Negotiations Collapse: JBS (JBSS3) Walks Away From Banco Master Deal

Table of Contents

Key Reasons Behind the JBS (JBSS3) and Banco Master Deal Collapse

The failure of the JBS (JBSS3) and Banco Master merger represents a significant setback, stemming from a confluence of factors. Understanding these contributing elements is crucial to comprehending the full scope of this deal breakdown.

Valuation Discrepancies

A major stumbling block was the significant disagreement between JBS and Banco Master regarding the target valuation. JBS reportedly believed Banco Master's asking price was inflated, considering the prevailing market conditions and recent economic headwinds impacting the Brazilian financial sector. This valuation gap proved insurmountable, ultimately leading to the deal's demise.

- Differences in due diligence findings: JBS's due diligence process likely uncovered discrepancies between Banco Master's self-reported financial health and the reality of its assets and liabilities.

- Disagreements on future profitability projections: Diverging views on Banco Master's future growth potential and profitability contributed to the widening valuation gap. JBS may have projected lower future earnings than Banco Master, leading to a reduced willingness to pay the asking price.

Regulatory Hurdles and Antitrust Concerns

The proposed acquisition faced substantial regulatory hurdles and potential antitrust concerns from Brazilian regulatory bodies. Concerns centered around the potential for increased market concentration and its impact on competition within the Brazilian financial landscape. The prospect of lengthy and complex regulatory approvals, coupled with the inherent uncertainty of the approval process itself, likely played a significant role in JBS's decision to withdraw.

- Potential delays in regulatory approvals: Navigating the Brazilian regulatory system can be a lengthy and complex process, potentially delaying the acquisition indefinitely.

- Significant time and resources required to navigate regulatory processes: The cost and effort involved in securing regulatory approvals might have exceeded JBS's anticipated return on investment.

Unforeseen Financial Challenges for Banco Master

Recent financial performance indicators for Banco Master may have raised significant concerns for JBS. The emergence of unforeseen financial challenges or underlying weaknesses could have significantly impacted JBS's risk assessment and ultimately influenced its decision to abandon the acquisition.

- Declining profitability: A downward trend in Banco Master's profitability could have signaled a higher-than-anticipated risk profile for JBS.

- Increased non-performing loans: A rising number of non-performing loans within Banco Master's portfolio could have raised significant concerns about the long-term health and stability of the institution.

- Negative impact of macroeconomic factors: Broader macroeconomic factors impacting the Brazilian economy likely played a role, influencing both the valuation discussions and JBS’s overall risk assessment.

Market Reaction and Implications for JBS (JBSS3) and Banco Master

The abrupt collapse of the negotiations sent ripples through the Brazilian market, with immediate and potentially long-term consequences for both JBS and Banco Master.

Impact on JBS (JBSS3) Stock Price

The news of the deal's collapse likely resulted in short-term volatility in JBS's stock price (JBSS3). Investors will carefully scrutinize JBS's revised acquisition strategy and its implications for long-term growth and profitability.

- Analyst downgrades: Following the news, some analysts may have downgraded JBS's stock, reflecting concerns about the company's future acquisition plans.

- Investor uncertainty: The unexpected failure may have created uncertainty among investors, prompting some to sell their shares.

- Potential for revised investment plans: JBS may need to reassess its investment priorities and allocate resources to alternative strategic initiatives.

Future Prospects for Banco Master

Banco Master faces the challenge of navigating a new strategic direction following the failed acquisition. The company will likely need to explore alternative avenues for growth and potentially seek new strategic partners or investors.

- Search for new investors: Banco Master may need to actively seek new investment opportunities to maintain its financial stability.

- Potential restructuring: The company may consider restructuring its operations to improve profitability and attract potential investors.

- Challenges in attracting future investment: The failed acquisition may negatively impact Banco Master's reputation and its ability to attract future investments.

Conclusion

The collapse of negotiations between JBS (JBSS3) and Banco Master represents a significant development with far-reaching implications for the Brazilian financial market. Valuation discrepancies, regulatory hurdles, and underlying financial weaknesses at Banco Master all contributed to the deal's failure. The outcome will undoubtedly impact both companies' stock prices and future strategic planning. Investors and analysts should closely monitor both JBS and Banco Master for further announcements concerning their future strategies. Understanding the complexities surrounding the JBS (JBSS3) and Banco Master deal collapse is vital for navigating the Brazilian financial landscape. Stay informed to better understand the fallout from this significant acquisition failure.

Featured Posts

-

Dendam Israel Pada Paus Fransiskus Analisis Penghindaran Pejabat Senior Dalam Pemakaman

May 18, 2025

Dendam Israel Pada Paus Fransiskus Analisis Penghindaran Pejabat Senior Dalam Pemakaman

May 18, 2025 -

Kalorama 2025 Star Studded Lineup Featuring Pet Shop Boys Fka Twigs Jorja Smith And Father John Misty

May 18, 2025

Kalorama 2025 Star Studded Lineup Featuring Pet Shop Boys Fka Twigs Jorja Smith And Father John Misty

May 18, 2025 -

Man On Fire A 9 11 Survivors Account On Netflix

May 18, 2025

Man On Fire A 9 11 Survivors Account On Netflix

May 18, 2025 -

Assessing The Suitability Of This Novel Investment For Retirement

May 18, 2025

Assessing The Suitability Of This Novel Investment For Retirement

May 18, 2025 -

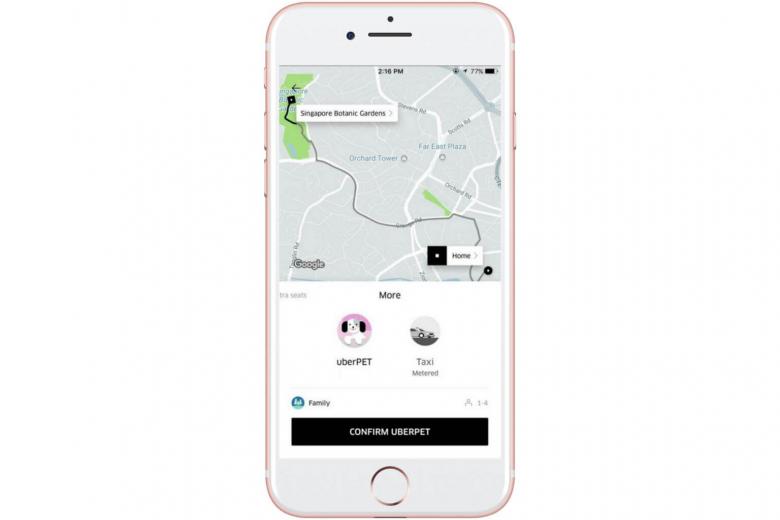

Delhi And Mumbai Residents Can Now Use Uber For Pet Transportation

May 18, 2025

Delhi And Mumbai Residents Can Now Use Uber For Pet Transportation

May 18, 2025