One Analyst Forecasts $254 For Apple Stock: Time To Buy?

Table of Contents

The Analyst's Rationale Behind the $254 Apple Stock Prediction

The $254 Apple stock prediction, reportedly from [Analyst Name and Affiliation – insert name and details here if available], stems from a confluence of factors suggesting strong future growth for the tech giant. The analyst's reasoning centers on Apple's robust ecosystem and anticipated performance across several key areas. Their Apple stock forecast rests on the following pillars:

- Sustained iPhone Sales Growth: Despite market saturation, the analyst anticipates continued strong sales driven by innovative features and loyal customer base. The iPhone remains the cornerstone of Apple's revenue, and consistent growth in this segment is vital to the $254 Apple stock price target.

- Expansion of Services Revenue: Apple's services sector, encompassing Apple Music, iCloud, and the App Store, continues to show exponential growth. This recurring revenue stream provides stability and is expected to significantly contribute to the overall value of Apple stock.

- Potential for New Product Categories: The analyst's Apple stock forecast incorporates the potential impact of new product categories such as augmented reality (AR) and virtual reality (VR) headsets, which could unlock entirely new markets for Apple. Successful launches in these areas could substantially boost Apple's revenue and drive the $254 price prediction.

- Global Market Expansion: Apple continues to tap into emerging markets worldwide, further contributing to the optimistic Apple stock forecast.

The analyst's report, while not publicly available [Insert link to report if available], highlights these factors and provides detailed financial modeling supporting the $254 Apple stock price target.

Analyzing Apple's Current Financial Performance and Future Prospects

Apple's recent financial reports paint a mixed picture. While revenue and earnings have remained strong, growth rates have shown some moderation. To effectively assess the validity of the $254 Apple stock price prediction, let's analyze some key performance indicators (KPIs):

- Revenue Growth: [Insert recent revenue growth data]. Although growth has slowed slightly compared to previous quarters, it remains positive, indicating sustained market demand.

- Earnings Per Share (EPS): [Insert recent EPS data]. Consistent EPS growth is a positive indicator and supports the long-term outlook for Apple stock.

- Debt Levels: [Insert data on Apple's debt]. A healthy balance sheet is crucial for long-term growth, and Apple's relatively low debt levels are a positive factor.

However, challenges exist. Increased competition in the smartphone market and potential economic downturns could impact future Apple revenue growth. These are important considerations when evaluating the $254 Apple stock price prediction.

Comparing the $254 Prediction to Other Analyst Forecasts and Current Market Sentiment

The $254 Apple stock prediction isn't an isolated opinion. While a range of forecasts exists, many analysts share an optimistic outlook for Apple stock. The average analyst price target currently sits at [Insert average analyst price target]. However, it's crucial to consider the current market sentiment. Recent tech sector volatility has raised some concerns. While the long-term Apple stock outlook remains strong, short-term fluctuations are possible.

- Average Analyst Price Target: [Insert data – e.g., $230]

- Current Apple Stock Price: [Insert current price]

- Market Sentiment: [Describe the overall market sentiment – e.g., cautiously optimistic].

Significant news events, like new product announcements or regulatory changes, can significantly influence Apple stock price, adding another layer of complexity to the analysis.

Risk Assessment and Investment Strategies for Apple Stock

Investing in Apple stock, even with a promising $254 Apple stock price prediction, involves inherent risks.

- Market Volatility: The stock market is inherently volatile. Unexpected economic downturns or geopolitical events could negatively impact Apple stock price.

- Competition: Apple faces increasing competition in all its major product categories, requiring continuous innovation to maintain market share.

- Economic Downturns: A global recession could significantly impact consumer spending, potentially affecting Apple sales.

Considering these risks, investors should adopt a suitable investment strategy:

- Buy and Hold: This long-term strategy is appropriate for investors with a high risk tolerance and a belief in Apple's long-term growth potential.

- Dollar-Cost Averaging: Regularly investing a fixed amount, regardless of price fluctuations, reduces the impact of market volatility.

- Diversification: Spreading investments across different asset classes minimizes overall risk.

Conclusion: Should You Buy Apple Stock at the $254 Prediction?

The $254 Apple stock price prediction presents an intriguing possibility, driven by strong underlying factors like sustained iPhone sales, expansion of services, and the potential for new product categories. However, it’s vital to acknowledge the inherent risks associated with any stock investment, including market volatility and competition. The prediction should be viewed within the context of other analyst forecasts and overall market sentiment. A balanced approach is crucial.

Is the $254 Apple stock price prediction the signal you've been waiting for? Do your due diligence, consider your personal risk tolerance and financial goals, and make an informed decision. Remember to conduct thorough research before making any investment decisions. Apple stock, like any investment, requires careful consideration of your individual circumstances.

Featured Posts

-

Unlocking Ai And Automation Potential Orchestration At Camunda Con 2025 Amsterdam

May 24, 2025

Unlocking Ai And Automation Potential Orchestration At Camunda Con 2025 Amsterdam

May 24, 2025 -

Kering Sales Decline As Demna Prepares First Gucci Collection

May 24, 2025

Kering Sales Decline As Demna Prepares First Gucci Collection

May 24, 2025 -

Fatal Shop Stabbing Leads To Teens Rearrest Following Bail Release

May 24, 2025

Fatal Shop Stabbing Leads To Teens Rearrest Following Bail Release

May 24, 2025 -

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025 -

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets A Guide

May 24, 2025

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets A Guide

May 24, 2025

Latest Posts

-

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Increase

May 24, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Increase

May 24, 2025 -

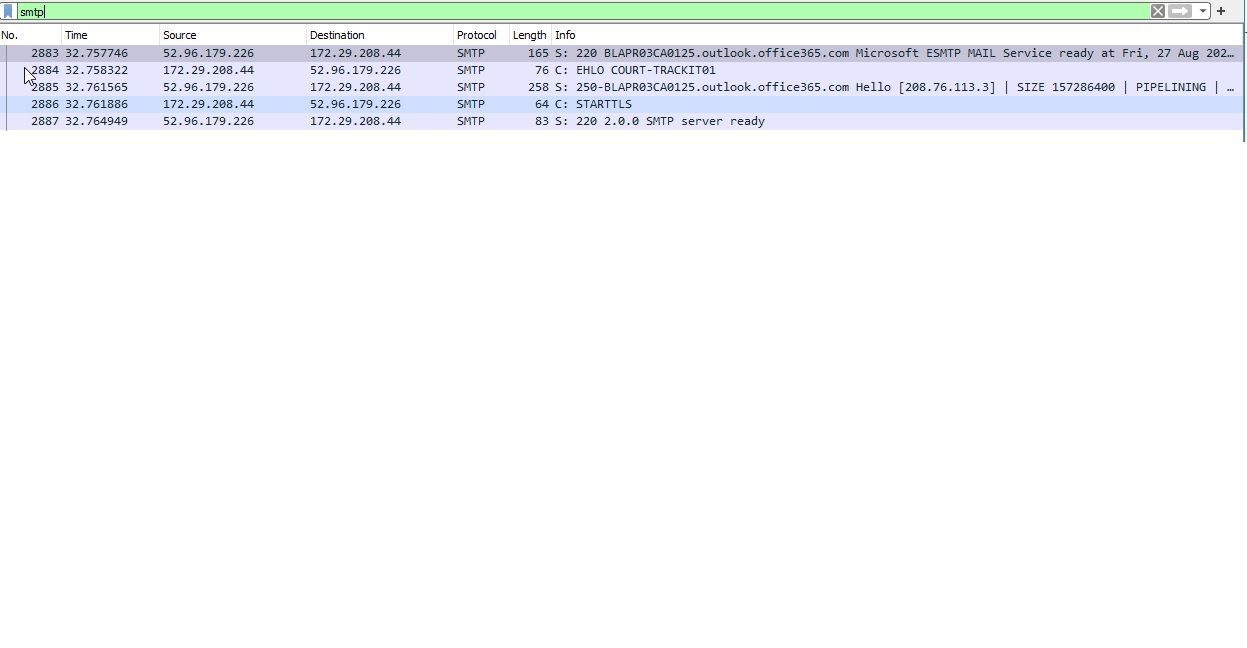

Office365 Security Failure Millions Lost In Targeted Email Hacks

May 24, 2025

Office365 Security Failure Millions Lost In Targeted Email Hacks

May 24, 2025 -

Strengthening Bonds Bipartisan Senate Resolution On The Canada U S Relationship

May 24, 2025

Strengthening Bonds Bipartisan Senate Resolution On The Canada U S Relationship

May 24, 2025 -

Data Breach Exposes Millions In Losses Targeting Of Executive Office365 Accounts

May 24, 2025

Data Breach Exposes Millions In Losses Targeting Of Executive Office365 Accounts

May 24, 2025 -

The Impact Of A Judges Ruling On E Bay Listings Of Banned Chemicals

May 24, 2025

The Impact Of A Judges Ruling On E Bay Listings Of Banned Chemicals

May 24, 2025