New HMRC Letters: What UK Households Need To Know

Table of Contents

Types of New HMRC Letters UK Households Might Receive

The types of HMRC letters you receive will depend on your individual circumstances and tax situation. Here are some of the most common types:

Tax Return Reminders and Updates

The self-assessment tax return process is a significant part of the UK tax system. HMRC regularly sends out letters reminding taxpayers of upcoming deadlines and providing updates on online filing procedures. These letters might detail changes to self-assessment deadlines, highlight improvements to the online portal, or emphasize penalties for late submissions.

- Changes to self-assessment deadlines: Be aware of any adjustments to the 31 January deadline for submitting your tax return.

- HMRC online services updates: Familiarize yourself with any updates to the online portal, including new features or improved security measures.

- Penalties for late filing: Understand the potential financial penalties for not submitting your self-assessment tax return on time. These penalties can be significant, so prompt action is crucial.

- Contacting HMRC for support: If you encounter any difficulties filing your tax return online, don't hesitate to contact HMRC for assistance using their official channels. This could prevent late filing penalties. Using approved tax filing software can also help streamline the process.

Changes to PAYE Tax Codes

Your PAYE (Pay As You Earn) tax code determines how much income tax is deducted from your salary or wages. HMRC might send letters notifying you of changes to your tax code, which could result in underpayments or overpayments of tax.

- Understanding your PAYE tax code: Your tax code is a crucial element of your tax affairs. Understanding its meaning is essential for accurate tax calculation.

- Checking your tax code online: Use the HMRC online services to check your current tax code and ensure its accuracy. Discrepancies should be reported immediately.

- Reporting changes to your circumstances: Any significant life changes (marriage, new job, etc.) should be reported to HMRC to ensure your tax code remains accurate.

- Contacting your employer about tax code discrepancies: If you believe your tax code is incorrect, contact your employer to discuss the issue and ensure the correct amount of tax is deducted.

Tax Refund or Debt Notifications

HMRC letters might inform you about a tax refund you're owed or an outstanding tax debt. These letters provide details on how to claim your refund or arrange payment for any outstanding debt.

- Understanding your tax refund: Check the details carefully to ensure the amount is correct and the payment method is suitable for you.

- Paying outstanding tax debts: Follow the instructions carefully and make timely payments to avoid additional penalties and interest charges. HMRC offers several payment options to suit different circumstances.

- Appealing an HMRC decision: If you disagree with an assessment or believe a mistake has been made, understand your rights and the process for lodging an appeal.

- Contacting HMRC for clarification on tax debt: Don't hesitate to contact HMRC if you need clarification on any aspect of your tax debt notification.

Letters Regarding Investigations or Audits

In some cases, HMRC may initiate an investigation into your tax affairs. These letters will outline the reasons for the investigation, request supporting documentation, and detail the next steps. It's crucial to respond promptly and seek professional tax advice if necessary.

- Responding to HMRC investigations: Respond to all requests for information promptly and thoroughly. This can demonstrate cooperation and avoid further complications.

- Gathering necessary documents: Collect and organize all relevant documents requested by HMRC. Accuracy and completeness are essential.

- Seeking professional tax advice: Considering seeking advice from a qualified tax advisor can help navigate the complexities of an HMRC investigation.

- Understanding your rights: Familiarize yourself with your rights as a taxpayer and understand the process involved in an HMRC investigation.

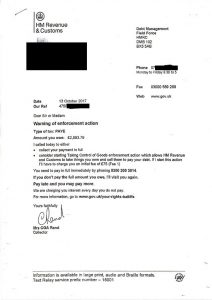

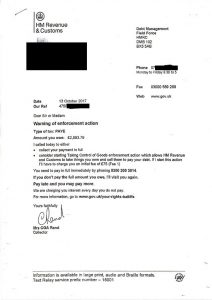

How to Identify Genuine HMRC Letters

It’s crucial to be aware of HMRC scams. Criminals often try to impersonate HMRC to obtain personal and financial information. Therefore, verifying the authenticity of any HMRC letter is paramount.

- Identifying official HMRC letterhead: Genuine HMRC letters will always feature their official letterhead and branding.

- Verifying contact details: Check the contact details against those listed on the official HMRC website. Never trust unsolicited contact.

- Checking for security features: HMRC letters may include security features, like unique reference numbers or security holograms.

- Reporting suspicious communications: Report any suspicious communications claiming to be from HMRC to the authorities immediately.

- Never clicking on links in unsolicited emails: Legitimate HMRC correspondence will never contain links requesting personal information via email.

Responding to HMRC Letters

Responding correctly to HMRC letters is crucial to avoid penalties and maintain a good standing with the tax authorities.

- Reading the letter carefully: Pay close attention to the details, deadlines, and requested information.

- Understanding the request: Ensure you clearly understand what action is required and by when.

- Meeting deadlines: Always meet the stated deadlines to avoid penalties.

- Responding through official channels: Use the official methods of communication specified by HMRC to avoid scams.

- Keeping records of correspondence: Keep records of all correspondence, including copies of your replies and any supporting documentation.

Conclusion

Receiving a new HMRC letter can be concerning, but understanding the different types and how to respond appropriately is crucial for tax compliance. This guide has highlighted key letter types, how to identify genuine communications, and the necessary steps for responding effectively. Stay informed about changes to tax legislation and ensure your tax affairs are up-to-date. If you are unsure about any aspects of your new HMRC letters, seek professional advice. Don’t delay; understanding your HMRC letters is key to avoiding potential penalties and maintaining your financial well-being.

Featured Posts

-

Salaries De La Gaite Lyrique Occupation Illegale Et Preoccupations Securitaires

May 20, 2025

Salaries De La Gaite Lyrique Occupation Illegale Et Preoccupations Securitaires

May 20, 2025 -

Napad Na Detsu U Bi Kh Tadi Protiv Shmita Zbog Trogodishnjeg Ignorisanja Sukoba

May 20, 2025

Napad Na Detsu U Bi Kh Tadi Protiv Shmita Zbog Trogodishnjeg Ignorisanja Sukoba

May 20, 2025 -

Ferrariye Koetue Haber Hamilton Ve Leclerc Cin Grand Prix Sinden Diskalifiye

May 20, 2025

Ferrariye Koetue Haber Hamilton Ve Leclerc Cin Grand Prix Sinden Diskalifiye

May 20, 2025 -

Arsenals New Director Eyes Matheus Cunha Wolves Transfer On The Cards

May 20, 2025

Arsenals New Director Eyes Matheus Cunha Wolves Transfer On The Cards

May 20, 2025 -

Incendio Na Tijuca Escola Em Luto Recordacoes E Solidariedade

May 20, 2025

Incendio Na Tijuca Escola Em Luto Recordacoes E Solidariedade

May 20, 2025

Latest Posts

-

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025 -

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025 -

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025 -

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025