Monday's Rise In D-Wave Quantum Inc. (QBTS) Stock: An In-Depth Look

Table of Contents

D-Wave Quantum Inc. (QBTS), a leading player in the burgeoning field of quantum computing, experienced a significant stock price increase on Monday. This unexpected surge in the QBTS stock price has sparked considerable interest, prompting investors and analysts alike to seek an explanation for this market movement. This article aims to provide an in-depth analysis of Monday's events, exploring the potential factors contributing to the rise in D-Wave Quantum stock, assessing the associated risks, and offering strategic considerations for investors interested in the quantum computing stock market, specifically focusing on QBTS stock price fluctuations and D-Wave Quantum stock analysis.

Analyzing the Factors Contributing to QBTS Stock's Rise

Several factors likely contributed to the upward trajectory of QBTS stock on Monday. Let's delve into the key elements that influenced investor sentiment and market behavior.

Positive News and Announcements

Positive news and announcements often serve as catalysts for stock price increases. Did D-Wave Quantum release any press releases or partnerships that could explain Monday's surge? This section requires real-time information and verification of any relevant news.

- Example: Hypothetical scenario: If D-Wave announced a major partnership with a Fortune 500 company to utilize their quantum annealing technology for optimization problems, it could significantly boost investor confidence. This would be a positive development impacting D-Wave Quantum news and QBTS partnership announcements. (Insert link to hypothetical news source here).

- Example: Another Hypothetical Scenario: The announcement of a significant technological breakthrough, like achieving a higher level of qubit coherence or developing a new algorithm solving a previously intractable problem, could also trigger a positive market reaction. This would represent a quantum computing breakthrough and impact the D-Wave Quantum news cycle. (Insert link to hypothetical news source here).

Market Sentiment and Investor Behavior

Market sentiment plays a crucial role in shaping stock prices. The overall positive sentiment towards the technology sector, especially within the innovative quantum computing investment space, could influence QBTS’s performance.

- General Market Trends: A positive trend in the broader technology market often lifts related stocks, including those in the quantum computing sector.

- Investor Speculation: Speculative trading, driven by anticipation of future growth in the quantum computing industry, can lead to price volatility.

- Social Media Influence: Social media platforms can amplify positive or negative narratives, influencing investor behavior and impacting the QBTS stock price. A wave of positive sentiment on platforms like Twitter or Reddit could contribute to a price surge.

- Investor Confidence: Strong investor confidence in D-Wave Quantum's long-term prospects can fuel demand for its stock, driving the price upwards.

Competitive Landscape and Industry Developments

The competitive landscape and broader industry developments within the quantum computing space also shape investor perception of D-Wave Quantum.

- Competitor Performance: The performance of D-Wave's competitors in the quantum computing field might indirectly influence its stock price. If competitors experience setbacks or slowdowns, D-Wave could benefit from a relative improvement in its market position. This relates to quantum computing competition and would fall under the D-Wave competitors category.

- Industry Advancements: Significant advancements in the broader quantum computing industry can create a positive ripple effect, boosting investor enthusiasm across the sector and benefitting companies like D-Wave. Understanding these quantum computing industry trends is crucial for analyzing QBTS.

Understanding the Risks Associated with QBTS Stock

Investing in QBTS, like any investment in a developing technology, carries inherent risks.

Volatility in the Quantum Computing Market

The quantum computing market is characterized by significant volatility. The technology is still relatively nascent, making it susceptible to unforeseen technological hurdles, regulatory changes, and competitive pressures.

- Technological Setbacks: Potential setbacks in D-Wave's technological development could negatively impact investor sentiment and the QBTS stock price.

- Market Fluctuations: Even positive news can be overshadowed by broader market downturns, resulting in volatility for QBTS and other technology stocks. Understanding technology stock volatility is crucial for risk assessment.

- Competition: Intense competition from other companies developing quantum computing technologies could pressure D-Wave's market share and profitability. This falls under the quantum computing risk category.

Financial Performance and Future Outlook

Analyzing D-Wave Quantum's financial performance, including revenue streams, profitability, and growth projections, is essential for assessing its investment potential. A thorough review of D-Wave financials, specifically QBTS revenue figures, and an analysis of quantum computing profitability within the company are critical.

Strategies for Investors Considering QBTS

Investors considering QBTS should adopt a well-defined strategy that incorporates risk management and a clear investment horizon.

Risk Management and Diversification

Risk management is paramount when investing in the volatile quantum computing market. Diversification is crucial for mitigating potential losses.

- Portfolio Diversification: Investing in a diverse portfolio of assets, not just focusing on QBTS, helps to reduce the overall risk.

- Position Sizing: Carefully determine the appropriate amount to invest in QBTS, relative to your overall investment portfolio.

- Stop-Loss Orders: Employ stop-loss orders to limit potential losses if the stock price declines significantly.

Long-Term vs. Short-Term Investment

The quantum computing industry holds immense long-term potential, but short-term volatility is expected.

- Long-Term Outlook: Investors with a long-term perspective might find QBTS attractive, considering the potential for substantial growth in the quantum computing market.

- Short-Term Trading: Short-term trading in QBTS carries higher risk due to the stock's volatility.

Conclusion: Navigating the Future of D-Wave Quantum Inc. (QBTS) Stock

Monday's rise in D-Wave Quantum Inc. (QBTS) stock highlights the potential and volatility of the quantum computing sector. While positive news and market sentiment can drive significant price increases, understanding the inherent risks is crucial. Before making any investment decisions regarding QBTS or any other quantum computing stocks, conduct thorough research and due diligence. Consider your risk tolerance, investment horizon, and diversify your portfolio. The future of D-Wave Quantum and the quantum computing industry holds considerable promise, but informed decision-making is essential for successful QBTS investment. Carefully consider your QBTS investment strategy and evaluate the D-Wave Quantum stock outlook before making any investment decisions in this dynamic market.

Featured Posts

-

Mohawk Council Faces 220 Million Lawsuit From Kahnawake Casino Owners

May 21, 2025

Mohawk Council Faces 220 Million Lawsuit From Kahnawake Casino Owners

May 21, 2025 -

Update Ex Tory Councillors Wifes Appeal On Racial Hatred Tweet

May 21, 2025

Update Ex Tory Councillors Wifes Appeal On Racial Hatred Tweet

May 21, 2025 -

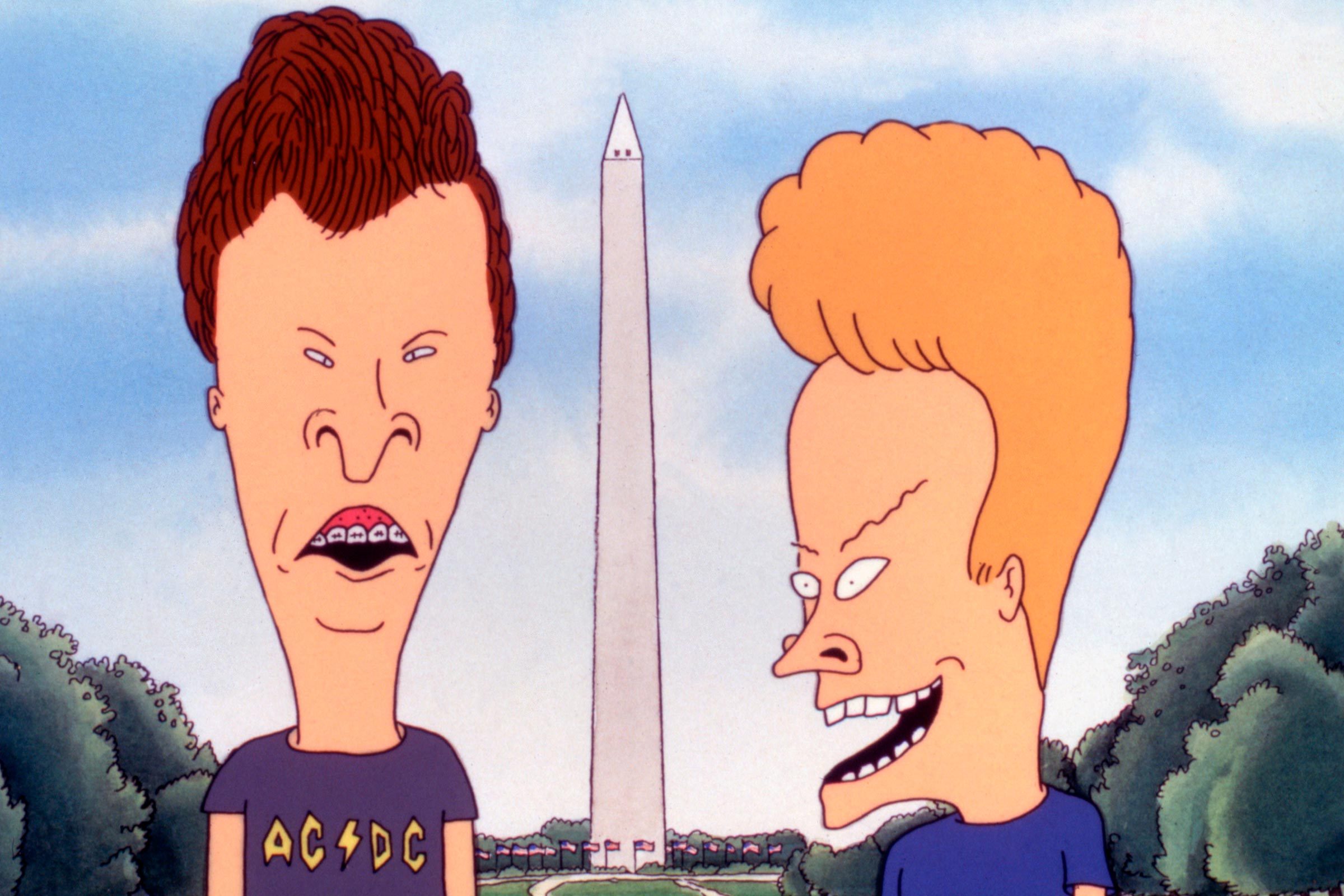

The Goldbergs A Nostalgic Look At 80s Family Life

May 21, 2025

The Goldbergs A Nostalgic Look At 80s Family Life

May 21, 2025 -

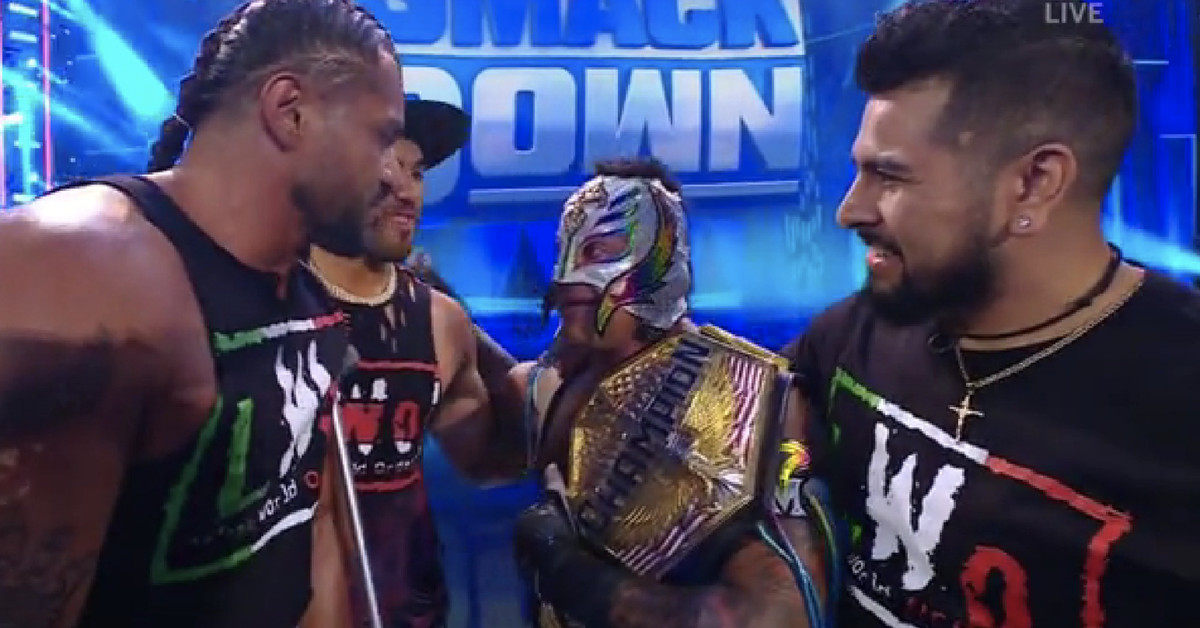

Wwe Smack Down Rey Fenixs Arrival And New Name Unveiled

May 21, 2025

Wwe Smack Down Rey Fenixs Arrival And New Name Unveiled

May 21, 2025 -

Bribery Charges And The Downfall Of A Retired Navy Admiral

May 21, 2025

Bribery Charges And The Downfall Of A Retired Navy Admiral

May 21, 2025

Latest Posts

-

Federal Leaders Saskatchewan Visit Analysis Of Controversial Remarks

May 22, 2025

Federal Leaders Saskatchewan Visit Analysis Of Controversial Remarks

May 22, 2025 -

Financial Times Bp Ceos Plan To Double Company Value Uk Listing Confirmed

May 22, 2025

Financial Times Bp Ceos Plan To Double Company Value Uk Listing Confirmed

May 22, 2025 -

The Goldbergs Cast Characters And Their Real Life Inspirations

May 22, 2025

The Goldbergs Cast Characters And Their Real Life Inspirations

May 22, 2025 -

Slots Admission Liverpools Win Alissons Display And Luis Enriques Opinion

May 22, 2025

Slots Admission Liverpools Win Alissons Display And Luis Enriques Opinion

May 22, 2025 -

The Goldbergs A Complete Guide To The Popular Sitcom

May 22, 2025

The Goldbergs A Complete Guide To The Popular Sitcom

May 22, 2025