Navigating Economic Uncertainty: Inflation And Unemployment Challenges

Table of Contents

Understanding the Inflationary Pressure

Defining Inflation and its Causes

Inflation, simply put, is a general increase in the prices of goods and services in an economy over a period of time. It's measured using indices like the Consumer Price Index (CPI), which tracks the average change in prices paid by urban consumers for a basket of consumer goods and services, and the Producer Price Index (PPI), which measures the average change in prices received by domestic producers for their output. Several factors contribute to inflationary pressures. These include:

- Supply chain disruptions: Bottlenecks in global supply chains, often exacerbated by geopolitical events or natural disasters, lead to shortages and increased prices.

- Energy price volatility: Fluctuations in oil and gas prices significantly impact transportation, manufacturing, and overall consumer costs, driving up inflation.

- Monetary policy: Expansionary monetary policies, such as lowering interest rates or increasing the money supply, can stimulate demand and potentially lead to inflation if not managed carefully.

- Demand-pull inflation: This occurs when aggregate demand exceeds aggregate supply, pushing prices upward. This can be fueled by strong economic growth or increased consumer spending.

- Cost-push inflation: This occurs when increases in production costs (e.g., wages, raw materials) are passed on to consumers in the form of higher prices.

Examples of inflationary pressures: The recent surge in energy prices, global supply chain disruptions caused by the pandemic and the war in Ukraine, and increased demand for goods and services post-lockdown have all contributed to significant inflationary pressures globally.

Impact on consumer spending: Rising prices erode purchasing power, forcing consumers to cut back on spending or take on debt.

Impact on businesses: Inflation increases production costs, potentially squeezing profit margins and hindering investment.

The Impact of Inflation on Households and Businesses

Inflation significantly erodes purchasing power, meaning that each unit of currency buys fewer goods and services. This impacts households across the income spectrum, though lower-income households often bear a disproportionate burden as a larger percentage of their income is spent on essentials.

-

Impact on Personal Finances: Inflation necessitates adjustments to saving and investment strategies. High inflation can diminish the real return on savings accounts and erode the value of fixed-income investments.

-

Strategies for mitigating inflation's impact on personal finances: Diversifying investments, considering inflation-protected securities (like TIPS), and budgeting carefully are crucial strategies.

-

Impact on Businesses: Businesses face increased costs for raw materials, labor, and energy. This can lead to decreased profitability, reduced investment, and potential job losses if they cannot pass on these increased costs to consumers.

-

Strategies for businesses to manage inflation: Implementing efficient cost-cutting measures, negotiating with suppliers, and raising prices strategically (while considering consumer demand) are vital strategies for businesses to navigate inflationary periods.

Addressing the Unemployment Challenge

Defining Unemployment and its Measurement

Unemployment refers to the state of being actively seeking employment but unable to find a job. Different types of unemployment exist:

- Frictional unemployment: Temporary unemployment between jobs.

- Structural unemployment: Unemployment due to a mismatch between worker skills and available jobs.

- Cyclical unemployment: Unemployment related to the business cycle (e.g., recessions).

Unemployment rates are calculated by dividing the number of unemployed individuals by the total labor force (employed plus unemployed).

Factors contributing to unemployment:

- Automation: Technological advancements leading to job displacement.

- Globalization: Increased international competition affecting domestic employment.

- Economic downturns: Recessions and economic slowdowns lead to widespread job losses.

Regional variations in unemployment: Unemployment rates can vary significantly across regions due to differences in industrial structure, economic growth rates, and government policies.

The Socioeconomic Consequences of High Unemployment

High unemployment has severe socioeconomic consequences:

- Increased poverty rates: Job losses lead to reduced income and increased poverty.

- Higher crime rates: Unemployment is often correlated with increased crime.

- Negative impact on mental health: Job loss can cause significant stress and mental health issues.

- Strained social welfare systems: Increased demand for social safety nets like unemployment benefits.

Government responses to unemployment: Governments employ various strategies to combat unemployment, including job training programs, infrastructure investments to create jobs, and unemployment benefits to provide temporary financial support. The effectiveness of these programs varies depending on their design and implementation.

The role of social safety nets: Robust social safety nets are critical in mitigating the negative socioeconomic impacts of high unemployment, providing a crucial buffer for those facing job loss.

The Interplay Between Inflation and Unemployment

The Phillips Curve and its Limitations

The Phillips Curve traditionally suggests an inverse relationship between inflation and unemployment: lower unemployment is associated with higher inflation, and vice versa. However, this relationship has proven unreliable in explaining current economic conditions.

Limitations of the Phillips Curve:

- Stagflation: The simultaneous occurrence of high inflation and high unemployment, contradicting the Phillips Curve's prediction.

- Supply shocks: Unexpected events (e.g., oil price shocks) can simultaneously increase inflation and unemployment.

- The role of expectations: Inflationary expectations can become self-fulfilling, leading to wage-price spirals and persistent inflation, even with high unemployment.

Policy Responses to Economic Uncertainty

Governments use monetary and fiscal policies to address both inflation and unemployment:

-

Monetary policy: Central banks can adjust interest rates to influence inflation and employment. Raising interest rates can curb inflation but may increase unemployment; lowering rates can stimulate economic growth and reduce unemployment, but may fuel inflation. Quantitative easing involves injecting liquidity into the financial system.

-

Fiscal policy: Governments can use government spending and taxation to influence aggregate demand. Increased government spending can stimulate economic activity and reduce unemployment but can also lead to increased inflation if not managed carefully. Tax cuts can boost consumer spending but may also increase inflation.

Potential risks and side effects of different policy interventions: Policymakers must carefully consider the potential trade-offs between controlling inflation and reducing unemployment when implementing monetary and fiscal policies. Uncoordinated or poorly designed interventions can exacerbate economic instability.

Conclusion

Navigating economic uncertainty caused by the intertwined challenges of inflation and unemployment requires a multifaceted approach. Understanding the root causes of both issues, their impact on households and businesses, and the limitations of traditional economic models is crucial. Effective policy responses must balance the need to control inflation without exacerbating unemployment. By staying informed about economic trends and adapting strategies accordingly, individuals and businesses can better navigate this period of economic uncertainty. Further research into the latest economic data and policy pronouncements is essential for successfully managing the risks associated with inflation and unemployment. Proactive planning and adaptation are key to mitigating the effects of economic uncertainty.

Featured Posts

-

London Calling Gorillaz Mark 25th Anniversary With Concerts And Exhibition

May 30, 2025

London Calling Gorillaz Mark 25th Anniversary With Concerts And Exhibition

May 30, 2025 -

La Guerra De Trump Contra Ticketmaster Detalles De La Orden Ejecutiva Sobre Reventa De Boletos

May 30, 2025

La Guerra De Trump Contra Ticketmaster Detalles De La Orden Ejecutiva Sobre Reventa De Boletos

May 30, 2025 -

Tv Guide Metadoseis M Savvatoy 19 Aprilioy

May 30, 2025

Tv Guide Metadoseis M Savvatoy 19 Aprilioy

May 30, 2025 -

Ev Mandate Pushback Car Dealers Reiterate Concerns

May 30, 2025

Ev Mandate Pushback Car Dealers Reiterate Concerns

May 30, 2025 -

Mas Claridad Sobre Los Precios De Boletos De Ticketmaster

May 30, 2025

Mas Claridad Sobre Los Precios De Boletos De Ticketmaster

May 30, 2025

Latest Posts

-

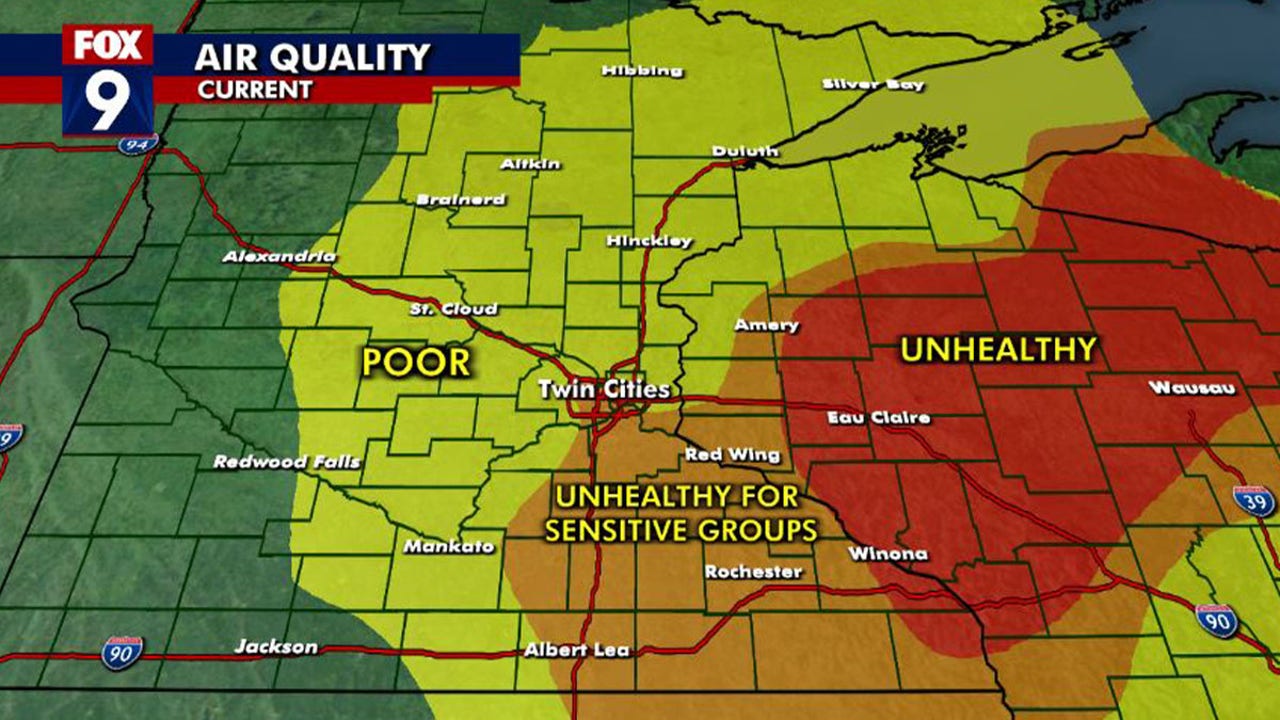

Health Impacts Of Canadian Wildfire Smoke On Minnesota

May 31, 2025

Health Impacts Of Canadian Wildfire Smoke On Minnesota

May 31, 2025 -

Dangerous Air Quality In Minnesota Due To Canadian Wildfires

May 31, 2025

Dangerous Air Quality In Minnesota Due To Canadian Wildfires

May 31, 2025 -

Canadian Wildfires Cause Dangerous Air In Minnesota

May 31, 2025

Canadian Wildfires Cause Dangerous Air In Minnesota

May 31, 2025 -

Eastern Manitoba Wildfires Rage Crews Struggle For Control

May 31, 2025

Eastern Manitoba Wildfires Rage Crews Struggle For Control

May 31, 2025 -

Homes Lost Lives Disrupted The Newfoundland Wildfire Crisis

May 31, 2025

Homes Lost Lives Disrupted The Newfoundland Wildfire Crisis

May 31, 2025