Mississippi Income Tax: Governor's Decision Impacts Hernando's Future

Table of Contents

Potential Economic Benefits of Reduced Mississippi Income Tax in Hernando

Lowering the Mississippi income tax could offer several advantages for Hernando's economic development.

Increased Investment and Business Growth

Reduced tax burdens can act as a powerful incentive, encouraging businesses to establish themselves in or expand their operations within Hernando. This influx of businesses translates to:

- Job Creation: New businesses bring new job opportunities, potentially attracting a higher-skilled workforce and boosting the local economy.

- Higher-Paying Employment: Businesses seeking a more tax-advantageous location may offer more competitive salaries, improving the overall standard of living in Hernando.

- Reinvestment of Profits: With less money going to taxes, businesses can reinvest profits into expansion, further fueling economic growth and job creation.

Examples from other Mississippi towns that have experienced similar tax cuts show a correlation between reduced taxes and increased business activity. A comparative study of these towns could provide valuable insights for Hernando's future planning.

Attracting New Residents and Boosting the Housing Market

Lower Mississippi income taxes can make Hernando a more appealing place to live, attracting new residents and stimulating the local housing market. This leads to:

- Increased Housing Demand: A growing population creates higher demand for housing, potentially leading to increased property values and construction activity.

- Higher Consumer Spending: Increased disposable income, due to lower taxes, results in greater consumer spending within the Hernando community, supporting local businesses.

Analyzing case studies of other towns where lower taxes impacted housing markets could offer valuable data to predict Hernando's potential growth. Historical data on property values and building permits can be used to project future trends.

Potential Drawbacks and Challenges of the Mississippi Income Tax Cuts for Hernando

While tax cuts offer potential benefits, it's crucial to consider potential negative consequences for Hernando.

Impact on Public Services

Reduced income tax revenue for the state could lead to decreased funding for essential public services in Hernando. This could manifest in:

- Cuts to Education: Less funding might result in larger class sizes, reduced educational programs, and decreased teacher salaries.

- Infrastructure Deficiencies: Maintenance and upgrades to roads, bridges, and other infrastructure could be delayed or scaled back.

- Public Safety Concerns: Reduced funding could impact police and fire departments, potentially affecting response times and public safety.

A thorough analysis of the potential revenue shortfall and the resulting impact on specific Hernando services is crucial. Exploring alternative funding mechanisms, such as increased property taxes or local sales taxes, would be necessary to mitigate potential negative impacts.

Income Inequality and its Effect on Hernando's Population

Tax cuts may disproportionately benefit higher-income earners, exacerbating income inequality within Hernando. This could lead to:

- Widening Wealth Gap: Lower-income families might not see the same level of benefit from tax cuts as higher-income families.

- Social and Economic Disparities: Increased inequality could lead to social unrest and hinder overall community development.

Detailed analysis of the distribution of wealth within Hernando before and after the tax cuts is necessary to understand the long-term consequences. Considering targeted support programs for lower-income families could help lessen the negative impact of income inequality.

Long-Term Outlook and Strategic Planning for Hernando's Economic Future

Navigating the changes brought about by the Mississippi income tax cuts requires proactive planning and community involvement.

Adaptation and Mitigation Strategies

Hernando needs to implement strategies to minimize potential negative impacts and maximize positive ones:

- Diversification of Industries: Attracting a diverse range of industries can reduce reliance on specific sectors and create more resilient economic growth.

- Sustainable Development: Focusing on sustainable long-term growth strategies will ensure Hernando's economic stability despite fluctuations in state-level policies.

- Infrastructure Investments: Investing in infrastructure projects will be crucial to ensure a business-friendly environment.

Proactive engagement with state and regional economic development organizations can help Hernando secure funding for essential projects and secure advantages for local businesses.

Community Engagement and Collaboration

Collaboration between local government, businesses, and residents is essential for successful navigation of these changes:

- Public-Private Partnerships: Joint ventures between the public and private sectors can leverage resources and expertise for impactful community development projects.

- Community Initiatives: Community-led initiatives to support local businesses and attract investment can foster a stronger and more resilient economy.

Open communication channels and a strong sense of community will be crucial in navigating this significant shift in Mississippi income tax policy.

Conclusion

The Mississippi Governor's decision on income tax changes will significantly affect Hernando's future. While opportunities for economic growth exist, careful consideration of potential challenges related to public services and income inequality is paramount. Understanding the nuances of this Mississippi income tax shift is vital for Hernando's residents and businesses. Stay informed, participate in local government processes, and engage in community initiatives to help shape Hernando's future. Learn more about the implications of the Mississippi income tax changes and how they will directly impact your community.

Featured Posts

-

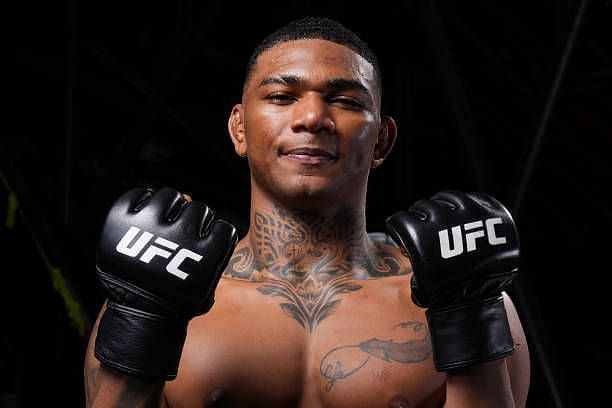

Who Is Michael Morales Ufcs Undefeated Welterweight Contender

May 19, 2025

Who Is Michael Morales Ufcs Undefeated Welterweight Contender

May 19, 2025 -

The Reality Of Unequal Earnings Starving On An A List Salary

May 19, 2025

The Reality Of Unequal Earnings Starving On An A List Salary

May 19, 2025 -

Creating A Chateau Aesthetic Affordable Chateau Diy Home Decor

May 19, 2025

Creating A Chateau Aesthetic Affordable Chateau Diy Home Decor

May 19, 2025 -

Eurovision 2025 Az Rbaycani S Fur T Msil Ed C K

May 19, 2025

Eurovision 2025 Az Rbaycani S Fur T Msil Ed C K

May 19, 2025 -

Canadian Tire And Hudsons Bay Synergies Challenges And Future Outlook

May 19, 2025

Canadian Tire And Hudsons Bay Synergies Challenges And Future Outlook

May 19, 2025