Navigating Crypto Exchange Regulations In India: Your 2025 Compliance Checklist

Table of Contents

Understanding the Current Regulatory Framework for Crypto Exchanges in India

The legal status of cryptocurrencies in India remains somewhat ambiguous, though the government's stance is shifting towards regulation rather than outright prohibition. While not explicitly legalized, cryptocurrencies are not banned either. This creates a complex regulatory environment that requires careful navigation.

Key government bodies involved include the Reserve Bank of India (RBI) and the Ministry of Finance, both of which have issued statements and guidelines impacting the crypto space. While a comprehensive crypto bill is anticipated, its exact form and implementation timeline remain uncertain. The current landscape necessitates a focus on compliance with existing guidelines and anticipating potential future regulations.

- Tax implications of cryptocurrency transactions: Currently, profits from cryptocurrency trading are taxed as capital gains.

- Anti-money laundering (AML) and know-your-customer (KYC) requirements: Indian crypto exchanges are expected to comply with AML and KYC norms, mirroring those of traditional financial institutions.

- Data protection and privacy concerns: The Information Technology Act, 2000, and related regulations apply to the handling of user data by crypto exchanges.

- Licensing and registration requirements: Currently, there's no specific licensing framework for crypto exchanges in India, although this is a likely area for future regulatory development.

KYC/AML Compliance for Crypto Exchanges Operating in India

Robust KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures are paramount for crypto exchanges operating in India. These programs aim to prevent financial crimes such as money laundering and terrorist financing.

Implementing a robust KYC/AML program involves several key steps:

- Customer verification: This typically involves verifying the identity of customers through documentation such as Aadhaar cards, PAN cards, and passport copies. Liveness checks and biometric verification are becoming increasingly common.

- Document requirements: The specific documents required may vary depending on the exchange's risk assessment and regulatory guidelines. However, proof of identity and address are usually essential.

- Transaction monitoring: Exchanges must monitor transactions for suspicious activity, such as unusually large transactions or patterns suggestive of money laundering.

- Suspicious activity reporting: Any suspicious activity must be reported to the relevant authorities as per the Prevention of Money Laundering Act, 2002 (PMLA).

Non-compliance with KYC/AML regulations can lead to significant penalties, including fines and even legal action.

Taxation of Cryptocurrency Transactions in India

Understanding the tax implications of cryptocurrency transactions is crucial for both individuals and businesses. Currently, income from cryptocurrency trading is considered capital gains, taxed at different rates depending on the holding period.

- Capital gains tax: Short-term capital gains (holding period less than one year) are taxed at a higher rate than long-term capital gains (holding period of one year or more).

- GST implications: While there's ongoing debate, currently, Goods and Services Tax (GST) is generally not applicable to cryptocurrency transactions themselves.

- Tax implications of airdrops and staking rewards: These are generally taxed as income based on their fair market value at the time of receipt.

Seeking professional tax advice is highly recommended to ensure accurate reporting and compliance with all applicable tax laws. The tax landscape is dynamic, so staying updated is vital for minimizing risks.

Data Security and Privacy Regulations for Indian Crypto Exchanges

Protecting user data is not just a best practice; it's a legal obligation for Indian crypto exchanges. Compliance with data protection laws is essential to maintain trust and avoid penalties. The IT Act, 2000, along with other relevant regulations, dictates how user data must be handled.

Best practices include:

- Strong cybersecurity measures: Implementing robust security protocols, including encryption, firewalls, and intrusion detection systems, is paramount.

- Regular security audits: Conducting regular security audits and vulnerability assessments helps identify and address potential weaknesses.

- Incident response planning: Having a well-defined incident response plan is crucial for effectively handling data breaches or security incidents.

- Data transparency: Being transparent with users about data handling practices builds trust and demonstrates a commitment to responsible data management.

Future Outlook: Anticipated Changes to Crypto Exchange Regulations in India

The future regulatory landscape for crypto exchanges in India is likely to evolve significantly. Expect increased clarity and a more structured regulatory framework.

- Potential licensing frameworks: The government may introduce a licensing regime for crypto exchanges, requiring them to obtain specific permits to operate.

- Expected changes to tax regulations: Further clarification and potential changes to tax laws governing cryptocurrency transactions are expected.

- Increased focus on consumer protection: Greater emphasis on consumer protection measures, such as investor education and dispute resolution mechanisms, is anticipated.

- International cooperation: Increased collaboration with other countries on cryptocurrency regulation and cross-border AML compliance is likely.

Conclusion

Successfully navigating the crypto exchange regulations in India requires a proactive and informed approach. By understanding the current framework, implementing robust compliance measures, and staying updated on future developments, you can ensure the long-term success and sustainability of your crypto exchange operations in India. Don't delay—start building your 2025 compliance strategy for crypto exchange regulations in India today. Review this checklist regularly and seek professional legal and financial advice to ensure complete adherence to all applicable laws and guidelines.

Featured Posts

-

Gaza Airstrike Israel Targets Hamas Leader Mohammed Sinwar

May 15, 2025

Gaza Airstrike Israel Targets Hamas Leader Mohammed Sinwar

May 15, 2025 -

Max Muncys First Homer Of 2025 Ends Career Long Drought

May 15, 2025

Max Muncys First Homer Of 2025 Ends Career Long Drought

May 15, 2025 -

Quakes Epicenter Your San Jose Earthquakes Game Preview

May 15, 2025

Quakes Epicenter Your San Jose Earthquakes Game Preview

May 15, 2025 -

The King Of Davoss Decline Exploring The Factors Leading To His Ruin

May 15, 2025

The King Of Davoss Decline Exploring The Factors Leading To His Ruin

May 15, 2025 -

Blue Origins Rocket Launch Postponed Subsystem Failure Reported

May 15, 2025

Blue Origins Rocket Launch Postponed Subsystem Failure Reported

May 15, 2025

Latest Posts

-

Trouver Un Emploi De Gardien Conseils Et Ressources Pour Les Candidats

May 15, 2025

Trouver Un Emploi De Gardien Conseils Et Ressources Pour Les Candidats

May 15, 2025 -

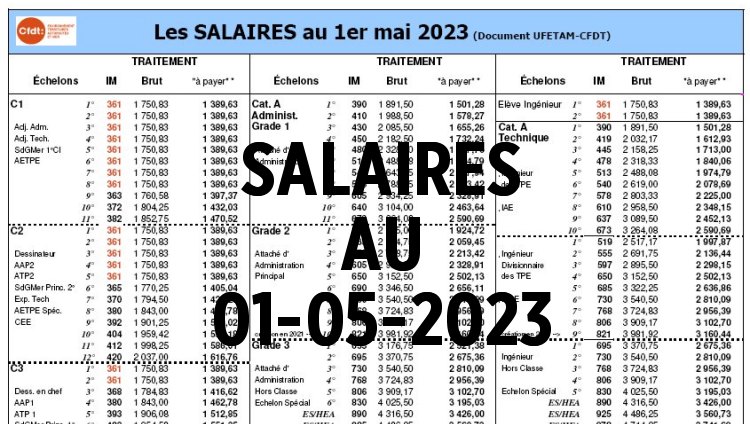

Salaires Des Gardiens Remuneration Et Conditions De Travail

May 15, 2025

Salaires Des Gardiens Remuneration Et Conditions De Travail

May 15, 2025 -

High Profile Nhl 4 Nations Face Off In Pei Cost Analysis Revealed

May 15, 2025

High Profile Nhl 4 Nations Face Off In Pei Cost Analysis Revealed

May 15, 2025 -

Devenir Gardien Un Secteur En Forte Croissance Malgre La Penurie

May 15, 2025

Devenir Gardien Un Secteur En Forte Croissance Malgre La Penurie

May 15, 2025 -

Reviewing The Earthquakes Loss Goalkeeping And Strategic Errors

May 15, 2025

Reviewing The Earthquakes Loss Goalkeeping And Strategic Errors

May 15, 2025