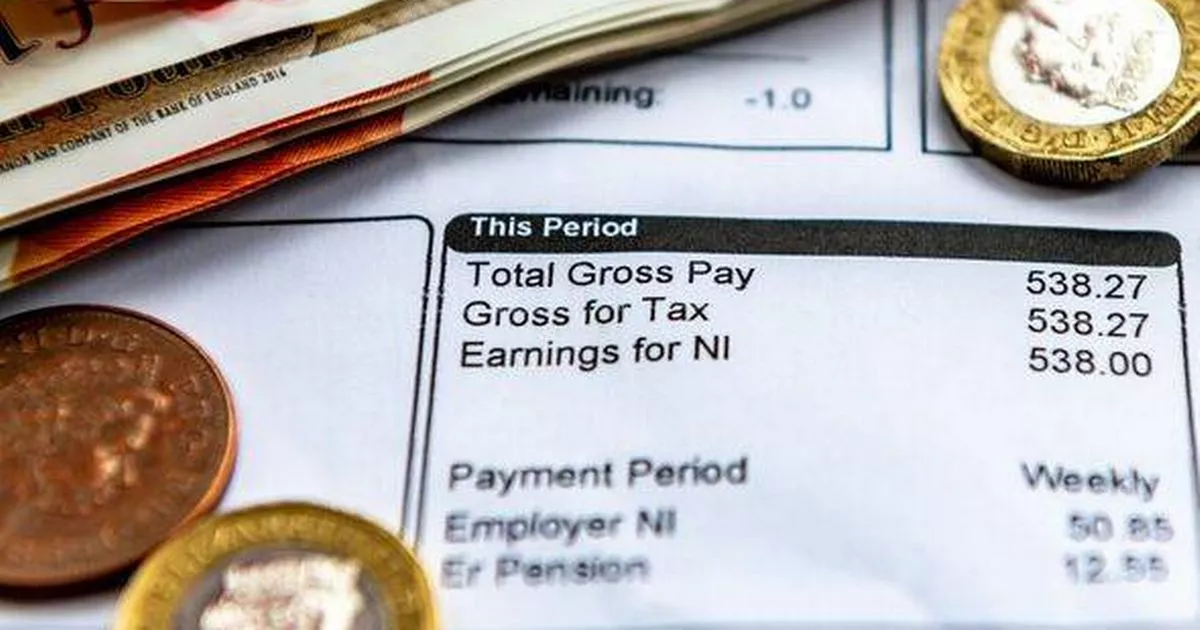

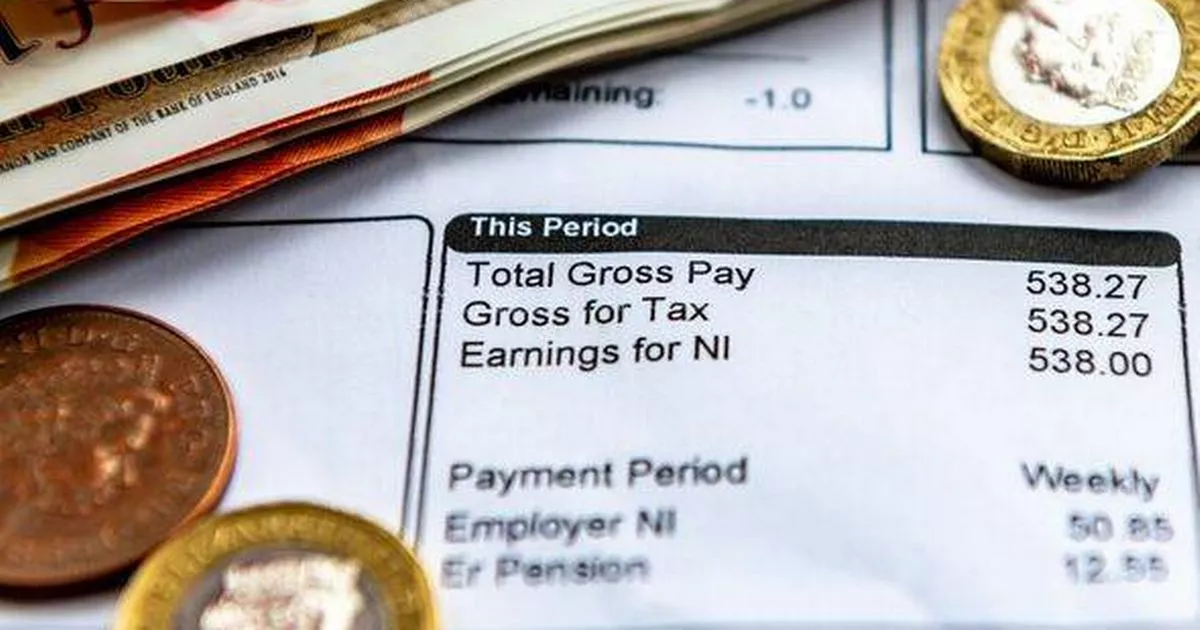

Millions Could Be Owed HMRC Refunds: Check Your Payslip Now

Table of Contents

Common Reasons for HMRC Refunds

Several factors can lead to overpayment of tax, resulting in potential HMRC refunds. Understanding these common reasons is the first step to reclaiming what's rightfully yours.

Tax Code Errors

Incorrect tax codes are a leading cause of overpaid tax. Your tax code determines how much income tax is deducted from your salary. An incorrect code can lead to too much tax being taken each month, accumulating into a significant overpayment over time.

- Examples of incorrect tax codes and their consequences:

- A code that's too high (e.g., 1257L instead of 1257) will result in higher tax deductions.

- A code that doesn't reflect your personal circumstances (e.g., neglecting marriage allowance) can lead to overpayment.

- How to identify a potentially incorrect tax code: Compare your payslip tax code to your HMRC online account details. Any discrepancies should be investigated.

Changes in Personal Circumstances

Life events often impact your tax liability. Failing to inform HMRC of these changes can lead to overpayment and potential HMRC refunds.

- Specific life events that may qualify for a refund:

- Marriage or civil partnership: You might be eligible for marriage allowance.

- Childbirth: Child benefit and tax credits can affect your tax code.

- Job change: Changes in income or employment status require updates to your tax code.

- Moving house: This can impact your council tax band and therefore your overall tax liability.

Pension Contributions

Pension contributions reduce your taxable income, thus lowering your overall tax bill. However, errors in recording these contributions can lead to overpayment and potential HMRC refunds.

- Different types of pension contributions and their tax implications:

- Workplace pensions: Contributions are usually tax-deductible.

- Personal pensions: You can claim tax relief on contributions.

How to Check Your Payslip for Potential HMRC Refunds

Regularly reviewing your payslips is crucial for identifying potential overpayments and claiming your HMRC refunds.

Key Information to Look For

Focus on these key areas of your payslip:

- Tax Code: Check for accuracy and consistency with your HMRC online account.

- Tax Deducted: Compare this amount to your expected tax liability based on your income and tax code. Significant discrepancies should raise a flag.

- Net Pay: While not a direct indicator, unusually low net pay could suggest overpayment of tax.

Understanding Your Tax Code

Understanding your tax code is vital. Many online resources can help decipher its meaning.

- Resources to help decipher your tax code: Use the HMRC website or consult a tax advisor if needed.

Comparing Payslips Over Time

Comparing payslips over several months can reveal inconsistencies and potential overpayment patterns.

- Tips on how to effectively compare payslips: Create a spreadsheet to track key data points like tax deducted and net pay over time.

How to Claim Your HMRC Refund

Claiming a refund is a straightforward process.

Gathering Necessary Documentation

You will need:

- Recent payslips

- P60s (end-of-year tax statements)

- Any other relevant documentation supporting your claim (e.g., marriage certificate)

Online Claim Process

The easiest way to claim is online through the HMRC website.

Alternative Claim Methods

You can also contact HMRC directly by phone or post, though the online method is generally quicker.

Timeframe for Receiving a Refund

HMRC usually processes refunds within a few weeks, but this can vary.

Conclusion

Millions of people in the UK could be owed substantial HMRC refunds due to various factors such as incorrect tax codes, unreported life events, or miscalculations related to pension contributions. Checking your payslips regularly for discrepancies is crucial to ensure you're not overpaying tax. Claiming your HMRC refund is a relatively straightforward process, either online or via other HMRC channels. Don't delay – check your payslips now and see if you're owed an HMRC refund! Share this article to help others find out about potential refunds. For more information, visit the HMRC website: .

Featured Posts

-

Balancing Hamilton And Leclerc Ferraris Delicate Act

May 20, 2025

Balancing Hamilton And Leclerc Ferraris Delicate Act

May 20, 2025 -

Suki Waterhouses Full Circle Met Gala Style Evolution

May 20, 2025

Suki Waterhouses Full Circle Met Gala Style Evolution

May 20, 2025 -

Nyt Mini Crossword Answers Today March 13 2025 Hints And Clues

May 20, 2025

Nyt Mini Crossword Answers Today March 13 2025 Hints And Clues

May 20, 2025 -

Local History Unveiled New Burnham And Highbridge Photo Archive Opens

May 20, 2025

Local History Unveiled New Burnham And Highbridge Photo Archive Opens

May 20, 2025 -

Solve The Nyt Mini Crossword Answers For March 16 2025

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 16 2025

May 20, 2025

Latest Posts

-

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025 -

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025 -

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025 -

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025