Moody's US Downgrade: White House Condemnation And Economic Fallout

Table of Contents

White House Response and Political Fallout

The White House's response to the Moody's downgrade was swift and scathing. The administration vehemently rejected Moody's assessment, framing the downgrade as a politically motivated attack rather than a reflection of genuine economic weakness.

Official Statements and Criticisms

President Biden and Treasury Secretary Janet Yellen issued strong statements criticizing Moody's methodology and questioning the timing of the downgrade. Key criticisms included:

- Disagreement with Moody's assessment of US fiscal strength: The White House argued that the downgrade overlooked recent economic progress and the administration's efforts to reduce the deficit.

- Allegations of political bias: The administration hinted at partisan motivations behind the downgrade, suggesting it was timed to undermine the President's agenda ahead of the upcoming elections.

- Emphasis on long-term economic stability: The White House reiterated its commitment to long-term fiscal responsibility and highlighted its efforts to strengthen the American economy.

Congressional Reactions and Debate

The downgrade sparked a heated debate in Congress, with Republicans and Democrats offering sharply contrasting interpretations.

- Republican lawmakers largely agreed with Moody's assessment, citing concerns about the national debt and the administration's spending policies. They used the downgrade as ammunition to criticize the Biden administration’s economic stewardship.

- Democratic lawmakers defended the administration's record, arguing that the downgrade was an overreaction and that the US economy remains fundamentally strong. They emphasized the need for bipartisan cooperation to address long-term fiscal challenges.

- Proposed legislative actions ranged from calls for greater fiscal responsibility to proposals for increased government spending to stimulate economic growth. The political maneuvering surrounding the issue promises to be intense in the lead-up to the next election cycle.

Economic Implications of the Moody's Downgrade

The Moody's downgrade carries significant economic consequences, impacting interest rates, the US dollar, and the overall economic outlook.

Impact on Interest Rates and Borrowing Costs

The downgrade is expected to increase US Treasury yields, making it more expensive for the government to borrow money. This will, in turn, likely lead to:

- Higher interest rates on mortgages and consumer loans: Borrowing costs for individuals will likely rise, potentially dampening consumer spending.

- Increased borrowing costs for businesses: Higher interest rates will make it more expensive for businesses to invest and expand, potentially slowing economic growth.

- Reduced government spending: The increased cost of borrowing could force the government to cut spending in certain areas.

Effect on the US Dollar and Global Markets

The downgrade has already impacted the value of the US dollar, causing some volatility in the foreign exchange markets. Further implications include:

- Potential weakening of the US dollar: A weaker dollar could make imports more expensive and potentially fuel inflation.

- Increased volatility in global financial markets: The uncertainty surrounding the US economy could trigger wider market fluctuations.

- Shift in global investment flows: Investors may reconsider their investments in US assets, potentially leading to capital outflows.

Long-Term Economic Outlook and Uncertainty

The long-term consequences of the Moody's downgrade remain uncertain, but several potential scenarios exist:

- Slower economic growth: Higher interest rates and reduced investment could lead to a slowdown in economic growth.

- Increased inflation: A weaker dollar and higher borrowing costs could exacerbate inflationary pressures.

- Increased risk of recession: The combined effects of higher interest rates, reduced investment, and decreased consumer spending could increase the likelihood of a recession.

Moody's Justification and Methodology

Moody's cited several factors in justifying their decision to downgrade the US credit rating.

Key Factors Cited in the Downgrade

The rating agency's report highlighted:

- Persistent fiscal challenges: Moody's expressed concerns about the increasing national debt and the projected trajectory of US government finances.

- Erosion of governance strength: Concerns were raised about the increasing political polarization and the potential for gridlock in addressing fiscal challenges.

- Projections of continued deterioration: Moody's forecast that the fiscal situation in the US is likely to worsen in the coming years.

Critique of Moody's Methodology and Potential Biases

Critics have questioned Moody's methodology and raised concerns about potential biases. Arguments include:

- Overemphasis on short-term factors: Some argue that Moody's focused too heavily on short-term fiscal challenges while neglecting the long-term strengths of the US economy.

- Potential political influence: Concerns have been raised about the potential for political influence to shape the agency's assessment.

- Inconsistency with other rating agencies: The downgrade contrasts with the ratings maintained by other major credit rating agencies, raising questions about the overall accuracy of the assessment.

Conclusion: Understanding the Implications of the Moody's US Downgrade

The Moody's downgrade of the US credit rating is a significant event with far-reaching consequences. The White House's condemnation, the potential for increased interest rates and economic slowdown, and the overall uncertainty created by this decision all underscore the gravity of the situation. The implications for the US economy, global markets, and future fiscal policy are substantial and will require careful monitoring.

Stay informed about the evolving situation regarding the Moody's US downgrade and its implications for the American economy. Continue to follow reputable news sources for updates and analysis. Understanding the nuances of this “Moody's downgrade” is crucial for navigating the economic uncertainty ahead.

Featured Posts

-

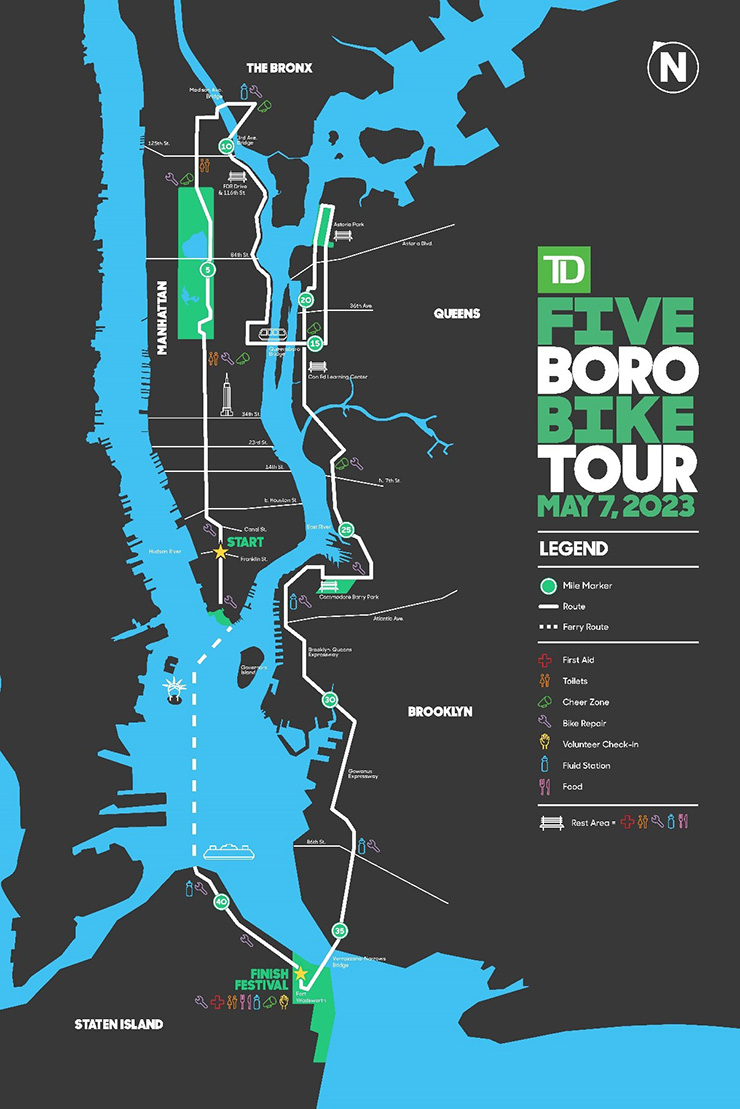

Planning Your Five Boro Bike Tour Tips For A Smooth Nyc Ride

May 18, 2025

Planning Your Five Boro Bike Tour Tips For A Smooth Nyc Ride

May 18, 2025 -

The Auto Industrys Growing Resistance To Electric Vehicle Mandates

May 18, 2025

The Auto Industrys Growing Resistance To Electric Vehicle Mandates

May 18, 2025 -

East Hampton Officer Luis Morales Dwi Arrest And Charges Filed By Southampton Police

May 18, 2025

East Hampton Officer Luis Morales Dwi Arrest And Charges Filed By Southampton Police

May 18, 2025 -

Photos Cassie And Alex Fines Red Carpet Moment At Mob Land Premiere

May 18, 2025

Photos Cassie And Alex Fines Red Carpet Moment At Mob Land Premiere

May 18, 2025 -

Maneskins Damiano David On Jimmy Kimmel Live Performance Highlights

May 18, 2025

Maneskins Damiano David On Jimmy Kimmel Live Performance Highlights

May 18, 2025