New House Bill Targets Harvard And Yale With Higher Endowment Taxes

Table of Contents

The Proposed Legislation: Key Details of the Higher Endowment Tax Bill

The proposed legislation seeks to significantly increase the tax rate on university endowments exceeding a certain threshold. Understanding the specifics of this bill is crucial to evaluating its potential consequences.

Specific Tax Rate Increases

The bill proposes a substantial percentage increase—let's say, for the sake of example, a jump from the current 1% to 5%—on endowments exceeding $1 billion. This means universities with endowments above this threshold would face a dramatically higher tax burden.

- Example 1: Harvard University, with an endowment exceeding $50 billion (hypothetical figure for illustrative purposes), would see a substantial increase in its tax liability under this 5% rate.

- Example 2: Yale University, with a similarly large endowment (hypothetical figure for illustrative purposes), would face a comparable increase.

- Exemptions: The bill might include exemptions for endowments specifically dedicated to research in critical areas like public health or renewable energy.

- Exceptions: There might be provisions for phased implementation, allowing universities time to adjust their financial strategies.

Allocation of Revenue

A key aspect of the bill is how the increased tax revenue would be allocated. Proponents argue this revenue could significantly benefit public institutions and address critical societal needs.

- Funding Public Schools: A substantial portion of the revenue could be channeled into improving public schools, providing much-needed resources and reducing class sizes.

- Scholarships for Low-Income Students: Increased funding for need-based scholarships could make higher education more accessible to students from disadvantaged backgrounds.

- Infrastructure Improvements: The revenue could be used to fund critical infrastructure projects, such as repairing aging school buildings or constructing new facilities.

- Transparency and Oversight: The bill likely includes provisions for rigorous oversight and transparency in how the funds are managed and distributed to ensure accountability.

Arguments in Favor of Higher Endowment Taxes

Supporters of the bill argue that taxing large university endowments is a necessary step to address wealth inequality and improve public resources.

Addressing Wealth Inequality

The vast sums held by elite universities’ endowments stand in stark contrast to the limited resources available to many public institutions.

- Resource Disparity: Statistics comparing the endowments of Ivy League institutions to the per-pupil funding of public schools in under-resourced communities would highlight this stark disparity.

- Moral Obligation: Proponents argue that these wealthy institutions have a moral obligation to contribute more significantly to society, especially given their tax-exempt status.

Funding for Public Education

Increased funding for public education is a central argument for higher endowment taxes.

- Improved Teacher Salaries: Higher salaries would attract and retain qualified teachers, improving the quality of education.

- Enhanced Classroom Resources: More funding would provide access to updated technology, necessary learning materials, and extracurricular activities.

- Improved Student Outcomes: Increased investment in public education could lead to better student outcomes, closing the achievement gap between students from different socioeconomic backgrounds.

Arguments Against Higher Endowment Taxes

Opponents raise concerns about the potential negative impacts of higher endowment taxes on universities and the legal challenges they might face.

Potential Negative Impacts on Universities

Increased taxes on endowments could have significant repercussions for universities.

- Reduced Research Funding: Universities might be forced to cut back on crucial research initiatives, impacting scientific advancements.

- Decreased Financial Aid: Financial aid programs could be reduced, making higher education less accessible to low-income students.

- Difficulty Attracting Top Faculty: Reduced resources could make it harder for universities to compete for top faculty, potentially lowering the quality of education.

- Tuition Increases: Universities may respond to the tax by increasing tuition fees, placing an even greater burden on students and their families.

Legal Challenges and Constitutional Concerns

The proposed legislation could face legal challenges based on various constitutional grounds.

- Tax Exemptions: Universities might argue that the increased taxes violate their existing tax-exempt status.

- Due Process: There could be concerns about due process and fair treatment in how the tax is levied and enforced.

- Precedent: Legal experts might analyze previous cases involving taxes on non-profit institutions to predict the outcome of potential legal challenges.

Conclusion

This proposed legislation to increase taxes on university endowments represents a significant shift in the debate surrounding wealth inequality and public funding. The bill's details, including the specific tax rate increases and allocation of revenue, will be crucial in determining its ultimate impact. While proponents argue that taxing large endowments can address wealth inequality and improve public education, opponents raise concerns about potential negative consequences for universities and potential legal challenges. The ongoing debate surrounding higher endowment taxes will undoubtedly shape the future of higher education funding and resource allocation. Stay informed about the debate surrounding higher endowment taxes and how this legislation will shape the future of higher education by consulting resources such as government websites and reputable news sources.

Featured Posts

-

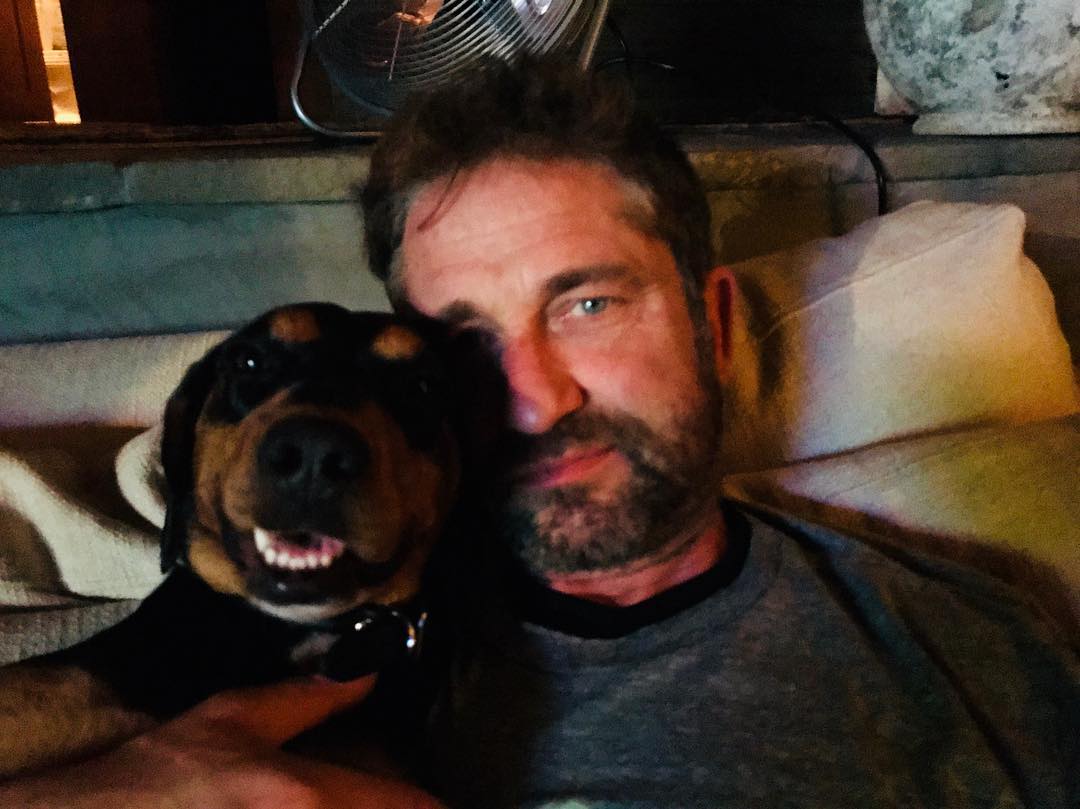

Dzherard Btlr I Blgarskoto Mu Kuche 8 Godini Vyarnost

May 13, 2025

Dzherard Btlr I Blgarskoto Mu Kuche 8 Godini Vyarnost

May 13, 2025 -

School Stabbing Victims Funeral A Community Grieves

May 13, 2025

School Stabbing Victims Funeral A Community Grieves

May 13, 2025 -

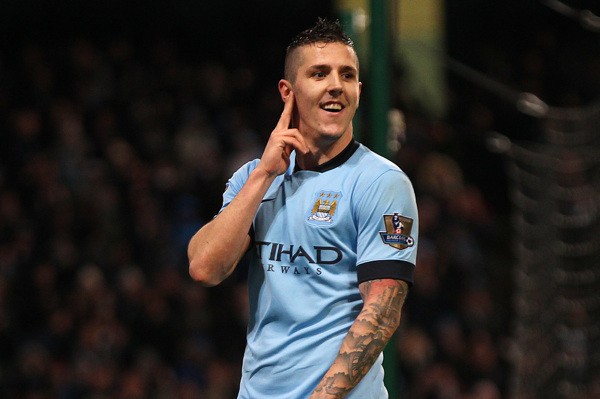

Liverpool Transfers Reds To Battle Chelsea For Lookman

May 13, 2025

Liverpool Transfers Reds To Battle Chelsea For Lookman

May 13, 2025 -

Cp Music Productions Father Son Musical Duo Creates Unique Sounds

May 13, 2025

Cp Music Productions Father Son Musical Duo Creates Unique Sounds

May 13, 2025 -

The Shifting Sands Of The Chinese Auto Market Bmw Porsche And The Path Forward

May 13, 2025

The Shifting Sands Of The Chinese Auto Market Bmw Porsche And The Path Forward

May 13, 2025

Latest Posts

-

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025 -

Dodgers Rally Ohtanis 6 Run 9th Inning Leads To Victory

May 14, 2025

Dodgers Rally Ohtanis 6 Run 9th Inning Leads To Victory

May 14, 2025 -

Shohei Ohtanis 6 Run 9th A Pivotal Moment In Dodgers Win

May 14, 2025

Shohei Ohtanis 6 Run 9th A Pivotal Moment In Dodgers Win

May 14, 2025 -

Ohtanis Historic 9th Inning Dodgers Secure Comeback Victory

May 14, 2025

Ohtanis Historic 9th Inning Dodgers Secure Comeback Victory

May 14, 2025 -

Shohei Ohtanis 6 Run 9th Inning Powers Wild Dodgers Comeback

May 14, 2025

Shohei Ohtanis 6 Run 9th Inning Powers Wild Dodgers Comeback

May 14, 2025