Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc: Explained

Table of Contents

What is the Net Asset Value (NAV) and how is it calculated?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets after deducting liabilities. For the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV reflects the total value of all the world's stocks held within the fund, minus any liabilities such as management fees and expenses.

- Assets: This includes the market value of all the stocks comprising the ETF's portfolio, reflecting the current market prices of those securities. The Amundi MSCI All Country World UCITS ETF USD Acc aims for broad global market exposure, so its assets are diverse and numerous.

- Liabilities: These are the outstanding debts and expenses associated with managing the ETF, including management fees, administrative costs, and any accrued liabilities.

Calculating the Amundi MSCI All Country World UCITS ETF USD Acc NAV: The calculation is fairly straightforward: The total market value of the ETF's underlying assets is determined at the close of each trading day. Then, the total liabilities are subtracted from this value. The result, divided by the number of outstanding ETF shares, gives the NAV per share. This process is typically performed daily, providing an up-to-date reflection of the fund's value.

Factors Affecting the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Several factors influence the daily fluctuations of the Amundi MSCI All Country World UCITS ETF USD Acc's NAV:

- Market Fluctuations: The primary driver is the performance of the global stock markets. Changes in the prices of the underlying stocks directly impact the total asset value and, consequently, the NAV. Market volatility, whether due to economic news, geopolitical events, or investor sentiment, creates significant NAV fluctuations.

- Currency Exchange Rates (USD Acc): Since the ETF is denominated in USD (USD Acc), fluctuations in exchange rates against other currencies affect the value of the foreign assets held within the ETF. A strengthening dollar would generally increase the NAV (when converted to USD), while a weakening dollar would have the opposite effect.

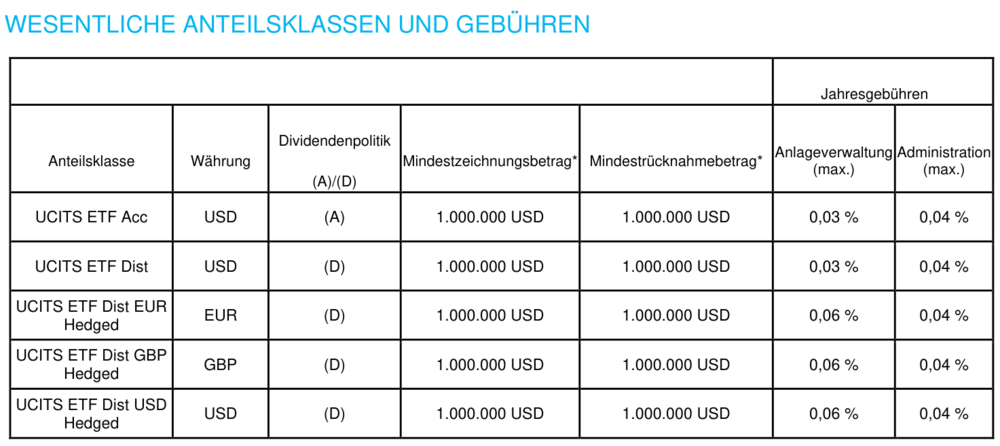

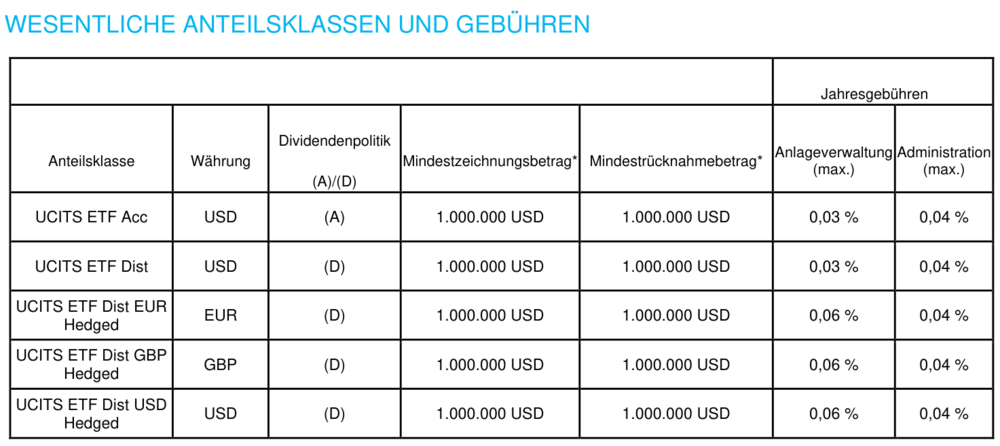

- Expense Ratio and Management Fees: These fees, deducted from the assets, directly reduce the NAV. While generally small, they cumulatively impact the NAV over time. It's crucial to understand the expense ratio of any ETF before investing.

- Dividend Distributions: When the underlying companies in the ETF pay dividends, the NAV will typically decrease after the distribution, as the assets of the fund are reduced by the amount paid out. However, investors who reinvest these dividends will see an increase in the number of ETF shares they own, mitigating the impact on their overall investment.

Where to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Reliable sources for accessing the Amundi MSCI All Country World UCITS ETF USD Acc NAV include:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

- Financial Data Providers: Major financial data providers like Bloomberg, Refinitiv, and Yahoo Finance typically offer real-time and historical NAV data for this and other ETFs. These platforms often provide charting tools to visualize NAV trends.

- Brokerage Platforms: Most brokerage accounts displaying your ETF holdings will automatically show the current NAV.

Interpreting the NAV data is simple; it's presented as a value per share. Always ensure you're looking at the NAV and not confusing it with the ETF's market price, which can differ slightly due to intraday trading.

Using NAV to Make Informed Investment Decisions

Understanding the NAV is instrumental in making sound investment choices:

- Arbitrage Opportunities: By comparing the NAV to the ETF's market price, you can potentially identify arbitrage opportunities. Slight discrepancies can exist, presenting brief windows for profitable trades (though this often requires significant capital and timing).

- Performance Tracking: Tracking the NAV over time allows you to monitor the performance of your investment. Consistent growth in the NAV indicates positive performance of your holdings.

- Buy/Sell Decisions: While NAV alone shouldn't dictate buy/sell decisions, it's a key component of a comprehensive investment strategy. Analyzing NAV trends in conjunction with broader market conditions and your personal risk tolerance will support informed decisions.

Conclusion: Mastering the Net Asset Value (NAV) of Your Amundi MSCI All Country World UCITS ETF USD Acc Investment

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is vital for every investor. It provides a clear picture of the fund's underlying value, allowing you to track performance, understand influencing factors, and potentially identify profitable opportunities. Regularly checking the NAV alongside other market indicators will help you refine your investment strategy and make confident investment choices. Stay informed about the Net Asset Value (NAV) of your Amundi MSCI All Country World UCITS ETF USD Acc holdings to make confident investment choices. Regularly check the NAV to optimize your investment strategy.

Featured Posts

-

Accentures 50 000 Employee Promotion A Six Month Delay Explained

May 25, 2025

Accentures 50 000 Employee Promotion A Six Month Delay Explained

May 25, 2025 -

Republican Dealmaking Trumps Influence And Tactics

May 25, 2025

Republican Dealmaking Trumps Influence And Tactics

May 25, 2025 -

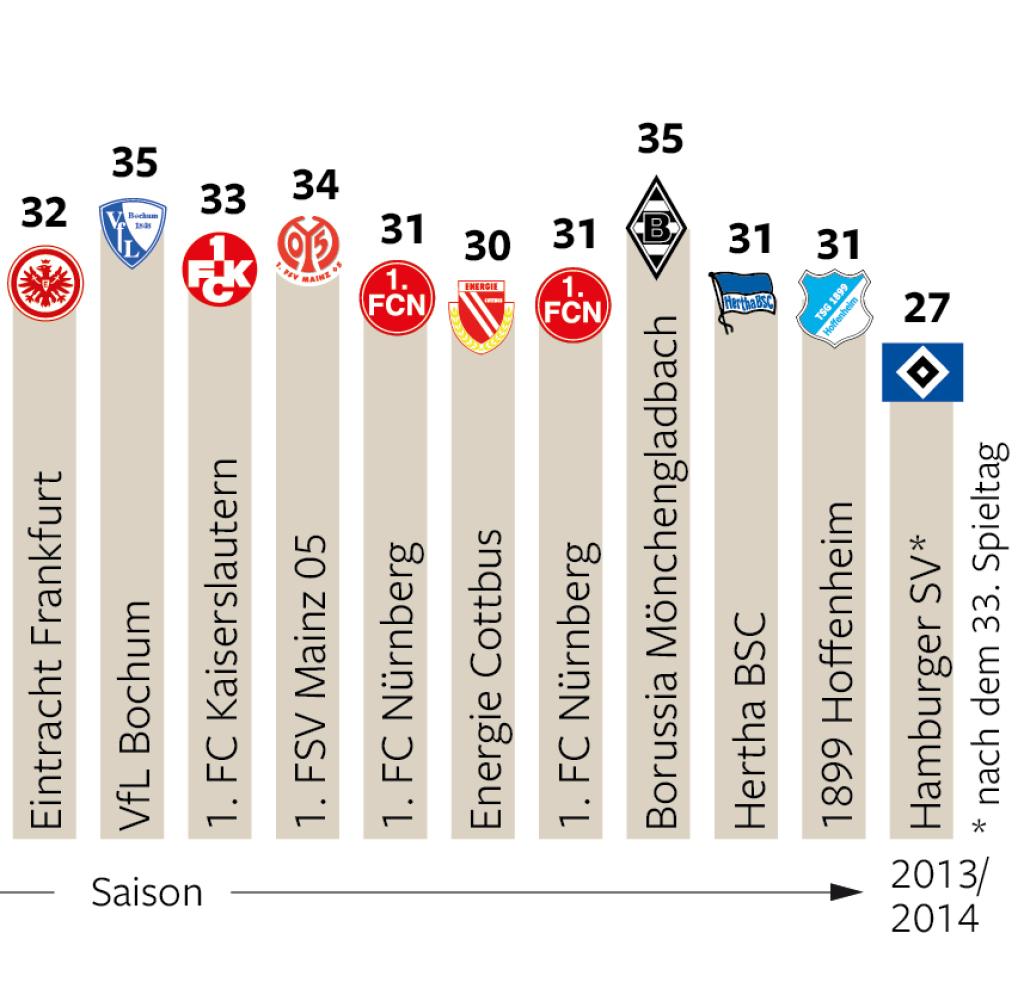

Rueckkehr In Die Bundesliga Der Hsv Ist Wieder Da

May 25, 2025

Rueckkehr In Die Bundesliga Der Hsv Ist Wieder Da

May 25, 2025 -

The Great New Orleans Jailbreak How 10 Inmates Vanished

May 25, 2025

The Great New Orleans Jailbreak How 10 Inmates Vanished

May 25, 2025 -

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 25, 2025

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 25, 2025