Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: Key Considerations

Table of Contents

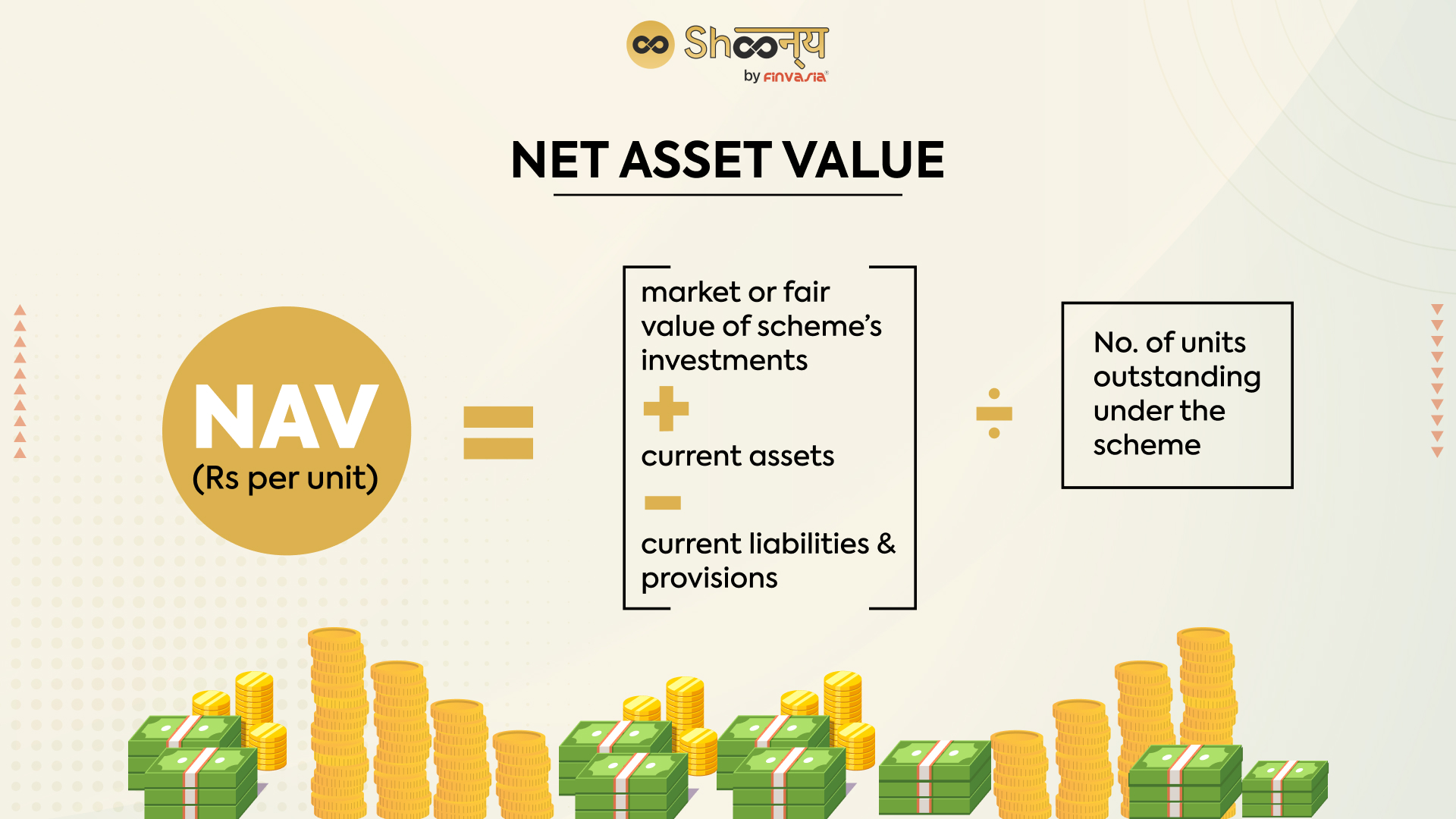

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets. It's a crucial metric for determining the ETF's intrinsic worth. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV calculation involves several steps:

- Determining the Market Value of Assets: This involves calculating the total market value of all the stocks and securities held within the ETF, reflecting their current market prices. This is a critical component of NAV calculation for any ETF, including this one.

- Accounting for Liabilities: The ETF's liabilities, which include management fees and other expenses, are subtracted from the total asset value. Understanding these liabilities is vital for a complete picture of the NAV.

- Currency Hedging Impact: The "USD Hedged" designation indicates that the ETF employs currency hedging strategies to minimize the impact of exchange rate fluctuations between the USD and other currencies represented in the underlying assets. This hedging impacts the NAV, reducing volatility compared to an unhedged counterpart. The effectiveness of this hedging strategy needs to be considered when interpreting NAV movements.

- Daily Calculation: The NAV is typically calculated daily, providing investors with an up-to-date assessment of the ETF's value.

The relationship between NAV and the ETF's market price is usually very close, though minor discrepancies can occur due to trading activity. Understanding the NAV calculation provides transparency into the ETF's valuation.

Factors Influencing the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors contribute to the daily fluctuations in the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

- MSCI World Index Performance: As the ETF tracks the MSCI World Index, the performance of this benchmark index significantly influences the NAV. Positive performance in the index generally leads to a higher NAV, and vice-versa. Monitoring the index's performance is essential for understanding NAV movements.

- USD Exchange Rate Fluctuations: Even with currency hedging, fluctuations in the value of the USD against other currencies can still impact the NAV. While the hedge aims to mitigate this risk, residual effects can still be observed. Understanding the interplay between currency markets and the ETF's NAV is crucial.

- Global Market Volatility: Geopolitical events, economic news, and overall market sentiment all contribute to market volatility, directly impacting the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Periods of heightened volatility often translate to more significant NAV swings.

- Sector and Geographic Exposure: The MSCI World Index comprises companies across various sectors and geographies. The performance of specific sectors or regions can disproportionately impact the NAV. For example, strong performance in the technology sector would likely boost the NAV.

Interpreting NAV Data and Making Informed Investment Decisions

Analyzing NAV data effectively is crucial for successful ETF investing. Here's how to utilize this information:

- Tracking NAV Changes: Regularly monitor NAV changes over time to assess the ETF's performance. This allows investors to see the long-term growth potential and identify potential risks.

- Comparison with Other Investments: Compare the NAV performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist with other investment options to evaluate its relative value and risk profile.

- Long-Term Perspective: Focus on long-term NAV trends rather than short-term fluctuations. Short-term volatility is common in the market, and a long-term perspective is key to effective investing.

- Diversification: Diversifying your investment portfolio mitigates risk and reduces the impact of any single asset's performance on your overall returns. Using this ETF as part of a wider strategy is recommended.

Where to Find the Daily NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Reliable NAV data for the Amundi MSCI World II UCITS ETF USD Hedged Dist can be found at several sources:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

- Financial News Websites: Reputable financial news sources often provide ETF data, including NAV.

- Dedicated ETF Data Providers: Several specialized platforms provide comprehensive ETF data, including real-time NAV updates.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is paramount for successful investing. By considering the factors influencing NAV, such as the MSCI World Index performance, currency exchange rates, and global market conditions, investors can make more informed decisions. Regularly monitor the NAV using reliable sources and use this information to evaluate the performance of your investment within a well-diversified portfolio. Further research into the ETF's underlying assets and investment strategy will enhance your understanding and lead to more effective investment choices. Remember, consistently understanding the Net Asset Value (NAV) is key to long-term success in ETF investing.

Featured Posts

-

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025 -

Nimi Muistiin Ferrarin 13 Vuotias Lupaus

May 24, 2025

Nimi Muistiin Ferrarin 13 Vuotias Lupaus

May 24, 2025 -

Eiskaltes Ergebnis Der Ueberraschungssieger In Essen

May 24, 2025

Eiskaltes Ergebnis Der Ueberraschungssieger In Essen

May 24, 2025 -

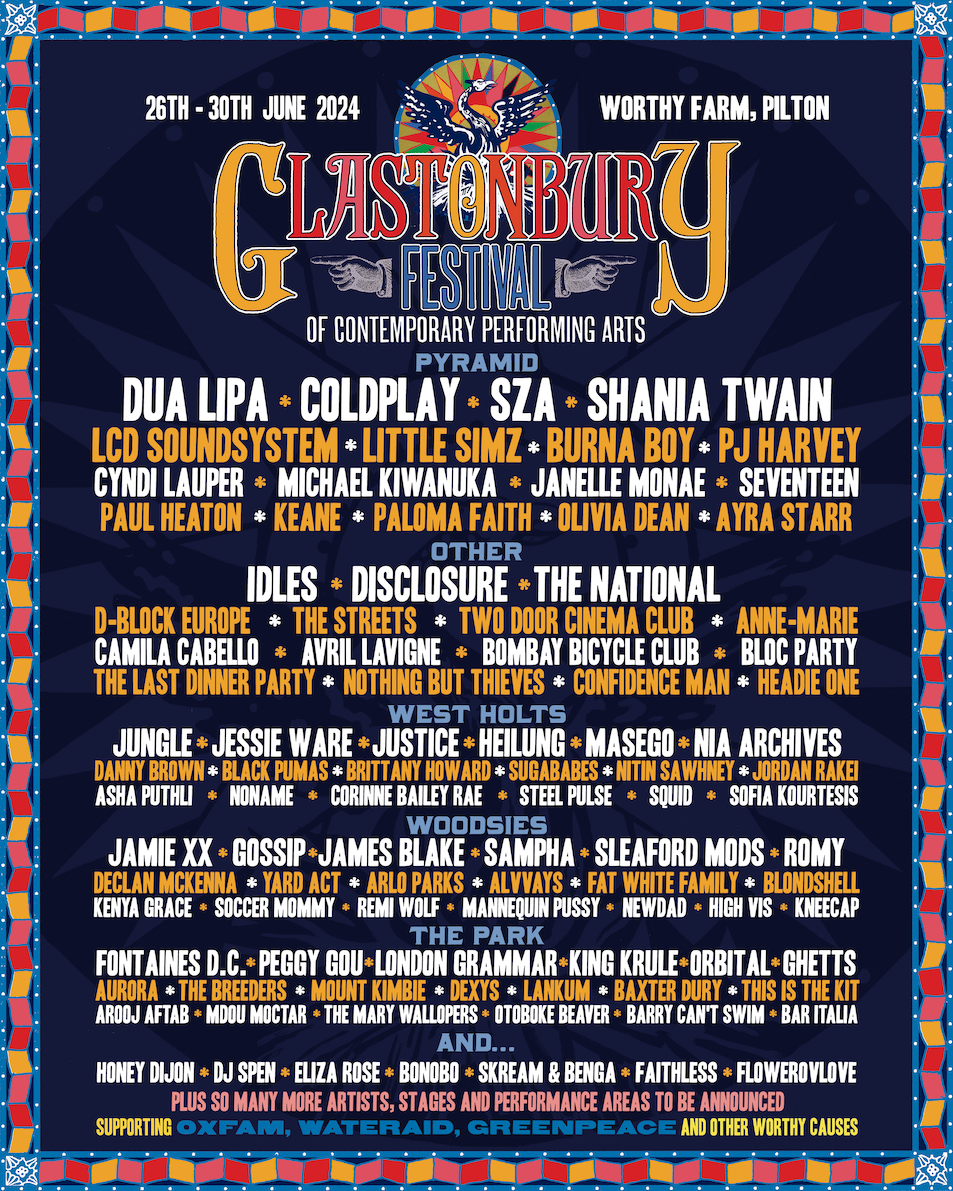

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025 -

Dax Verluste Bei Frankfurter Aktienmarkt Eroeffnung Am 21 Maerz 2025

May 24, 2025

Dax Verluste Bei Frankfurter Aktienmarkt Eroeffnung Am 21 Maerz 2025

May 24, 2025

Latest Posts

-

Kyle Walker And The Serbian Models The Milan Party Following Wife Annie Kilners Return To The Uk

May 24, 2025

Kyle Walker And The Serbian Models The Milan Party Following Wife Annie Kilners Return To The Uk

May 24, 2025 -

Footballer Kyle Walker Spotted With Models In Milan After Wifes Flight Home

May 24, 2025

Footballer Kyle Walker Spotted With Models In Milan After Wifes Flight Home

May 24, 2025 -

The Kyle And Teddi Dog Walker Incident A Detailed Look

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Detailed Look

May 24, 2025 -

The Truth Behind The Claims Annie Kilners Social Media Activity And Kyle Walker

May 24, 2025

The Truth Behind The Claims Annie Kilners Social Media Activity And Kyle Walker

May 24, 2025 -

The Kyle Walker Annie Kilner Situation Explaining The Recent Events

May 24, 2025

The Kyle Walker Annie Kilner Situation Explaining The Recent Events

May 24, 2025