One Cryptocurrency Stands Strong Amidst Trade War Uncertainty

Table of Contents

Bitcoin's Resilience During Economic Uncertainty

Bitcoin's ability to weather the storm of trade war anxieties highlights its unique characteristics. Its resilience stems from several key factors:

Decentralization as a Protective Factor

Bitcoin's decentralized nature is a significant advantage during periods of geopolitical instability. Unlike traditional financial systems susceptible to government intervention and manipulation, Bitcoin operates on a peer-to-peer network, making it resistant to censorship and control.

- Reduced reliance on centralized authorities: Bitcoin's distributed ledger technology (blockchain) eliminates the single point of failure present in traditional banking systems.

- Lack of susceptibility to government sanctions or manipulation: Governments cannot easily freeze or confiscate Bitcoin holdings, offering a level of protection unavailable with fiat currencies.

- Inherent security features: Cryptographic hashing and blockchain technology ensure the integrity and security of transactions, making Bitcoin a robust and trustworthy asset.

Safe Haven Asset Characteristics

Bitcoin is increasingly viewed as a safe haven asset, similar to gold, offering a store of value during economic uncertainty. This perception is driven by several factors:

- Limited supply: Bitcoin's fixed supply of 21 million coins limits inflation and provides a predictable scarcity factor, appealing to investors seeking stability.

- Historical price performance during crises: Although volatile, Bitcoin has demonstrated periods of strong performance during times of market turmoil, suggesting a potential hedge against traditional market downturns.

- Growing institutional adoption: The increasing adoption of Bitcoin by institutional investors, such as MicroStrategy and Tesla, lends further credence to its status as a valuable, long-term investment.

Diversification Benefits for Investors

Including Bitcoin in a diversified investment portfolio can help mitigate risk and potentially enhance returns. Its low correlation with traditional assets like stocks and bonds makes it a valuable addition to a well-rounded portfolio.

- Low correlation with stocks and bonds: Bitcoin's price movements often differ from traditional markets, providing diversification benefits during periods of market stress.

- Potential for higher returns: Bitcoin's historical price appreciation has outpaced many traditional asset classes, although past performance is not indicative of future results.

- Risk mitigation strategies: A carefully constructed portfolio including Bitcoin can help to reduce overall portfolio volatility and improve risk-adjusted returns.

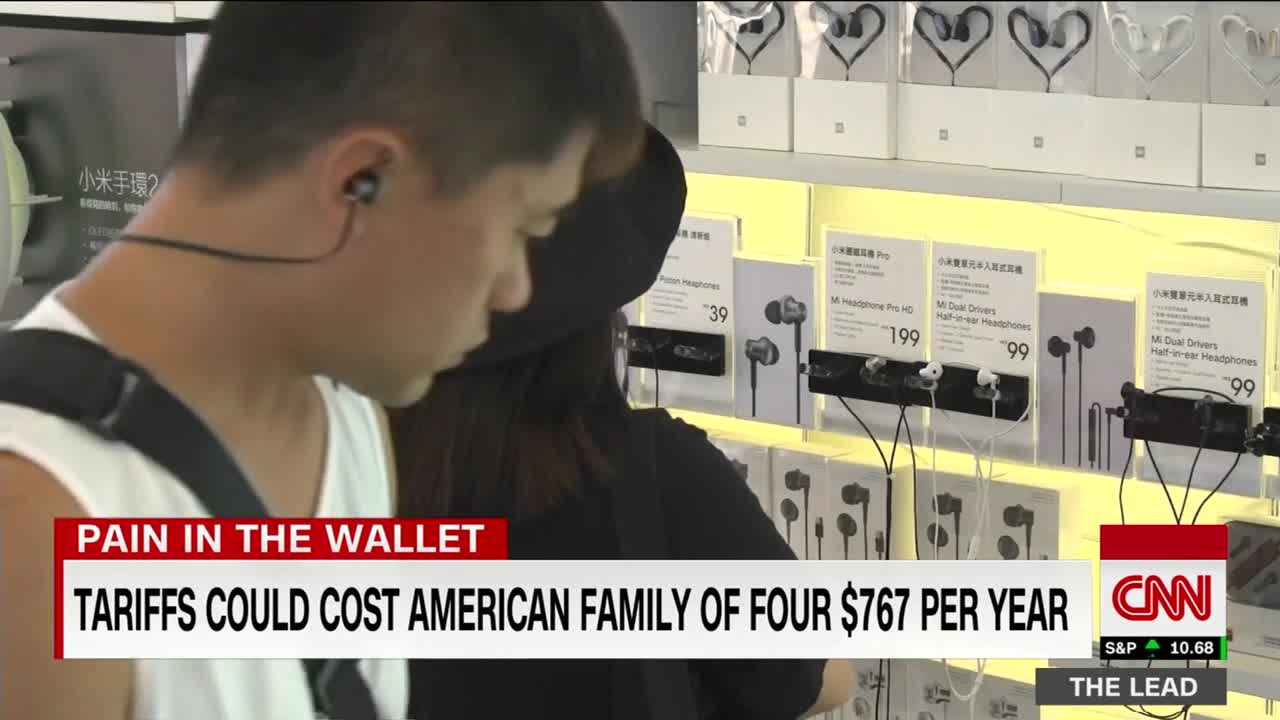

The Impact of Trade Wars on Traditional Markets

Trade wars significantly impact traditional financial markets, creating increased volatility and anxiety among investors.

Increased Market Volatility

Trade wars introduce considerable uncertainty, leading to sharp market fluctuations. The imposition of tariffs and trade restrictions disrupts supply chains, affects company earnings, and undermines investor confidence.

- Examples of market reactions to trade war news: We've seen sharp drops in stock markets globally following announcements of new tariffs or trade disputes.

- Impact on investor confidence: Uncertainty surrounding trade policies leads to decreased investor confidence, resulting in reduced investment and increased volatility.

- Increased uncertainty: The unpredictable nature of trade wars makes it difficult for investors to make informed decisions, increasing overall market uncertainty.

Safe Haven Assets vs. Risk Assets

During periods of trade war escalation, investors often shift from risk assets (stocks, bonds) to safe haven assets (gold, US Treasury bonds). Bitcoin’s performance during such periods is worthy of close examination and comparison.

- Comparison of returns and volatility: While gold traditionally serves as a safe haven, Bitcoin's performance can sometimes be more dynamic, offering potential for higher returns, though with increased volatility.

- Highlighting Bitcoin's performance relative to others: Bitcoin's resilience in the face of trade war uncertainty offers a compelling case for its inclusion in a diversified investment portfolio.

The Future of Cryptocurrency in a Volatile Global Landscape

The future of cryptocurrency, particularly Bitcoin, looks promising, driven by several factors:

Growing Institutional Interest

The increasing adoption of Bitcoin by institutional investors signifies a growing acceptance and confidence in the asset class.

- Examples of institutional investments in crypto: Major companies are now actively investing in and holding Bitcoin as a reserve asset.

- Reasons for increased adoption: Institutional investors are attracted to Bitcoin's decentralization, scarcity, and potential for long-term appreciation.

- Future projections: Further institutional adoption is expected, potentially driving even greater price appreciation and market maturity.

Technological Advancements and Regulation

Technological advancements and evolving regulatory frameworks are shaping the future of the cryptocurrency market.

- Scalability solutions: Ongoing development of layer-2 solutions and other technologies is improving Bitcoin’s scalability and transaction speed.

- Regulatory clarity in different jurisdictions: While regulatory uncertainty remains in some areas, increasing regulatory clarity in key markets is fostering growth and adoption.

- Impact on market growth: Technological improvements and clear regulatory frameworks will contribute significantly to the continued growth and mainstream adoption of Bitcoin.

Conclusion

Bitcoin's resilience amidst trade war uncertainty underscores its potential as a valuable asset in a volatile global landscape. Its decentralized nature, characteristics as a safe-haven asset, and growing institutional interest contribute significantly to its strength during turbulent economic times. Bitcoin's unique properties distinguish it from traditional assets and present a compelling case for its inclusion in diversified investment strategies. Explore the potential of Bitcoin in your portfolio and learn more about how this cryptocurrency can navigate trade war uncertainty. Remember to conduct thorough research before making any investment decisions. Invest in Bitcoin wisely.

Featured Posts

-

Cologne Takes Bundesliga 2 Lead After Matchday 27

May 09, 2025

Cologne Takes Bundesliga 2 Lead After Matchday 27

May 09, 2025 -

Are Trumps Tariffs His Only Weapon Senator Warner Weighs In

May 09, 2025

Are Trumps Tariffs His Only Weapon Senator Warner Weighs In

May 09, 2025 -

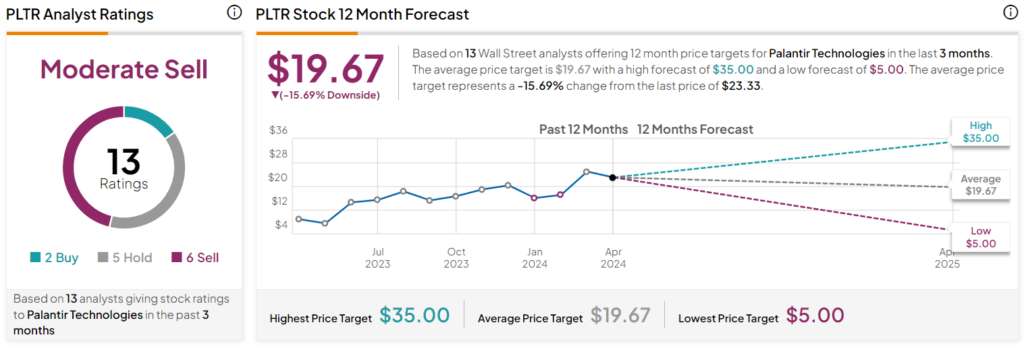

Updated Palantir Stock Predictions After Recent Price Increase

May 09, 2025

Updated Palantir Stock Predictions After Recent Price Increase

May 09, 2025 -

Taiwans Vice President Lai Warns Of Growing Totalitarian Threat

May 09, 2025

Taiwans Vice President Lai Warns Of Growing Totalitarian Threat

May 09, 2025 -

Abcs High Potential A Ballsy Season Finale And What It Means

May 09, 2025

Abcs High Potential A Ballsy Season Finale And What It Means

May 09, 2025