Monday's Market Drop: Deciphering The D-Wave Quantum (QBTS) Stock Fall

Table of Contents

Potential Factors Contributing to the D-Wave Quantum Stock Fall

Several factors likely contributed to the significant decline in D-Wave Quantum's stock price on Monday. Understanding these contributing elements is crucial for investors seeking to interpret the market's reaction and make informed decisions.

Broad Market Downturn

Monday's market drop wasn't isolated to QBTS. A broader tech sector downturn, influenced by prevailing economic anxieties, likely played a significant role.

- The Nasdaq Composite, a benchmark for technology stocks, experienced a considerable decrease, indicating a negative overall sentiment towards the tech industry.

- Concerns about rising interest rates and potential recessionary pressures weighed heavily on investor confidence, impacting even companies perceived as having strong long-term potential.

- Negative news concerning inflation and potential Federal Reserve actions further exacerbated the market's bearish mood.

Sector-Specific Concerns

Beyond the broader market trends, specific worries within the quantum computing sector may have also contributed to the QBTS stock drop.

- Increased competition from other quantum computing companies, each vying for market share and investment, creates uncertainty within the sector.

- Potential delays in the development and deployment of commercially viable quantum computers could lead investors to question the near-term prospects of the technology.

- Regulatory hurdles and the need for significant further investment in research and development might also have dampened investor enthusiasm.

Company-Specific News

While no major negative news was directly released by D-Wave Quantum on Monday, the absence of positive announcements in a volatile market could have contributed to the sell-off.

- The lack of significant updates on partnerships or technological breakthroughs might have led investors to take profits or reduce their exposure.

- Speculation about future funding rounds or potential challenges in securing additional capital could have fueled negative sentiment among investors.

- Any perceived delays in project timelines or shifts in corporate strategy, even without official announcements, could be interpreted negatively by the market.

Investor Sentiment and Trading Activity

The QBTS stock drop was accompanied by increased trading volume, suggesting a significant shift in investor sentiment.

- High trading volume coupled with a sharp price decline points to a combination of selling pressure and potential short-selling activity.

- Analysis of short interest data (if available) could offer insights into the extent to which short selling contributed to the downward pressure.

- Unusual trading patterns, identified through market analysis tools, might reveal additional insights into the drivers of the QBTS stock fall.

Analyzing the Impact of the D-Wave Quantum Stock Fall

The D-Wave Quantum stock fall has significant ramifications for both investors and the quantum computing industry as a whole.

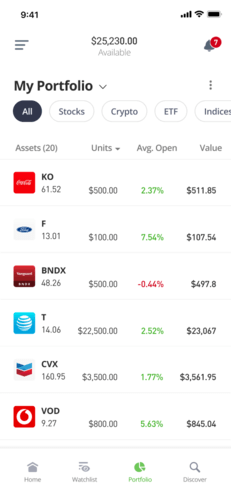

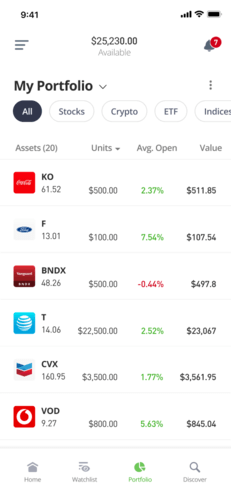

Impact on Investors

The decline in QBTS stock price directly impacted existing investors.

- Investors experienced a significant decrease in their portfolio value, with the percentage loss directly proportional to their holdings.

- The negative market reaction likely led to a wave of selling, further amplifying the price drop and impacting investor confidence.

- The overall sentiment among QBTS investors shifted towards caution and uncertainty, highlighting the volatility inherent in investing in early-stage technology companies.

Impact on the Quantum Computing Industry

The QBTS stock drop raises broader concerns about the quantum computing industry.

- The decline could negatively impact the ability of quantum computing companies to secure funding for future research and development.

- Investor confidence in the sector may be temporarily shaken, potentially delaying investment in other quantum computing ventures.

- While not necessarily indicative of an industry-wide crisis, the QBTS drop underscores the risks involved in investing in this nascent technology.

Future Outlook and Investment Strategies for D-Wave Quantum

Despite Monday's setback, the future outlook for D-Wave Quantum and the quantum computing sector remains complex.

Potential for Recovery

Several factors could trigger a potential recovery in the QBTS stock price.

- The successful completion of key milestones in research and development and announcements of significant partnerships could boost investor confidence.

- Positive news concerning technological breakthroughs or increased adoption of quantum computing technologies in various industries could lead to a rebound.

- Strong financial results from future earnings reports could also demonstrate the company's resilience and long-term growth potential.

Risk Assessment

Investing in QBTS or any company in the quantum computing sector involves significant risks.

- The technology is still in its early stages, making the success of any given company uncertain.

- Market volatility is inherent in the tech sector, particularly in this emerging area, leading to significant price fluctuations.

- Intense competition from established tech giants and emerging quantum computing startups adds further complexity to the investment landscape.

Investment Recommendations

Based on the analysis, investors should exercise caution when considering investments in QBTS. (Disclaimer: This is not financial advice).

- Thorough due diligence is crucial before making any investment decisions, including a careful assessment of company financials, market conditions, and competitive landscape.

- Diversifying investments across different sectors and asset classes is vital to mitigate risks.

- Adopting a long-term investment strategy, rather than reacting to short-term market fluctuations, may be more appropriate for this sector.

Conclusion

The D-Wave Quantum (QBTS) stock fall on Monday resulted from a complex interplay of broad market trends, sector-specific concerns, and potentially some company-specific factors. While the decline is a cause for concern, it doesn't necessarily signal the demise of the quantum computing sector or D-Wave Quantum. The key takeaways are the significant risks inherent in investing in this emerging technology and the importance of careful research and risk management. To make informed decisions, monitor the D-Wave Quantum stock, stay updated on QBTS developments, and track the fluctuations of D-Wave Quantum in relation to broader market trends and sector-specific news. Understanding these dynamics is key to navigating the future of quantum computing investments.

Featured Posts

-

Did Abc Cbs And Nbc Censor Coverage Of The New Mexico Gop Arson Attack A News Analysis

May 20, 2025

Did Abc Cbs And Nbc Censor Coverage Of The New Mexico Gop Arson Attack A News Analysis

May 20, 2025 -

Explore Burnham And Highbridges Past Photo Archive Grand Opening

May 20, 2025

Explore Burnham And Highbridges Past Photo Archive Grand Opening

May 20, 2025 -

Abc News Shows Future In Jeopardy After Staff Cuts

May 20, 2025

Abc News Shows Future In Jeopardy After Staff Cuts

May 20, 2025 -

Mesure De Restriction Des 2 Et 3 Roues Boulevard Fhb Ex Vge A Partir Du 15 Avril

May 20, 2025

Mesure De Restriction Des 2 Et 3 Roues Boulevard Fhb Ex Vge A Partir Du 15 Avril

May 20, 2025 -

Cote D Ivoire Lancement Des Plans D Urbanisme De Detail Une Invitation A La Collaboration Des Maires

May 20, 2025

Cote D Ivoire Lancement Des Plans D Urbanisme De Detail Une Invitation A La Collaboration Des Maires

May 20, 2025

Latest Posts

-

Huuhkajat Avauskokoonpanoon Merkittaeviae Muutoksia

May 20, 2025

Huuhkajat Avauskokoonpanoon Merkittaeviae Muutoksia

May 20, 2025 -

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 20, 2025 -

Huuhkajat Kaellman Ja Hoskonen Etsivaet Uutta Seuraa

May 20, 2025

Huuhkajat Kaellman Ja Hoskonen Etsivaet Uutta Seuraa

May 20, 2025 -

Jalkapalloilijat Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025

Jalkapalloilijat Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025 -

Kaellman Ja Hoskonen Puolalainen Seuran Vaihtuu

May 20, 2025

Kaellman Ja Hoskonen Puolalainen Seuran Vaihtuu

May 20, 2025