MicroStrategy's Rival: Analyzing The Hype Surrounding This New SPAC Stock

Table of Contents

Understanding the SPAC Landscape and its Risks

SPACs, or blank-check companies, raise capital through an initial public offering (IPO) with the express purpose of merging with a private company. This allows private companies to go public without undergoing the traditional IPO process. While SPACs offer a quicker route to market and can attract significant investment, they also carry substantial risks.

Advantages of investing in SPACs include potentially high returns and access to pre-IPO companies. However, disadvantages outweigh these positives for many. Investors often have limited information about the target company before the merger, increasing uncertainty. The success heavily relies on the SPAC management team's ability to identify and successfully integrate a viable acquisition. Furthermore, significant dilution can occur after the merger, impacting existing shareholder value.

- High potential returns, but equally high risk: SPACs are inherently speculative investments.

- Limited information before the merger: Due diligence is crucial, but information can be scarce.

- Dependence on the SPAC management team: Their expertise and track record are paramount.

MicroStrategy's Position in the Market

MicroStrategy is a well-established player in the business intelligence and analytics market, offering a comprehensive suite of software solutions for enterprise clients. While its market capitalization fluctuates, its strong brand recognition and long history give it a significant market advantage. However, its controversial, and substantial, investment in Bitcoin has significantly influenced its stock price, creating both opportunities and risks.

- Market leader (debatable): While not definitively the market leader, MicroStrategy holds a strong position within the enterprise analytics space. Its exact market share requires further independent analysis.

- Strong brand recognition: Years of experience have built trust among large enterprises.

- Bitcoin strategy: A double-edged sword—high potential gains but also significant volatility.

Analyzing the New Competitor's Potential

The specifics of the unnamed SPAC and its target company remain shrouded in secrecy. However, based on market trends, we can speculate on its potential focus. It's likely the new SPAC will target a niche within business intelligence, data analytics, or cloud computing, aiming to compete with established players like MicroStrategy. The success of this new competitor will depend on several factors.

- Technological advantages: Does the unnamed company possess groundbreaking technology or innovative approaches to data analytics? This is crucial for disrupting the market.

- Potential market share capture: Identifying a specific underserved market segment will be key to capturing a significant market share.

- Financial projections and funding sources: Secure funding and realistic financial projections are essential for long-term success.

Comparing MicroStrategy and the New SPAC

| Feature | MicroStrategy | New SPAC (Projected) |

|---|---|---|

| Market Cap | (Current Market Cap – needs to be updated) | (Projected – needs to be estimated/researched) |

| Revenue | (Current Revenue – needs to be updated) | (Projected – needs to be estimated/researched) |

| Technology | Mature, established enterprise solutions | Potentially innovative, niche focus |

| Competitive Adv. | Brand recognition, established client base | Innovative technology, potentially lower costs |

| Risks | Bitcoin volatility, competition | Unproven technology, execution risk |

MicroStrategy boasts brand recognition and a large customer base. The new SPAC, however, could leverage innovative technology and potentially disrupt the market with a focused approach and potentially lower costs.

Investment Implications and Future Outlook

Investing in either MicroStrategy or the new SPAC carries inherent risks and rewards. MicroStrategy offers a more established, albeit volatile, investment. The new SPAC, while potentially offering higher returns, presents significantly higher risk due to its unknown future performance.

- Potential ROI: MicroStrategy’s ROI depends on Bitcoin’s price and its software sales; the SPAC's ROI is highly speculative.

- Suitable investor profiles: MicroStrategy suits risk-tolerant investors comfortable with Bitcoin's volatility; the SPAC is for high-risk, high-reward seekers.

- Future market share: The new SPAC's success will determine if it makes significant inroads into MicroStrategy’s market share.

Conclusion: Is This SPAC Stock a Real Threat to MicroStrategy?

MicroStrategy remains a dominant force in the business intelligence market, benefiting from strong brand recognition and a substantial existing client base. However, the emergence of this new SPAC competitor presents a potential challenge. Whether this new entrant poses a significant threat depends largely on its ability to successfully execute its business plan, introduce innovative technology, and capture a substantial market share. Investing in either company requires careful consideration of their respective strengths, weaknesses, and the inherent risks associated with the volatile nature of the SPAC market.

Learn more about the potential of this exciting new SPAC stock and its implications for MicroStrategy – conduct your own thorough due diligence before making any investment decisions. Stay updated on the latest news regarding this MicroStrategy rival as it navigates the competitive landscape of the business intelligence industry.

Featured Posts

-

Is Daycare Harmful A Psychologists Claims And The Expert Response

May 09, 2025

Is Daycare Harmful A Psychologists Claims And The Expert Response

May 09, 2025 -

Williams Boss Comments On Doohan Amidst Colapinto Speculation

May 09, 2025

Williams Boss Comments On Doohan Amidst Colapinto Speculation

May 09, 2025 -

Nl Federal Election 2024 Candidate Profiles And Platforms

May 09, 2025

Nl Federal Election 2024 Candidate Profiles And Platforms

May 09, 2025 -

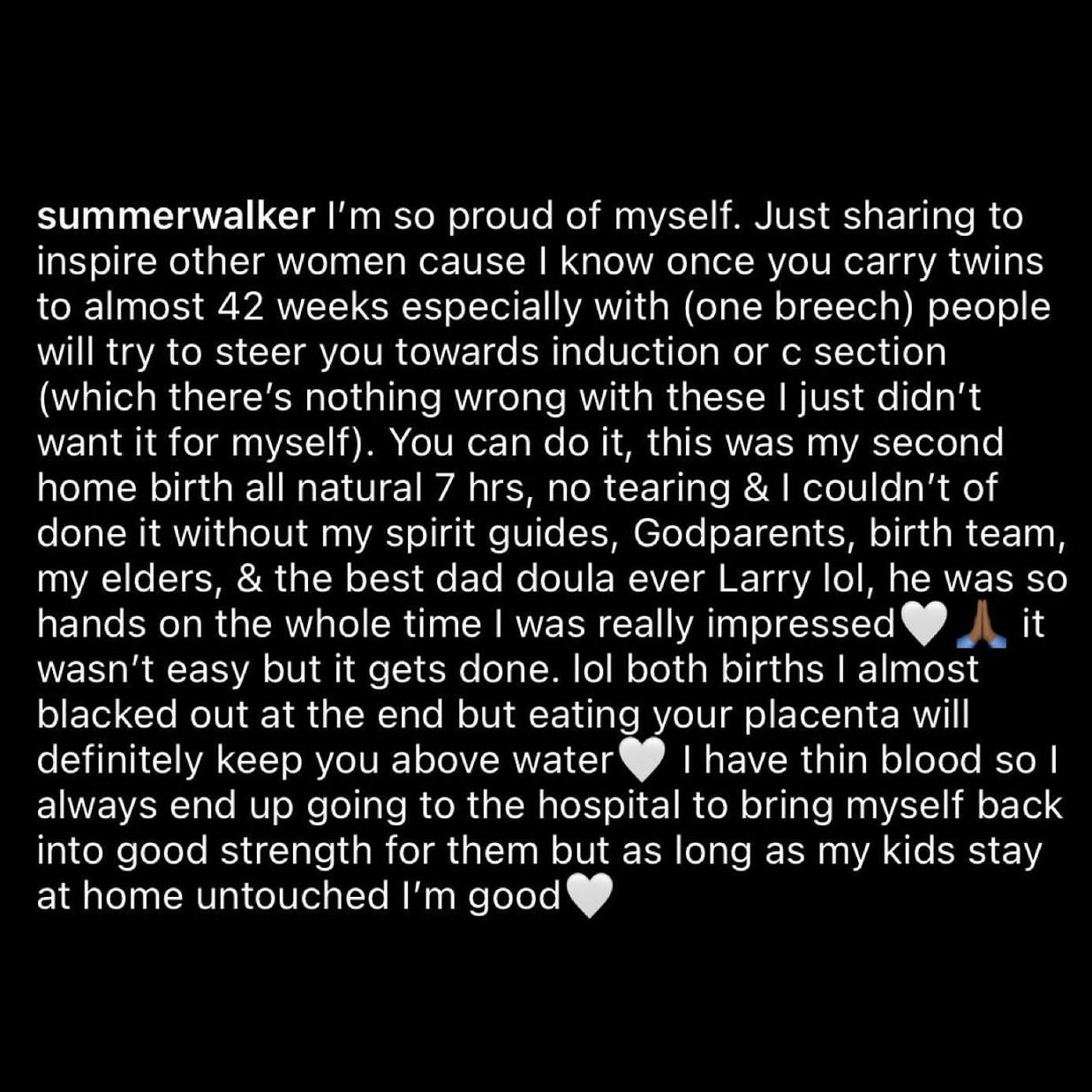

Summer Walker Reveals Perils Of Childbirth

May 09, 2025

Summer Walker Reveals Perils Of Childbirth

May 09, 2025 -

Polufinal I Final Ligi Chempionov 2024 2025 Prognoz Raspisanie I Gde Smotret

May 09, 2025

Polufinal I Final Ligi Chempionov 2024 2025 Prognoz Raspisanie I Gde Smotret

May 09, 2025