Mortgage Rates Below 3%: Can They Revive Canada's Housing Market?

Table of Contents

The Allure of Sub-3% Mortgage Rates

The allure of mortgage rates below 3% is undeniable, particularly for potential homebuyers who have been sidelined by higher borrowing costs.

Increased Affordability

Lower mortgage rates translate directly into significantly reduced monthly payments. This increased affordability opens the door to homeownership for a wider range of buyers, particularly first-time homebuyers.

- Example: A $500,000 mortgage at a 3% interest rate over 25 years results in a monthly payment approximately $2,000 lower than a similar mortgage at 5%. A $400,000 mortgage sees an even more significant difference.

- Impact on First-Time Homebuyers: For many first-time homebuyers, the difference between a 3% and a 5% mortgage rate could be the deciding factor in whether or not they can afford to enter the market. This surge in affordability could inject much-needed energy into the market.

Stimulating Buyer Demand

The potential for lower monthly payments acts as a powerful incentive, encouraging those who were previously hesitant due to high interest rates to re-enter the market. This renewed buyer demand could lead to increased market activity.

- Increased Buyer Activity Predictions: Real estate analysts predict a notable surge in buyer activity if sub-3% mortgage rates persist.

- Impact on Inventory Levels: Increased demand could potentially help to reduce the current high levels of unsold inventory in some regions.

- Pent-Up Demand: There's significant pent-up demand from buyers who delayed purchases due to higher rates. Low rates could unlock this potential.

Challenges and Counterarguments

While sub-3% mortgage rates are undeniably attractive, several challenges and counterarguments need consideration.

Economic Uncertainty

Lingering economic concerns, such as inflation and potential interest rate hikes by the Bank of Canada, cast a shadow over the long-term viability of these low rates.

- Current Inflation Rates: High inflation continues to erode purchasing power, potentially offsetting some of the benefits of lower mortgage rates.

- Potential Bank of Canada Actions: The Bank of Canada's actions to combat inflation could lead to future interest rate increases, potentially negating the positive impacts of current low rates.

- Impact of Rising Living Costs: The rising cost of living puts pressure on household budgets, potentially limiting how much buyers can realistically afford to spend on a home, even with lower mortgage rates.

Other Market Factors

The Canadian housing market is influenced by factors beyond just interest rates.

- Supply Chain Issues: Ongoing supply chain disruptions continue to impact construction timelines and housing inventory.

- Limited Housing Inventory: A shortage of available homes for sale in many areas remains a significant constraint.

- Government Regulations: Government policies and regulations related to housing also play a crucial role in shaping market dynamics.

- Immigration Levels: High levels of immigration continue to exert upward pressure on housing demand.

Regional Variations in Impact

The impact of sub-3% mortgage rates will not be uniform across Canada. Regional variations in market conditions will influence the extent of any market recovery.

Market-Specific Analysis

Specific market dynamics in different regions will affect buyer response.

- High Demand/Low Inventory Regions: In areas with already high demand and limited inventory, low rates could lead to a rapid increase in competition and potentially drive prices upward.

- Oversupply Regions: In regions experiencing an oversupply of housing, the impact of lower rates might be less dramatic, with prices potentially remaining relatively stagnant.

- Local Economic Factors: Regional economic conditions will also play a significant role. Strong local economies will tend to see greater market responsiveness to lower rates.

Long-Term Outlook and Predictions

The sustainability of any housing market recovery fueled by sub-3% mortgage rates depends on several factors.

Sustainable Growth?

Sustained growth hinges on various factors and predictions.

- Expert Opinions: Experts hold diverse opinions on the long-term outlook, with some predicting a moderate recovery and others remaining cautious.

- Forecasts for House Price Growth: Forecasts for future house price growth vary depending on the region and economic assumptions.

- Predictions for Market Stability: Market stability depends on the interplay between buyer demand, inventory levels, and economic conditions.

Conclusion

Sub-3% mortgage rates offer increased affordability and could stimulate buyer demand in Canada's housing market. However, economic uncertainty, limited inventory, and regional variations in market conditions must be considered. While these low rates offer potential benefits, they aren't a guaranteed solution for a quick market recovery. Stay updated on the latest mortgage rates below 3% and consult with a financial advisor to explore your options in Canada's revitalized housing market. Don't miss out on the potential benefits of low mortgage rates – explore your options today! [Link to mortgage rate comparison tool or financial advisor directory]

Featured Posts

-

Double Standards Uk And Australias Selective Sanctions On Myanmar

May 13, 2025

Double Standards Uk And Australias Selective Sanctions On Myanmar

May 13, 2025 -

Kyle Tuckers Comments On Chicago Cubs Fans Spark Debate

May 13, 2025

Kyle Tuckers Comments On Chicago Cubs Fans Spark Debate

May 13, 2025 -

Sun Kissed Highlights Eva Longorias Stunning Hairstyle Transformation

May 13, 2025

Sun Kissed Highlights Eva Longorias Stunning Hairstyle Transformation

May 13, 2025 -

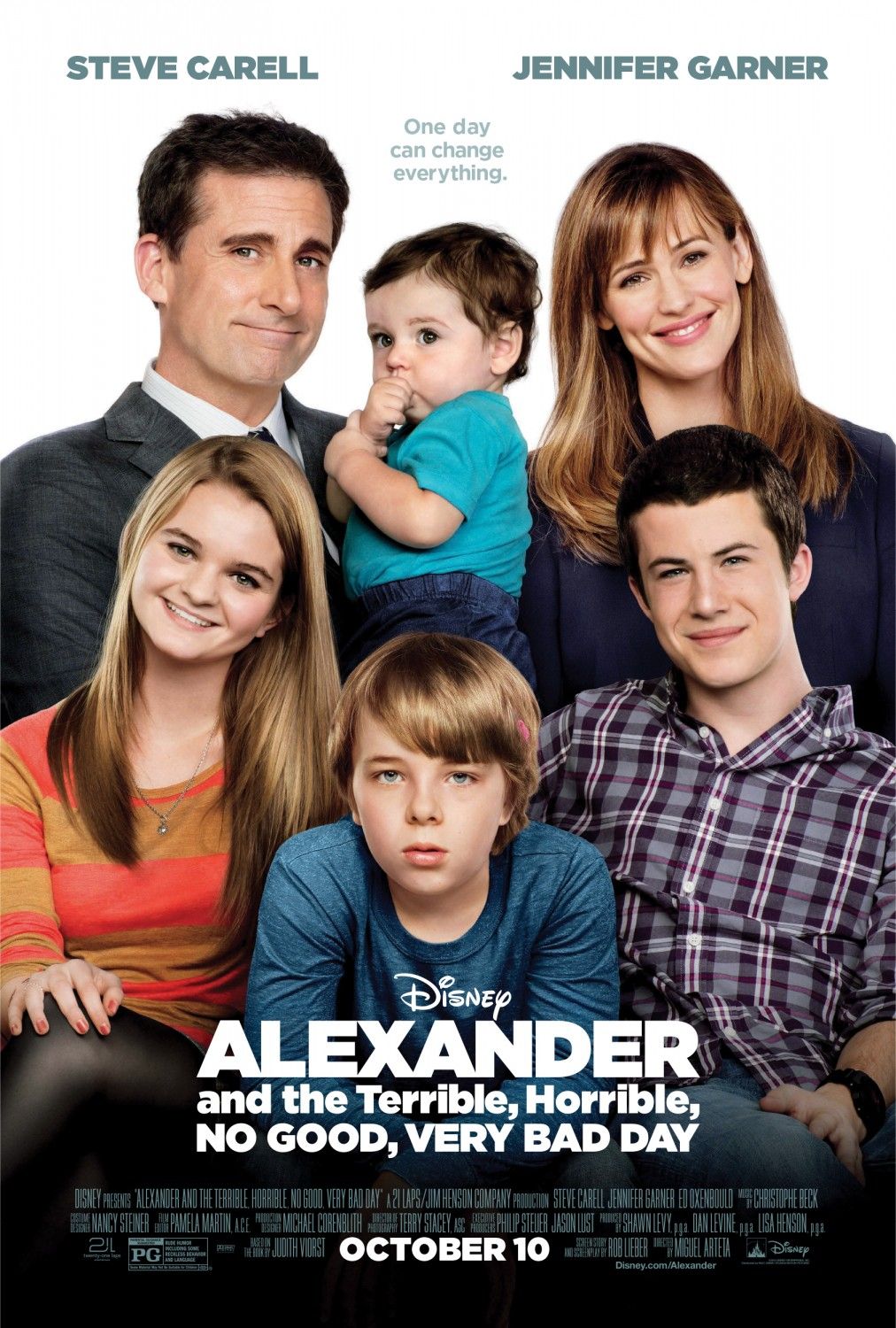

Eva Longorias Hilarious Road Trip Disasters In Alexander And The Terrible Horrible No Good Very Bad Day

May 13, 2025

Eva Longorias Hilarious Road Trip Disasters In Alexander And The Terrible Horrible No Good Very Bad Day

May 13, 2025 -

Lywnardw Dy Kapryw W Adryn Brwdy Bazy Dr Fylm Aywl Knywl

May 13, 2025

Lywnardw Dy Kapryw W Adryn Brwdy Bazy Dr Fylm Aywl Knywl

May 13, 2025

Latest Posts

-

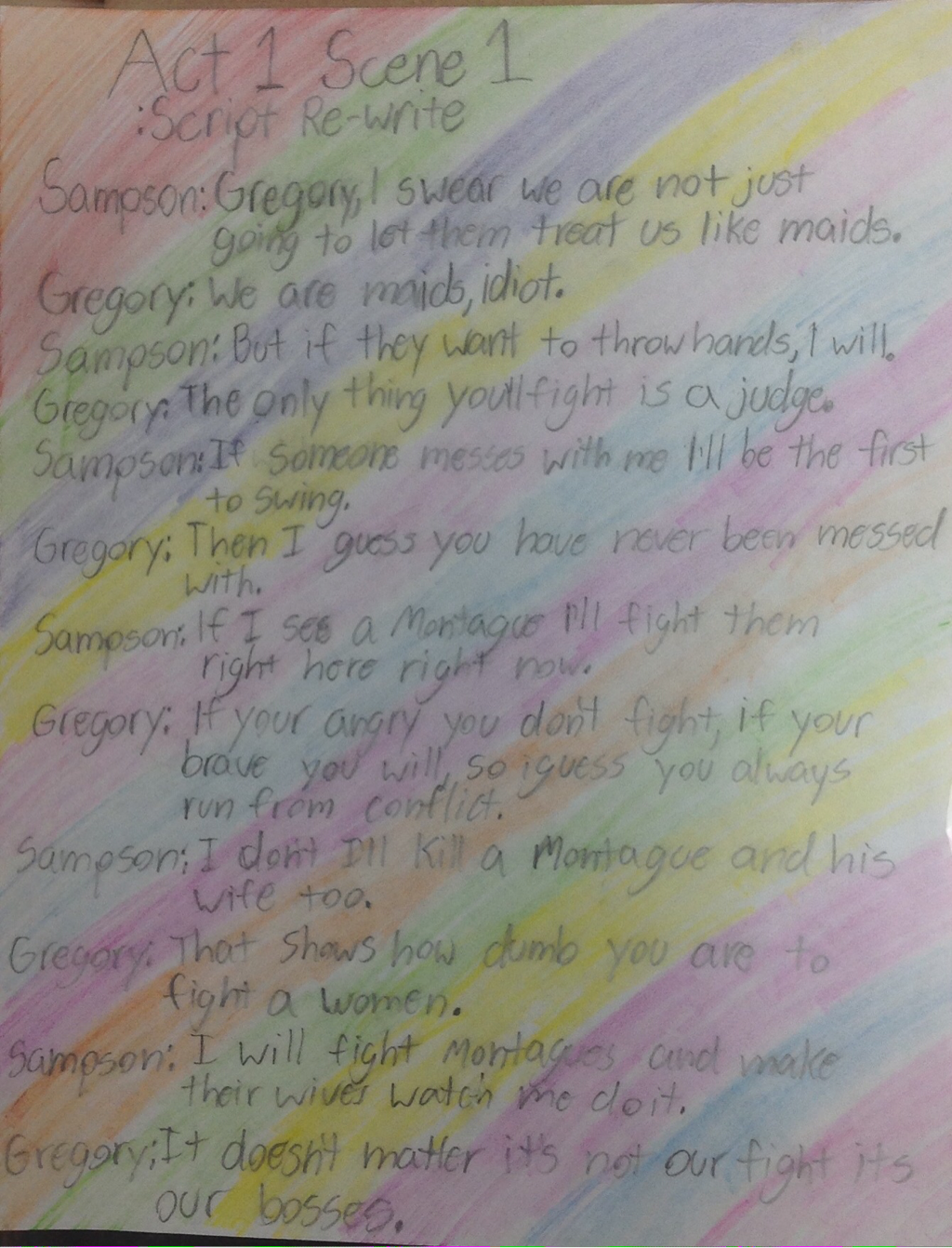

Beyonces Influence Five Script Changes Demanded Before Film Role

May 13, 2025

Beyonces Influence Five Script Changes Demanded Before Film Role

May 13, 2025 -

Hollywood Producers Five Time Script Rewrite For Beyonce

May 13, 2025

Hollywood Producers Five Time Script Rewrite For Beyonce

May 13, 2025 -

Salman Khans Film A 4 7 Budget Return Reasons For The Loss

May 13, 2025

Salman Khans Film A 4 7 Budget Return Reasons For The Loss

May 13, 2025 -

Landman Controversy Billy Bob Thorntons Public Support For Ali Larter And Angela Norris

May 13, 2025

Landman Controversy Billy Bob Thorntons Public Support For Ali Larter And Angela Norris

May 13, 2025 -

Beyonces Script Changes Five Times A Producer Rewrote For The Star

May 13, 2025

Beyonces Script Changes Five Times A Producer Rewrote For The Star

May 13, 2025