Nvidia's CoreWeave Investment: CRWV Stock Price Analysis

Table of Contents

Understanding Nvidia's Strategic Investment in CoreWeave

Nvidia's investment in CoreWeave represents a significant strategic move in the rapidly expanding cloud computing market. While the exact terms of the investment remain partially undisclosed, it signifies a substantial commitment by Nvidia, demonstrating their belief in CoreWeave's potential. Nvidia's motivations are multifaceted: securing access to a robust and scalable GPU cloud infrastructure aligns perfectly with their ambitions to dominate the data center market, particularly in the high-growth AI and machine learning sectors.

- Key details of the investment agreement: While specifics are limited, the investment likely includes a combination of equity funding and potential strategic partnerships, allowing for deeper integration of Nvidia's technologies within CoreWeave's platform.

- Significance of the partnership: For Nvidia, the partnership provides access to a critical distribution channel for their GPUs, expanding their reach to a broader range of AI developers and researchers. For CoreWeave, it grants them access to Nvidia's cutting-edge technology and the substantial brand recognition and market credibility that comes with it, strengthening their position as a leading provider of GPU cloud services.

- Market analysis of Nvidia's strategic moves: Nvidia's investment underscores their aggressive strategy to become a dominant player in the cloud computing landscape, mirroring similar strategic investments made by other tech giants.

CoreWeave's Business Model and Market Position

CoreWeave operates within the highly competitive GPU cloud computing market, offering a specialized service catering to the growing demand for high-performance computing resources. Their business model centers on providing on-demand access to a vast pool of NVIDIA GPUs via the cloud, enabling developers, researchers, and businesses to leverage the immense processing power needed for AI model training, rendering, and other computationally intensive tasks.

- Key features and benefits: CoreWeave's cloud offerings distinguish themselves through superior performance, scalability, and cost-effectiveness, attracting a diverse clientele.

- Target customer segments: Their primary target markets include AI developers, researchers in academia and industry, and businesses engaged in data-intensive applications such as machine learning, video rendering, and scientific simulations.

- Comparison with competitors: CoreWeave faces stiff competition from established players like AWS, Google Cloud, and Azure, but differentiates itself through its specialized focus on GPU-accelerated computing, allowing for a more tailored and optimized service.

CRWV Stock Price Performance Before and After Nvidia's Investment

Analyzing the CRWV stock price trajectory before and after Nvidia's investment reveals a compelling narrative. Leading up to the announcement, the stock demonstrated [insert specific price trends and data here, e.g., steady growth, periods of volatility, etc.]. The immediate reaction following the investment announcement was [insert specific data and description, e.g., a sharp increase, a more moderate rise, etc.]. Subsequent price fluctuations can be attributed to several factors including broader market sentiment, news related to the company's operations, and investor speculation.

- Historical CRWV stock price chart: [Insert a chart showing historical CRWV stock price data, highlighting key trends before and after the investment].

- Analysis of trading volume changes: [Describe the changes in trading volume around the investment announcement and subsequent periods. Did volume increase significantly, suggesting heightened investor interest?]

- Influencing factors: Factors such as general market trends, broader economic conditions, and news specific to CoreWeave and the competitive landscape in the GPU cloud computing sector all play a significant role in influencing CRWV stock price volatility.

Factors Influencing Future CRWV Stock Price Predictions

Predicting future CRWV stock prices requires considering various factors. The long-term impact of Nvidia's investment is likely to be substantial, fostering CoreWeave's growth and potentially leading to increased market share. However, several challenges remain.

- Projected revenue growth: Based on industry forecasts and CoreWeave's current trajectory, projected revenue growth indicates [insert data and projections here], but these predictions are subject to change based on market dynamics and competition.

- Potential for future funding rounds or acquisitions: Further investment rounds could significantly impact the CRWV stock price. The possibility of acquisition by a larger tech company is also a factor to consider.

- Competitive threats and risks: The competitive landscape in the cloud computing sector remains intensely competitive. Market saturation and technological advancements by competitors present ongoing challenges.

Technical Analysis of CRWV Stock

Technical analysis provides another perspective on CRWV stock price movements. By examining indicators such as moving averages, relative strength index (RSI), and support/resistance levels, investors can gain insights into potential price trends. [Insert charts and relevant data illustrating technical analysis findings, such as support and resistance levels, trend lines, and relevant indicators].

Disclaimer: This is not financial advice. Conduct thorough research before making any investment decisions.

Conclusion: Nvidia's CoreWeave Investment and the Future of CRWV Stock

Nvidia's investment in CoreWeave represents a pivotal moment for the company and significantly impacts the CRWV stock price outlook. While the partnership offers substantial growth potential, investors should remain aware of the competitive landscape and inherent risks within the tech sector. Our analysis suggests [summarize key findings, e.g., positive long-term growth potential, but also the need for cautious optimism].

To make informed investment decisions concerning CRWV stock, further research is crucial. Understanding the ongoing impact of Nvidia's CoreWeave investment and continuously monitoring CRWV stock price analysis are vital steps. [Insert links to relevant resources such as financial news sites, CoreWeave's investor relations page, etc.]. Remember to conduct your own thorough due diligence before investing.

Featured Posts

-

Oh Jun Sungs Thrilling Wtt Star Contender Chennai Victory

May 22, 2025

Oh Jun Sungs Thrilling Wtt Star Contender Chennai Victory

May 22, 2025 -

7 Vi Tri Ket Noi Tp Hcm Long An Can Uu Tien Dau Tu

May 22, 2025

7 Vi Tri Ket Noi Tp Hcm Long An Can Uu Tien Dau Tu

May 22, 2025 -

David Walliams Attack On Simon Cowell A Britains Got Talent Controversy

May 22, 2025

David Walliams Attack On Simon Cowell A Britains Got Talent Controversy

May 22, 2025 -

Real Madrid De Klopp Olasi Bir Senaryo Ve Etkileri

May 22, 2025

Real Madrid De Klopp Olasi Bir Senaryo Ve Etkileri

May 22, 2025 -

Todays News Sesame Street Joins Netflix And More

May 22, 2025

Todays News Sesame Street Joins Netflix And More

May 22, 2025

Latest Posts

-

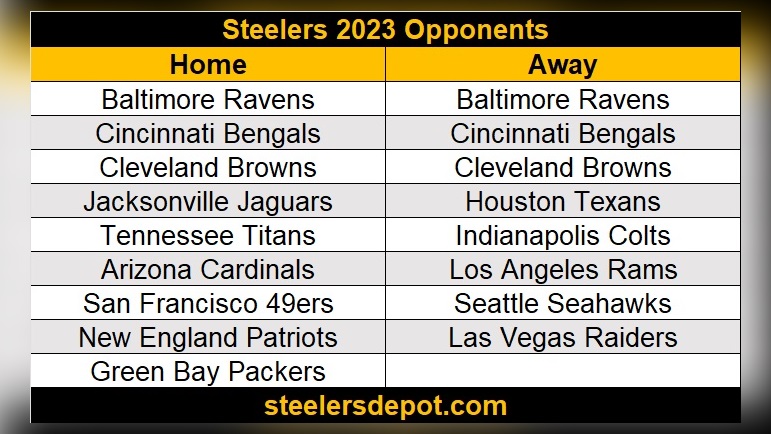

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025 -

Steelers Nfl Draft Plans The Case For A New Quarterback

May 22, 2025

Steelers Nfl Draft Plans The Case For A New Quarterback

May 22, 2025 -

Pittsburgh Steelers Insider Explains Pickens Trade Decision

May 22, 2025

Pittsburgh Steelers Insider Explains Pickens Trade Decision

May 22, 2025 -

The Pittsburgh Steelers Draft Strategy A Look At Quarterback Prospects

May 22, 2025

The Pittsburgh Steelers Draft Strategy A Look At Quarterback Prospects

May 22, 2025 -

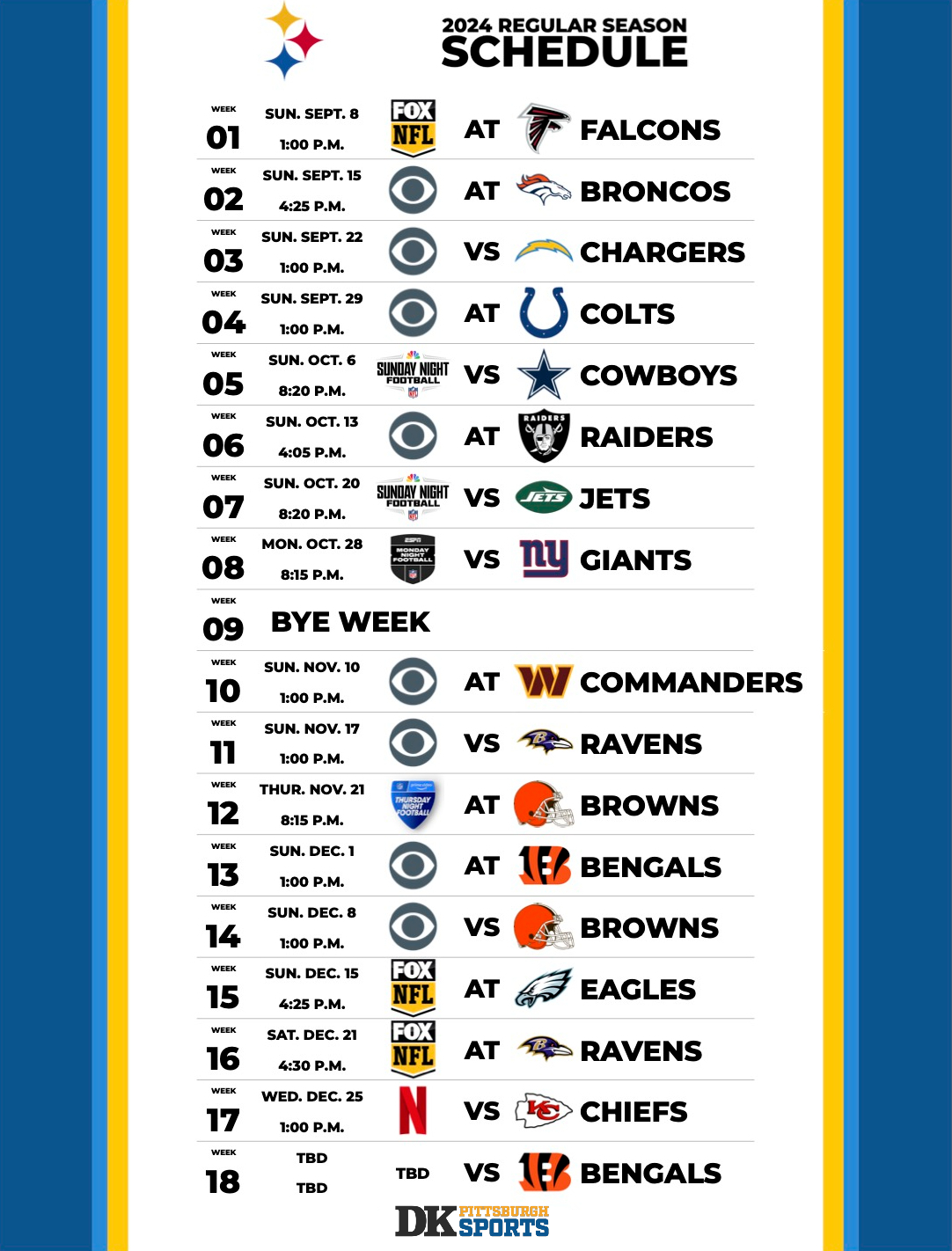

The Pittsburgh Steelers 2025 Schedule Key Matchups And Predictions

May 22, 2025

The Pittsburgh Steelers 2025 Schedule Key Matchups And Predictions

May 22, 2025