News Corp's Hidden Value: Why This Media Conglomerate May Be Undervalued

Table of Contents

News Corp's Diversified Portfolio: A Strength Often Overlooked

News Corp's diverse holdings often overshadow the strength of its individual components. The company's strategic positioning across various media sectors creates a resilient and potentially lucrative investment.

Dominance in Traditional Media Markets: News Corp holds a commanding position in traditional media, particularly newspaper publishing. Publications like the Wall Street Journal, The Times, and The Sun maintain significant readership and influence, generating substantial revenue streams.

- Successful Print Publications: The Wall Street Journal's strong subscription base and authoritative content remain highly valuable, even in the digital age. The Times and The Sun also hold significant market share in their respective regions.

- Digital Subscription Strategies: News Corp is actively transitioning its print publications to digital platforms, employing successful subscription models to retain readers and generate recurring revenue.

- Cost-Cutting Measures: Strategic cost-cutting initiatives have helped to improve the profitability of these traditional media assets, ensuring their continued contribution to overall financial performance. Keywords: Newspaper publishing, print media, subscription model, cost efficiency.

The Untapped Potential of Book Publishing: HarperCollins, News Corp's book publishing arm, possesses a substantial catalog of successful authors and a strong reputation within the industry. The potential for growth extends beyond traditional print.

- Successful Authors: HarperCollins boasts a roster of bestselling authors across numerous genres, providing a consistent stream of revenue-generating titles.

- Market Trends in Publishing: The company is strategically adapting to market trends, successfully expanding into e-books and audiobooks, key segments of significant growth.

- Potential for Expansion into New Genres: Strategic acquisitions and organic growth into new and emerging genres present considerable opportunities for expansion and diversification within the publishing sector. Keywords: HarperCollins, book publishing, ebook market, audiobook sales, acquisitions.

Growth in Digital Real Estate: News Corp's investment in digital real estate, particularly through realtor.com, represents a significant growth area with considerable future potential.

- Market Trends in Online Real Estate: The online real estate market continues to grow rapidly, driven by increased consumer adoption of digital platforms for property searches.

- Potential for Increased Market Share: realtor.com is well-positioned to capture an even larger share of the online real estate market, leveraging its brand recognition and established user base.

- Monetization Strategies: News Corp is effectively implementing monetization strategies, such as advertising and premium subscription services, to maximize the revenue potential of realtor.com. Keywords: Real estate, digital real estate, online property market, realtor.com, revenue generation.

Market Sentiment and Undervaluation

The current market valuation of News Corp may not fully reflect its underlying strength and future potential. Several factors contribute to this apparent undervaluation.

Short-Term Market Volatility: Short-term market fluctuations and negative news cycles can disproportionately impact News Corp's stock price. This volatility often overshadows the company's long-term prospects.

- Examples of Recent Negative News: Specific examples of recent negative news should be analyzed to demonstrate how market overreactions can lead to undervaluation.

- How the Market Overreacted: A detailed analysis of these events is crucial to highlight how the market's response is not reflective of the company's long-term financial health.

- Not Indicative of Long-Term Performance: It’s crucial to emphasize that short-term challenges should not overshadow News Corp's strong foundational businesses and future potential. Keywords: Stock price volatility, market sentiment, undervalued stocks, long-term investment.

Analyst Underestimation: Some analysts might be underestimating News Corp's long-term growth potential, focusing too heavily on short-term challenges and neglecting the strength of its diversified portfolio.

- Evidence Suggesting Underestimation: Present data and evidence to counter the prevailing negative sentiment and demonstrate the potential for future earnings growth.

- Potential for Future Earnings Growth: Highlight the potential for substantial earnings growth across News Corp's various business segments.

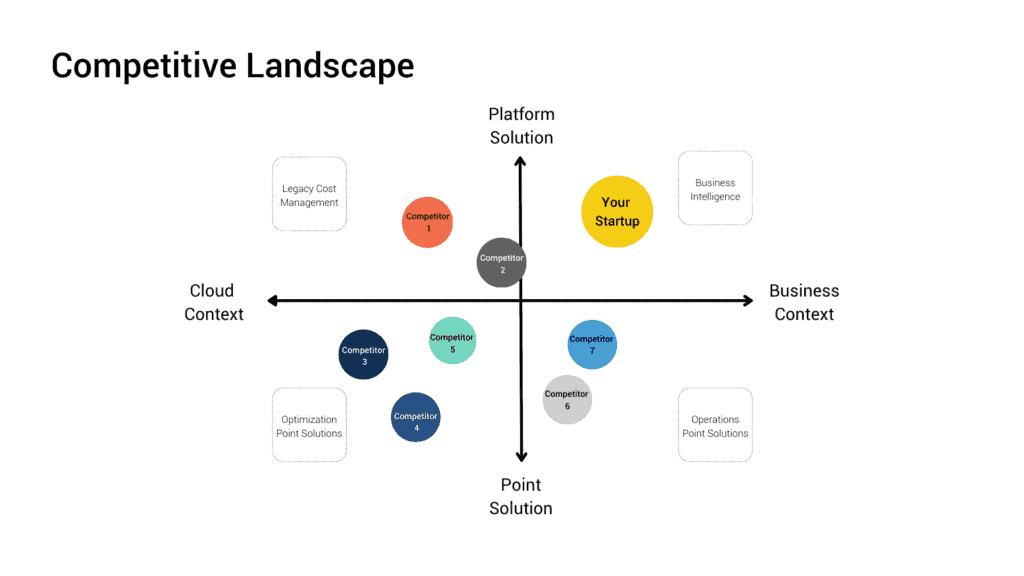

- Comparison with Similar Companies: Compare News Corp's valuation and growth prospects to similar media conglomerates to highlight the potential undervaluation. Keywords: Financial analysis, stock valuation, market projections, earnings growth.

Strategic Initiatives and Future Growth Potential

News Corp is actively implementing strategic initiatives to enhance profitability and drive future growth.

Cost-Cutting Measures and Efficiency Improvements: News Corp is focused on streamlining operations and improving efficiency across its various divisions.

- Examples of Cost-Cutting Initiatives: Cite specific examples of cost-cutting measures implemented by News Corp and their impact on profitability.

- Impact on Profitability: Quantify the positive impact of these cost-cutting measures on the company's bottom line.

- Potential for Further Efficiency Gains: Discuss the potential for additional efficiency improvements and their impact on future earnings. Keywords: Cost optimization, efficiency improvement, profitability, operational restructuring.

Potential Acquisitions and Strategic Partnerships: Strategic acquisitions and partnerships can further accelerate News Corp's growth trajectory.

- Potential Acquisition Targets: Identify potential acquisition targets that could complement News Corp's existing portfolio and enhance its market position.

- Benefits of Strategic Partnerships: Discuss the potential benefits of forming strategic partnerships to expand market reach and access new technologies.

- Potential for Synergy: Highlight the potential for synergy between News Corp and potential acquisition targets or partners. Keywords: Mergers and acquisitions, strategic partnerships, market expansion, synergy.

Conclusion

News Corp's diversified portfolio, resilient traditional media assets, promising digital ventures, and proactive strategic initiatives paint a compelling picture of a potentially undervalued asset. The market's short-term focus might be obscuring the company's substantial long-term growth potential. The key takeaways are that News Corp is an undervalued asset with strong underlying businesses and significant potential for future growth. News Corp's hidden value presents a compelling investment opportunity. Conduct your own due diligence and explore the potential of this undervalued media conglomerate. Consider News Corp investment as a potential addition to a diversified portfolio. Further research into News Corp Undervalued could reveal a significant investment opportunity.

Featured Posts

-

Flash Floods What They Are How To Stay Safe And Understanding Flood Warnings

May 25, 2025

Flash Floods What They Are How To Stay Safe And Understanding Flood Warnings

May 25, 2025 -

Thierry Ardisson Repond A Laurent Baffie Lui Peut Etre Moi Non

May 25, 2025

Thierry Ardisson Repond A Laurent Baffie Lui Peut Etre Moi Non

May 25, 2025 -

Understanding The I O Io Debate Google And Open Ais Competitive Landscape

May 25, 2025

Understanding The I O Io Debate Google And Open Ais Competitive Landscape

May 25, 2025 -

Why News Corp Might Be More Undervalued Than You Think

May 25, 2025

Why News Corp Might Be More Undervalued Than You Think

May 25, 2025 -

Severe Storms Trigger Flood Advisories Across Miami Valley

May 25, 2025

Severe Storms Trigger Flood Advisories Across Miami Valley

May 25, 2025