Network18 Media & Investments Share Price Today (April 21, 2025): Live NSE/BSE Rates, Analysis & Forecasts

Table of Contents

Live Network18 Share Price (NSE/BSE)

Staying up-to-date on the Network18 share price is essential for investors. Here's a snapshot of the live data as of 11:00 AM IST, April 21, 2025 (Note: This data is a placeholder and should be replaced with a live data feed or updated manually).

NSE (National Stock Exchange) Current Price:

Placeholder for Live Data: ₹XXX.XX

BSE (Bombay Stock Exchange) Current Price:

Placeholder for Live Data: ₹XXX.XX

- Day's High: Placeholder for Live Data: ₹XXX.XX

- Day's Low: Placeholder for Live Data: ₹XXX.XX

- Volume Traded: Placeholder for Live Data: XXX,XXX shares

- Percentage Change from Previous Close: Placeholder for Live Data: +X.XX%

- 52-Week High: Placeholder for Live Data: ₹XXX.XX

- 52-Week Low: Placeholder for Live Data: ₹XXX.XX

These figures provide a real-time view of the Network18 share price and trading activity. A high volume traded suggests significant investor interest, while percentage change indicates the direction of the price movement. The 52-week high and low provide context for the current price, showing its range over the past year.

Network18 Media & Investments Stock Market Analysis

Understanding the factors behind the Network18 share price requires a comprehensive analysis.

Recent News and Events:

Recent positive news includes the announcement of a new strategic partnership with a major international media company, potentially expanding Network18's reach and revenue streams. Conversely, concerns remain about the impact of increased competition within the media industry.

Fundamental Analysis:

Network18's financial health is a key driver of its share price. A review of recent quarterly earnings reports suggests relatively stable revenue growth, though profit margins might need further improvement. Debt levels appear manageable, but require ongoing monitoring.

Technical Analysis:

Technical indicators such as moving averages and RSI (Relative Strength Index) suggest a potential short-term upward trend, but this needs confirmation. It's crucial to remember that technical analysis is just one piece of the puzzle.

- Key Factors Influencing the Share Price: Recent partnerships, competitive landscape, macroeconomic factors, investor sentiment.

- Strengths: Strong brand portfolio, diversified media holdings, potential for digital growth.

- Weaknesses: Dependence on advertising revenue, competition from digital platforms, regulatory challenges.

- Comparison with Competitors: Network18's performance compared to peers like Zee Entertainment and Sun TV Network needs further analysis to gain a complete market perspective.

This combined fundamental and technical analysis provides a nuanced understanding of Network18's current market position and future prospects.

Network18 Share Price Forecast (April 21, 2025)

Predicting stock prices is inherently uncertain, and this forecast is not financial advice.

Short-Term Outlook:

Based on the current analysis, a cautious prediction for the closing price of Network18 on April 21, 2025, could be within a range of ₹XXX.XX to ₹YYY.YY. However, this is a speculative estimate and could be significantly influenced by unforeseen events.

Factors Affecting the Forecast:

-

Market Trends: Overall market sentiment and global economic conditions will heavily influence Network18's share price.

-

Global News: Major geopolitical events or economic announcements can cause significant market fluctuations.

-

Sector-Specific Events: News specific to the media and entertainment sector could impact Network18 disproportionately.

-

Possible Price Ranges: The price could fluctuate significantly throughout the day, influenced by the factors listed above.

-

Key Events to Watch: Announcements of new partnerships, quarterly earnings reports, and any significant regulatory changes are crucial to monitor.

-

Potential Risks: Increased competition, changes in advertising revenue, and macroeconomic headwinds are potential risks.

-

Potential Opportunities: Expansion into new digital platforms, successful strategic partnerships, and growing consumer demand could create opportunities for Network18.

The forecast presented here is conditional and subject to change based on new information.

Conclusion

Today's Network18 share price, as observed on both the NSE and BSE, indicates [summarize the current price trend and volume]. Key factors influencing this include [mention 2-3 key factors from the analysis]. Our short-term forecast suggests a potential range of [reiterate the price range], but it is vital to remember this is not financial advice. Stay informed on the Network18 share price fluctuations by visiting this website regularly for live updates and in-depth analyses. Track the Network18 Media & Investments stock price live to make optimal investment decisions. Monitor Network18's share price for timely insights and informed investment strategies.

Featured Posts

-

Rare Earth Minerals And The Threat Of A New Cold War

May 17, 2025

Rare Earth Minerals And The Threat Of A New Cold War

May 17, 2025 -

No Christmas Special For Doctor Who Whats Next

May 17, 2025

No Christmas Special For Doctor Who Whats Next

May 17, 2025 -

Car Dealerships Renew Resistance To Electric Vehicle Mandates

May 17, 2025

Car Dealerships Renew Resistance To Electric Vehicle Mandates

May 17, 2025 -

Chat Gpt Developer Open Ai Under Ftc Investigation Key Questions Answered

May 17, 2025

Chat Gpt Developer Open Ai Under Ftc Investigation Key Questions Answered

May 17, 2025 -

Mlb Betting Yankees Vs Mariners Predictions And Odds For Tonights Game

May 17, 2025

Mlb Betting Yankees Vs Mariners Predictions And Odds For Tonights Game

May 17, 2025

Latest Posts

-

Sherlock Holmes 10 Greatest Quotes Ranked

May 17, 2025

Sherlock Holmes 10 Greatest Quotes Ranked

May 17, 2025 -

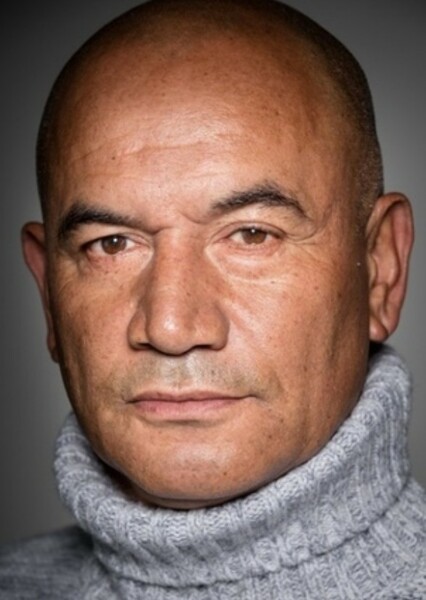

Temuera Morrison In End Of The Valley Your Guide To The Listener This March

May 17, 2025

Temuera Morrison In End Of The Valley Your Guide To The Listener This March

May 17, 2025 -

The Top 10 Sherlock Holmes Quotes Of All Time

May 17, 2025

The Top 10 Sherlock Holmes Quotes Of All Time

May 17, 2025 -

End Of The Valley A March Viewing Guide For The Listener

May 17, 2025

End Of The Valley A March Viewing Guide For The Listener

May 17, 2025 -

The Listener March Viewing Guide End Of The Valley With Temuera Morrison

May 17, 2025

The Listener March Viewing Guide End Of The Valley With Temuera Morrison

May 17, 2025