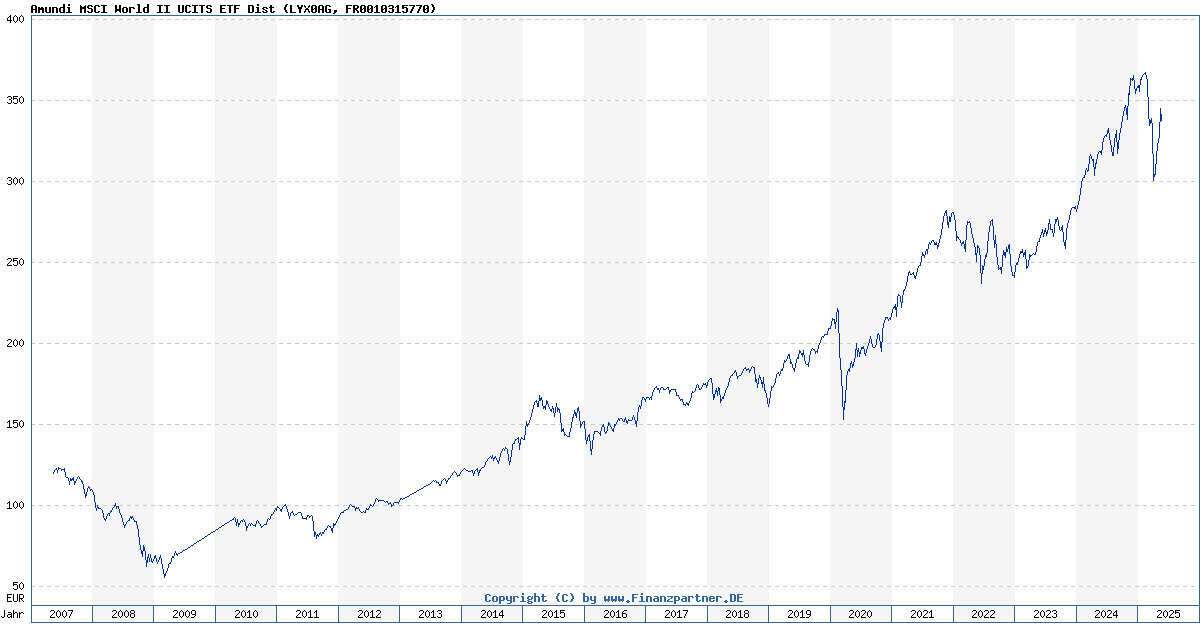

Net Asset Value (NAV) Explained: Amundi MSCI World II UCITS ETF Dist

Table of Contents

How NAV is Calculated for the Amundi MSCI World II UCITS ETF Dist

The Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist, like any ETF, represents the net asset value per share. This calculation provides a snapshot of the fund's intrinsic value. The process involves several key steps:

-

Market Value of Holdings: First, the market value of all the underlying assets within the ETF is determined. The Amundi MSCI World II UCITS ETF Dist invests in a globally diversified portfolio of equities, so this involves assessing the current market price of each stock within its holdings. This valuation considers various factors, including market trends and individual company performance.

-

Deduction of ETF Expenses: Next, the ETF's total expenses, including management fees and operating costs, are deducted from the total asset value. This expense ratio is a crucial factor impacting the fund's overall performance and the NAV over the long term.

-

Division by Outstanding Shares: Finally, the remaining net asset value is divided by the total number of outstanding shares of the Amundi MSCI World II UCITS ETF Dist. This calculation yields the NAV per share, which is a key indicator of the fund's performance.

-

Currency Conversion Considerations: Because the Amundi MSCI World II UCITS ETF Dist likely holds international assets, currency conversion rates play a significant role. Fluctuations in exchange rates can impact the NAV, introducing a degree of volatility dependent on the composition of the underlying holdings.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF Dist

Several factors influence the NAV of the Amundi MSCI World II UCITS ETF Dist:

-

Market Fluctuations: The most significant influence on the NAV is the performance of the underlying assets. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV. Market volatility directly impacts the daily NAV calculation.

-

Dividend Distributions: When the underlying companies in the ETF distribute dividends, the NAV will typically decrease immediately after the ex-dividend date. This is because the assets held by the ETF are reduced by the amount paid out in dividends.

-

Currency Exchange Rates: As mentioned earlier, currency fluctuations significantly affect the NAV if the ETF holds assets denominated in different currencies. A strengthening of the euro (or the investor's base currency) against other currencies can positively affect the NAV, while weakening has the opposite impact.

-

Expense Ratio: The expense ratio, while not directly impacting the daily calculation, does influence the NAV indirectly over time. Higher expense ratios eat into the fund's returns, resulting in potentially lower NAV growth compared to ETFs with lower expense ratios.

NAV vs. Market Price of Amundi MSCI World II UCITS ETF Dist

While the NAV represents the intrinsic value of the ETF's assets, the market price is determined by supply and demand in the secondary market. This means there might be discrepancies between these two values:

-

Market Price Fluctuation: The market price can fluctuate throughout the trading day, unlike the NAV, which is typically calculated at the close of the market.

-

Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) creates a spread. This can cause the market price to momentarily deviate from the NAV.

-

Trading Volume: Low trading volume can lead to larger discrepancies between the market price and the NAV. High trading volume tends to bring the market price closer to the NAV.

-

Premium and Discount to NAV: The market price can trade at a premium or a discount to the NAV. A premium means the market price is higher than the NAV, possibly due to high demand. A discount signifies the opposite, potentially reflecting a lower demand for the ETF.

Using NAV Information to Make Informed Investment Decisions

Monitoring the NAV of your Amundi MSCI World II UCITS ETF Dist investments is vital for several reasons:

-

Performance Evaluation: By tracking the NAV over time, you can effectively assess the fund's performance and compare it to your investment goals.

-

Comparison with Other ETFs: Comparing the NAV of the Amundi MSCI World II UCITS ETF Dist with similar ETFs in the same asset class helps you make informed decisions about diversification and portfolio allocation.

-

Regular NAV Checking: Regular checks on the NAV allow you to react to market shifts and adjust your investment strategy accordingly.

-

Accessing NAV Data: You can usually find the daily NAV of the Amundi MSCI World II UCITS ETF Dist on the Amundi website, major financial news websites, and through your brokerage account.

Conclusion: Mastering Net Asset Value for Amundi MSCI World II UCITS ETF Dist Success

Understanding Net Asset Value (NAV) is essential for successfully managing your investments in the Amundi MSCI World II UCITS ETF Dist. Knowing how the NAV is calculated, the factors influencing it, and the relationship between NAV and market price will enable you to make more informed decisions. Regularly track your Amundi MSCI World II UCITS ETF Dist NAV and use this information to optimize your investment strategy. Remember to conduct further research on NAV calculations and how they apply to other ETFs in your portfolio to gain a comprehensive understanding of your overall investment landscape. Mastering your ETF's NAV is key to achieving your investment goals. Start tracking your Amundi MSCI World II UCITS ETF Dist NAV today!

Featured Posts

-

Porsche Koezuti Autok F1 Technologia A Kormany Moegoett

May 24, 2025

Porsche Koezuti Autok F1 Technologia A Kormany Moegoett

May 24, 2025 -

Koezuti Porsche F1 Es Motor Erejevel

May 24, 2025

Koezuti Porsche F1 Es Motor Erejevel

May 24, 2025 -

Masivne Prepustanie V Nemecku Dopady Na Ekonomiku A Zamestnancov

May 24, 2025

Masivne Prepustanie V Nemecku Dopady Na Ekonomiku A Zamestnancov

May 24, 2025 -

Nightcliff Shop Owners Death Teenager Charged Following Alleged Stabbing

May 24, 2025

Nightcliff Shop Owners Death Teenager Charged Following Alleged Stabbing

May 24, 2025 -

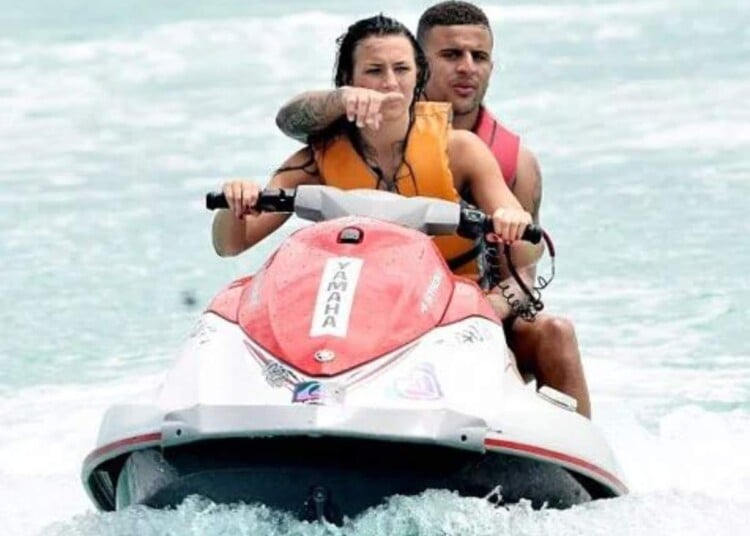

The Kyle Walker Annie Kilner Controversy Examining The Poisoning Claims

May 24, 2025

The Kyle Walker Annie Kilner Controversy Examining The Poisoning Claims

May 24, 2025

Latest Posts

-

The Truth Behind The Claims Annie Kilners Social Media Activity And Kyle Walker

May 24, 2025

The Truth Behind The Claims Annie Kilners Social Media Activity And Kyle Walker

May 24, 2025 -

The Kyle Walker Annie Kilner Situation Explaining The Recent Events

May 24, 2025

The Kyle Walker Annie Kilner Situation Explaining The Recent Events

May 24, 2025 -

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 24, 2025 -

Recent Developments Annie Kilners Public Statements After The Kyle Walker Night Out

May 24, 2025

Recent Developments Annie Kilners Public Statements After The Kyle Walker Night Out

May 24, 2025 -

Kyle Walkers Recent Parties A Look At The Events Following Annie Kilners Return Home

May 24, 2025

Kyle Walkers Recent Parties A Look At The Events Following Annie Kilners Return Home

May 24, 2025