Microsoft Leads Software Stocks As Tariff Safe Harbor

Table of Contents

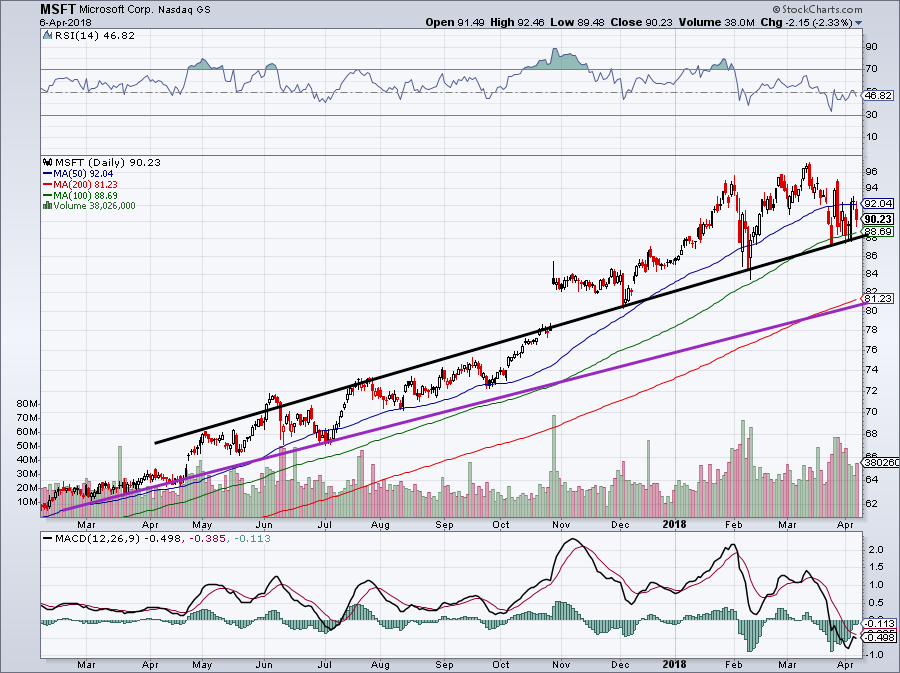

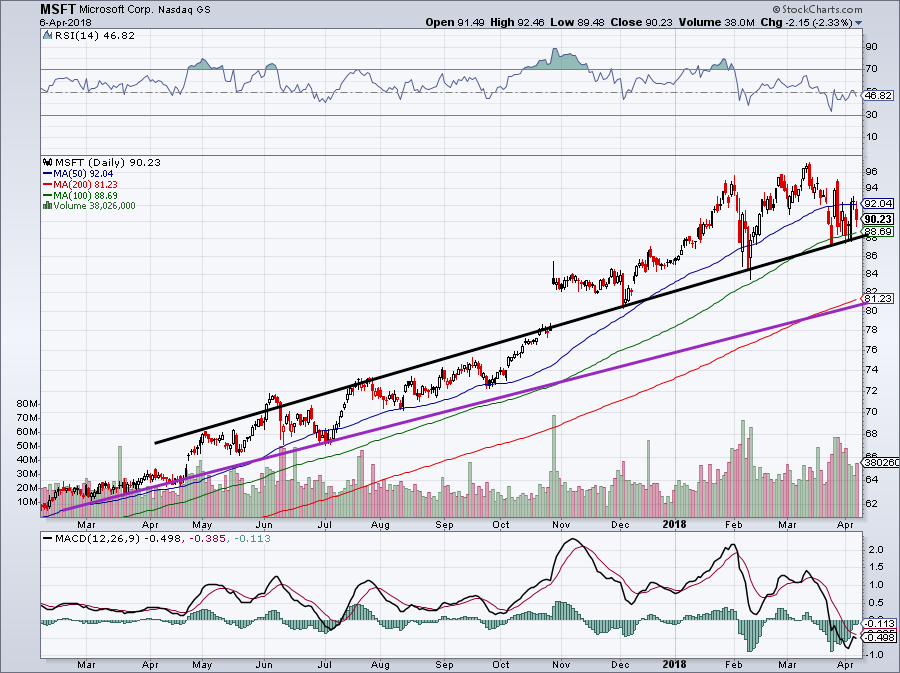

Microsoft's Position as a Tariff-Resilient Tech Giant

Microsoft's dominance in the tech world is well-established, but its position as a tariff-resistant leader is less discussed. Its business model, fundamentally built on software and cloud services, minimizes its exposure to the traditional impacts of tariffs on physical goods. This inherent advantage is what sets it apart in the current economic climate.

- High Percentage of Intangible Assets: A vast majority of Microsoft's revenue comes from intangible assets like software licenses, subscriptions (Microsoft 365), and intellectual property. These are not subject to the same tariffs as physical hardware components.

- Significant Revenue from Cloud Services (Azure): Microsoft Azure, its cloud computing platform, is a major driver of revenue. Cloud services are largely unaffected by tariffs on physical goods, providing a crucial buffer against trade uncertainties.

- Global Reach and Diversified Revenue Streams: Microsoft's global presence ensures it isn't overly reliant on any single market. This diversification significantly reduces vulnerability to regional tariff impacts.

- Strong Brand and Market Dominance: Microsoft's powerful brand and market leadership provide inherent resilience. Customers are less likely to switch providers during times of economic uncertainty, reinforcing its stability.

The Software Sector's Comparative Advantage in a Tariffed Environment

The software industry, as a whole, possesses a distinct advantage over hardware manufacturing when facing tariffs. This inherent resilience is a key reason why software stocks are thriving even amidst trade tensions.

- Lower Reliance on Physical Goods: Software, unlike hardware, isn't subject to the same import duties and logistical complexities associated with physical goods.

- Digital Distribution: The digital nature of software minimizes transportation costs and logistical challenges, further reducing tariff exposure.

- Adaptable Pricing Models: Software companies can adjust their pricing strategies to absorb or mitigate the effects of any indirect tariffs on related services or infrastructure.

- Increased Demand During Uncertainty: Ironically, economic uncertainty often leads to increased demand for software solutions as businesses seek to improve efficiency and streamline operations.

Other Software Stocks Benefiting from Tariff Safe Harbor

Microsoft isn't alone in this advantageous position. Several other major software companies are also exhibiting relative stability and strong performance, thanks to their business models.

- Adobe (ADBE): Adobe's Creative Cloud subscription model provides a steady stream of recurring revenue, largely insulated from tariff impacts.

- Salesforce (CRM): Salesforce's cloud-based customer relationship management (CRM) software benefits from the same digital distribution and low tariff exposure as Microsoft.

- Oracle (ORCL): Oracle's database software and cloud services also offer significant protection against tariff-related risks.

These companies' stock performance has, in many cases, outperformed hardware companies, demonstrating the protective nature of their software-centric business models.

Risks and Considerations for Software Stocks

While the software sector offers a relative safe harbor, it's crucial to acknowledge potential risks and limitations. Even software companies aren't entirely immune to external economic factors.

- Indirect Tariff Impacts: Future tariffs on related hardware (servers, networking equipment) or cloud infrastructure could indirectly affect software companies.

- Currency Fluctuations: Changes in exchange rates can impact international revenue streams, affecting profitability for globally operating software companies.

- Competition and Market Saturation: Intense competition within the software industry can put pressure on pricing and margins, regardless of tariff impacts.

- Overall Economic Downturns: Even software spending can be affected during severe economic downturns, impacting revenue growth.

Conclusion: Investing in the Tariff Safe Harbor of Software Stocks

This analysis shows that Microsoft's leading position, and the overall strength of the software sector, make it a relatively safe investment haven in the face of tariffs. The advantages of investing in software stocks as a "tariff safe harbor" are significant, including lower exposure to trade disputes, digital distribution advantages, and adaptable pricing models. We encourage readers to further research software stocks like Microsoft (MSFT), Adobe (ADBE), Salesforce (CRM), and Oracle (ORCL), and consider their inclusion in diversified investment portfolios for long-term growth potential. Investing in Microsoft and other tariff-resistant software stocks offers a compelling strategy for navigating the complexities of the global market. The inherent resilience of this sector makes it a potentially strong performer even amidst continued trade uncertainties; Microsoft leads Software Stocks as Tariff Safe Harbor, offering investors a pathway to relative stability and long-term growth.

Featured Posts

-

Anthony Edwards Custody Dispute The Latest Updates

May 15, 2025

Anthony Edwards Custody Dispute The Latest Updates

May 15, 2025 -

5 Dozen Eggs The Latest On Us Egg Price Decline

May 15, 2025

5 Dozen Eggs The Latest On Us Egg Price Decline

May 15, 2025 -

Le Repechage De La Lnh Decentralise Un Succes Mitige

May 15, 2025

Le Repechage De La Lnh Decentralise Un Succes Mitige

May 15, 2025 -

King Of Davos Examining His Rise And Ultimate Demise

May 15, 2025

King Of Davos Examining His Rise And Ultimate Demise

May 15, 2025 -

The Rise Of Kim Outman And Sauer In The Dodgers Minor League System

May 15, 2025

The Rise Of Kim Outman And Sauer In The Dodgers Minor League System

May 15, 2025

Latest Posts

-

Seriya Pley Off N Kh L Karolina Dominiruet Nad Vashingtonom

May 15, 2025

Seriya Pley Off N Kh L Karolina Dominiruet Nad Vashingtonom

May 15, 2025 -

Reshayuschiy Match Pley Off Karolina Protiv Vashingtona

May 15, 2025

Reshayuschiy Match Pley Off Karolina Protiv Vashingtona

May 15, 2025 -

Karolina Vashington Podrobniy Otchet O Matche Pley Off N Kh L

May 15, 2025

Karolina Vashington Podrobniy Otchet O Matche Pley Off N Kh L

May 15, 2025 -

Razgromnoe Porazhenie Vashingtona Ot Karoliny V Pley Off N Kh L

May 15, 2025

Razgromnoe Porazhenie Vashingtona Ot Karoliny V Pley Off N Kh L

May 15, 2025 -

Ovechkin I Demidov Vashington I Monreal Vstrechayutsya V Pley Off N Kh L

May 15, 2025

Ovechkin I Demidov Vashington I Monreal Vstrechayutsya V Pley Off N Kh L

May 15, 2025