Nike Q3 Results: Jefferies Warns Of Near-Term Impact On Foot Locker

Table of Contents

Nike's Q3 Performance: A Detailed Analysis

Key Highlights from Nike's Q3 Earnings Report:

Nike's Q3 earnings report revealed a mixed bag. While some metrics exceeded expectations, others raised concerns about the near-term outlook. Let's break down the key figures:

- Revenue: Increased by 5% year-over-year, reaching $12.3 billion. This growth, while positive, was slightly below some analysts' projections.

- Earnings Per Share (EPS): Beat expectations by 10%, reaching $0.88, demonstrating efficient cost management despite revenue challenges.

- Gross Margin: Declined slightly to 44%, primarily due to increased promotional activity and elevated freight costs. This signals a possible need for price adjustments or increased efficiency in the supply chain.

Nike's Inventory Levels and Their Significance:

Nike reported a significant increase in inventory levels compared to the previous year. This surplus could be attributed to several factors:

- Supply Chain Disruptions: Lingering effects of global supply chain issues may have contributed to an oversupply of products.

- Demand Fluctuations: Changes in consumer spending habits and preferences may have resulted in lower-than-anticipated demand for certain product lines.

High inventory levels often lead to increased promotional activity and potential margin pressure, as Nike may need to discount products to clear excess stock. This is directly relevant to the impact on Foot Locker, which relies on wholesale shipments from Nike.

Direct-to-Consumer (DTC) Strategy Impact:

Nike's DTC strategy continues to be a major focus. While the company reported growth in its DTC channels, the rate of growth was slower than in previous quarters. This indicates a potential shift in consumer purchasing behavior, influencing the wholesale channel and thus impacting partners like Foot Locker.

- Online Sales Growth: While online sales grew, the growth rate was less robust than anticipated. This could signal increased competition or a general softening of consumer demand in the online market.

- Brick-and-Mortar Performance: Brick-and-mortar sales also experienced slower-than-expected growth, further pointing to broader market challenges. This reduced demand across both channels has implications for Nike's wholesale partners.

Jefferies' Concerns Regarding Foot Locker's Near-Term Outlook

Jefferies' Prediction and Rationale:

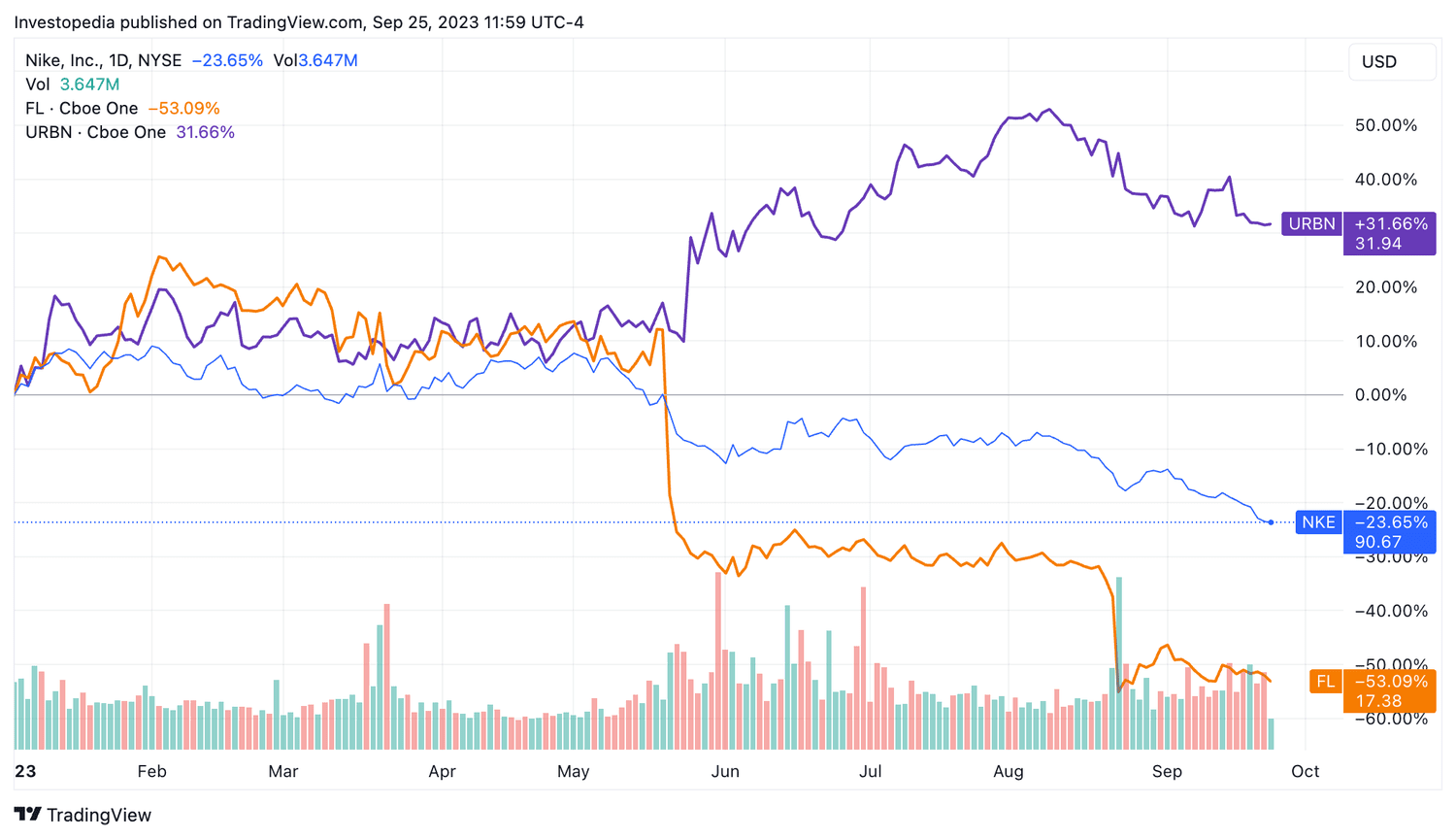

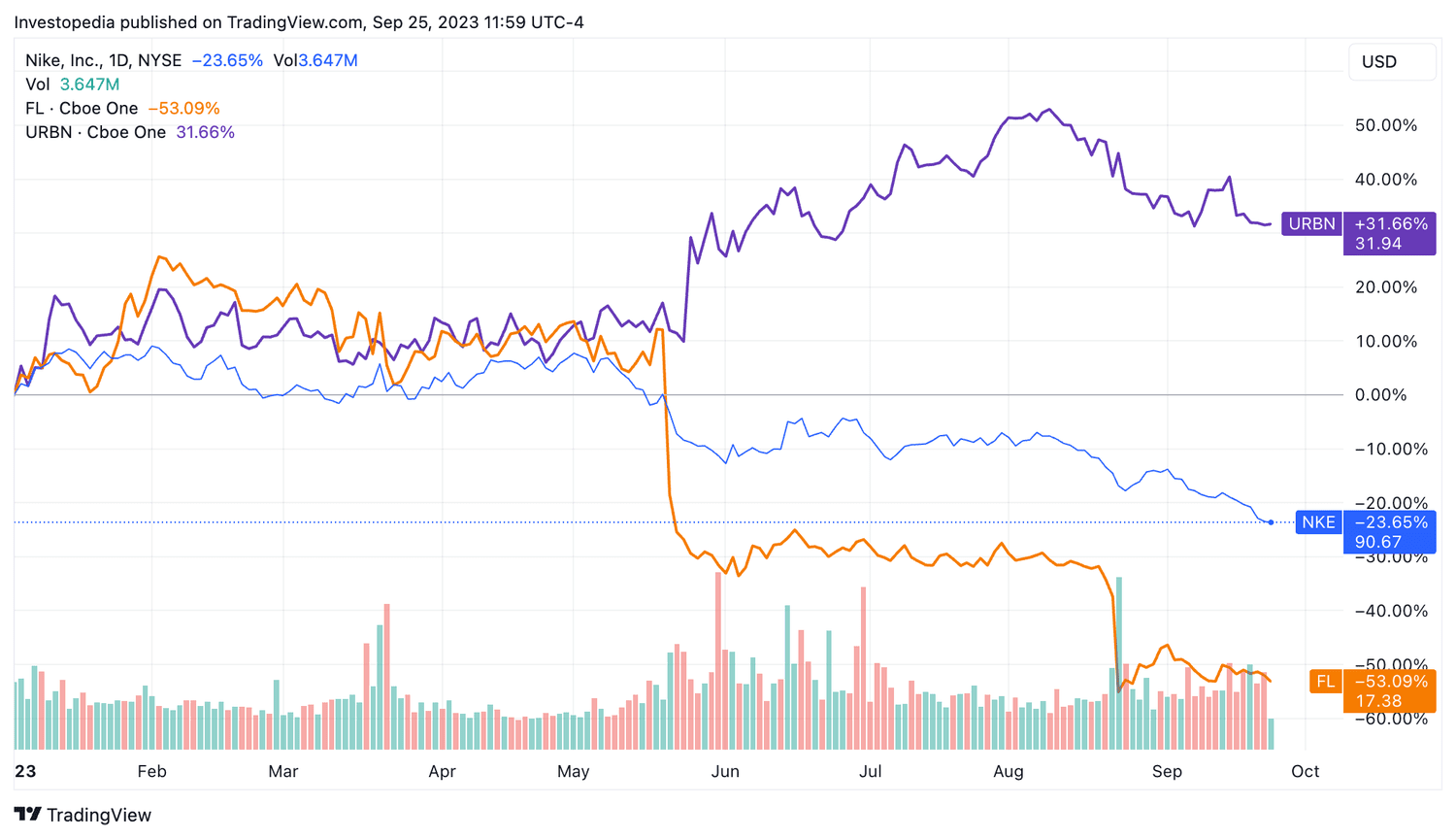

Jefferies has expressed concern that Nike's increased inventory levels and slower-than-expected sales growth could lead to reduced wholesale shipments to Foot Locker in the near term. The firm believes this could negatively impact Foot Locker's sales and profitability. Their analysis points to Nike prioritizing its DTC channels, potentially reducing its reliance on wholesale partners. One Jefferies analyst stated, "Nike's inventory build suggests a potential slowdown in wholesale shipments, which could create headwinds for Foot Locker in the coming quarters."

Potential Impacts on Foot Locker's Sales and Profitability:

Reduced Nike shipments could significantly impact Foot Locker's revenue streams, as Nike products represent a substantial portion of its sales. This reduced supply could lead to:

- Lower Sales: Fewer Nike products available for sale will directly translate to lower sales figures for Foot Locker.

- Margin Pressure: Foot Locker may be forced to rely more heavily on other brands, potentially impacting overall profitability and margin structure.

Foot Locker might mitigate these potential negative impacts by diversifying its product portfolio, strengthening relationships with other athletic brands, and implementing aggressive promotional campaigns.

The Broader Implications for the Athletic Footwear Industry

Industry-Wide Trends and Challenges:

Nike's Q3 performance and Jefferies' warning reflect broader trends in the athletic footwear industry. Increased inflation, decreased consumer spending, and a shift in consumer preferences are all influencing the sector. The increased competition among athletic brands is also playing a role. This highlights the vulnerabilities of retail partners heavily reliant on a single major supplier.

Conclusion: Nike Q3 Results and the Future of Foot Locker

Nike's Q3 results, while showing some positive aspects, have raised concerns about the near-term outlook for its wholesale partners, particularly Foot Locker. Jefferies' warning underscores the potential for reduced Nike shipments to impact Foot Locker's sales and profitability. While both companies may navigate these challenges successfully in the long term, the short-term outlook appears uncertain. To stay informed about future Nike Q3 results and their impact on the athletic footwear industry, subscribe to our newsletter and follow reputable financial news sources. Further research into the impact of Nike’s earnings on other key players within the athletic footwear industry is recommended.

Featured Posts

-

Assessing Trumps Oil Price Preference A Goldman Sachs Social Media Analysis

May 16, 2025

Assessing Trumps Oil Price Preference A Goldman Sachs Social Media Analysis

May 16, 2025 -

Knicks Brunson Exits Lakers Game After Ankle Roll In Overtime

May 16, 2025

Knicks Brunson Exits Lakers Game After Ankle Roll In Overtime

May 16, 2025 -

Predicting The Braves Vs Padres Game Atlantas Chances For A Win

May 16, 2025

Predicting The Braves Vs Padres Game Atlantas Chances For A Win

May 16, 2025 -

Sigue El Encuentro Venezia Napoles En Vivo

May 16, 2025

Sigue El Encuentro Venezia Napoles En Vivo

May 16, 2025 -

Predicting Padres Vs Yankees San Diegos Pursuit Of A Seven Game Winning Streak

May 16, 2025

Predicting Padres Vs Yankees San Diegos Pursuit Of A Seven Game Winning Streak

May 16, 2025

Latest Posts

-

And 7

May 17, 2025

And 7

May 17, 2025 -

The Unpaid 1 Tom Cruises Outstanding Debt To Tom Hanks

May 17, 2025

The Unpaid 1 Tom Cruises Outstanding Debt To Tom Hanks

May 17, 2025 -

Tom Cruise And Tom Hanks 1 Debt A Hollywood Oddity

May 17, 2025

Tom Cruise And Tom Hanks 1 Debt A Hollywood Oddity

May 17, 2025 -

The 1 Debt Tom Cruise And Tom Hanks Unresolved Hollywood Story

May 17, 2025

The 1 Debt Tom Cruise And Tom Hanks Unresolved Hollywood Story

May 17, 2025 -

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 17, 2025

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 17, 2025