Microsoft Leads Software Stocks As Tariff Safe Haven

Table of Contents

Microsoft's Resilience in the Face of Tariffs

Reduced Exposure to Tariffs

Microsoft's business model, heavily reliant on intangible assets and software licensing, minimizes direct exposure to tariffs impacting physical goods. Unlike companies heavily invested in manufacturing and physical product distribution, Microsoft's primary products are digital. This significantly reduces its vulnerability to import/export taxes and supply chain disruptions.

- Minimal reliance on physical manufacturing: Microsoft outsources much of its manufacturing, reducing its direct exposure to tariffs on manufactured goods.

- Global distribution network less susceptible to border taxes: The distribution of software happens digitally, largely bypassing physical border crossings and associated tariffs.

- Strong international revenue streams diversified across regions: Microsoft's revenue is diversified across numerous countries, mitigating the impact of tariffs imposed by any single nation. This geographic diversification is a key factor in its resilience.

Strong Fundamentals and Consistent Growth

Microsoft's robust financial performance further bolsters its position as a safe haven investment. Consistent revenue growth and diversification across key sectors contribute to its stability. Its dominant position in cloud computing (Azure), productivity software (Microsoft 365), and gaming (Xbox) provides multiple avenues for revenue generation.

- Stable earnings and high profit margins: Microsoft consistently delivers strong earnings and maintains healthy profit margins, indicating a financially sound and resilient business model.

- Continued market share dominance: Microsoft maintains a strong market share across its various product lines, demonstrating its continued relevance and competitive advantage.

- Successful cloud adoption driving growth: The strong growth of Microsoft Azure, its cloud computing platform, is a major driver of revenue and demonstrates the company's ability to adapt to market trends.

Safe Haven Appeal to Investors

Investors are increasingly viewing Microsoft as a safe haven during economic uncertainty. Its stability and potential for higher returns compared to more tariff-sensitive sectors make it an attractive investment option.

- Reduced volatility compared to other sectors: Microsoft's stock price tends to exhibit less volatility than stocks in sectors more directly affected by tariffs.

- Strong dividend payouts: Microsoft offers attractive dividend payouts, providing a reliable income stream for investors.

- Long-term growth prospects: Microsoft's ongoing innovation and expansion into new markets suggest strong long-term growth potential.

- Investor confidence in the brand: The Microsoft brand enjoys strong investor confidence, contributing to its appeal as a stable investment.

The Broader Appeal of Software Stocks as a Tariff Safe Haven

Intangible Assets and Reduced Physical Dependency

The intangible nature of software products inherently makes them less susceptible to tariffs than physical goods. This is a key differentiator that makes software stocks attractive during periods of trade uncertainty.

- Reduced transportation costs: Software distribution involves minimal physical transportation, eliminating associated costs and tariff risks.

- Lower reliance on physical supply chains: Software companies rely less on complex physical supply chains, making them less vulnerable to disruptions from tariffs and geopolitical events.

- Minimal impact from import/export regulations: The digital nature of software products largely bypasses traditional import/export regulations and their associated costs.

Recurring Revenue Models

Many software companies employ subscription-based or recurring revenue models. This offers predictability and stability, shielding them from short-term market fluctuations often associated with tariff changes.

- Predictable cash flows: Recurring revenue models provide consistent and predictable cash flows, reducing financial uncertainty.

- Reduced reliance on one-time sales: The focus shifts from one-time sales to long-term customer relationships, providing greater revenue stability.

- Greater revenue visibility: Recurring revenue models offer enhanced visibility into future revenue streams, improving financial forecasting and investor confidence.

Global Demand for Software and Cloud Services

The consistently high and growing global demand for software and cloud-based solutions remains largely unaffected by tariff policies. This sustained demand further strengthens the appeal of software stocks as a safe haven.

- Increased digital transformation across industries: The ongoing digital transformation across various industries fuels the demand for software and cloud services.

- Growing adoption of cloud computing: Cloud computing adoption continues to accelerate globally, driving significant growth for cloud-based software providers.

- Strong international market opportunities: The global nature of the software market provides significant growth opportunities, mitigating the impact of tariffs in any single region.

Investing in Software Stocks: Strategies and Considerations

Diversification Within the Sector

To minimize risk, investors should diversify their investments across various software sub-sectors. This approach reduces reliance on any single company or market segment.

- Cloud computing: Invest in leading cloud providers like AWS, Azure, and Google Cloud.

- Enterprise software: Consider companies specializing in enterprise resource planning (ERP), customer relationship management (CRM), and other enterprise applications.

- Cybersecurity: Invest in cybersecurity companies providing essential protection in an increasingly digital world.

- Fintech software: Explore companies developing software for the financial technology sector.

Fundamental Analysis

Thorough fundamental analysis is crucial before investing in any software stock. This involves examining various factors to assess the investment's potential.

- Examine financial statements: Analyze key financial metrics to assess the company's financial health and profitability.

- Assess growth potential: Evaluate the company's growth prospects based on market trends and competitive landscape.

- Analyze competitive landscape: Understand the competitive dynamics within the sector to identify companies with a sustainable competitive advantage.

- Evaluate management team: Assess the quality of the management team and their ability to drive growth and innovation.

Long-Term Investment Horizon

Adopting a long-term investment strategy is advisable for software stocks. While short-term market volatility may occur, the long-term growth potential of the sector remains compelling.

- Avoid emotional decision-making: Resist the urge to make impulsive decisions based on short-term market fluctuations.

- Ride out market fluctuations: Be prepared to ride out temporary market downturns, focusing on the long-term growth prospects.

- Focus on long-term growth: Maintain a long-term perspective, focusing on the sustainable growth potential of the chosen software companies.

Conclusion

In conclusion, Microsoft's strong performance highlights the growing trend of software stocks acting as a tariff safe haven. Their inherent characteristics – intangible assets, recurring revenue models, and consistent global demand – offer investors a degree of protection against economic uncertainty caused by tariff wars. By carefully considering diversification, thorough fundamental analysis, and adopting a long-term investment horizon, investors can leverage the resilience of software stocks, including Microsoft, to navigate the complexities of the current global market. Begin your research into the potential of software stocks as a strategic investment today. Explore the opportunities available in the dynamic world of technology and secure your financial future by considering a portfolio that includes leading software companies.

Featured Posts

-

Tom Cruise And Suri Cruise A Fathers Unconventional Approach

May 16, 2025

Tom Cruise And Suri Cruise A Fathers Unconventional Approach

May 16, 2025 -

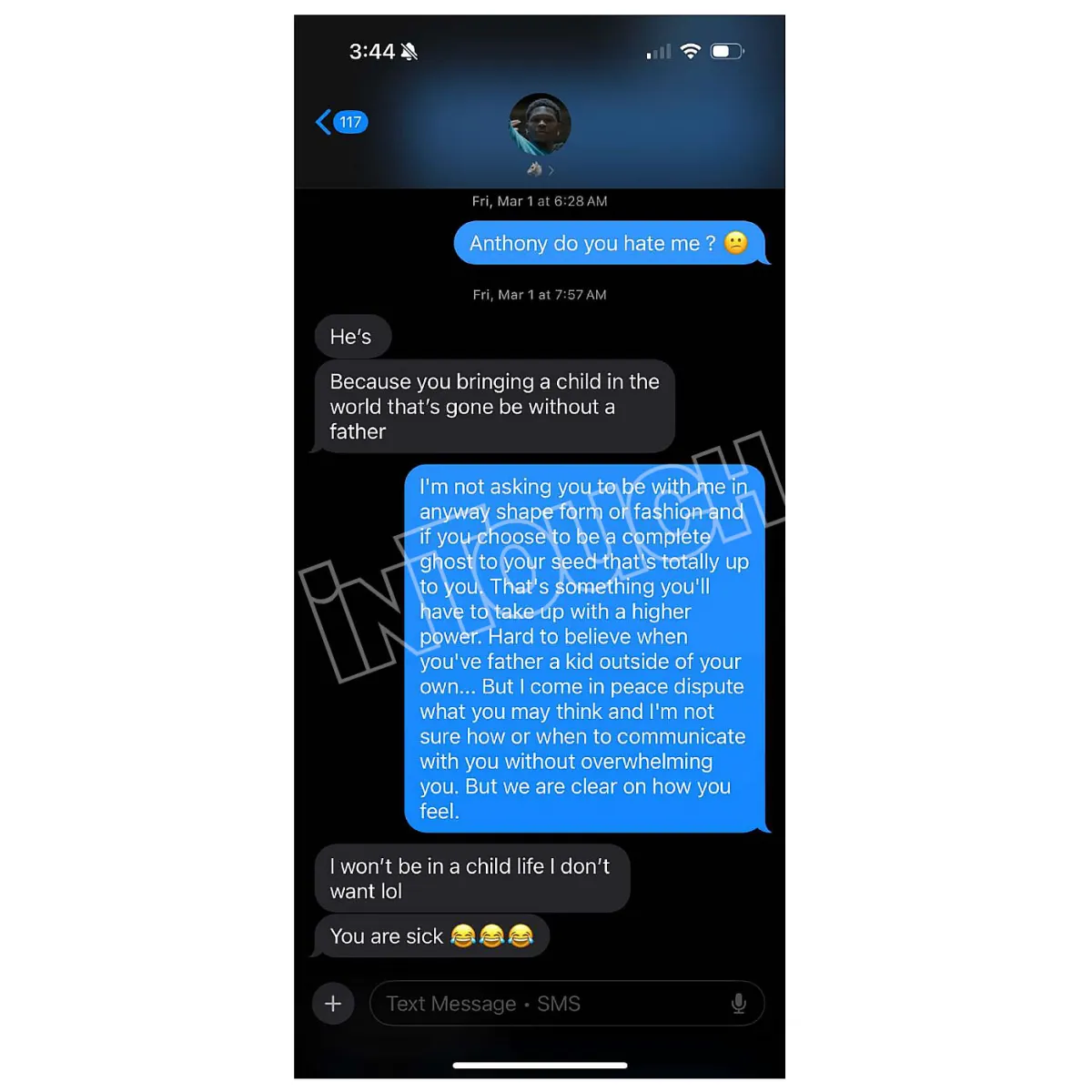

Anthony Edwards Baby Mama Drama The Full Story Unfolds On Twitter

May 16, 2025

Anthony Edwards Baby Mama Drama The Full Story Unfolds On Twitter

May 16, 2025 -

San Jose Earthquakes Season Debut A Fresh Start Against Real Salt Lake

May 16, 2025

San Jose Earthquakes Season Debut A Fresh Start Against Real Salt Lake

May 16, 2025 -

San Jose Earthquakes Fall To Charlotte Fc 4 1 In Third Consecutive Loss

May 16, 2025

San Jose Earthquakes Fall To Charlotte Fc 4 1 In Third Consecutive Loss

May 16, 2025 -

Paddy Pimblett Ufc 314 Champion Goat Legends Backing

May 16, 2025

Paddy Pimblett Ufc 314 Champion Goat Legends Backing

May 16, 2025

Latest Posts

-

High Profile Nhl 4 Nations Face Off In Pei Cost Analysis And Legislative Review

May 16, 2025

High Profile Nhl 4 Nations Face Off In Pei Cost Analysis And Legislative Review

May 16, 2025 -

Pei Legislature Reviews 500 000 Bill For Nhl 4 Nations Face Off

May 16, 2025

Pei Legislature Reviews 500 000 Bill For Nhl 4 Nations Face Off

May 16, 2025 -

500 000 Pei Bill For Nhl 4 Nations Face Off Legislative Details

May 16, 2025

500 000 Pei Bill For Nhl 4 Nations Face Off Legislative Details

May 16, 2025 -

Lnh Le Deplacement Du Repechage Une Erreur

May 16, 2025

Lnh Le Deplacement Du Repechage Une Erreur

May 16, 2025 -

La Decentralisation Du Repechage De La Lnh Un Regret

May 16, 2025

La Decentralisation Du Repechage De La Lnh Un Regret

May 16, 2025