Money Laundering Lapses Cost Paytm Payments Bank ₹5.45 Crore: FIU-IND Penalty

Table of Contents

Details of the FIU-IND Penalty Against Paytm Payments Bank

The Amount and its Significance

The ₹5.45 crore penalty imposed on Paytm Payments Bank represents a substantial financial blow. This amount not only impacts the bank's bottom line but also significantly damages its reputation. Such a public penalty can erode customer trust and potentially affect future investor confidence. The penalty also serves as a strong warning – further regulatory action, including more significant fines or even license suspension, remains a possibility if the bank fails to address the underlying issues. Compared to penalties levied on other financial institutions for similar offenses, this amount falls within a range suggesting the seriousness of the AML failures discovered.

The Nature of the Money Laundering Lapses

The FIU-IND's investigation uncovered several critical AML shortcomings in Paytm Payments Bank's operations. The specific violations included:

- Inadequate KYC (Know Your Customer) procedures: Insufficient verification of customer identities and a lack of due diligence in onboarding new clients.

- Failures in transaction monitoring: The bank's systems failed to effectively flag suspicious transactions, allowing potentially illicit activities to go undetected.

- Deficiencies in reporting suspicious activity: The bank failed to report suspicious transactions to the authorities as required by law. This inaction is a serious offense under the Prevention of Money Laundering Act (PMLA).

These lapses demonstrate a systemic failure within the bank's AML compliance framework, highlighting the need for comprehensive reform and improved oversight.

FIU-IND's Role and Enforcement

The FIU-IND plays a vital role in India's fight against financial crime. Its responsibilities include gathering and analyzing financial intelligence, identifying suspicious transactions, and coordinating with law enforcement agencies to investigate and prosecute money laundering cases. The penalty imposed on Paytm Payments Bank demonstrates the FIU-IND's commitment to holding financial institutions accountable for their AML compliance obligations. The process involved a thorough investigation, reviewing evidence of non-compliance with the PMLA, and subsequently imposing the penalty under the relevant legal framework.

Implications for the Fintech Industry and AML Compliance

Increased Scrutiny for Fintech Companies

The Paytm Payments Bank case underscores the increasing regulatory scrutiny faced by fintech companies globally. The rapid growth of the fintech sector has brought with it heightened risks of financial crime, prompting regulators to implement stricter AML rules and increase enforcement. Fintechs, with their innovative and often complex business models, are under intense pressure to demonstrate their commitment to preventing money laundering. We can anticipate stricter regulations and increased penalties for non-compliance in the coming years.

Best Practices for Preventing Money Laundering

To avoid similar penalties, financial institutions, particularly fintechs, must implement robust AML compliance programs. This includes:

- Strong KYC/AML procedures: Implementing rigorous customer due diligence processes, including enhanced due diligence for high-risk customers.

- Effective transaction monitoring systems: Utilizing advanced technology to detect suspicious transactions and patterns.

- Regular employee training on AML regulations: Ensuring that employees are adequately trained on AML regulations and procedures.

- Independent audits of AML programs: Regularly auditing AML programs to identify weaknesses and ensure compliance.

The Impact on Customer Trust

The penalty imposed on Paytm Payments Bank has undoubtedly impacted customer trust. Any association with money laundering activities can severely damage a financial institution's reputation and erode confidence among its customer base. This event serves as a stark reminder that neglecting AML compliance has far-reaching consequences, extending beyond mere financial penalties to include damage to brand image and loss of customer loyalty.

Conclusion: Learning from Paytm's Money Laundering Lapses and Strengthening AML Compliance

The ₹5.45 crore penalty imposed on Paytm Payments Bank serves as a cautionary tale for the entire financial services industry. The incident highlights the critical importance of robust anti-money laundering compliance. Neglecting these measures can result in significant financial penalties, reputational damage, and legal ramifications. Financial institutions must prioritize investing in and strengthening their AML programs, ensuring they meet the ever-evolving regulatory landscape and customer expectations. Ensure your institution prioritizes comprehensive anti-money laundering measures to avoid costly penalties and protect your reputation. Learn more about money laundering prevention best practices today!

Featured Posts

-

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Palace Ta Tanitim

May 15, 2025

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Palace Ta Tanitim

May 15, 2025 -

Jimmy Butler Injury Update How It Affects Warriors Rockets Game 4

May 15, 2025

Jimmy Butler Injury Update How It Affects Warriors Rockets Game 4

May 15, 2025 -

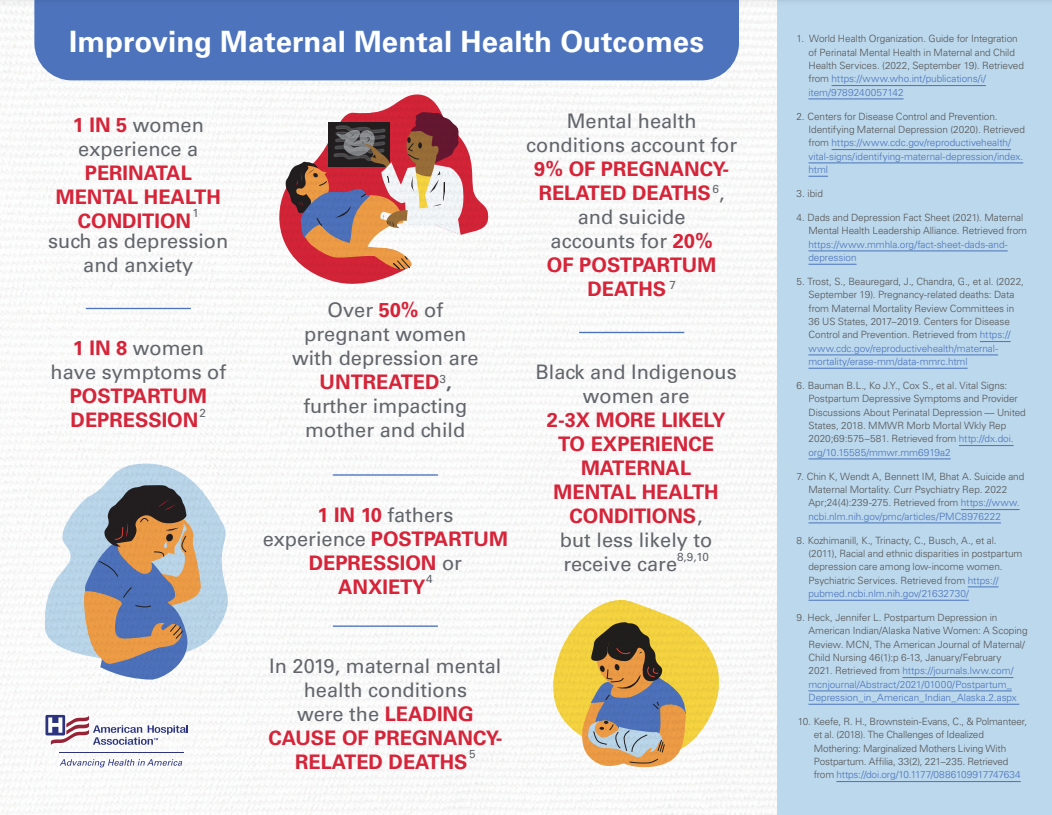

Measuring Gender Euphoria Impact On Transgender Mental Health Outcomes

May 15, 2025

Measuring Gender Euphoria Impact On Transgender Mental Health Outcomes

May 15, 2025 -

Hall Of Famers Comments Exacerbate Jimmy Butler Miami Heat Jersey Number Dispute

May 15, 2025

Hall Of Famers Comments Exacerbate Jimmy Butler Miami Heat Jersey Number Dispute

May 15, 2025 -

Fatih Erbakan Ve Kibris Sehitlerimizin Anisina

May 15, 2025

Fatih Erbakan Ve Kibris Sehitlerimizin Anisina

May 15, 2025

Latest Posts

-

The Warriors Need Jimmy Butler Not Kevin Durant A Strategic Analysis

May 15, 2025

The Warriors Need Jimmy Butler Not Kevin Durant A Strategic Analysis

May 15, 2025 -

Jimmy Butler The Missing Piece The Warriors Need Not Kevin Durant

May 15, 2025

Jimmy Butler The Missing Piece The Warriors Need Not Kevin Durant

May 15, 2025 -

Is Jimmy Butler The Better Fit For The Warriors Than Kevin Durant

May 15, 2025

Is Jimmy Butler The Better Fit For The Warriors Than Kevin Durant

May 15, 2025 -

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025 -

Jimmy Butler Vs Kevin Durant A Case For Butler Joining The Warriors

May 15, 2025

Jimmy Butler Vs Kevin Durant A Case For Butler Joining The Warriors

May 15, 2025