of advantages and disadvantages compared to investing in MicroStrategy.

Pros of Direct Bitcoin Ownership:

Direct Bitcoin ownership provides several benefits:

- Potential for high ROI: Bitcoin's price history demonstrates its potential for significant returns, though this also involves substantial risk. Understanding Bitcoin ROI is key.

- Control over private keys: Owning Bitcoin directly means you control your private keys, enhancing security but requiring careful management.

- Accessibility through exchanges: Numerous cryptocurrency exchanges offer easy access to Bitcoin for purchase. Knowing how to buy Bitcoin securely is essential.

- Bitcoin portfolio diversification: Bitcoin can serve as a diversifier within a broader investment portfolio.

Cons of Direct Bitcoin Ownership:

However, direct Bitcoin investment carries considerable risks:

- Bitcoin volatility: Bitcoin's price is highly volatile, exposing investors to substantial losses. Understanding Bitcoin volatility is crucial for risk management.

- Bitcoin security: Self-custody of Bitcoin requires robust security measures to protect against theft or loss.

- Bitcoin taxation: Tax implications related to Bitcoin trading vary significantly across jurisdictions.

Bitcoin Investment Strategies for 2025:

Several strategies can mitigate the risks of direct Bitcoin investment:

- Dollar-Cost Averaging (DCA): This involves regularly investing a fixed amount of money, regardless of price fluctuations.

- Hodling strategy: This involves buying and holding Bitcoin for the long term, regardless of short-term price movements.

- Risk management techniques: Diversification and setting stop-loss orders can help limit potential losses.

Comparative Analysis: MicroStrategy vs. Direct Bitcoin Investment in 2025

| Feature | MicroStrategy Stock Investment | Direct Bitcoin Investment |

|---|---|---|

| Risk | Moderate to High (correlated with Bitcoin price) | High (due to Bitcoin price volatility) |

| Potential Return | Moderate to High (correlated with Bitcoin price) | High (but also high risk) |

| Ease of Access | Relatively easy (through brokerage accounts) | Relatively easy (through cryptocurrency exchanges) |

| Control | Indirect (through stock ownership) | Direct (you control your private keys) |

| Regulatory Risk | Subject to regulatory changes affecting both MicroStrategy and Bitcoin | Subject to regulatory changes affecting Bitcoin |

Conclusion

Investing in either MicroStrategy or directly in Bitcoin presents both opportunities and risks. MicroStrategy offers a less volatile approach, albeit with indirect exposure to Bitcoin's price fluctuations. Direct Bitcoin investment offers higher potential returns but significantly higher risk due to inherent Bitcoin volatility. The best approach depends on your individual risk tolerance, financial goals, and understanding of the Bitcoin market and MicroStrategy's business model. Thorough research is paramount before making any investment decisions. Remember to revisit this article and conduct further research as the market evolves, staying informed on the ongoing developments in "MicroStrategy vs Bitcoin Investment."

Featured Posts

-

Antipremiya Zolotaya Malina Razgromnye Rezultaty Dlya Dakoty Dzhonson

May 09, 2025

Antipremiya Zolotaya Malina Razgromnye Rezultaty Dlya Dakoty Dzhonson

May 09, 2025 -

Understanding Jeanine Pirro Education Net Worth And Public Profile

May 09, 2025

Understanding Jeanine Pirro Education Net Worth And Public Profile

May 09, 2025 -

Fin De Serie Pour Dijon Face Au Psg En Arkema Premiere Ligue

May 09, 2025

Fin De Serie Pour Dijon Face Au Psg En Arkema Premiere Ligue

May 09, 2025 -

Should You Buy Palantir Stock Before 2025s Predicted 40 Rise

May 09, 2025

Should You Buy Palantir Stock Before 2025s Predicted 40 Rise

May 09, 2025 -

Ev Mandate Backlash Car Dealerships Push For Alternatives

May 09, 2025

Ev Mandate Backlash Car Dealerships Push For Alternatives

May 09, 2025